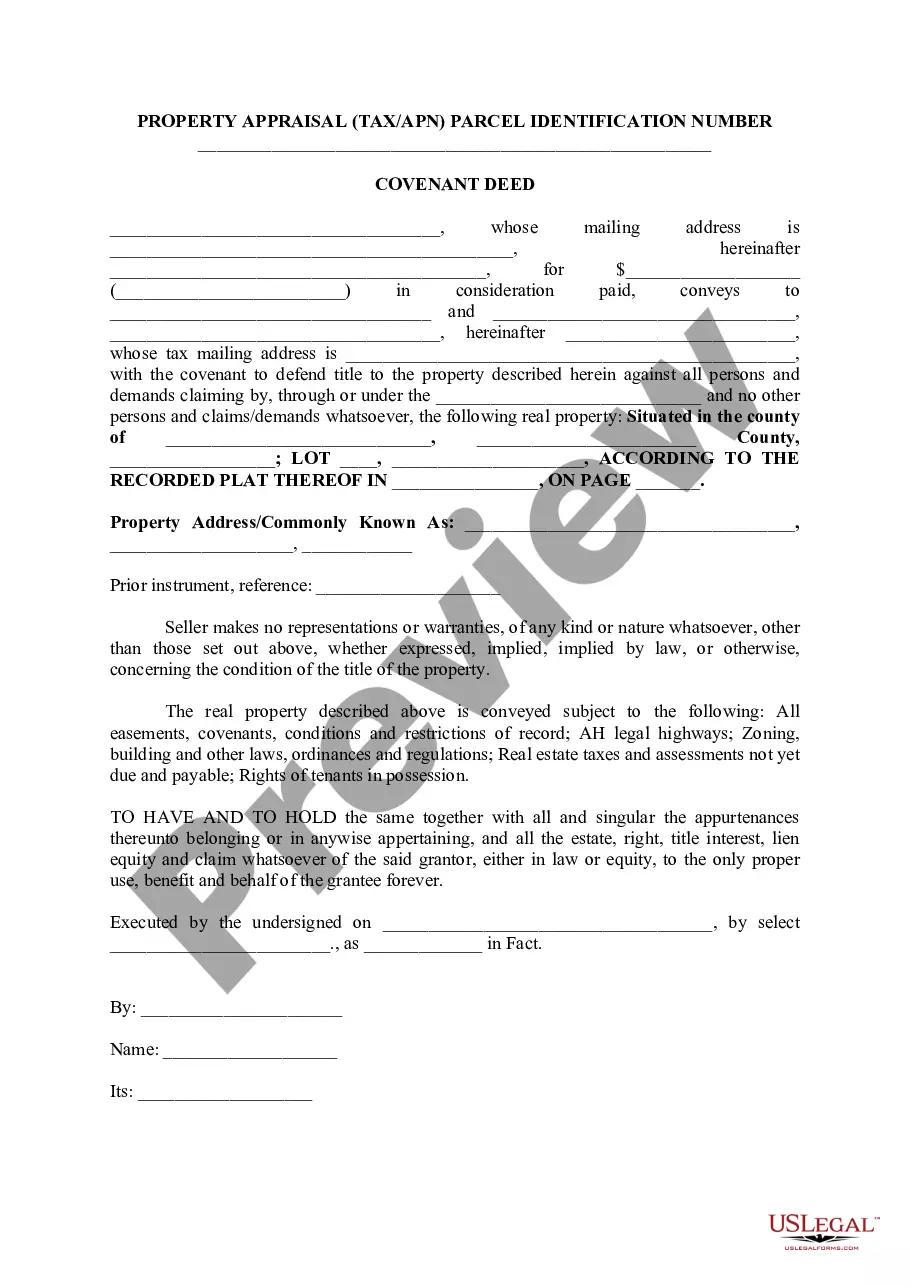

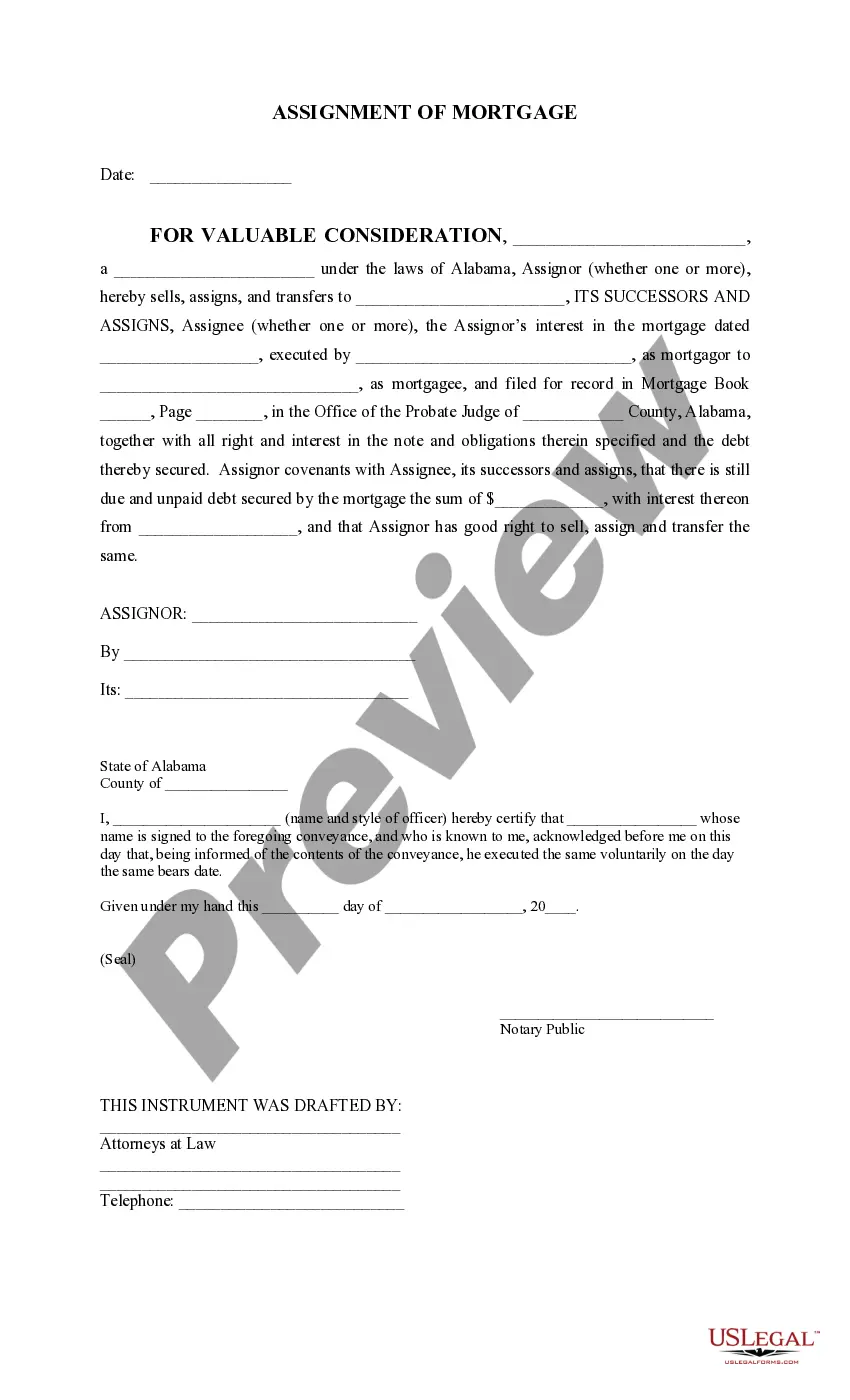

This form assigns the conveyance of a title to property for the payment of a debt. This form specifies the terms of the transfer and the loan of the transaction. It is available in Word and Wordperfect formats.

Alabama Assignment of Mortgage

Description

How to fill out Alabama Assignment Of Mortgage?

Utilizing Alabama Assignment of Mortgage templates crafted by experienced attorneys allows you to evade troubles while completing paperwork.

Simply download the form from our site, fill it in, and have legal advice review it.

This approach will conserve much more time and expenses than asking a lawyer to create a document entirely from the beginning for you would.

Ensure to verify twice all entered information for accuracy prior to submitting or dispatching it. Minimize the time spent on paperwork with US Legal Forms!

