New York Financial Account Transfer to Living Trust

About this form

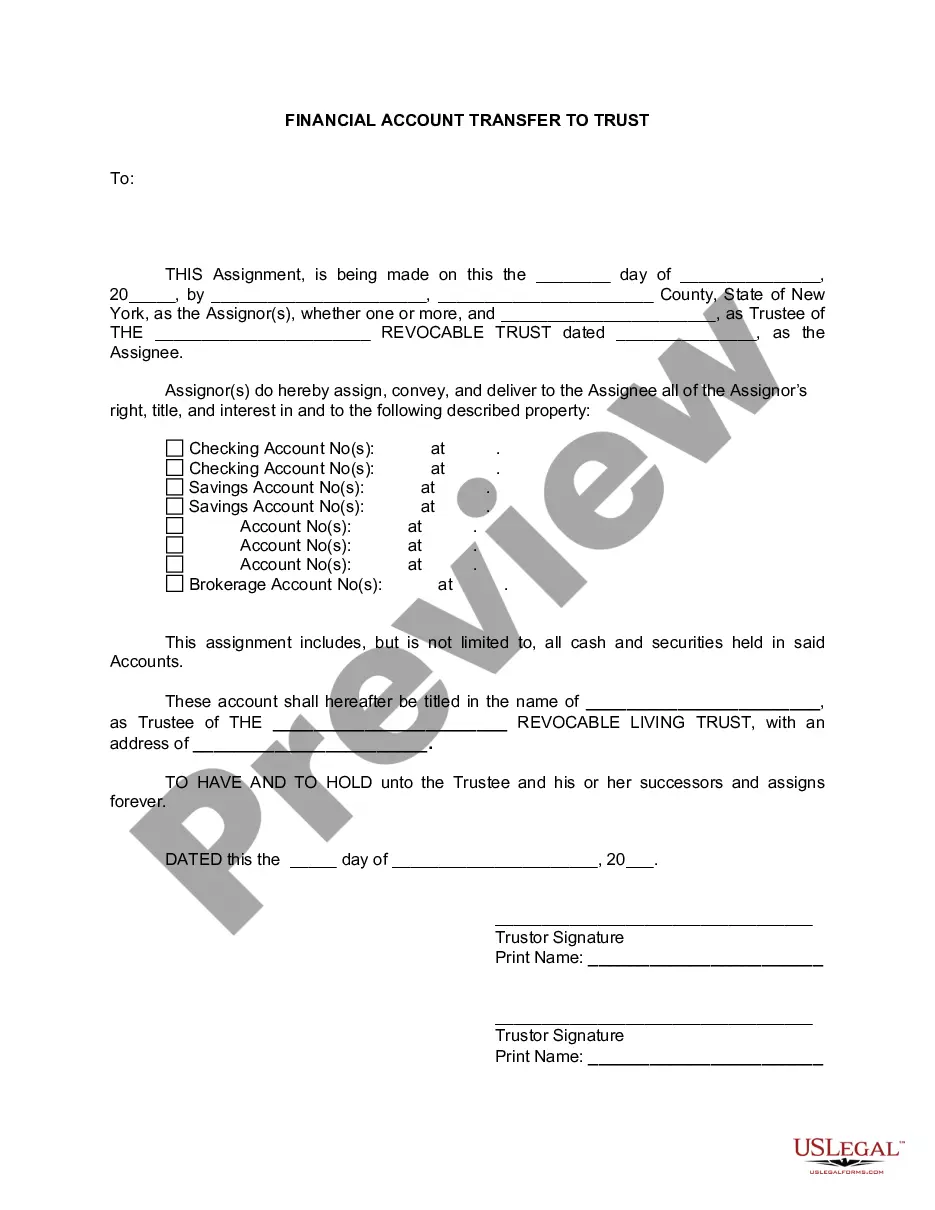

The Financial Account Transfer to Living Trust form is designed for individuals wishing to transfer their financial accounts, such as bank accounts or securities, into a living trust. This legal document facilitates the assignment of ownership from the individual (the Assignor) to the living trust, thereby streamlining the estate planning process. Unlike simple account transfer forms, this document ensures that assets are held under the legal authority of the trust during the Assignor's lifetime and beyond, offering various legal protections and benefits for the estate.

