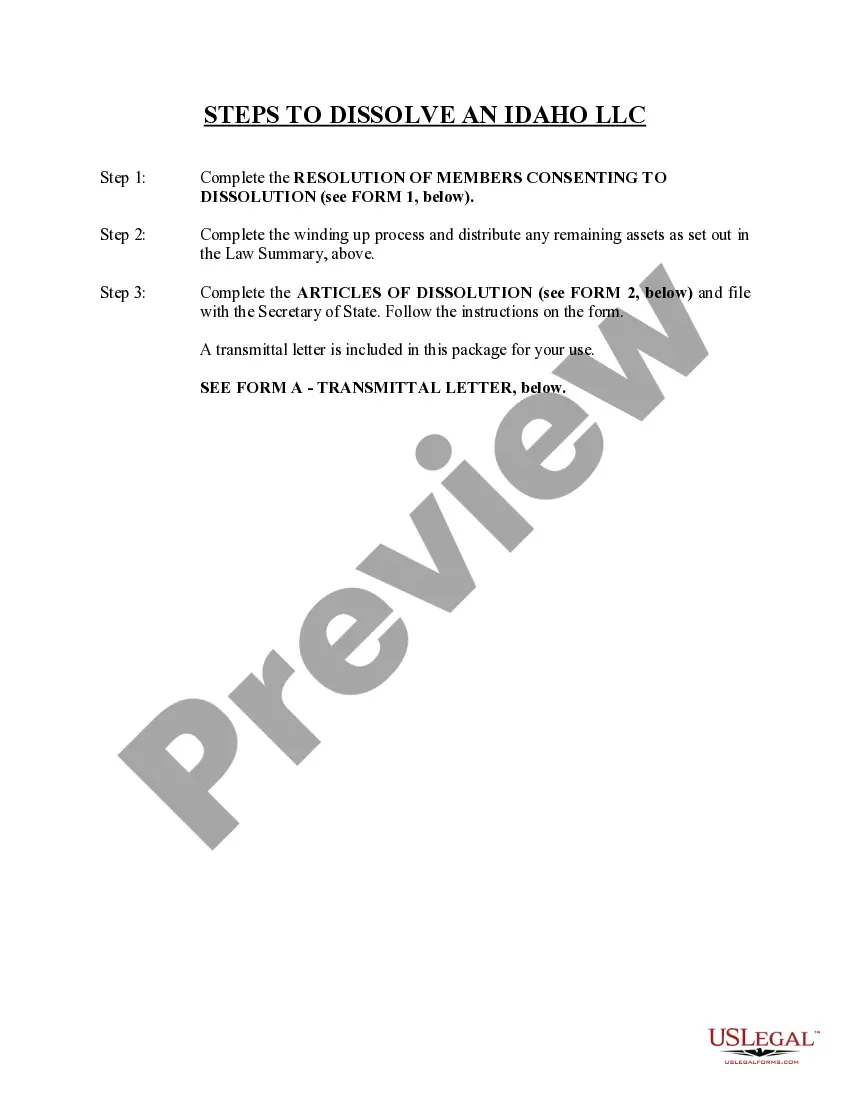

The dissolution package contains all forms to dissolve a LLC or PLLC in Idaho, step by step instructions, addresses, transmittal letters, and other information.

Idaho Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Idaho Dissolution Package To Dissolve Limited Liability Company LLC?

Looking for Idaho Dissolution Package to terminate Limited Liability Company LLC forms and filling them out could be a hurdle.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our lawyers prepare every document, so you only need to complete them.

Select your plan on the pricing page and create your account. Choose your payment method by credit card or PayPal. Save the form in your preferred file format. You can print the Idaho Dissolution Package to dissolve Limited Liability Company LLC template or complete it using any online editor. There’s no need to worry about errors because your template can be utilized and submitted, and printed as many times as you like. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the template.

- All of your saved templates are stored in My documents and are available at all times for future use.

- If you haven’t signed up yet, you must register.

- Review our detailed instructions on how to acquire your Idaho Dissolution Package to dissolve Limited Liability Company LLC template in a few moments.

- To find a suitable template, verify its relevance for your state.

- Examine the sample using the Preview option (if it’s available).

- If there's an explanation, read it to grasp the essential details.

- Click on the Buy Now button if you found what you're looking for.

