Liquidation Proposal

Overview of this form

The Liquidation Proposal is a legal document used in corporate settings to outline a plan for dissolving a company. This form differs from other corporate forms because it specifically addresses the process of liquidating a businessâs assets and settling its liabilities before closing operations entirely. Designed to comply with state regulations, this form ensures that all procedures are legally sound and systematically conducted, enabling shareholders to understand and vote on the dissolution.

Main sections of this form

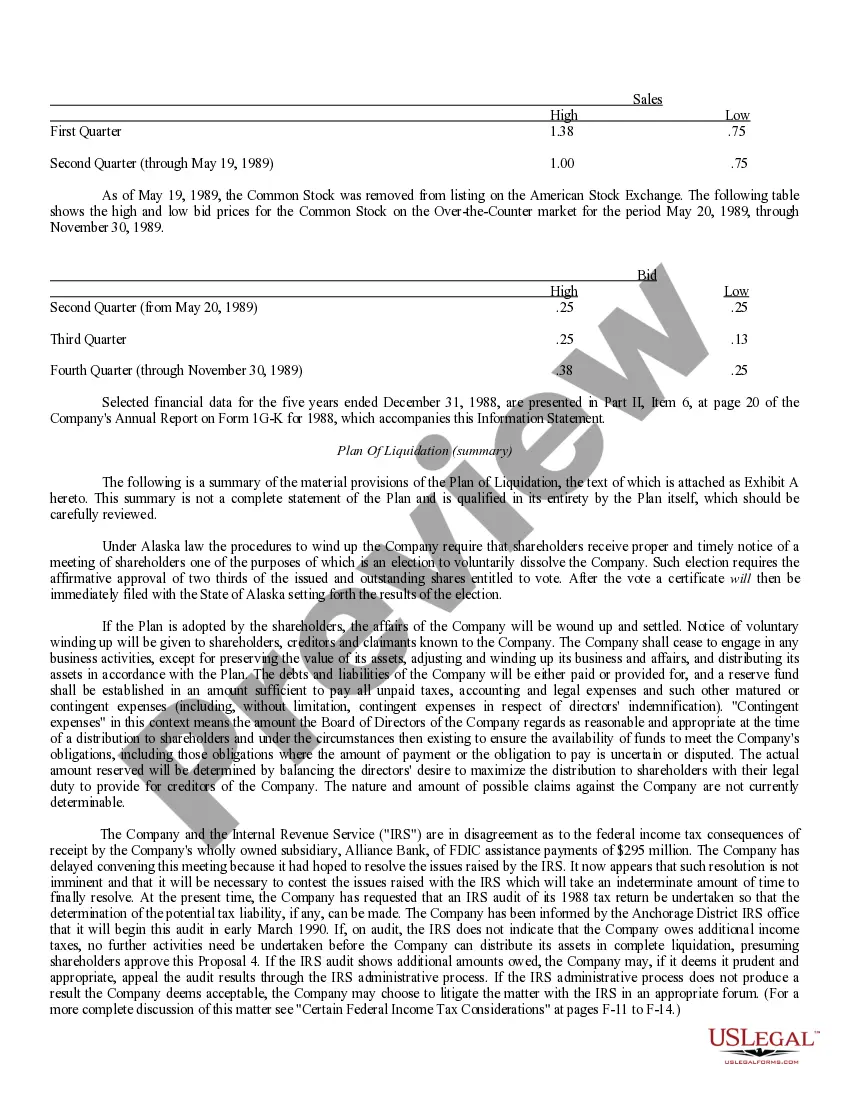

- Details on the company's financial situation and reasons for liquidation.