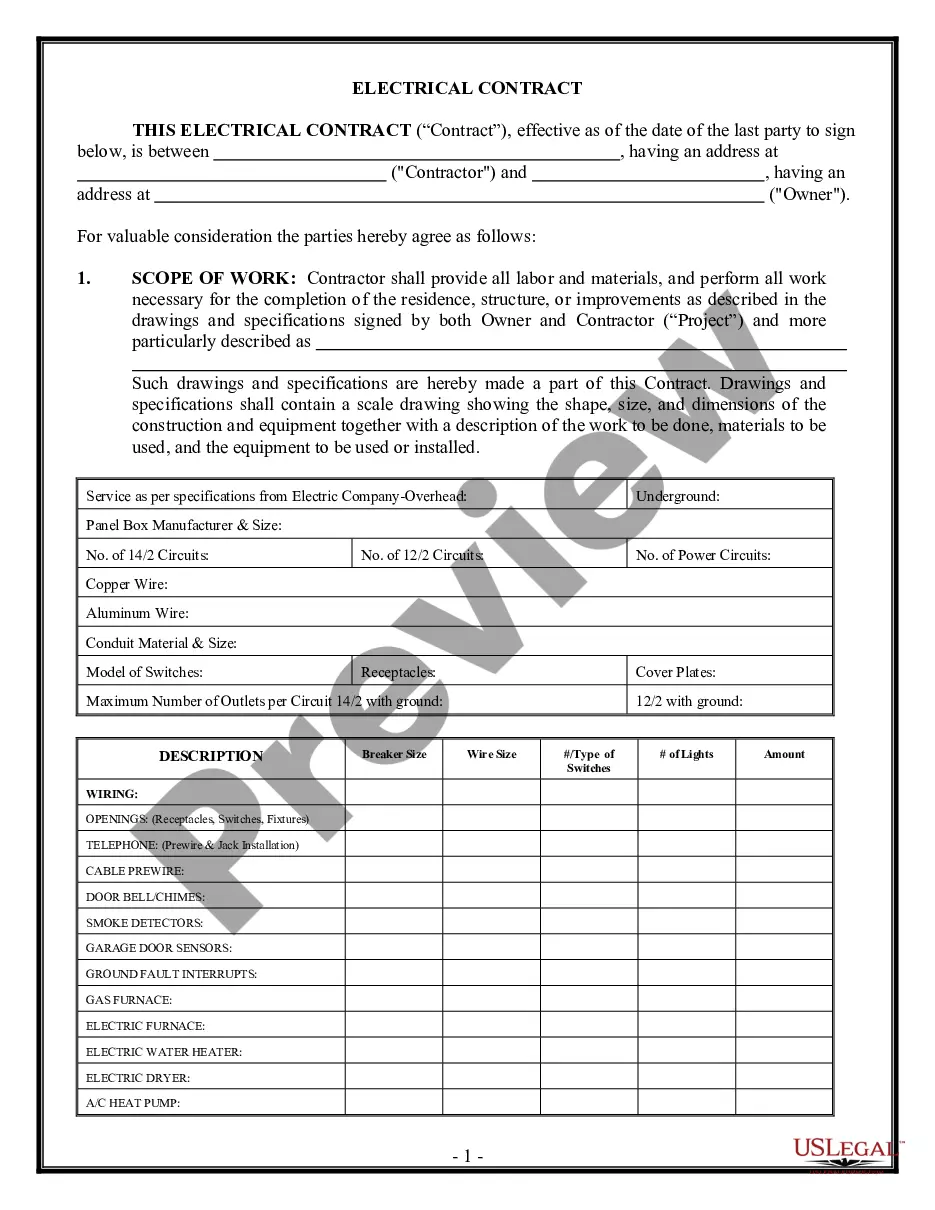

Form components explained

- Assignor's name and contact information.

