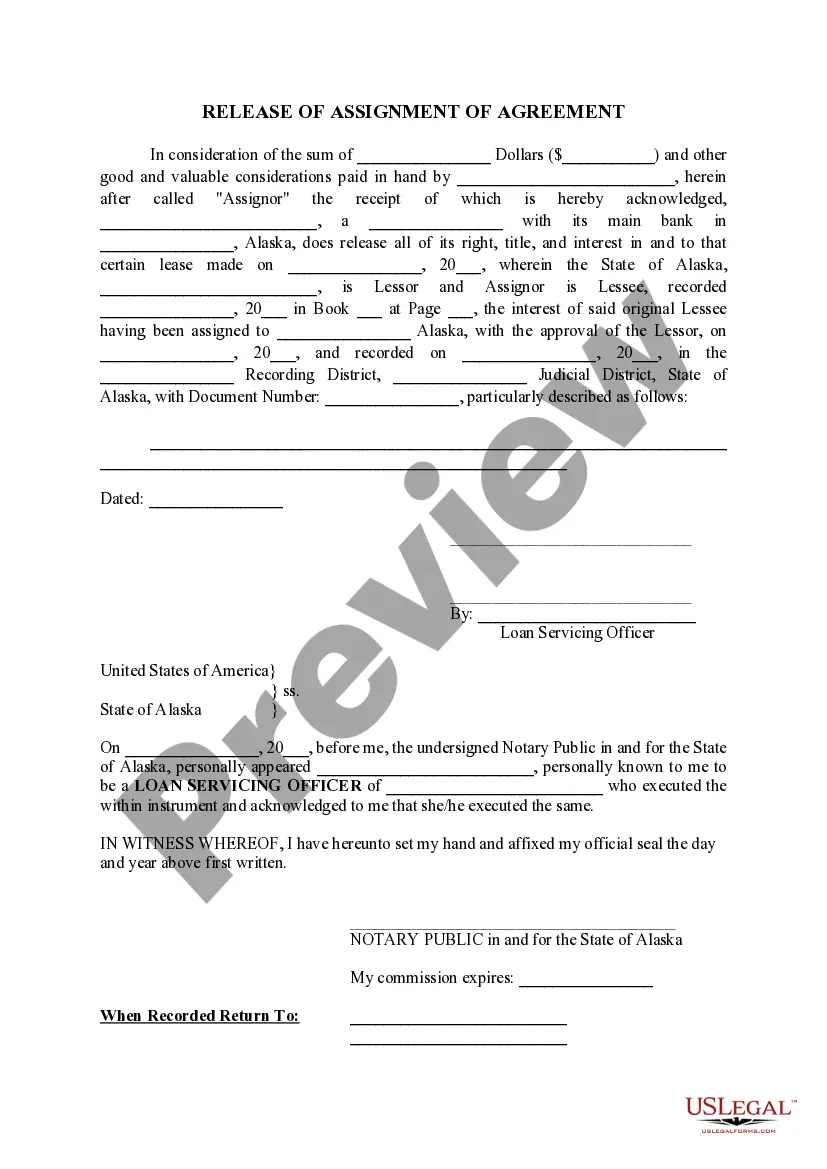

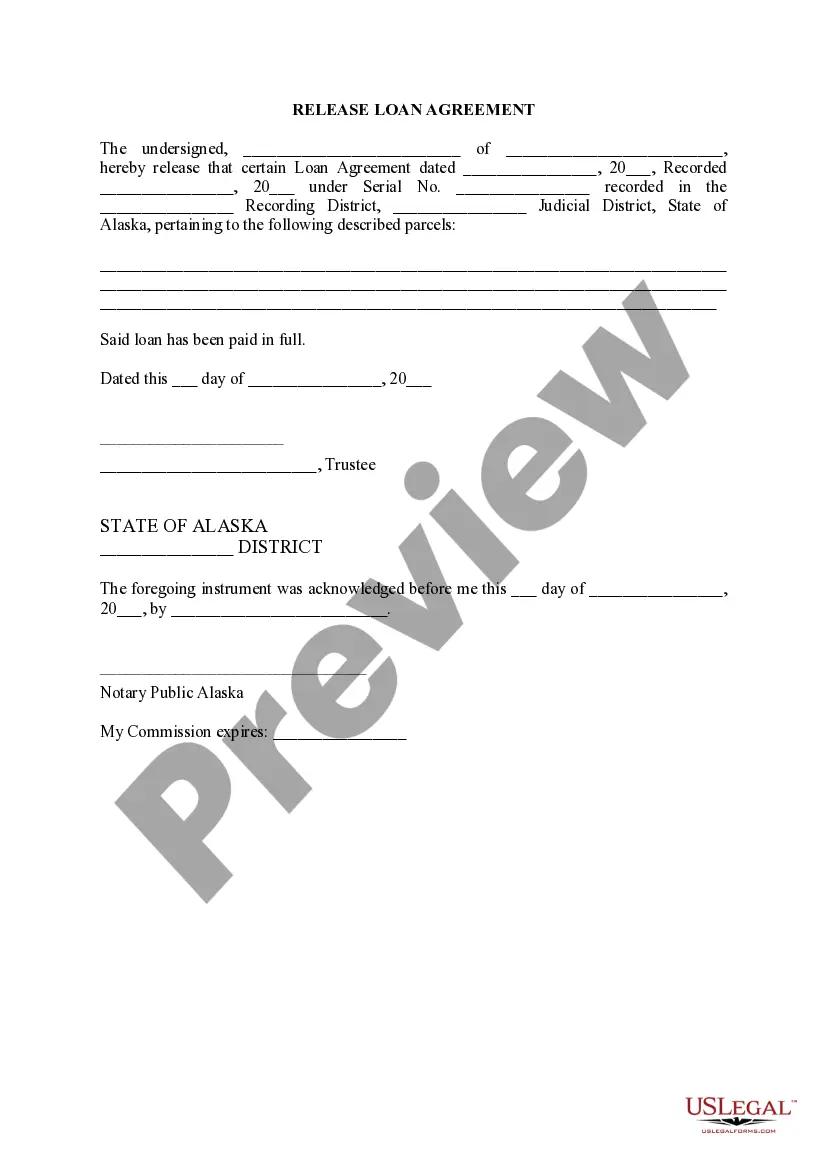

Alaska Release Loan Agreement

Description

How to fill out Alaska Release Loan Agreement?

Utilize US Legal Forms to acquire a printable Alaska Release Loan Agreement.

Our court-acceptable forms are composed and frequently revised by experienced attorneys.

Ours is the most comprehensive Forms directory online and offers economical and precise samples for clients, legal practitioners, and small to medium-sized businesses.

Click Buy Now if it is the template you require. Set up your account and pay via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search field if you need to obtain another document template. US Legal Forms offers a significant number of legal and tax templates and packages for both business and personal use, including the Alaska Release Loan Agreement. More than three million users have successfully utilized our service. Choose your subscription plan and receive high-quality documents in merely a few clicks.

- The documents are categorized based on state regulations and many can be previewed prior to downloading.

- To access samples, users must possess a subscription and Log In to their account.

- Press Download next to any necessary form and locate it in My documents.

- For those without a subscription, follow these steps to swiftly find and acquire the Alaska Release Loan Agreement.

- Ensure you select the correct template pertaining to the state required.

- Examine the document by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person.As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.

A loan agreement does not require a notary signature. The purpose of a notary seal is to provide evidence that the signature is genuinely the signature of the person signing.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

A loan agreement is a contract between you, the borrower and the lender.If there are valid reasons such as fraud or a breech of contract, you should be able to get out of the loan. If you are unable to cancel the contract, you may be forced to take other measures to get out of the loan.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how.Once it has been executed, it is essentially a promise to pay from the lender to the borrower.

A loan agreement is a contract between a borrower and a lender which regulates the mutual promises made by each party.Loan agreements are usually in written form, but there is no legal reason why a loan agreement cannot be a purely oral contract (although oral agreements are more difficult to enforce).