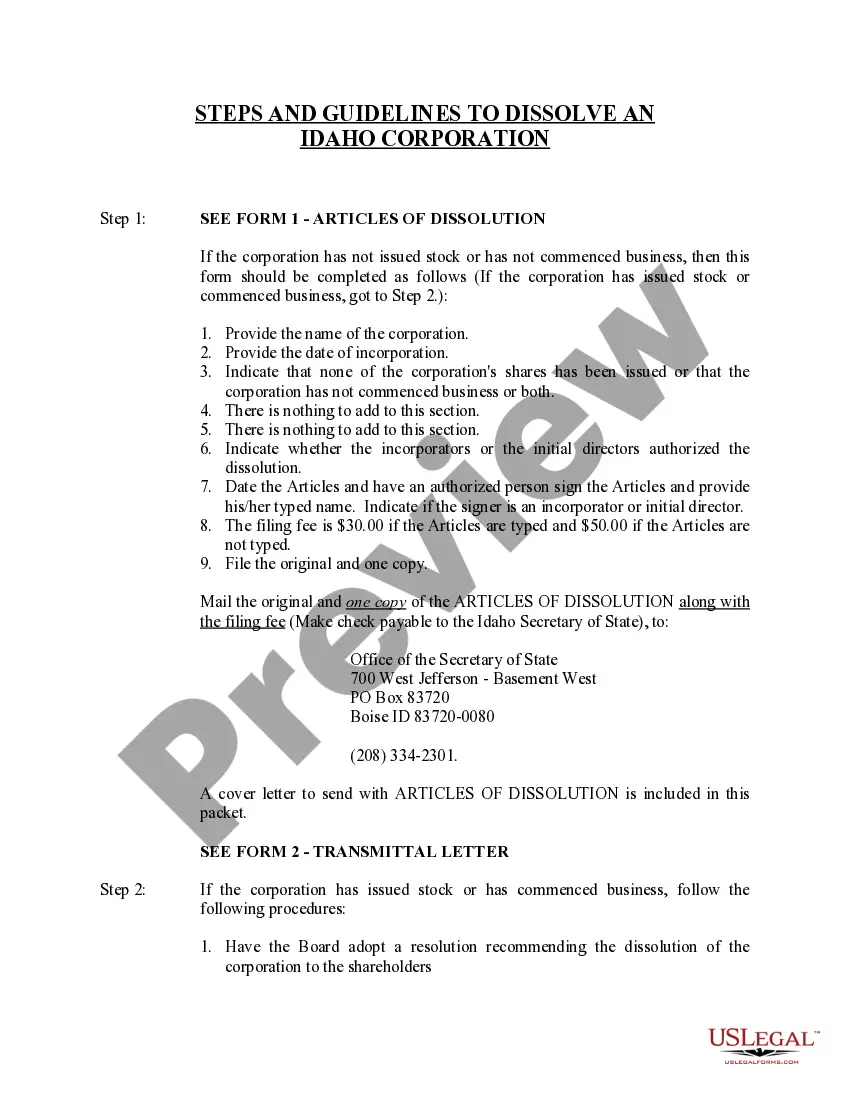

The dissolution of a corporation package contains all forms to dissolve a corporation in Idaho, step by step instructions, addresses, transmittal letters, and other information.

Idaho Dissolution Package to Dissolve Corporation

Description

How to fill out Idaho Dissolution Package To Dissolve Corporation?

Searching for Idaho Dissolution Package to terminate Corporation templates and completing them can be rather difficult.

To conserve time, expenses, and energy, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare each document, so you merely need to complete them. It is truly that straightforward.

Choose your plan on the pricing page and create an account. Opt to pay with a credit card or PayPal. Download the sample in your preferred format. You can print the Idaho Dissolution Package to terminate Corporation template or complete it using any online editor. Don’t worry about making mistakes because your sample can be used and submitted, and printed as many times as you want. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's web page to download the sample.

- Your saved samples are stored in My documents and are accessible at any time for future use.