- Description of the financial accounts being transferred.

- Name of the living trust and designated trustee.

- Signatures of the Assignor(s) to finalize the assignment.

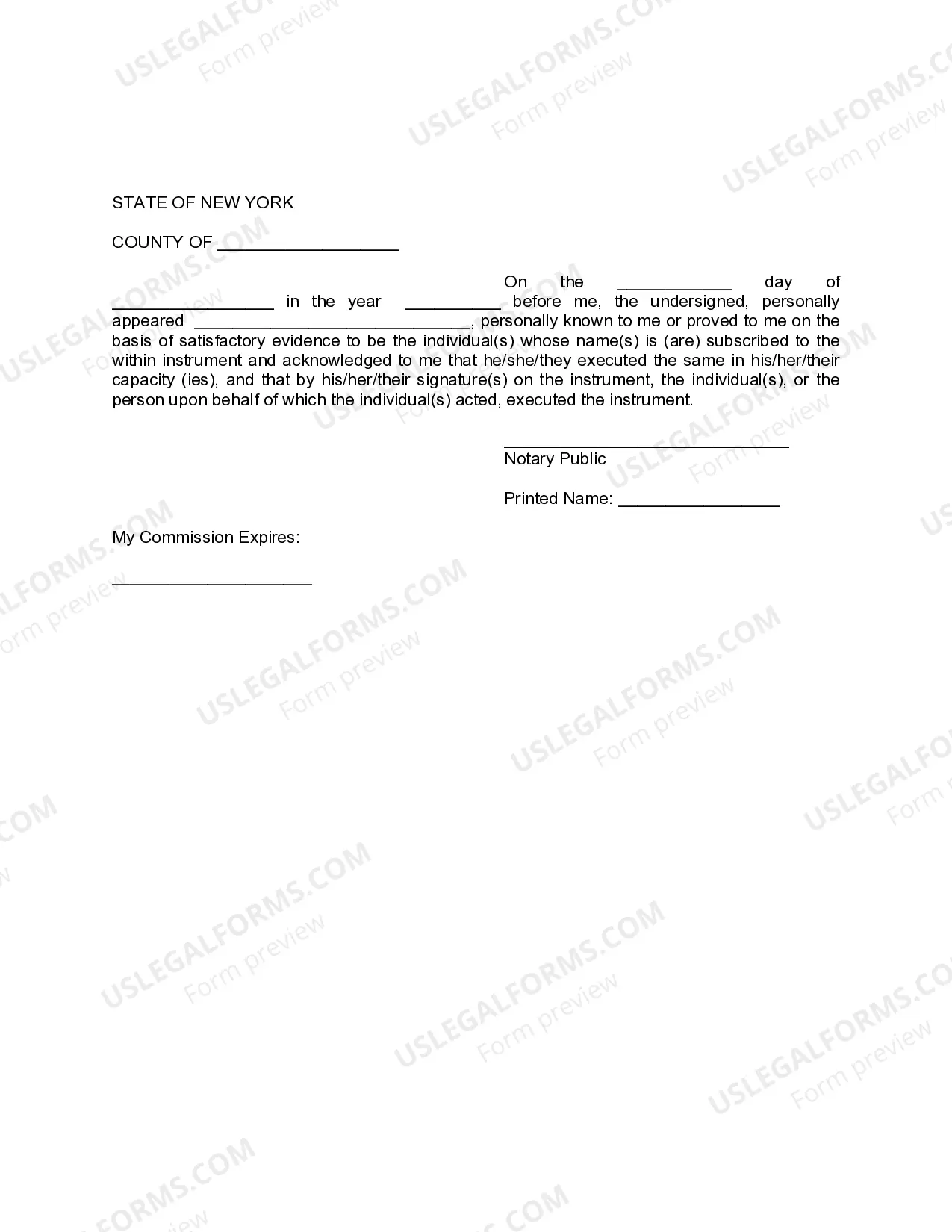

- Notary acknowledgment to validate the signatures.

