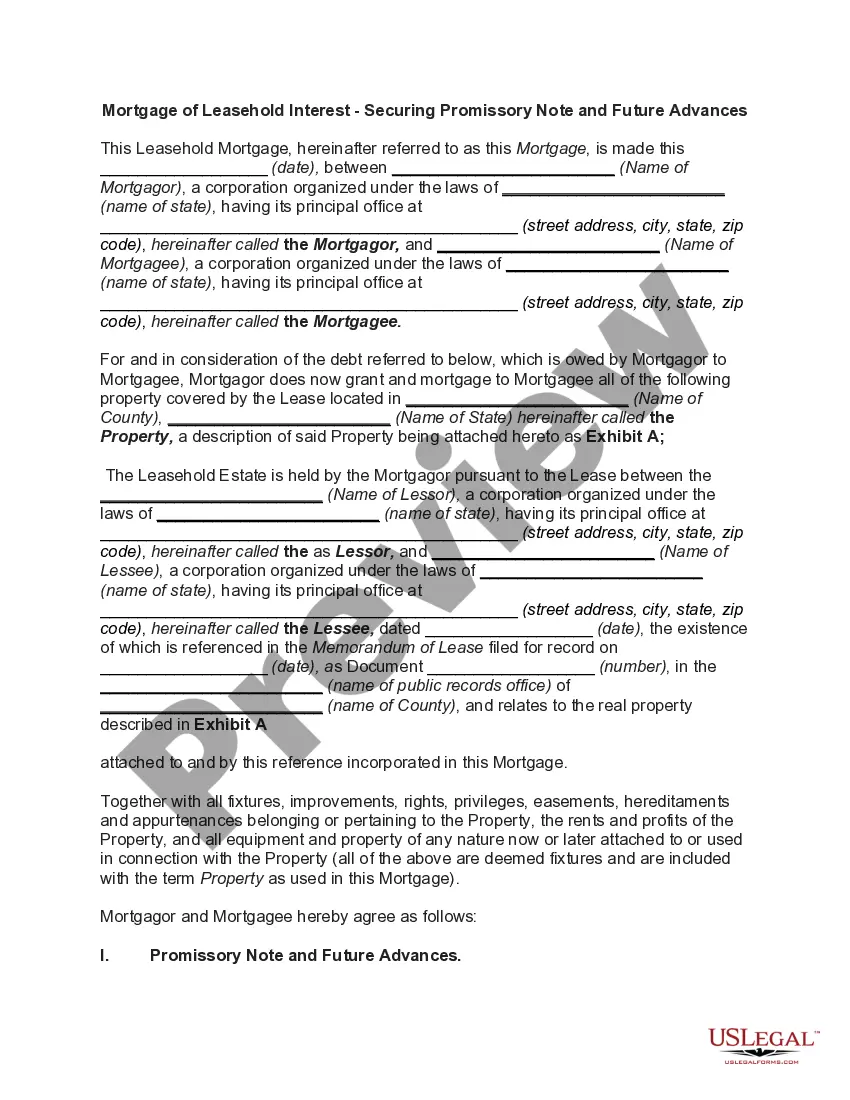

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Florida Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Obtain access to one of the most extensive collections of legal documents.

US Legal Forms truly serves as a platform where you can discover any state-specific form in just a few clicks, including examples of Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

No need to waste your time searching for a court-acceptable template. Our certified professionals guarantee you receive current examples every time.

After selecting a pricing plan, create your account. Make your payment via card or PayPal. Download the sample to your device by clicking Download. That's it! You should file the Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template and verify it. To ensure that everything is correct, consult your local legal advisor for assistance. Register and conveniently find over 85,000 useful samples.

- To utilize the document library, choose a subscription and create your account.

- If you have registered, just Log In and click on the Download button.

- The Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate example will quickly be stored in the My documents section (a section for all forms you save on US Legal Forms).

- To create a new account, follow the simple instructions below.

- If you plan to use a state-specific sample, ensure you select the appropriate state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview option if it’s available to examine the document's information.

- If everything is accurate, click Buy Now.

Form popularity

FAQ

To make a promissory note legally binding, both parties must sign the document. It is beneficial to have the note notarized to provide additional protection and verification. Incorporating details about collateral, such as the Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, can help solidify the agreement and ensure compliance.

Examples of promissory notes include personal loans, student loans, and mortgages, such as the Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Each of these notes outlines specific details about the borrowing agreement, including amounts and repayment schedules. Understanding these examples can help you draft your own or select a suitable template.

A promissory note typically follows a standard format, which includes the date, the names and addresses of both parties, the principal amount, the interest rate, and the repayment terms. Additionally, it should outline what will happen in case of default. Using the Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate as a guide can help you create a formal document that is effective and legal.

To write a simple promissory note, start by clearly identifying the parties involved, including the borrower and lender. Specify the amount being borrowed, the repayment terms, and the interest rate, if applicable. Include any collateral, such as the Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, to ensure that both parties understand their obligations.

In Florida, notarization is not strictly required for a secured promissory note to be valid. However, having your Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate notarized adds an extra layer of authenticity. It can help protect your interest and serve as a useful measure in case of disputes.

A secured promissory note does not necessarily have to be recorded to be enforceable, but doing so is beneficial. When you have a Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, recording it can establish your legal rights more clearly in the event of default. It serves as a public declaration of your claim on the collateral, reinforcing your position. Consider utilizing US Legal Forms to ensure your documentation is accurate and meets legal requirements.

While a promissory note does not need to be recorded in order to be valid, recording it offers additional safeguards and legal standing. Specifically, a Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can benefit from being recorded to provide proof of the lender’s interest in the collateral. This practice helps prevent potential legal disputes and protects both parties' interests. For streamlined documentation, using US Legal Forms can be a smart choice.

The law governing promissory notes in Florida outlines the essential elements required for a legally binding agreement. The Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate must include terms such as payment amounts and due dates. Understanding these laws is vital for both lenders and borrowers to ensure compliance and protect their rights. For detailed guidance, resources on the US Legal Forms platform provide valuable information.

In Florida, while it is not mandatory to record a promissory note, doing so can enhance its legal enforceability and public notice. When dealing with a Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, recording may help protect your interests against future claims. It creates a public record, which can be beneficial if disputes arise. For secure handling of documentation, consider using the US Legal Forms platform.

Yes, a promissory note is enforceable in Florida, provided it meets certain legal requirements. The note must include essential elements such as the amount owed, the borrower’s signature, and a clear repayment plan. Therefore, ensure your Florida Installments Fixed Rate Promissory Note Secured by Commercial Real Estate adheres to these standards to protect your rights as a lender.