Alabama Stone Contractor Agreement - Self-Employed

Description

How to fill out Stone Contractor Agreement - Self-Employed?

Have you ever been in a situation where you required documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a vast collection of form templates, such as the Alabama Stone Contractor Agreement - Self-Employed, that are designed to comply with state and federal regulations.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Stone Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

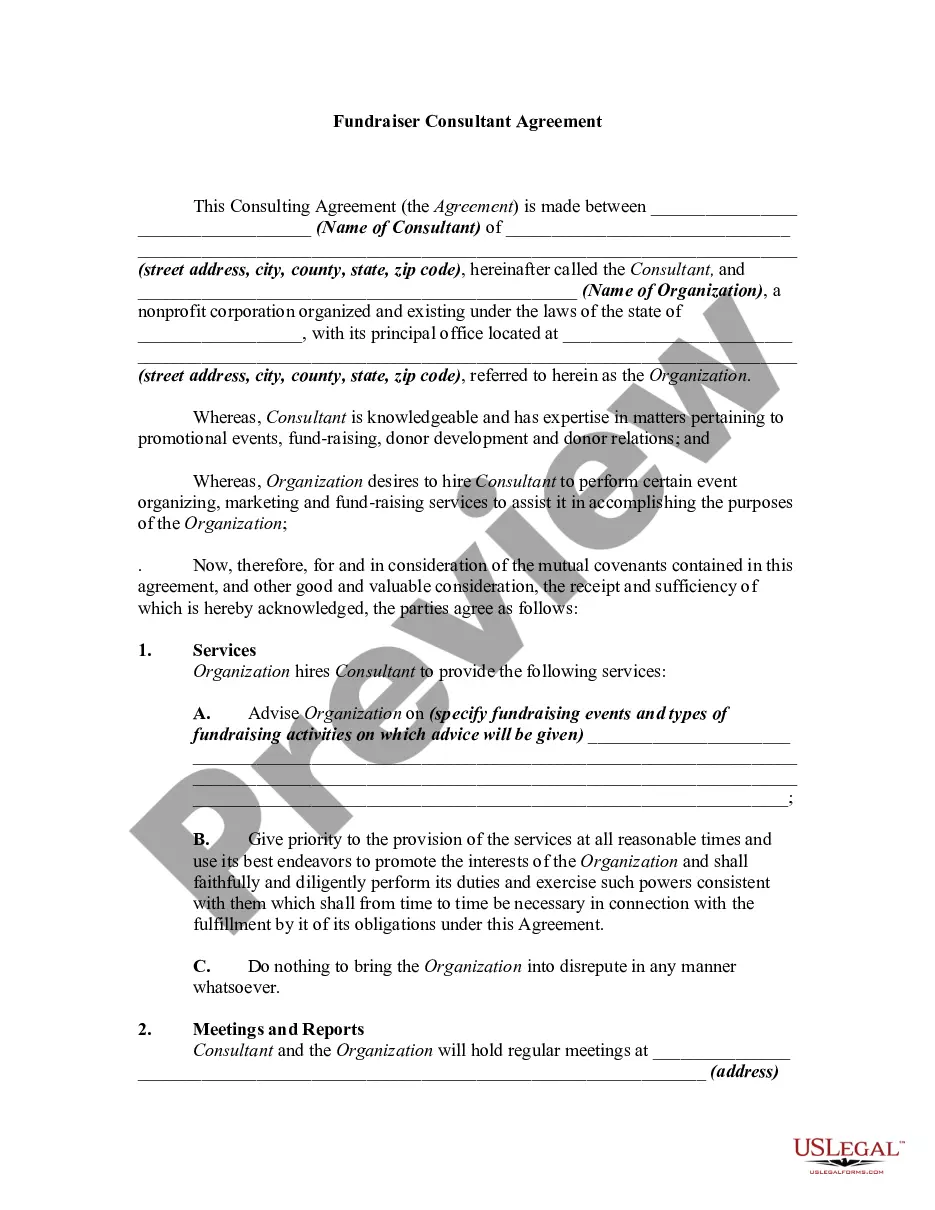

- Utilize the Preview button to review the document.

- Check the summary to confirm you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find a form that fits your needs and requirements.

- Once you find the right form, click Purchase now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can download an additional copy of the Alabama Stone Contractor Agreement - Self-Employed at any time, if needed. Just select the required form to download or print the document template.

- Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service offers properly crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and begin simplifying your life.

Form popularity

FAQ

An independent contractor typically fills out forms such as a W-9 for tax purposes, contracts for every project, and invoices for payments. It is crucial to maintain organized records of all these documents. The Alabama Stone Contractor Agreement - Self-Employed can serve as a key document to clarify your work arrangements and ensure you are compliant with tax regulations and client expectations.

Writing an independent contractor agreement involves detailing the nature of the work, payment arrangements, and timelines. You should also include any clauses regarding confidentiality and termination. To simplify this process, use the Alabama Stone Contractor Agreement - Self-Employed, which provides clear structure and essential clauses tailored for your needs.

To fill out an independent contractor agreement, begin by entering the contractor's and client's details, including contact information. Next, specify the work to be performed, payment terms, and duration of the agreement. Utilize the Alabama Stone Contractor Agreement - Self-Employed template for a comprehensive document that assures both parties know their obligations and benefits.

Writing a self-employed contract starts with defining the parties involved and the services to be provided. Clearly state the payment structure, deadlines, and any specific conditions or responsibilities. For a more streamlined process, consider using the Alabama Stone Contractor Agreement - Self-Employed, which offers a reliable template that helps you include all essential elements.

Filling out an independent contractor form involves providing your personal information, including your name, address, and tax identification number. You will also need to outline the scope of work, payment terms, and deadlines. By using the Alabama Stone Contractor Agreement - Self-Employed, you can easily ensure that you are covering all necessary details, helping you establish a clear understanding with your client.

Creating an independent contractor agreement involves drafting a clear document that includes project details, payment terms, and completion dates. Utilizing an Alabama Stone Contractor Agreement - Self-Employed template can simplify this process while ensuring you don’t miss any critical elements. You can find tools and resources on platforms like uslegalforms, making it easier to craft a solid agreement. A well-structured contract not only protects you but also builds trust with your clients.

In Alabama, a general contractor's license is necessary for projects over $50,000. However, self-employed individuals can perform small jobs without a license. For those working under the Alabama Stone Contractor Agreement - Self-Employed, it is essential to understand these limits to avoid legal issues. Always check local regulations to ensure compliance and protect your business.

Yes, a self-employed person can certainly have a contract, which is crucial for outlining working terms. An Alabama Stone Contractor Agreement - Self-Employed can clarify expectations, payment details, and project scope. This contract protects both parties, ensuring that services are delivered as agreed. Having a well-defined agreement fosters good business relationships and helps prevent misunderstandings.