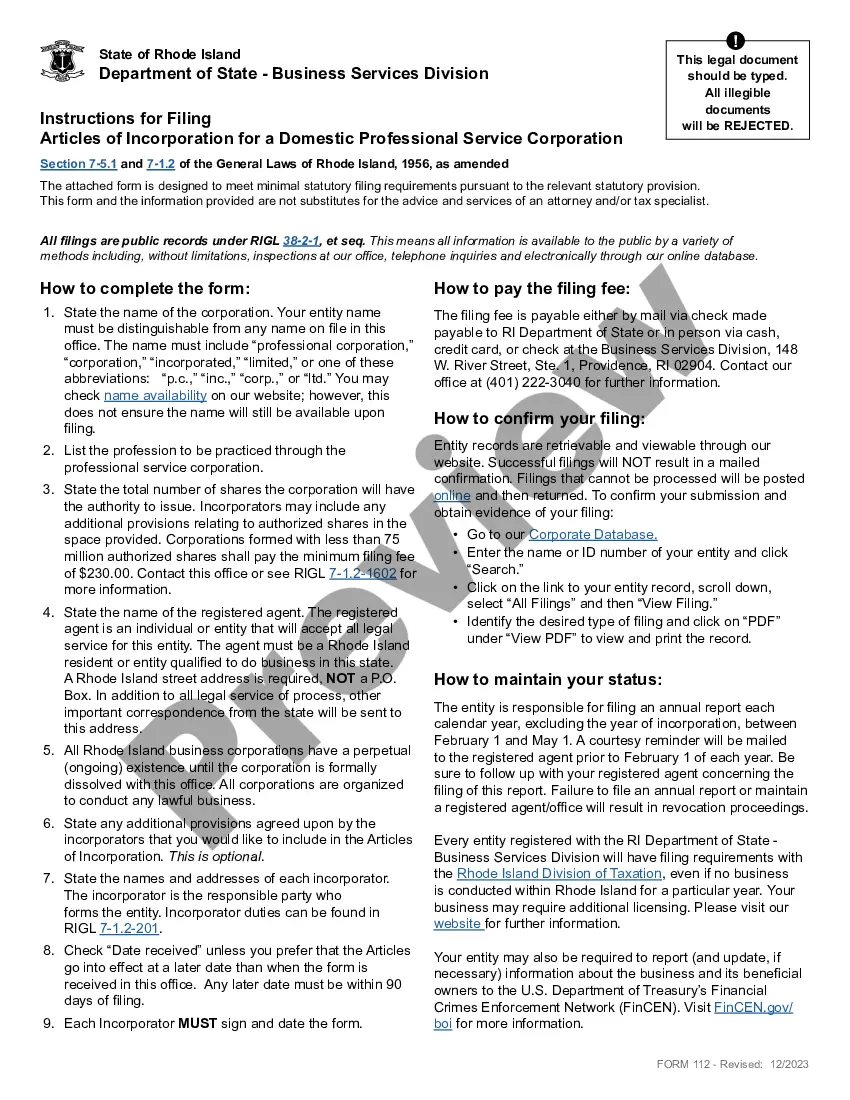

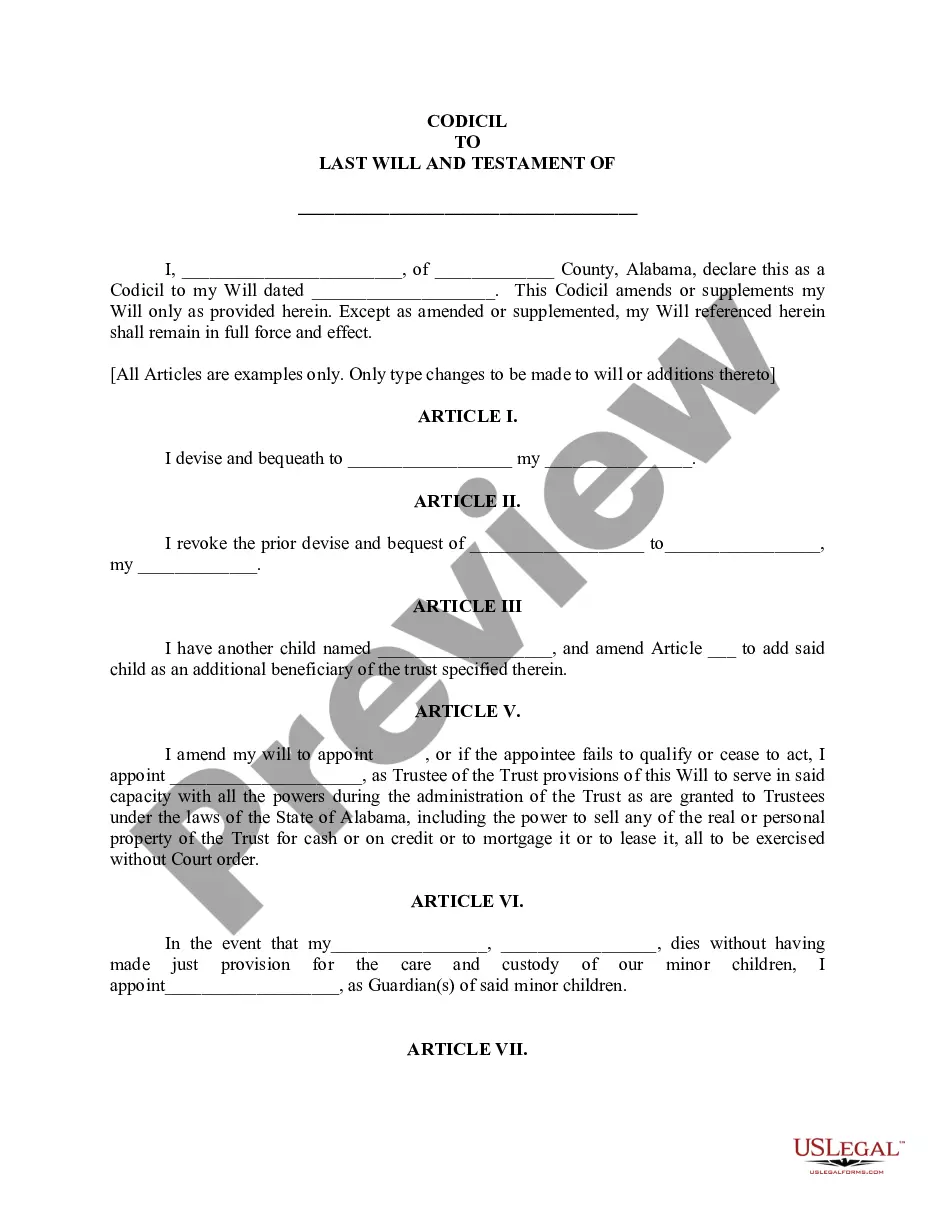

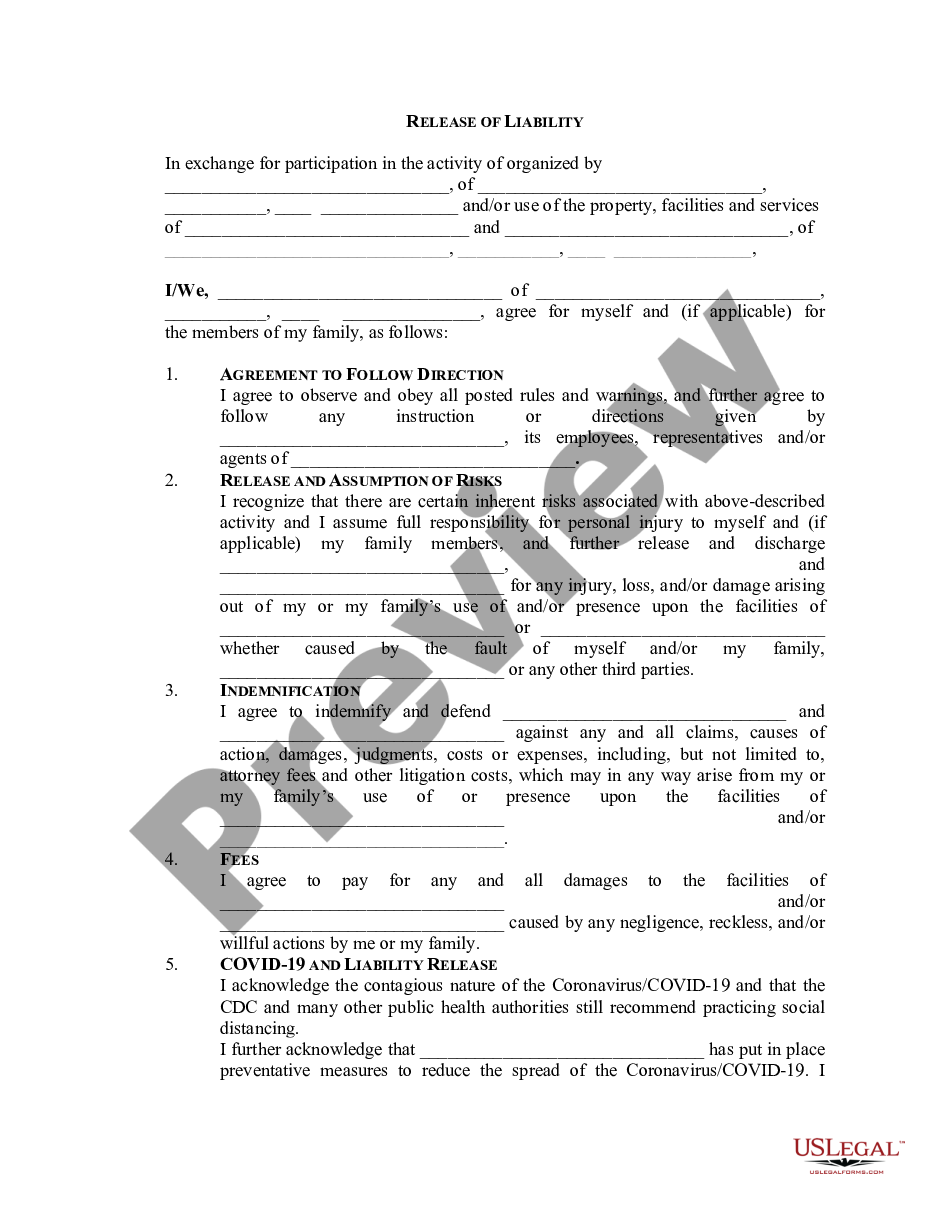

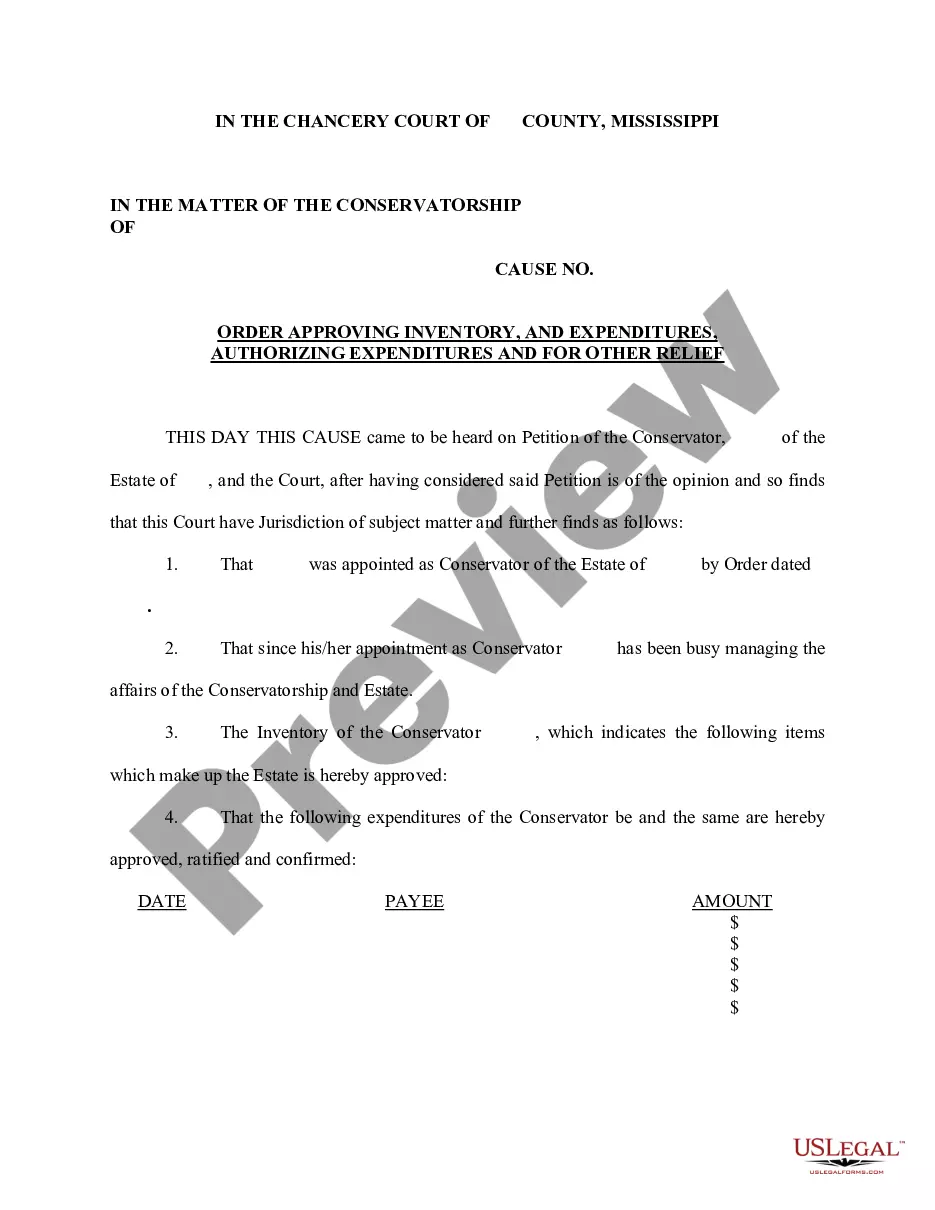

Professional Corporation Package for Rhode Island

Description

How to fill out Professional Corporation Package For Rhode Island?

Among lots of free and paid examples which you get on the web, you can't be sure about their accuracy and reliability. For example, who made them or if they are competent enough to take care of the thing you need them to. Keep calm and utilize US Legal Forms! Get Professional Corporation Package for Rhode Island samples developed by professional lawyers and avoid the expensive and time-consuming