Vermont Satisfaction, Release or Cancellation of Mortgage by Corporation

Overview of this form

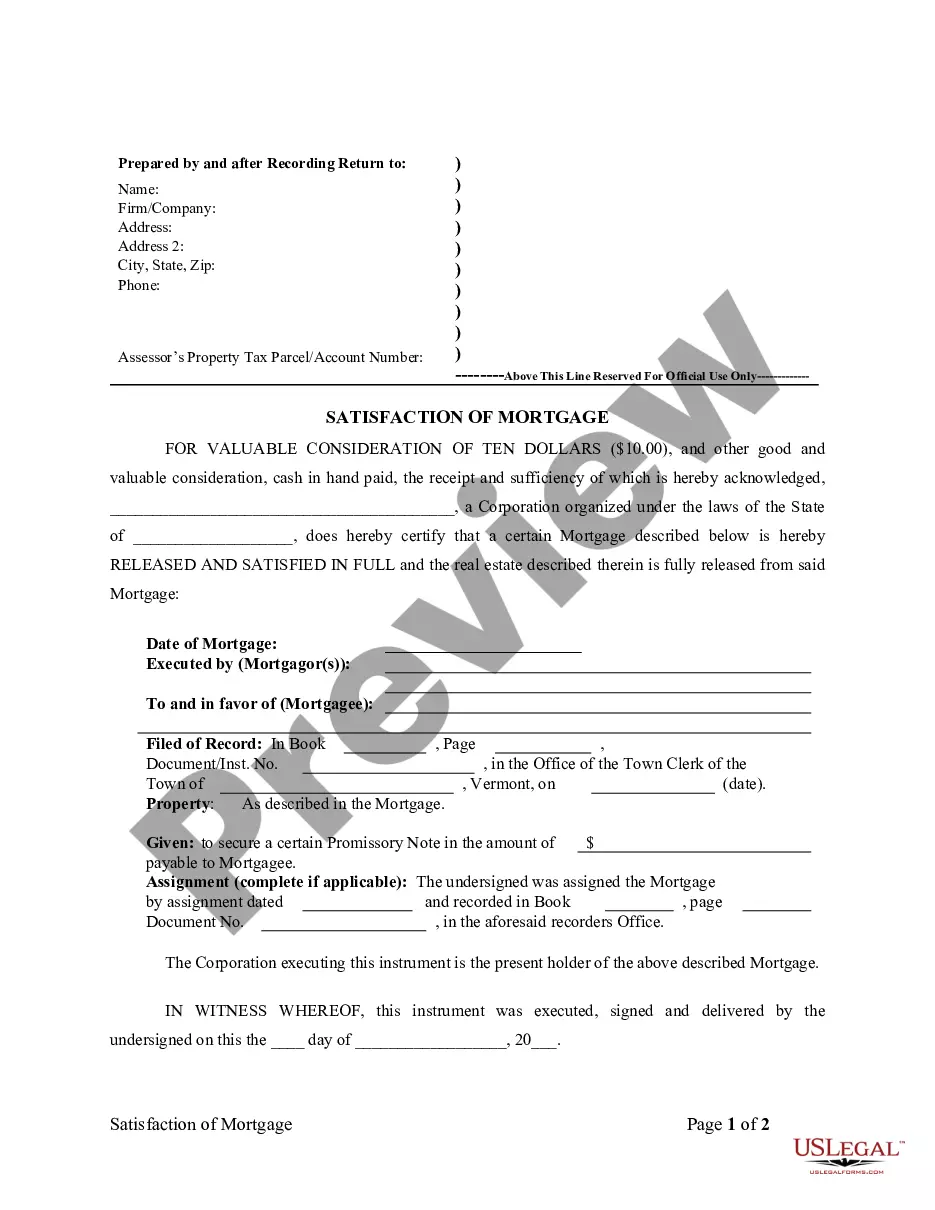

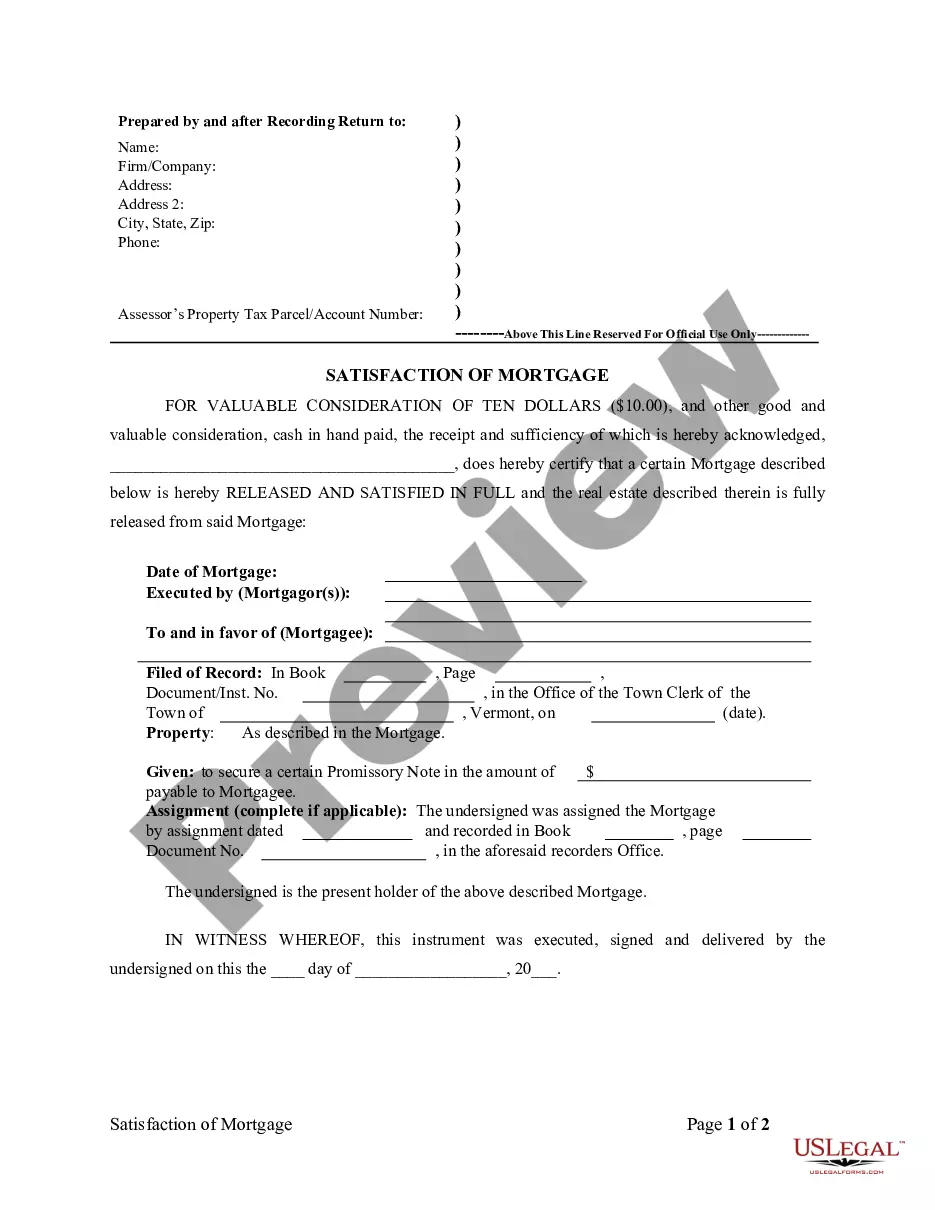

The Satisfaction, Release or Cancellation of Mortgage by Corporation form is designed for the satisfaction or release of a mortgage in Vermont, specifically when the lender is a corporation. This form provides legal documentation that confirms the mortgage is no longer binding on the property, ensuring that the property is definitively released from the mortgage obligations. It is important to distinguish this form from other property forms as it specifically addresses corporate lender scenarios and must be executed in compliance with state regulations.

Form components explained

- Date of mortgage execution.

- Names of mortgagor(s) and mortgagee.