- If you haven't subscribed yet, consider signing up.

- Review our comprehensive instructions on how to obtain your Idaho Dissolution Package to terminate Corporation sample in a few minutes.

- To acquire a qualified sample, verify its relevance for your state.

- Examine the form using the Preview option (if available).

- If there’s a description, read through it to understand the details.

- Click on the Buy Now button if you've found what you’re looking for.

Form popularity

FAQ

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

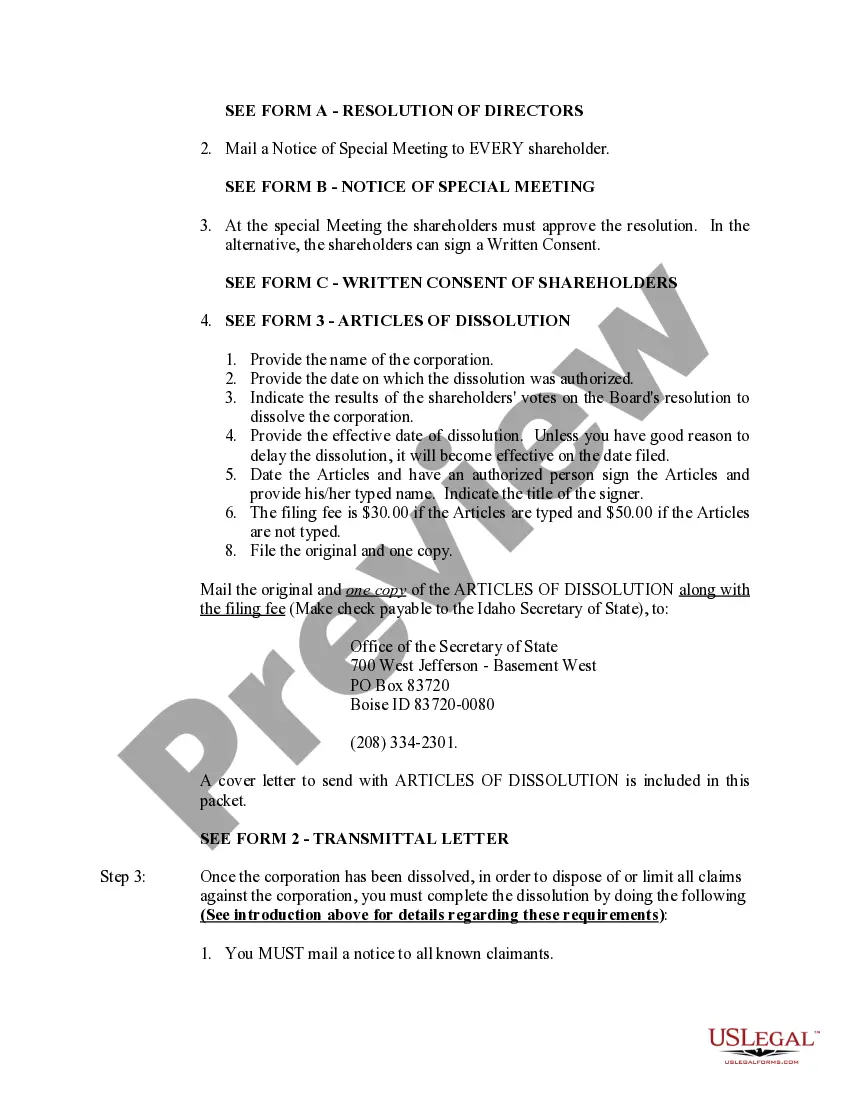

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Contact an attorney and an accountant. Secretary of State: File the appropriate form to terminate the business registration. Regional SBDC office locations. When a business closes, state tax permits and sales tax permits need to be cancelled, withholding accounts closed and a final tax return filed.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

Hold a board of directors meeting and formally move to dissolve your corporation. File the Articles of Dissolution (in duplicate) with the Idaho Secretary of State. Fulfill all tax obligations with the state of Idaho, as well as with the IRS.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.