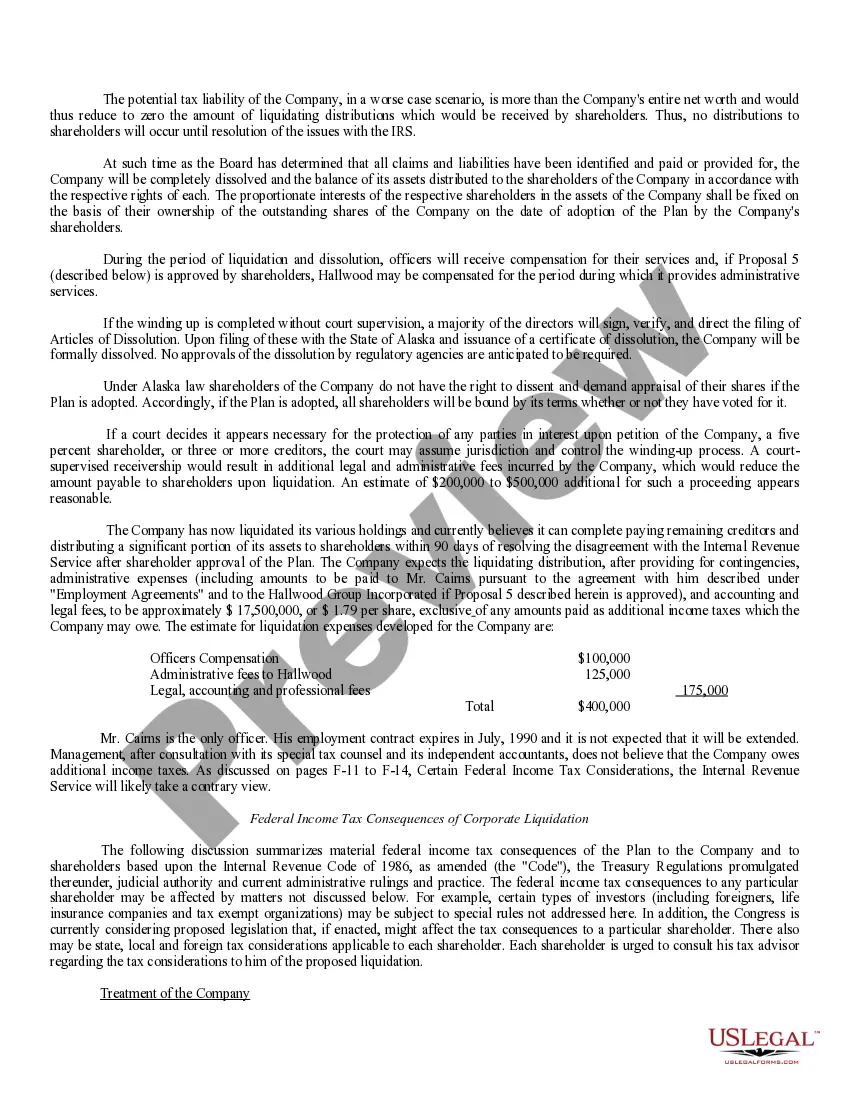

- Plan of liquidation outlining steps for asset distribution and debt settlement.

- Notice requirements for shareholders about the upcoming vote on the proposal.

