Idaho Dissolution Package to Dissolve Limited Liability Company LLC

What is this form?

The Idaho Dissolution Package to Dissolve Limited Liability Company (LLC) is a comprehensive legal tool designed for members wishing to officially dissolve an LLC or professional limited liability company (PLLC) in Idaho. This package includes all necessary forms, instructions, and important information to guide you through the dissolution process, ensuring compliance with state laws. Unlike other forms, this package is tailored specifically for the dissolution of LLCs in Idaho and includes additional support materials, such as transmittal letters and guidelines on asset distribution.

Main sections of this form

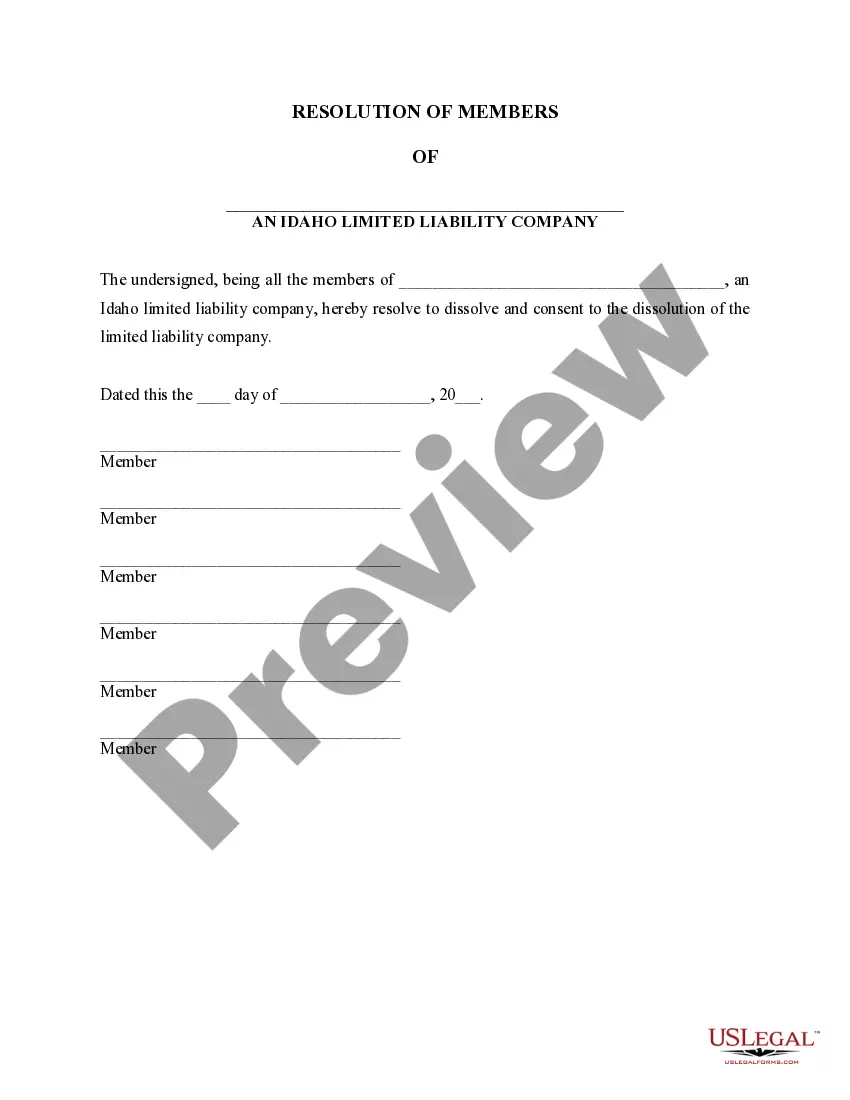

- Resolution of Members Consenting to Dissolution form

- Articles of Dissolution form

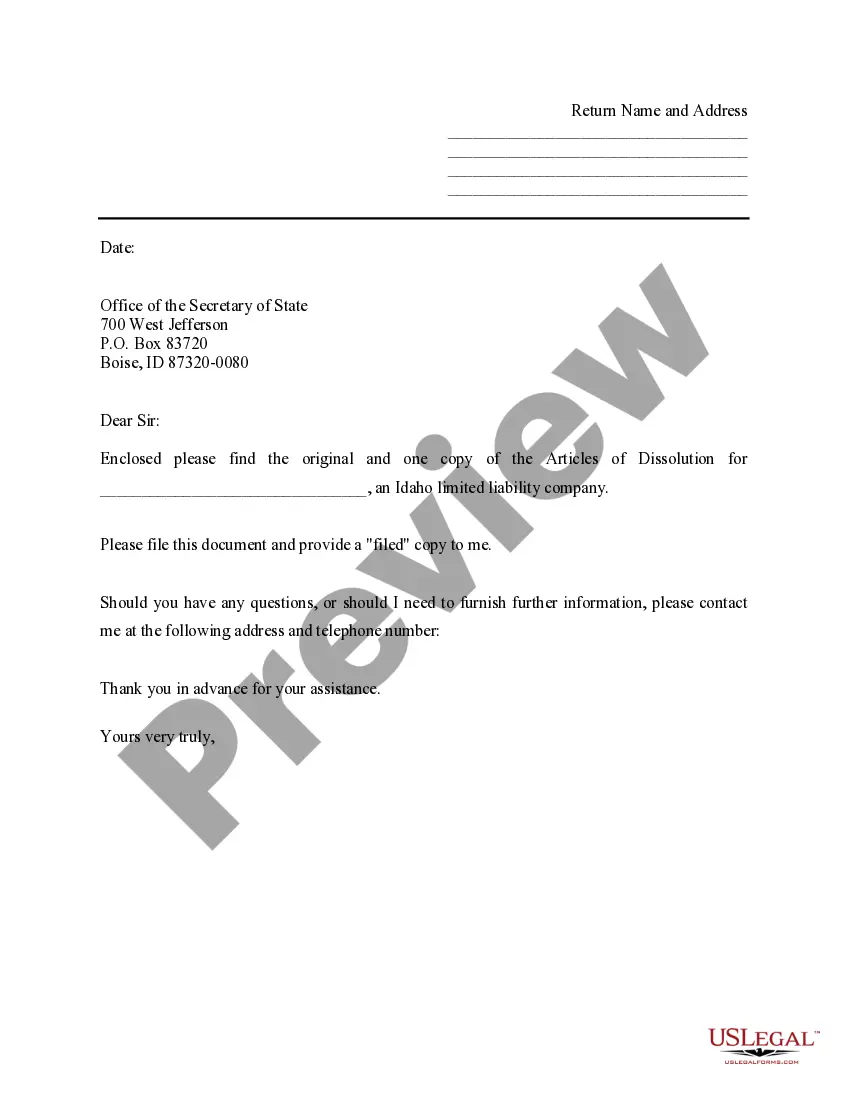

- Transmittal letter for submitting Articles of Dissolution

- Step-by-step instructions for the dissolution process

- Summary of relevant Idaho statutory references

When to use this document

This form should be used when the members of an Idaho LLC or PLLC have decided to dissolve the company. Scenarios include situations such as the company has fulfilled its purpose, members want to end business operations, or the company is no longer financially viable. Properly completing and filing this dissolution package ensures that all legal obligations are met and helps avoid potential penalties.

Who this form is for

- Members or owners of an Idaho limited liability company wanting to dissolve the business formally.

- Attorneys representing clients in the dissolution process.

- Individuals involved in the management or decision-making of an LLC or PLLC in Idaho.

