UCC1 - Financing Statement - Tennessee - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Tennessee UCC1 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee UCC1 Financing Statement?

Get access to high quality Tennessee UCC1 Financing Statement templates online with US Legal Forms. Avoid days of lost time searching the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific legal and tax templates that you can download and submit in clicks in the Forms library.

To get the sample, log in to your account and click on Download button. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

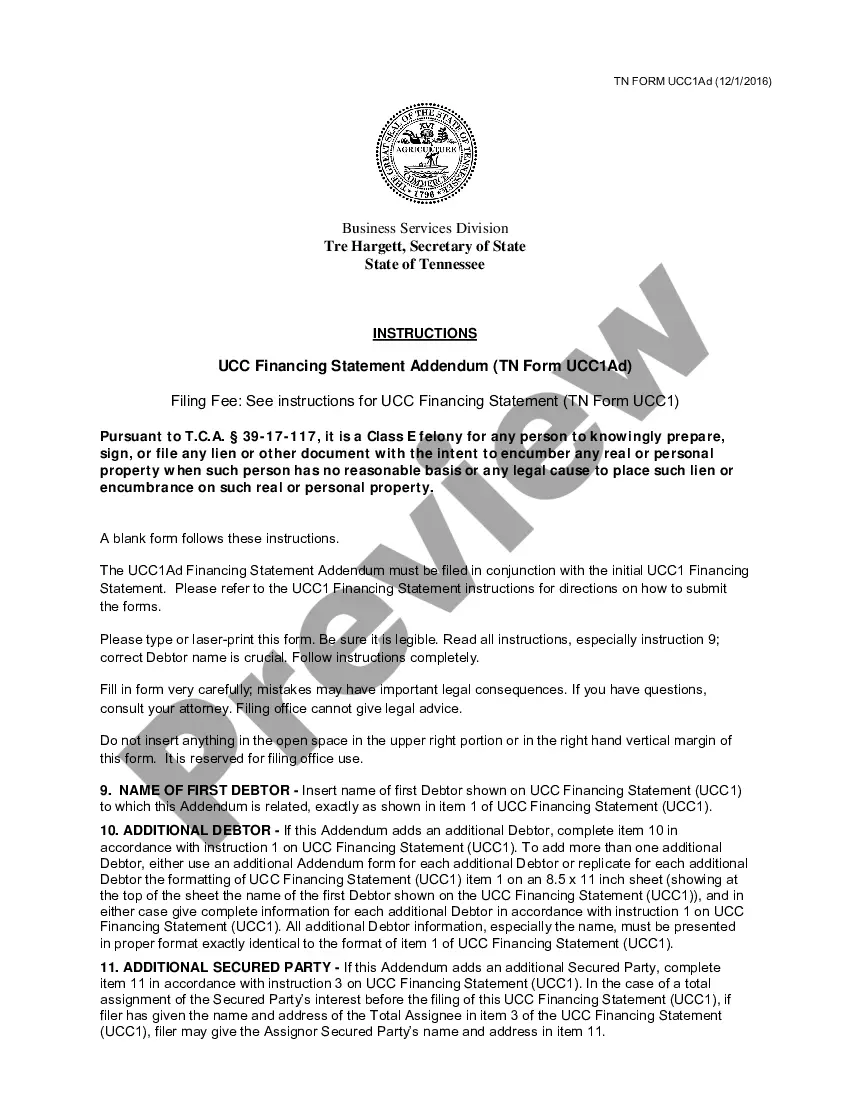

- Find out if the Tennessee UCC1 Financing Statement you’re looking at is appropriate for your state.

- View the sample using the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to register.

- Pay by card or PayPal to complete creating an account.

- Choose a favored format to save the document (.pdf or .docx).

Now you can open the Tennessee UCC1 Financing Statement sample and fill it out online or print it out and do it by hand. Consider giving the document to your legal counsel to ensure things are filled out appropriately. If you make a mistake, print out and fill application again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and access a lot more forms.