When to use this form

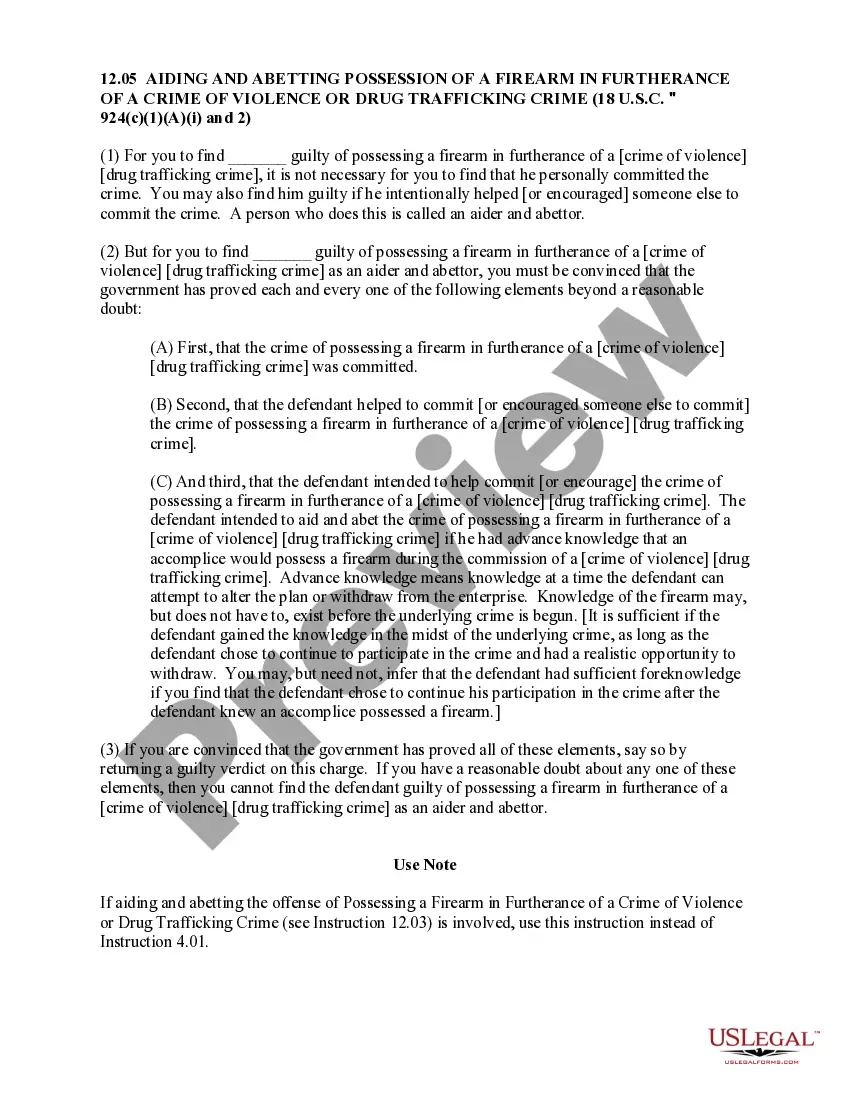

This form is particularly useful when setting up a living trust as part of your estate planning. It should be used when you want to ensure that your financial accounts are managed according to your trust's terms, allowing for easier asset management and distribution upon your passing. If you have recently established a living trust and wish to transfer existing accounts into it, this form is essential to formalizing that process.

Who needs this form

- Individuals who have established a living trust and want to transfer their financial accounts into that trust.

- Trustees who need a formal document to manage assets held within a living trust.

- Estate planners assisting clients who wish to consolidate assets for easier management and distribution.