- Record filing information (book, page, document number).

- Description of property being released.

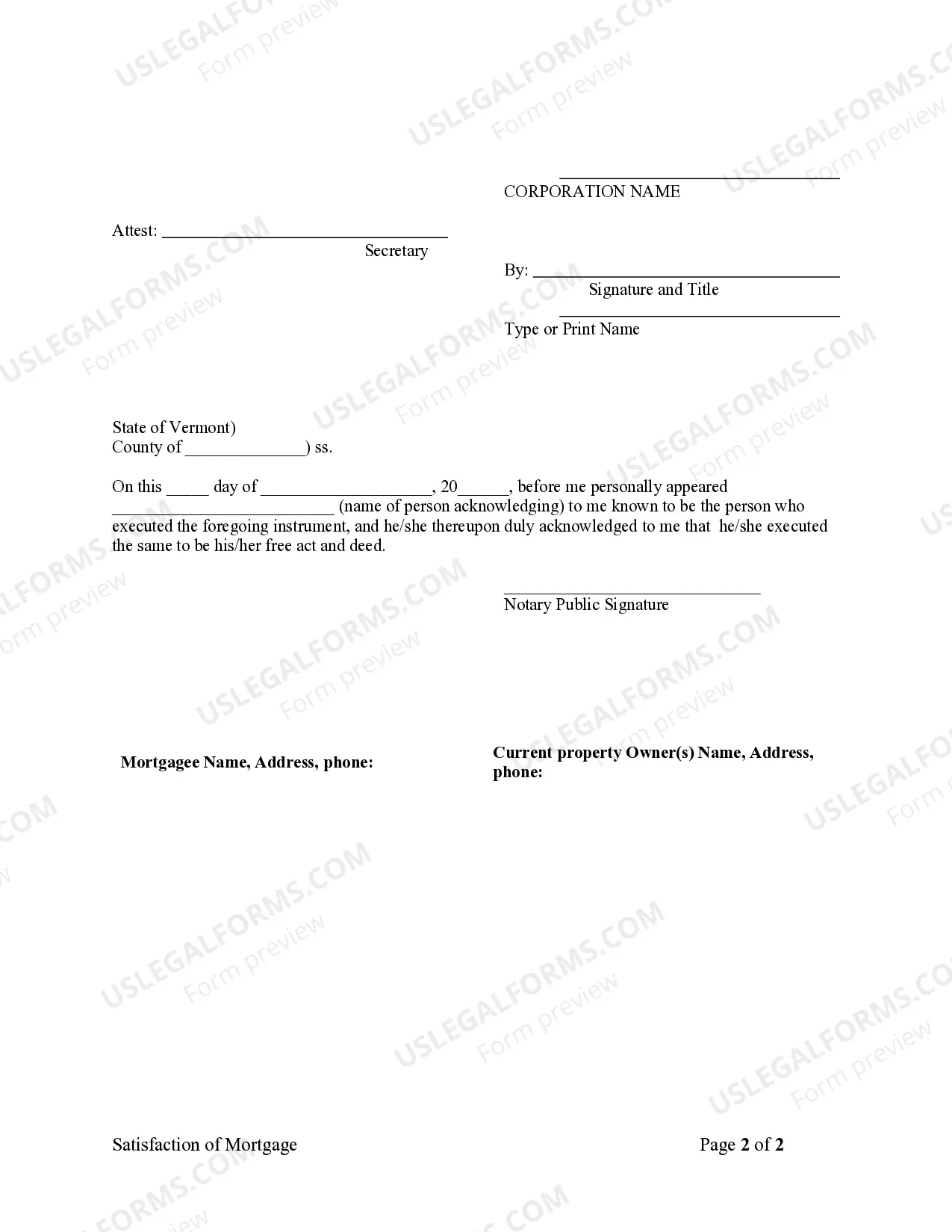

- Notary public acknowledgment for validation.

When to use this document

This form should be used when a corporate lender has fulfilled its mortgage obligations and needs to formally release a property from the mortgage. It is typically applicable in situations where a mortgage has been paid off, refinanced, or otherwise satisfied, and the lender wishes to document this release legally.