Form popularity

FAQ

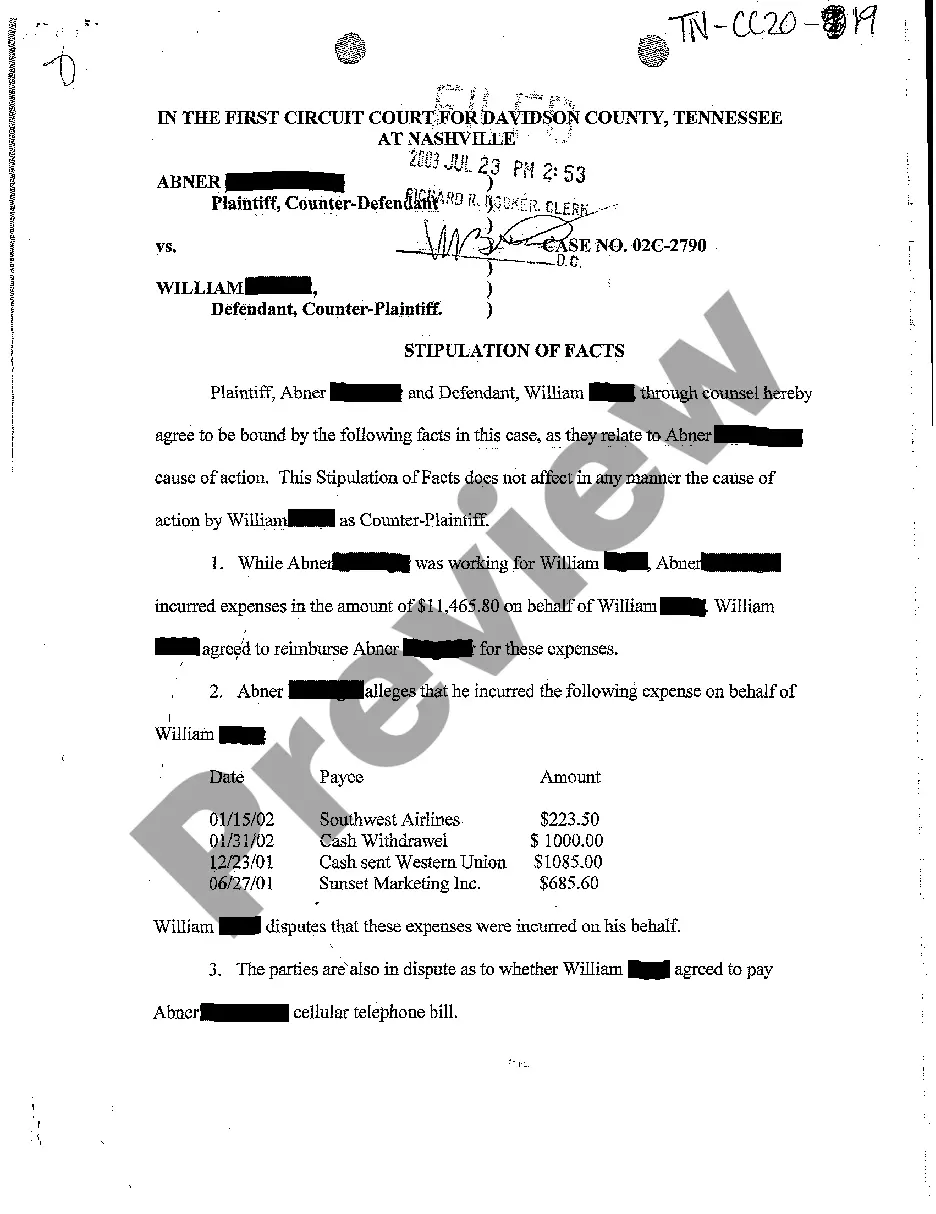

UCC filings or liens are legal forms that a creditor files to give notice that it has an interest in the personal or business property of a debtor. Essentially, UCC lien filings allow a lender to formally lay claim to collateral that a debtor pledges to secure their financing.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