Steps to complete this form

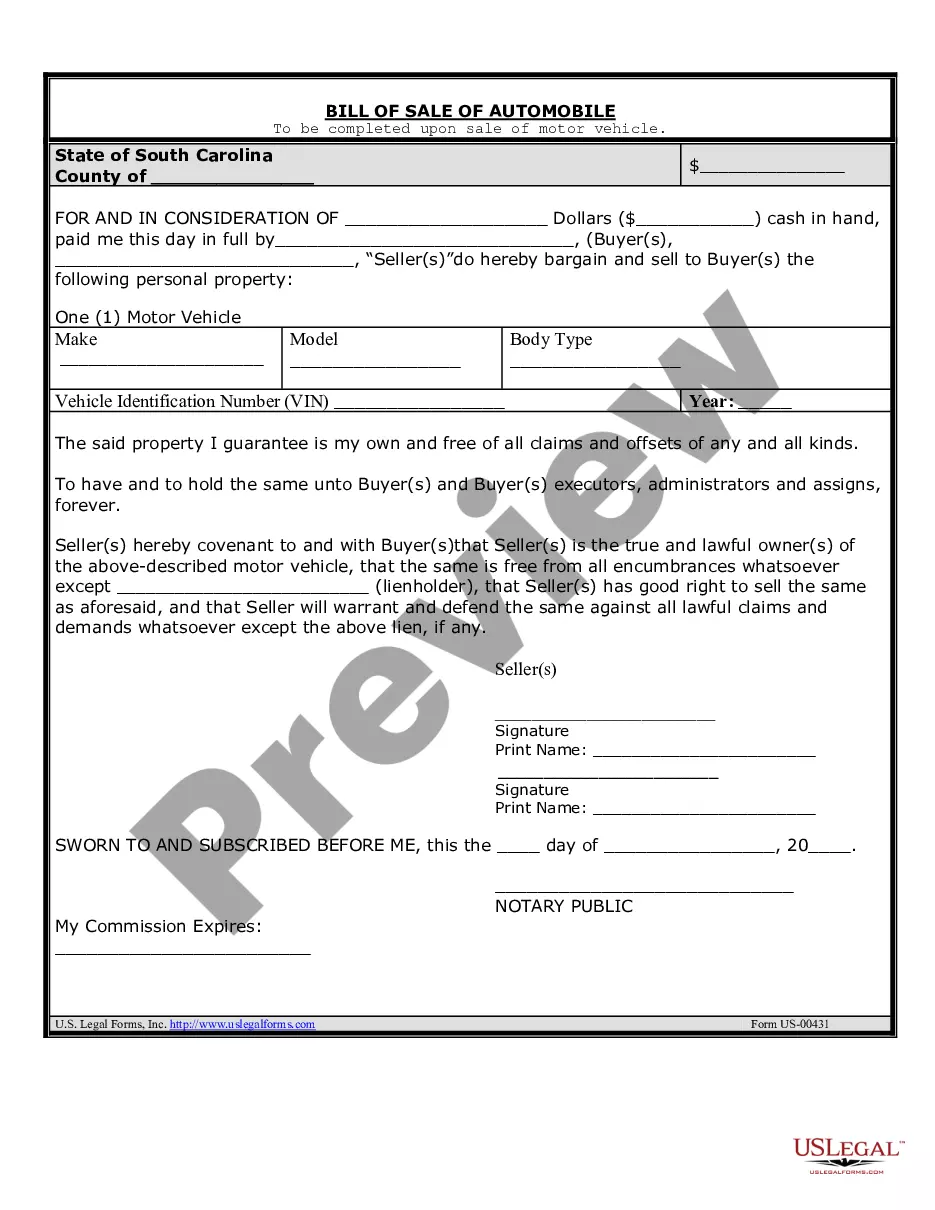

- Identify the Assignor(s) and complete their contact information at the top of the form.

- List all financial accounts being transferred, including account numbers and institutions.

- Specify the name of the living trust and the trustee, ensuring accuracy in titles.

- Have all Assignors sign the document to execute the transfer.

- Arrange for a notary public to witness the signatures and complete the notarization section.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all account details, which may lead to incomplete transfers.

- Not obtaining signatures from all required parties, compromising the validity.

- Overlooking the notarization requirement, which is essential for legality in certain states.

Benefits of using this form online

- Convenience of downloading and completing the form at your own pace.

- Editable templates allow for customization to fit your specific needs.

- Access to legally vetted content ensured by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.