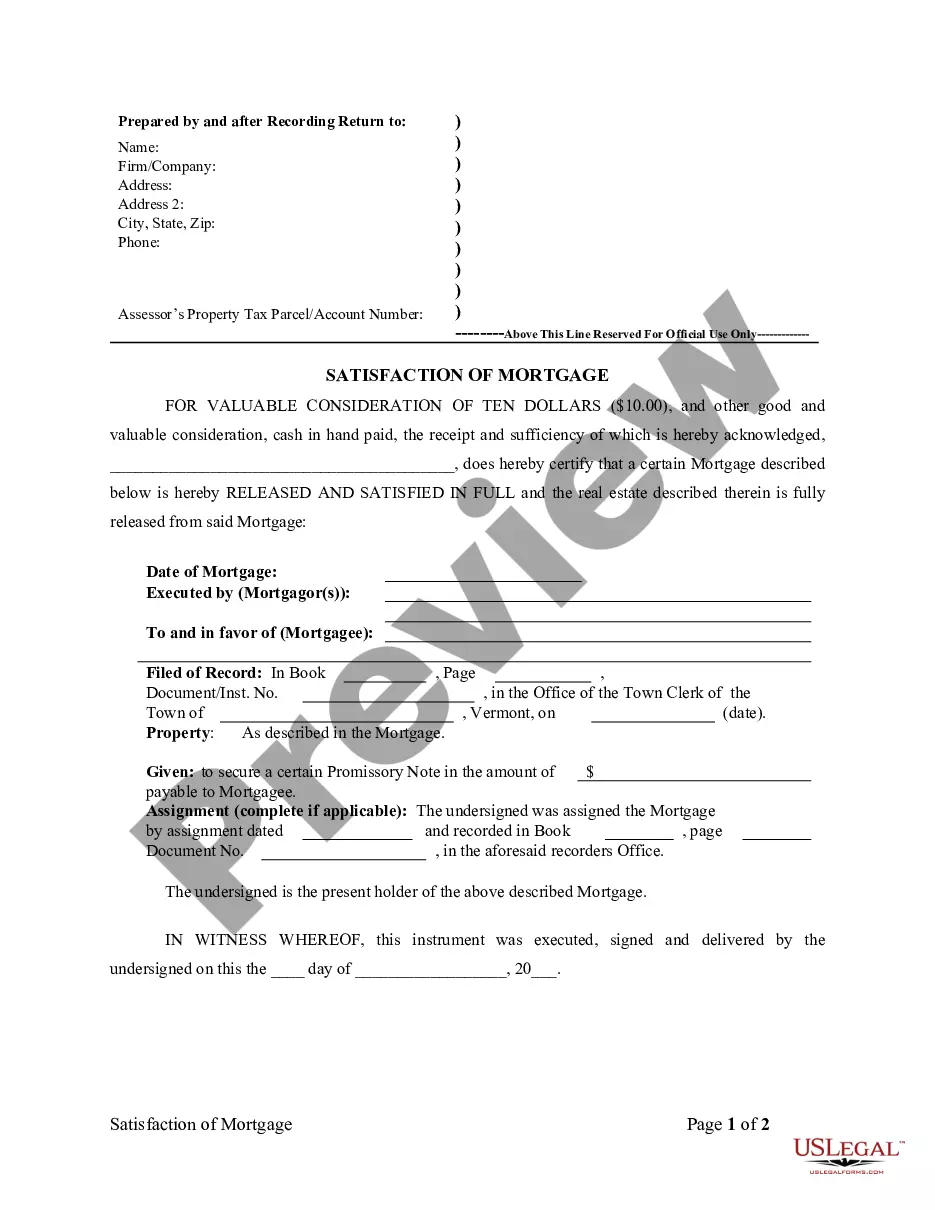

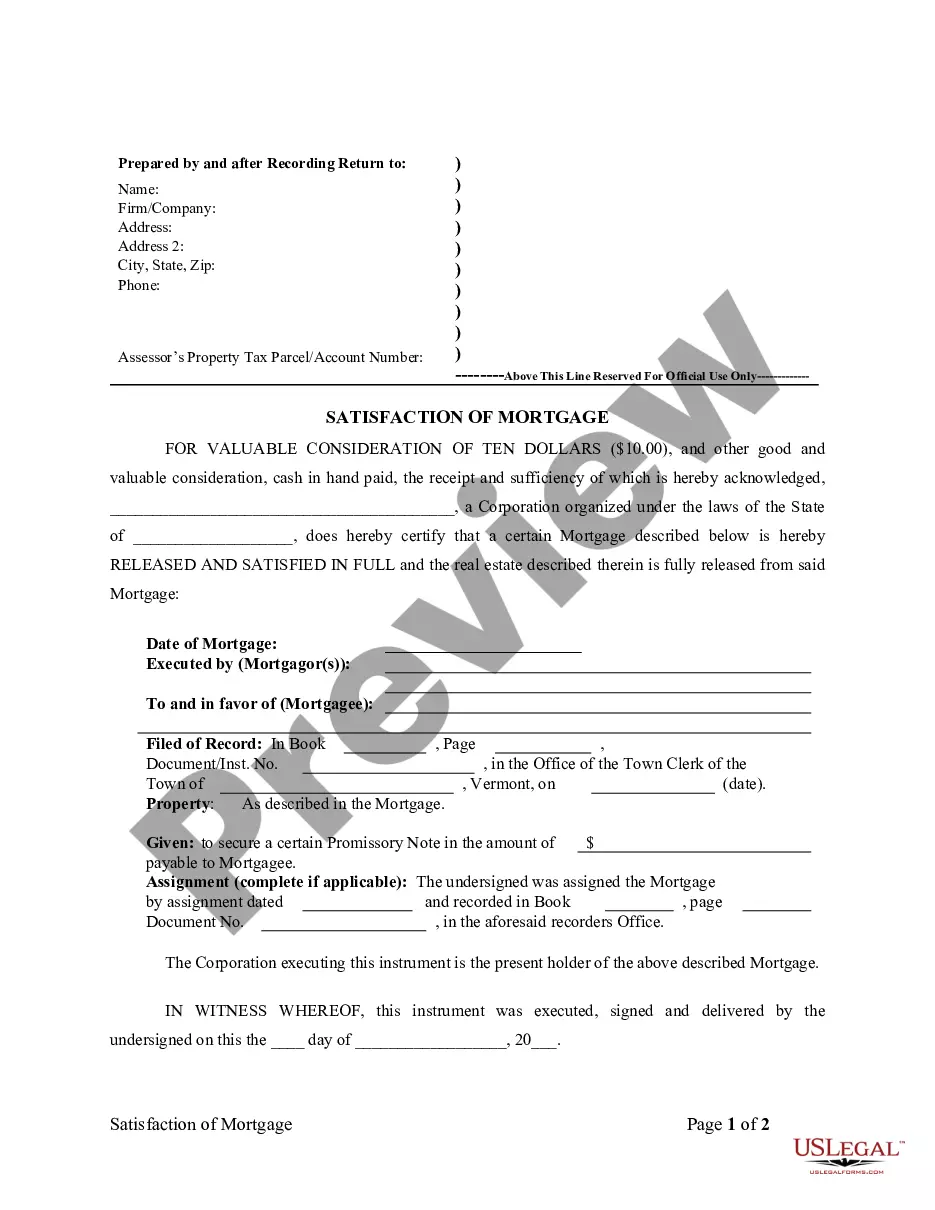

This form is for the satisfaction or release of a deed of trust for the state of Vermont by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Vermont Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Vermont Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Looking for a Vermont Satisfaction, Release or Cancellation of Mortgage by Individual online might be stressful. All too often, you see documents that you believe are alright to use, but discover afterwards they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Get any document you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be included to your My Forms section. If you don’t have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Satisfaction, Release or Cancellation of Mortgage by Individual from the website:

