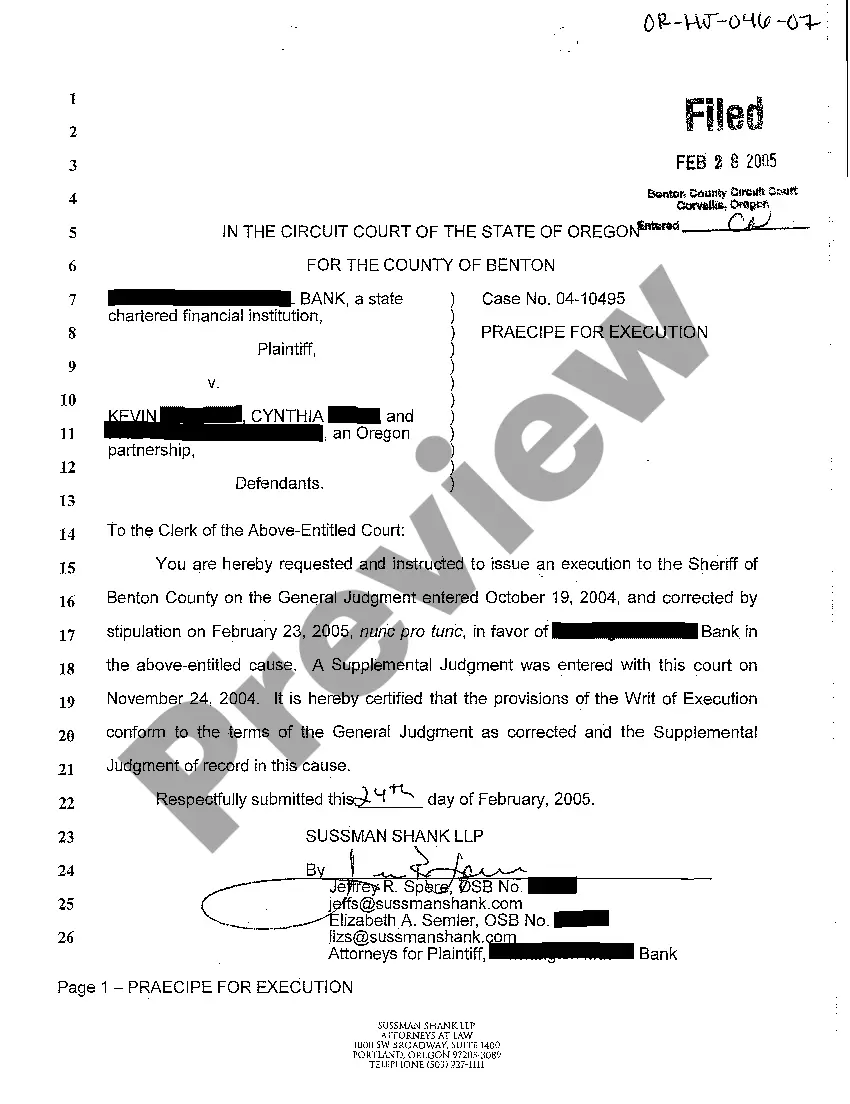

Oregon Praecipe for Execution to Satisfy Debt

Description

How to fill out Oregon Praecipe For Execution To Satisfy Debt?

Among numerous free and paid examples that you find online, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to deal with what you need those to. Keep calm and use US Legal Forms! Get Oregon Praecipe for Execution to Satisfy Debt templates made by skilled attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access all your earlier downloaded files in the My Forms menu.

If you’re making use of our website for the first time, follow the guidelines listed below to get your Oregon Praecipe for Execution to Satisfy Debt fast:

- Make sure that the document you see applies in your state.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another example using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you have signed up and purchased your subscription, you may use your Oregon Praecipe for Execution to Satisfy Debt as often as you need or for as long as it continues to be valid where you live. Revise it in your favorite editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Levies are the legal means by which a taxing authority or a bank can seize property for the payment of a debt.

Garnishment and (3) execution: Writ of Garnishment: Orders the garnishee to hold specified property (usually in the form of bank deposits) pending order of the court; limited to one Ataking.@ The following forms (number of copies, including original.

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.

Levy. 1) v. to seize (take) property upon a writ of execution (an order to seize property) issued by the court to pay a money judgment granted in a lawsuit.

Bank levies can continue until your debt is completely satisfied, and they can be used repeatedly. 5feff If you don't have sufficient funds available on the first try, creditors can come back numerous times.

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.

A personal property levy allows a creditor to obtain possession of much of the debtor's property in California (e.g., equipment, inventory, vehicles, cash in cash registers), excluding real property and property held by third parties.

Getting a Writ of Execution ), the court directs the sheriff or marshal to enforce the judgment in your case in the county where the assets are located. Writs of execution are only good for 180 days.