Arkansas Newly Widowed Individuals Package

Understanding this form package

The Arkansas Newly Widowed Individuals Package provides essential legal documents to help newly widowed individuals organize their legal affairs. This package is specifically tailored for Arkansas residents, offering state-specific forms designed to address important aspects of managing one's legal life, such as health care decisions and the handling of financial matters. It includes a General Power of Attorney, an Heirship Affidavit, and other vital forms necessary for those navigating their new circumstances.

Forms included in this package

- Heirship Affidavit - Descent

- Health Care Declarations - Two Forms - Living Will - Statutory

- General Durable Power of Attorney for Property and Finances or Financial Effective Immediately

- Revocation of General Durable Power of Attorney

- Personal Planning Information and Document Inventory Worksheets - A Legal Life Document

When to use this document

This form package is ideal for use in various scenarios, including:

- When a spouse has passed away, and you need to manage their estate.

- If you wish to appoint someone to make financial or legal decisions on your behalf.

- When you need to ensure your health care preferences are documented and followed.

- For organizing important documentation and information after the loss of a partner.

Who should use this form package

- Individuals who have recently lost a spouse.

- Anyone needing to organize their legal affairs after the death of a partner.

- Those looking for legal tools to manage estate matters and health care decisions.

- Residents of Arkansas seeking state-specific legal documentation.

Instructions for completing these forms

- Review the included forms to understand their purpose and requirements.

- Identify and gather any necessary personal information and documents needed to complete each form.

- Complete each form by entering the required information directly into the fields provided.

- Sign and date the forms where indicated, ensuring to follow any additional state-specific instructions.

- Store your completed forms securely and inform a trusted family member or attorney of their location.

Notarization guidance for this package

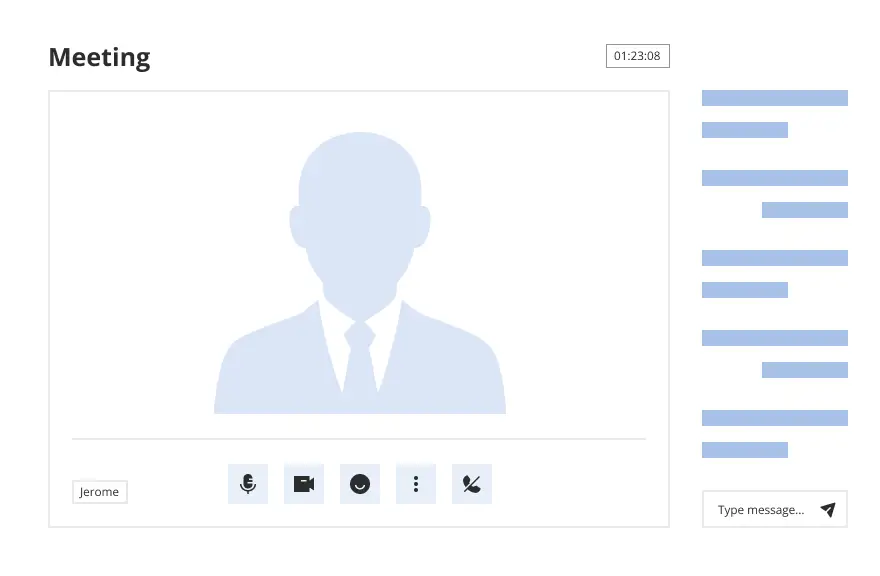

Some forms in this package need notarization to be legally binding. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

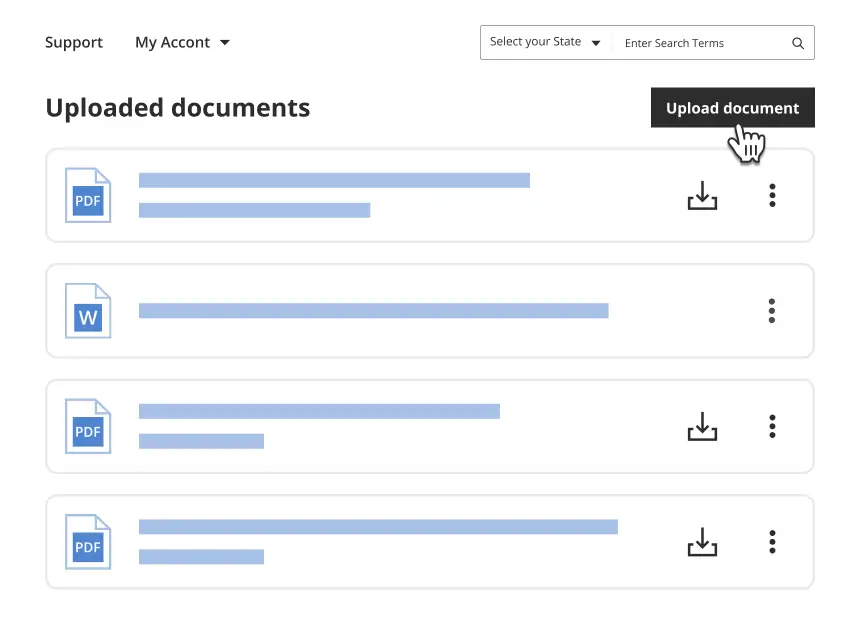

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to sign and date the documents after completion.

- Missing important information or forms that are needed for your specific situation.

- Not storing completed forms in a secure and accessible location.

- Overlooking the need to inform an agent about their responsibilities and the existence of the documents.

Why complete this package online

- Convenience of downloading forms instantly from the comfort of your home.

- Editability allows you to customize the documents to fit your specific circumstances.

- Reliability from documents created by licensed attorneys familiar with Arkansas law.

- Access to integrated online resources for guidance while completing your forms.

Quick recap

- This package provides essential legal forms tailored for newly widowed individuals in Arkansas.

- It assists in managing legal affairs, finances, and health care decisions during a challenging time.

- Completing and securing these documents is vital for protecting your interests and ensuring clarity for your loved ones.

Looking for another form?

Form popularity

FAQ

Employees may also be eligible to receive Medicare benefits through a deceased spouse if that spouse had earned 40 credits prior to their death and they were married to them at the time of the spouse's death.

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

These are examples of the benefits that survivors may receive: Widow or widower, full retirement age or older 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 full retirement age 71½ to 99 percent of the deceased worker's basic amount.

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 50 if they are disabled provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Widows can claim benefits at any time between 60 and their survivor full retirement age.

Widow Or WidowerReceive full benefits at full retirement age for survivors or reduced benefits as early as age 60. If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62.

For Your Widow Or WidowerWidows and widowers can receive: Reduced benefits as early as age 60 or full benefits at full retirement age or older. If widows or widowers qualify for retirement benefits on their own record, they can switch to their own retirement benefit as early as age 62.

There are two kinds of benefits that loved ones left behind may be entitled to receive after the death of a spouse. These are: Widowed parent's allowance. Bereavement allowance and bereavement payment.