- See the document description and hit Preview (if available) to verify whether the form meets your expectations or not.

- If the document is not what you need, get others using the Search engine or the listed recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted samples, customers will also be supported with step-by-step guidelines on how to get, download, and fill out templates.

Form popularity

FAQ

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

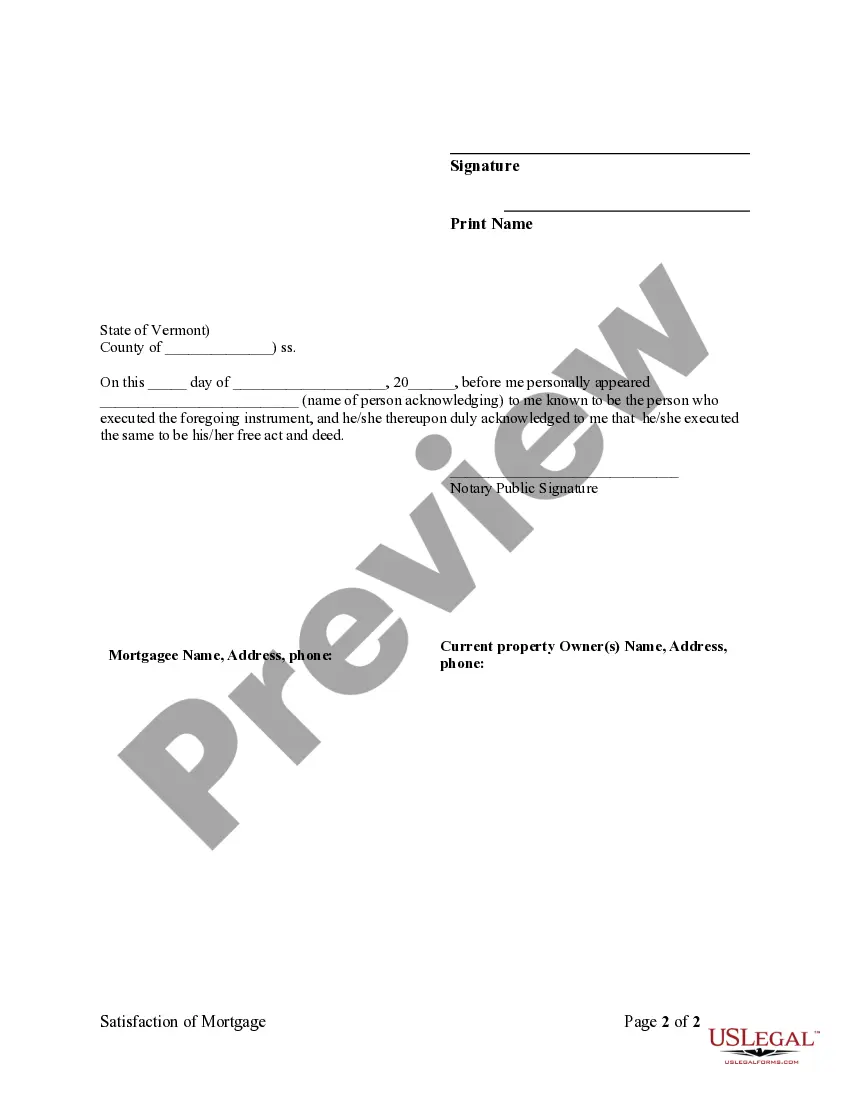

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Register the discharge of mortgage Once you return the Discharge Authority form, your bank would prepare a Discharge of Mortgage document. This document must be registered at the Land Titles office.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.