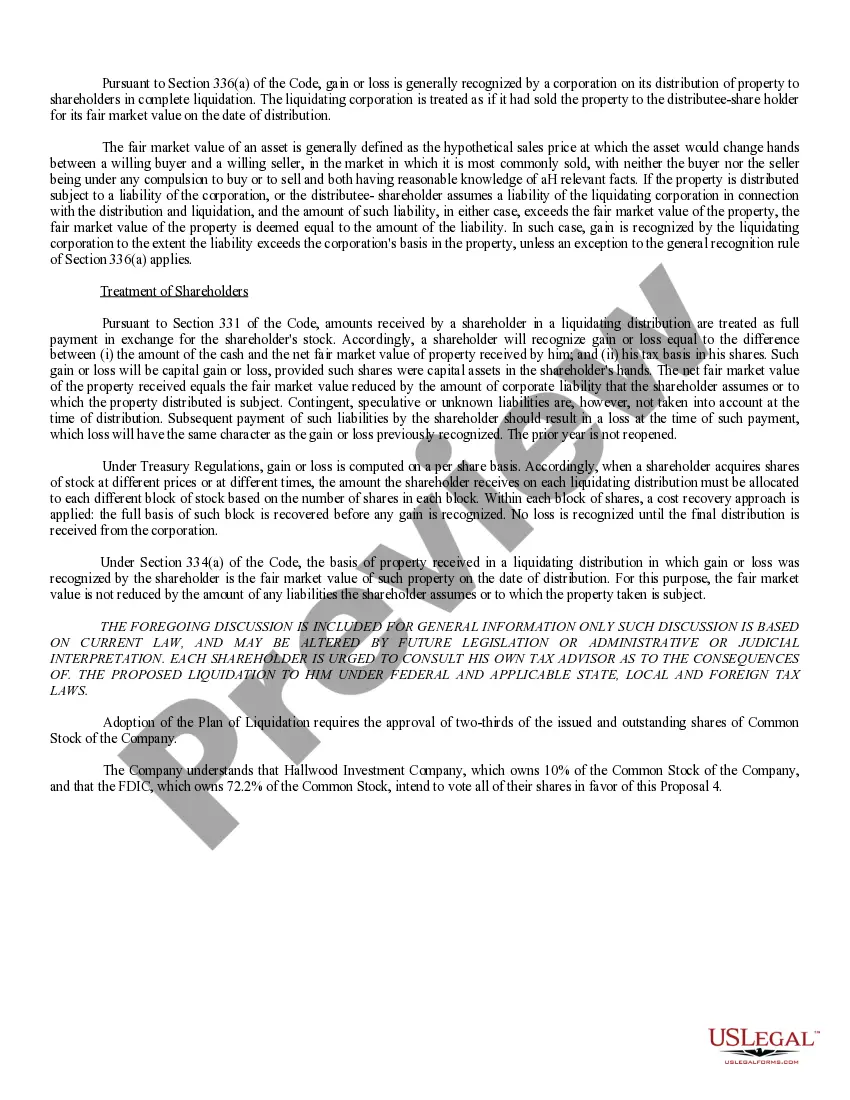

- Summary of potential tax implications related to the liquidation process.

- Voting thresholds needed for shareholders to approve the liquidation plan.

When to use this document

This form should be used when a corporation determines that it can no longer operate due to financial distress or other reasons, such as insufficient capital or business purpose frustration. It is appropriate for companies seeking to formally wind up their affairs, settle debts, and distribute any remaining assets among shareholders. Instances include companies facing insolvency, declining revenues, or those that wish to cease operations in a structured manner.

Who this form is for

- Corporations facing financial distress and considering dissolution.

- Shareholders of a company voting to approve or reject the liquidation plan.

- Corporate officers tasked with implementing the liquidation process.

- Legal representatives involved in corporate law and bankruptcy issues.

Steps to complete this form

- Identify the company's current financial status and reasons for liquidation.

- Draft the plan of liquidation, detailing the asset distribution and debt settlement process.

- Provide notice to all shareholders regarding the upcoming vote on the proposal.

- Ensure that the plan addresses any potential tax implications for the corporation and shareholders.

- Gather necessary approvals from shareholders, ensuring two-thirds of votes are in favor.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to properly notify shareholders about the vote.

- Not obtaining the required majority approval for the liquidation plan.

- Overlooking potential tax liabilities that impact the distribution to shareholders.

- Not providing a detailed plan of liquidation that addresses all necessary aspects.

Advantages of online completion

- Convenient access to the legal form at any time, allowing for quick implementation.

- Editability to customize the proposal according to specific corporate circumstances.

- Availability of templates drafted by licensed attorneys to ensure compliance with legal standards.

- Reduced risk of errors through guided instructions on completing the form.

Legal use & context

- This form is legally binding once approved by the shareholders of the corporation.

- Liquidation must comply with state corporate laws and regulations regarding dissolution.

- Shareholders do not have the right to dissent or demand appraisal once the plan is adopted.

- The process may be subject to IRS scrutiny regarding tax implications from the liquidation.

Looking for another form?

Form popularity

FAQ

Liquidate means converting property or assets into cash or cash equivalents by selling them on the open market. Liquidation similarly refers to the process of bringing a business to an end and distributing its assets to claimants.

After the costs of liquidation, secured creditors and preferential creditors are paid first, and then unsecured creditors. Creditors with valid specific security over stock and equipment (such as retention of title clauses or leases) generally have priority to recover those items where they can be clearly identified.

Liquidation is important if a business fails due to anything from a lack of visionary management to increasing debts; from almost-zero revenue inflow to rising costs of unnecessary assets. Absence of profit planning and control on the continuity of losses for extended periods also call for liquidation.

Plan of Liquidation means a plan (including by operation of law) that provides for, contemplates or the effectuation of which is preceded or accompanied by (whether or not substantially contemporaneously) (i) the sale, lease, conveyance or other disposition of all or substantially all of the assets of the referent

The different processes of closing a business.Simply put, a dissolution is a (typically) voluntary legal closure of a business while a liquidation involves the selling of a company's assets in order to pay creditors.

In that process, the corporation notifies creditors of the impending cessation of business and does all acts appropriate to liquidate its business, such as collecting and selling assets, discharging liabilities, and distributing any remaining assets to shareholders.6 The corporation may, but is rarely required to,

The term "dissolution" refers to the systemic closing down of a business entity, while "winding up" refers to the selling of assets and payment of debts prior to closing a business. Dissolution and winding up, as well as other aspects of closing a business, often require the assistance of a legal professional.