Who should use this form

- Corporations that have served as mortgage lenders.

- Property owners who have fully paid off their corporate mortgage.

- Attorneys assisting clients in the mortgage release process.

- Real estate professionals involved in closing transactions.

Completing this form step by step

- Identify the date the mortgage was executed.

- Clearly state the names of the mortgagor(s) and the corporation as mortgagee.

- Fill in the record filing information for the mortgage.

- Describe the property that is being released in detail.

- Have the form notarized to ensure it is legally valid.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to complete the notary section.

- Providing incomplete property descriptions.

- Omitting the record filing information.

- Not using the correct date format.

Advantages of online completion

- Easy download and instant access to the form.

- Edit the document to meet specific needs before printing.

- Legally compliant templates crafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

Register the discharge of mortgage Once you return the Discharge Authority form, your bank would prepare a Discharge of Mortgage document. This document must be registered at the Land Titles office.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

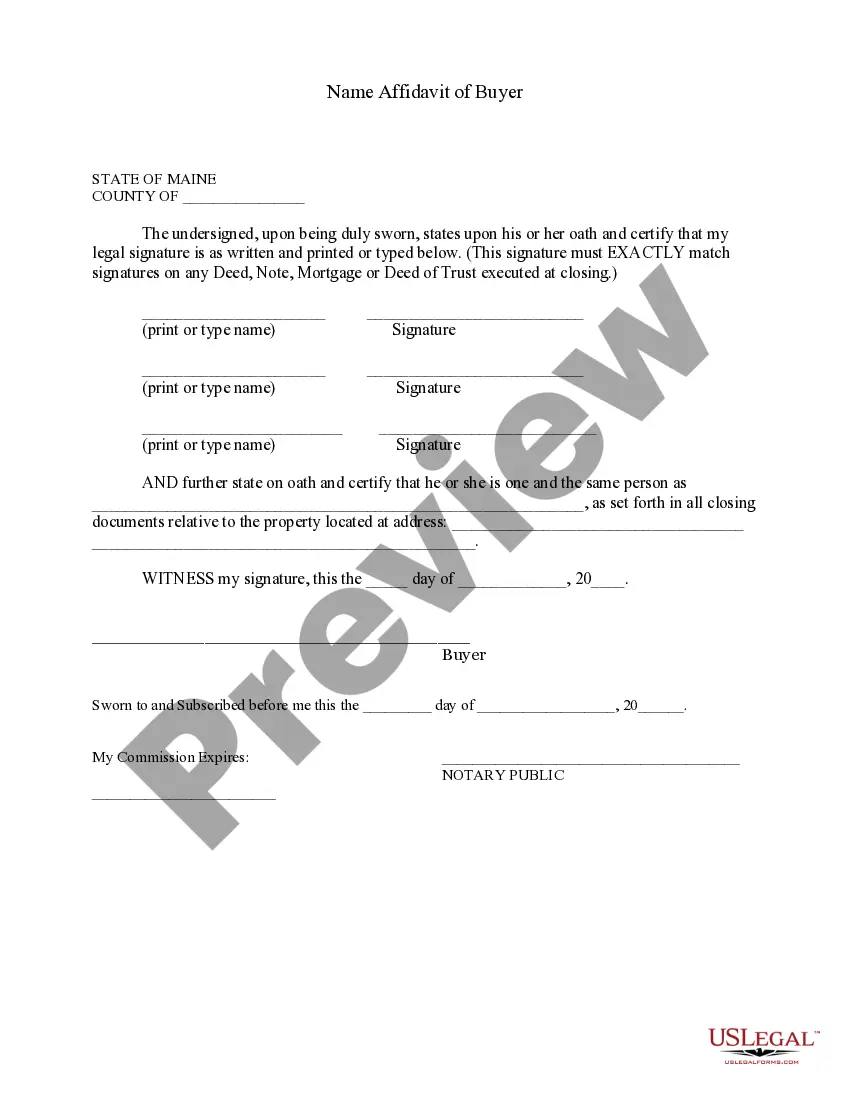

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.