Oregon Commercial Building or Space Lease

What is this form?

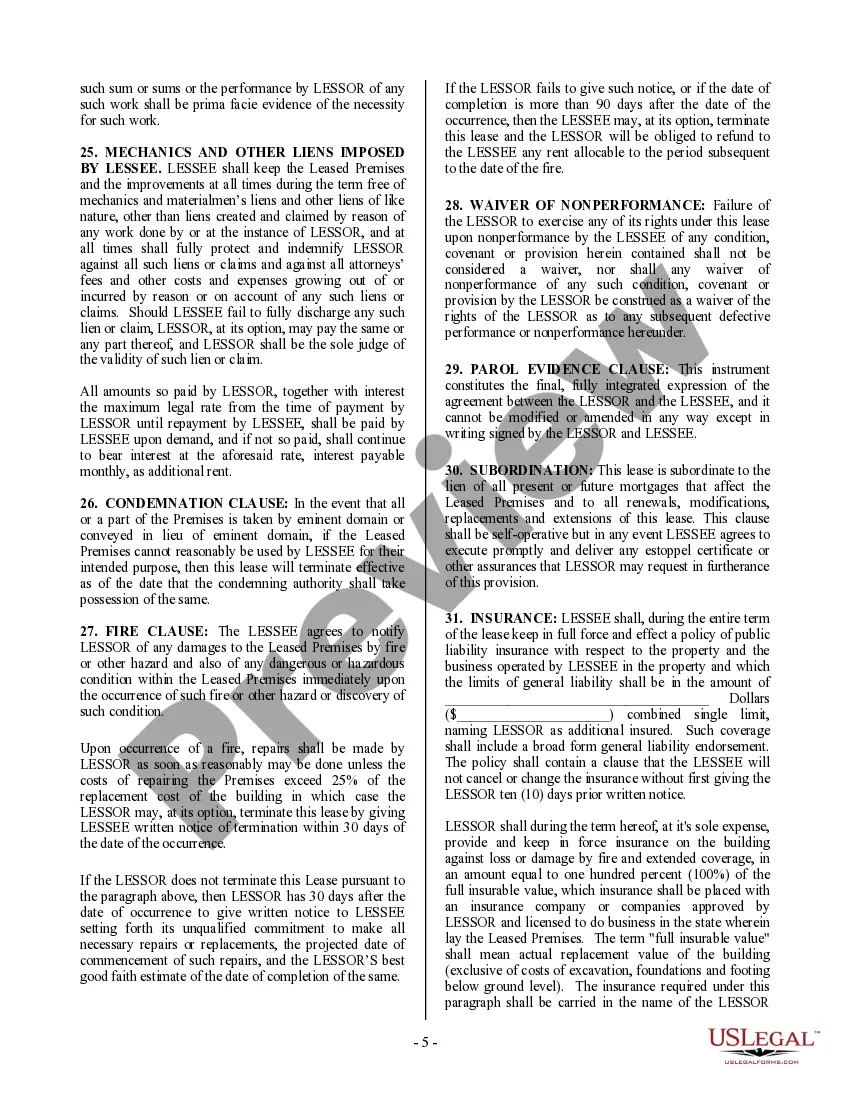

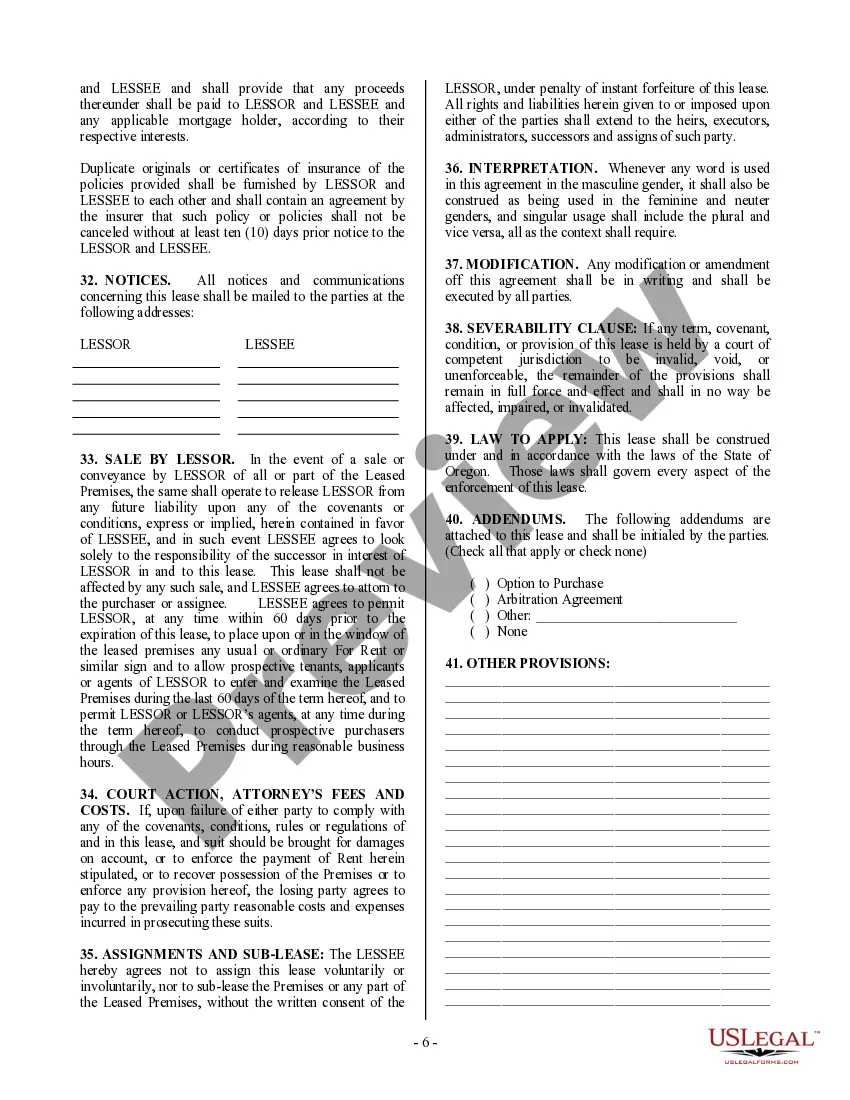

The Commercial Building or Space Lease is a legally binding agreement specifically designed for leasing commercial properties in the State of Oregon. This comprehensive lease outlines various terms and conditions, including the rental payment process, lease duration, utilities management, and provisions for property maintenance. Unlike residential leases, this document is tailored for business use and contains detailed clauses to protect both lessor and lessee interests, making it essential for any commercial leasing transaction.

What’s included in this form

- Lease Term: Specifies the duration of the lease agreement.

- Rent Payment: Outlines the rent amount, payment date, and consequences of late payment.

- Utilities Responsibility: Details which party is responsible for utility payments.

- Condition of Premises: States the responsibilities of the lessee regarding property maintenance.

- Security Deposit: Specifies the amount and purpose of the security deposit held by the lessor.

- Termination Rights: Outlines the events that constitute a default and the termination process.

When to use this document

This form should be used when entering into a lease agreement for a commercial space in Oregon. Common scenarios include leasing office space, retail locations, or any other business premises where a formal rental agreement is required. It is particularly useful when negotiating terms with a lessee to clarify expectations regarding rent, property use, and maintenance responsibilities.

Who can use this document

- Landlords or property owners looking to lease commercial space.

- Business owners seeking to rent office or retail space.

- Property managers involved in leasing commercial properties.

- Anyone engaged in a commercial rental agreement in Oregon.

How to complete this form

- Identify the parties: Clearly state the names of the lessor and lessee.

- Specify the property: Describe the commercial premises being leased.

- Enter lease term: Fill in the start and end dates of the lease.

- Set rent amount: Include the monthly rent and any late fee provisions.

- Outline utilities: Specify which utilities each party is responsible for.

- Sign and date: Ensure all parties sign and date the agreement for it to be legally binding.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify the property description accurately.

- Omitting details about the security deposit and its terms.

- Not addressing the responsibilities for maintenance and repairs.

- Neglecting to include late payment penalties and consequences.

- Forgetting to sign the lease agreement before the starting date.

Why complete this form online

- Convenience: Easily download and customize the form to meet your specific needs.

- Editability: Make changes easily without the need for professional drafting.

- Reliability: Ensure the form is based on updated legal standards and drafted by licensed attorneys.

Legal use & context