- If you already possess a US Legal Forms subscription, just Log In to your account and revisit the form webpage.

- Locate the Download button near the templates you are reviewing.

- Upon downloading a document, all your saved samples will be located in the My documents tab.

- If you lack a subscription, it's not a significant issue.

- Simply follow the step-by-step instructions below to register for your account online, acquire, and complete your Alabama Assignment of Mortgage template.

Form popularity

FAQ

A transfer or sale of your mortgage loan should not affect you. A lender cannot change the terms, balance or interest rate of the loan from those set forth in the documents you originally signed. The payment amount should not just change, either. And it should have no impact on your credit score, says Whitman.

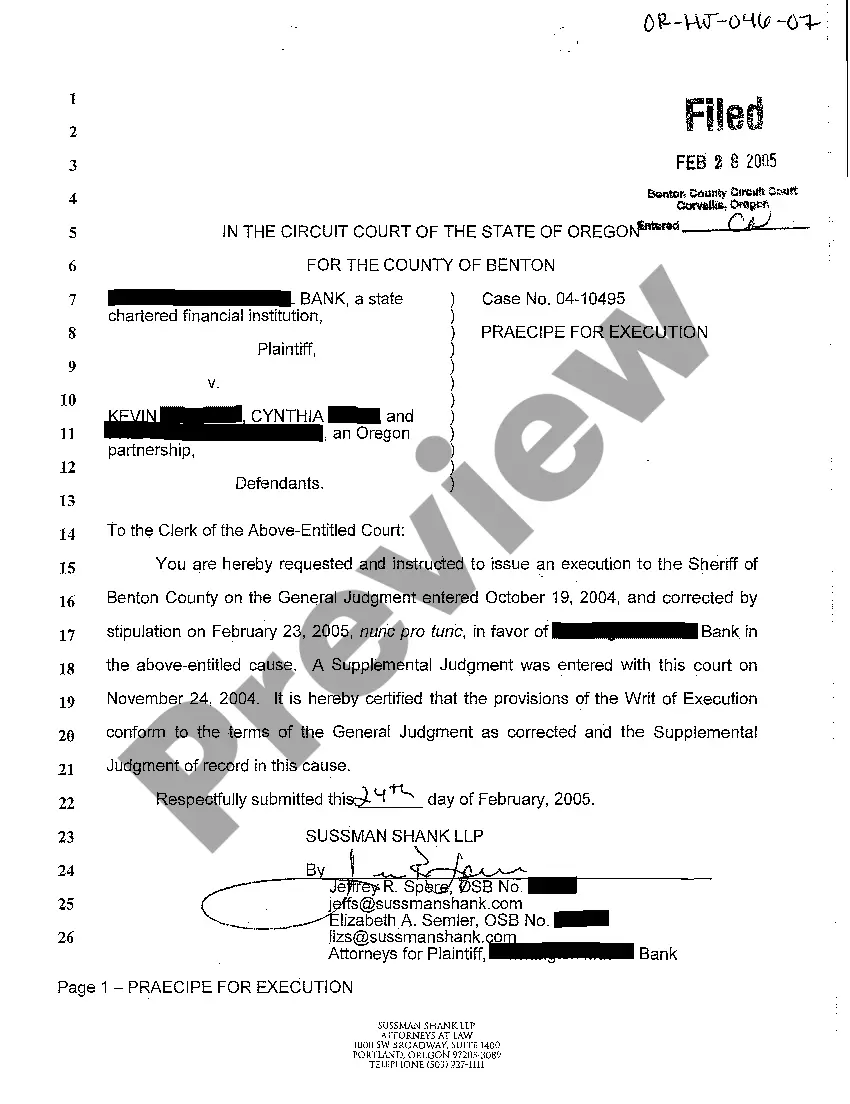

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

What does Assignment of Mortgage mean: The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid.If a borrower transfers the mortgage to another borrower, this is called an assumed mortgage.

Purpose A gap mortgages allows funding for a property to continue while it is going through the process of selling.Documents required for a mortgage assignment are: Instead of having you pay off your old loan with money from your new lender, your original lender assigns your loan balance to the new one.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Find the most recent deed to the property. Create the new deed. Sign and notarize the deed. Record the signed, notarized original deed with the Office of the Judge of Probate.