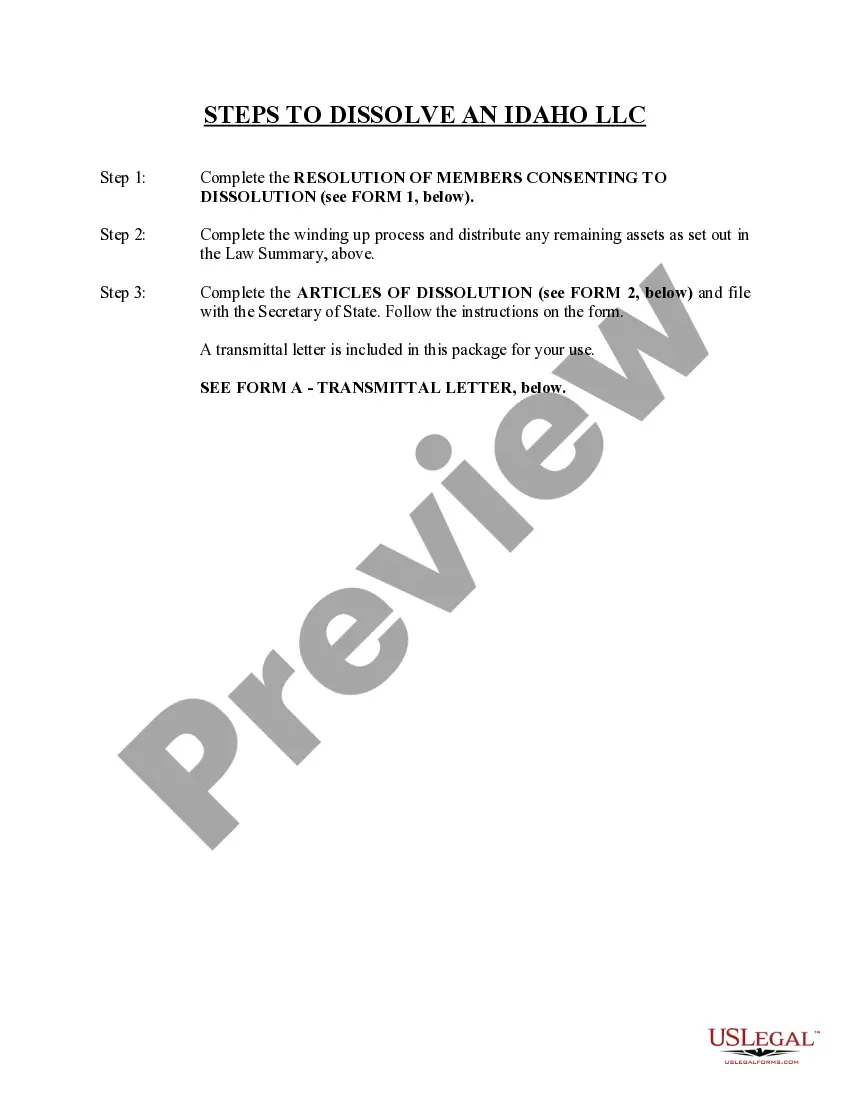

Completing this form step by step

- Complete the Resolution of Members Consenting to Dissolution form to document the agreement among members.

- Follow the winding up process as described in the instructions, including asset distribution as required by law.

- Fill out the Articles of Dissolution form, ensuring all information is accurate and complete.

- Include a transmittal letter when submitting the Articles of Dissolution to the Secretary of State.

- File the completed forms and documents with the appropriate state office and keep copies for your records.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to document all members' consent in the Resolution of Members Consenting to Dissolution form.

- Not distributing remaining assets as required before filing for dissolution.

- Neglecting to include a transmittal letter with the Articles of Dissolution submission.

- Filing the Articles of Dissolution without double-checking for accurate information.

Why complete this form online

- Convenient access to all necessary forms and instructions in one package.

- Edit and customize forms easily to fit specific needs and scenarios.

- Reliable access to updated legal information and guidelines for Idaho LLC dissolutions.

Looking for another form?

Form popularity

FAQ

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Contact an attorney and an accountant. Secretary of State: File the appropriate form to terminate the business registration. Regional SBDC office locations. When a business closes, state tax permits and sales tax permits need to be cancelled, withholding accounts closed and a final tax return filed.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.