- This lease is legally enforceable within the jurisdiction of Oregon, complying with the relevant laws and regulations.

- Failure to adhere to the terms outlined can result in legal consequences for either party.

- Both lessor and lessee are advised to consult legal counsel if uncertain about specific clauses or terms.

Key takeaways

- Understand the importance of detailing rental terms clearly in a commercial lease.

- Recognize the specific obligations related to the maintenance and use of the property.

- Be aware of the state-specific rules that govern commercial leases.

- Ensure that both parties' rights and obligations are clearly defined to prevent disputes.

Looking for another form?

Form popularity

FAQ

Good deals may be on the horizon According to the October 2020 RCA CPPI: U.S. summary report, U.S. commercial real estate prices rose at a 1.4% annual rate from September 2019 to 2020, a noticeable slowdown from the mid-single-digit growth rate in 2018 and 2019.

Yes, buying commercial property has proven to be a smart investment for those who know what to expect. The income potential alone is what draws so many real estate investors to this asset type. Commercial real estate is known to have a higher return on investment when compared to residential properties.

Multiply the amount by the rentable square footage to determine your monthly cost. Divide that amount by your usable square footage to calculate your actual price per usable square foot. For example, if the rentable square footage is 1,130 and the price is $1 per square foot, your monthly lease amount is $1,130.

According to our loan experts, the top three reasons to purchase a commercial building for your business are: Buying a building creates equity every payment made on buying a building for a business is an investment in a business owner's future.SBA 504 loans offer a fixed rate for 25, 20, or 10 years.

The value of your commercial real estate property can also be increased by increasing the rent. In reviewing the historical data on a property, take notice of whether the tenants are paying market rent or whether there is potential for a reasonable mark up in rents.

Typically, commercial space is evaluated at $X per square foot, and that rate times the rentable square feet for your space determines your monthly rent.

A lease may sometimes beat out a purchase in terms of cash flow, particularly in the early years. But over the long haul, a purchase is usually cheaper because a landlord, in addition to paying all of the costs associated with purchasing and maintaining the property, will attempt to build in a profit for himself.

For office buildings that include retail space, the 2019 edition of Chain Store Age's annual survey of retail build-outs put the average cost at $56.53 per square foot.

When you lease commercial property, you will be able to deduct your lease payments, as well as other rental expenses, on your taxes.It can be cost prohibitive to purchase commercial property in a expensive area, but leasing will give you access to higher-end properties for less money than if you bought there.