Form popularity

FAQ

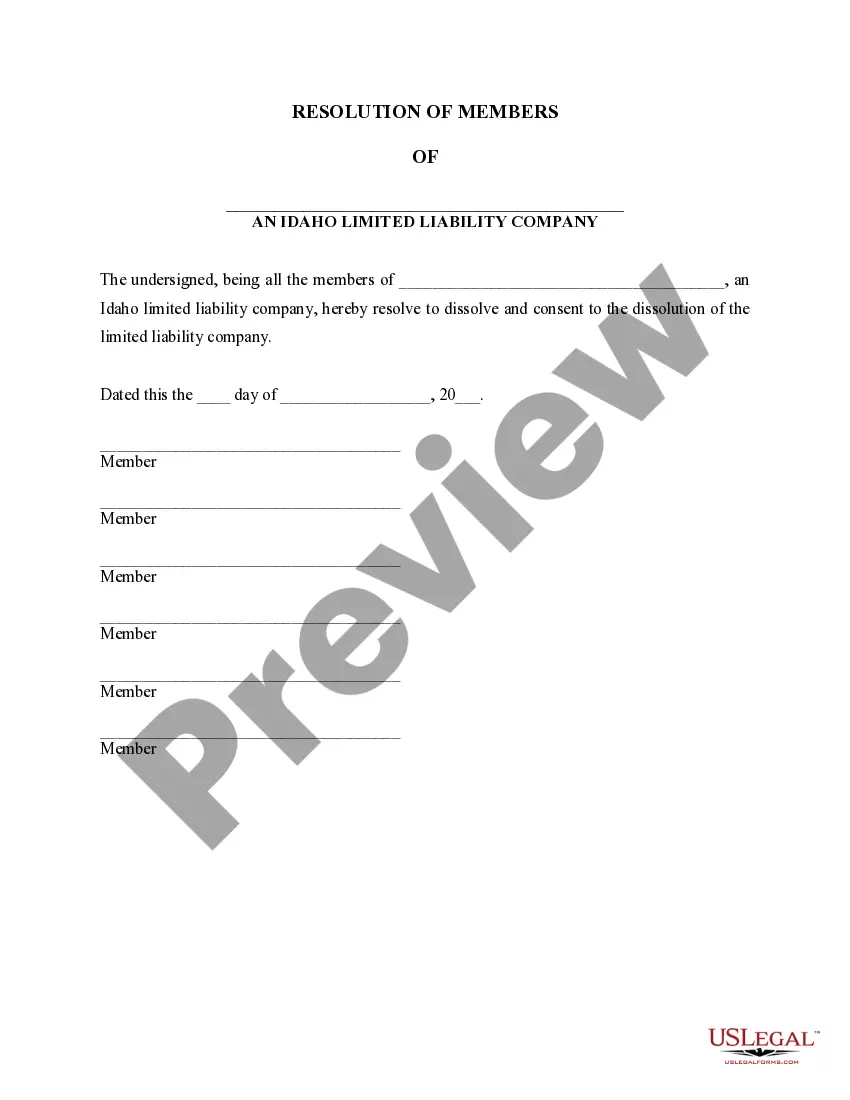

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

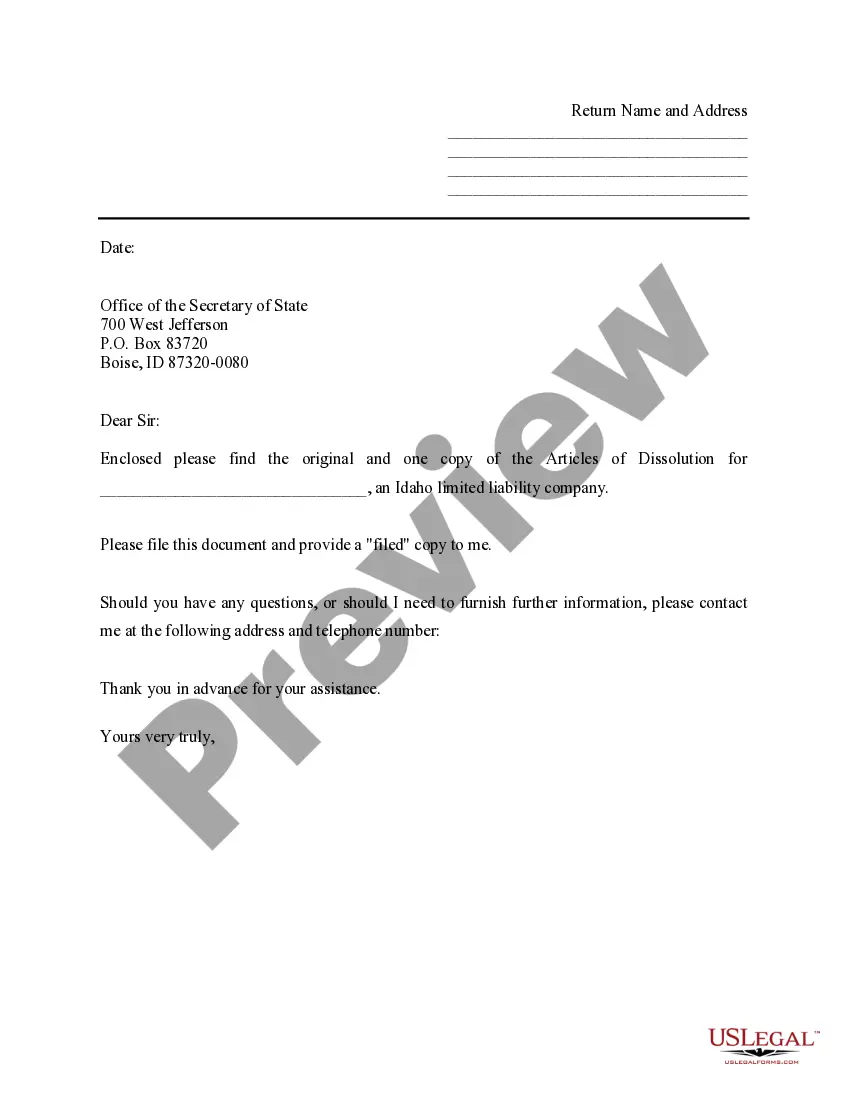

Contact an attorney and an accountant. Secretary of State: File the appropriate form to terminate the business registration. Regional SBDC office locations. When a business closes, state tax permits and sales tax permits need to be cancelled, withholding accounts closed and a final tax return filed.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.