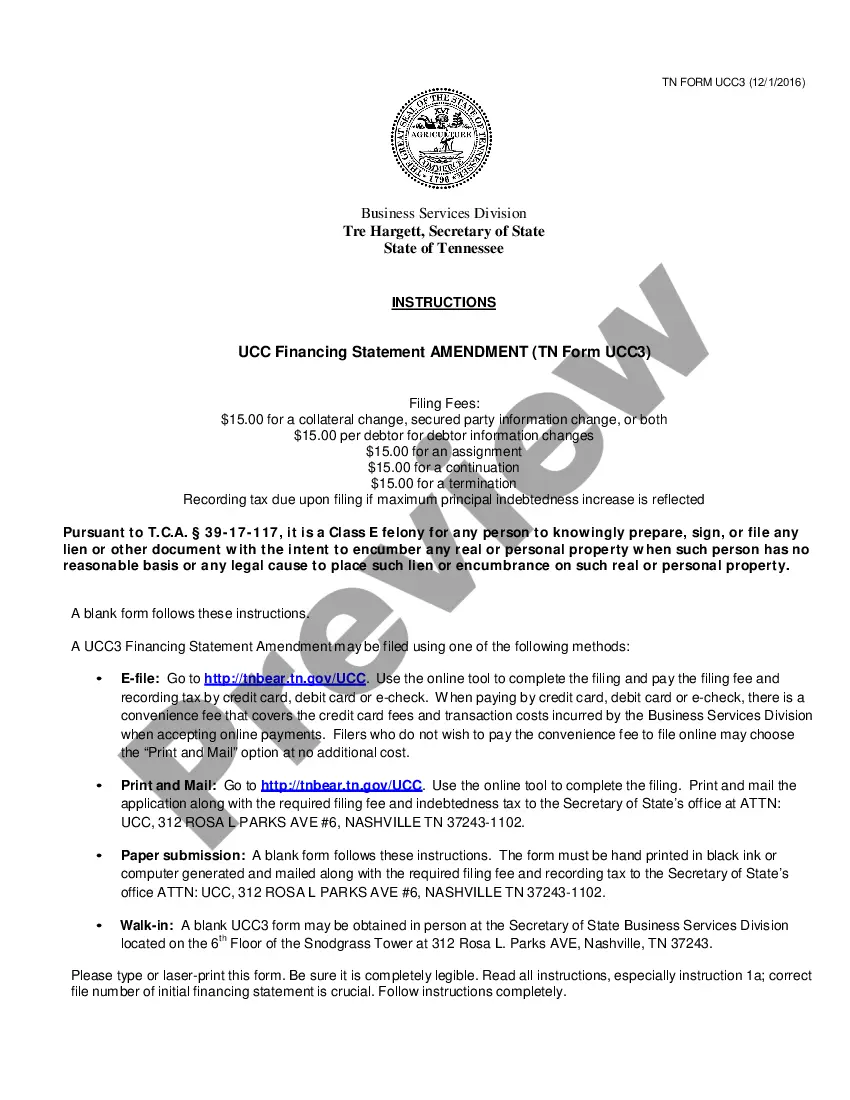

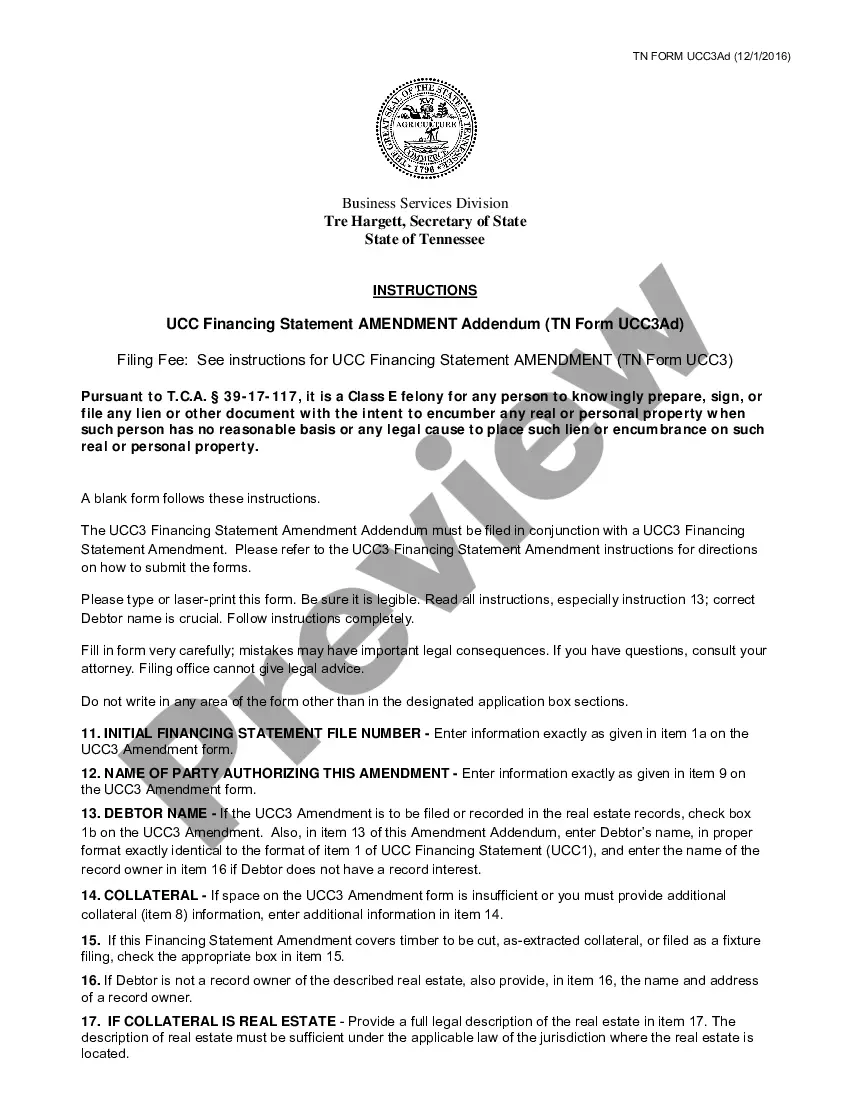

Documents Filed in the Offices of the County Clerks All other types of amendment filings would require the filing of a financing statement in the Office of the Secretary of State. Documents pertaining to real estate records are to be filed in the Office of the County Clerk.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

UCC-1 Financing Statements are commonly referred to as simply UCC-1 filings. UCC-1 filings are used by lenders to announce their rights to collateral or liens on secured loans and are usually filed by lenders with your state's secretary of state office when a loan is first originated.

A UCC 3 form, also known as a Financing Statement Amendment, is a document tracking changes to the UCC 1 such as the termination, the continuation, and the transfer of the Financing Statement. Other amendments are also filed, such as amending the names of the two parties or amending the collateral.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

The UCC-1 statement serves as a lien on secured collateral, where the components and filing procedures are comparable to the lien requirements in residential mortgage loan contracts.