process of looking for an lawyer or attorney and then paying them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are seeking. You'll also be able to access your previously downloaded templates in the My Forms menu.

If you’re using our service the very first time, follow the instructions below to get your Professional Corporation Package for Rhode Island quick:

- Make sure that the file you see is valid where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or look for another template utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you have signed up and bought your subscription, you can use your Professional Corporation Package for Rhode Island as many times as you need or for as long as it remains active in your state. Revise it with your favorite online or offline editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Rhode Island Small Business Information. Get One or More Business Licenses. File Records For Your Form of Business. Obtain Professional Licensing. Register an Assumed or Fictitious Business Name.

Decide on a name for your business. Assign a registered agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. File for pass-through withholding tax.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

Forming an LLC in Rhode Island is simple. Search your Rhode Island LLC name in the state database and select your RI Resident Agent. Then file your Articles of Organization with the Rhode Island Secretary of State and wait for your LLC to be approved. You can file your LLC by mail, online, or walk-in filing.

Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits. Step 8: Find Financing.

Form. Certificate of Assumed Business Name. Submit Your Certificate of Assumed Business Name. Providence City Hall. Payment. $10 Filing Fee. DBA Questions. Contact the Providence City Clerk: 401.680. Renew Your DBA. Your assumed name does not expire. Change Your DBA. Withdraw Your DBA.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Steps to Starting a Business in Rhode Island. Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits.