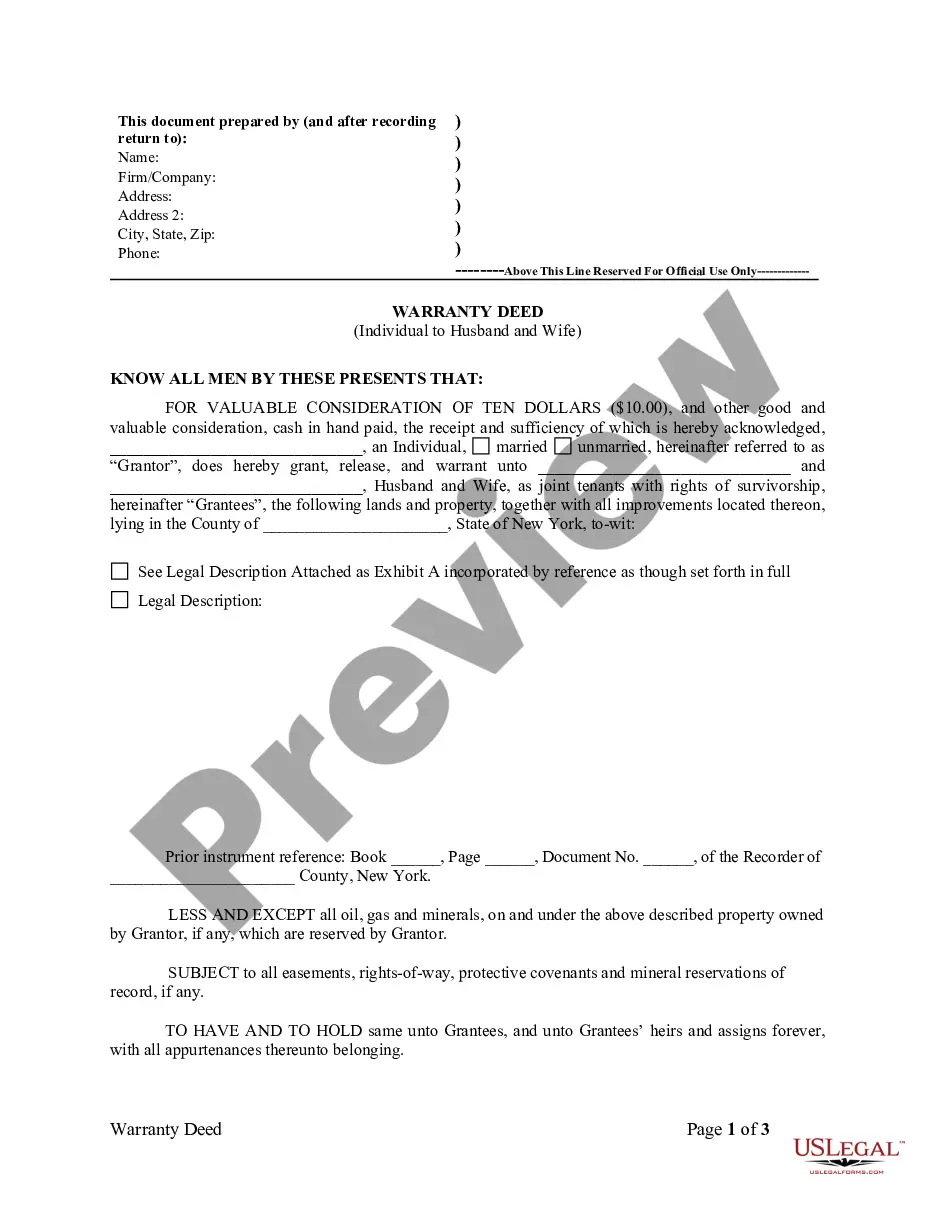

New York Warranty Deed from Individual to Husband and Wife

About this form

The Warranty Deed from Individual to Husband and Wife is a legal document used to transfer property ownership from an individual (the Grantor) to a couple (the Grantees) who are married. This type of warranty deed ensures that the Grantor guarantees clear ownership and provides a warranty against claims on the property, making it distinct from other types of deeds such as quitclaim deeds. The form specifically includes protections regarding oil, gas, and mineral rights, ensuring that those rights remain with the Grantor unless stated otherwise.

Main sections of this form

- Information on Grantor and Grantees, including names and relationship.

- A detailed legal description of the property being transferred.

- Provisions on reserved rights, including any mineral interests.

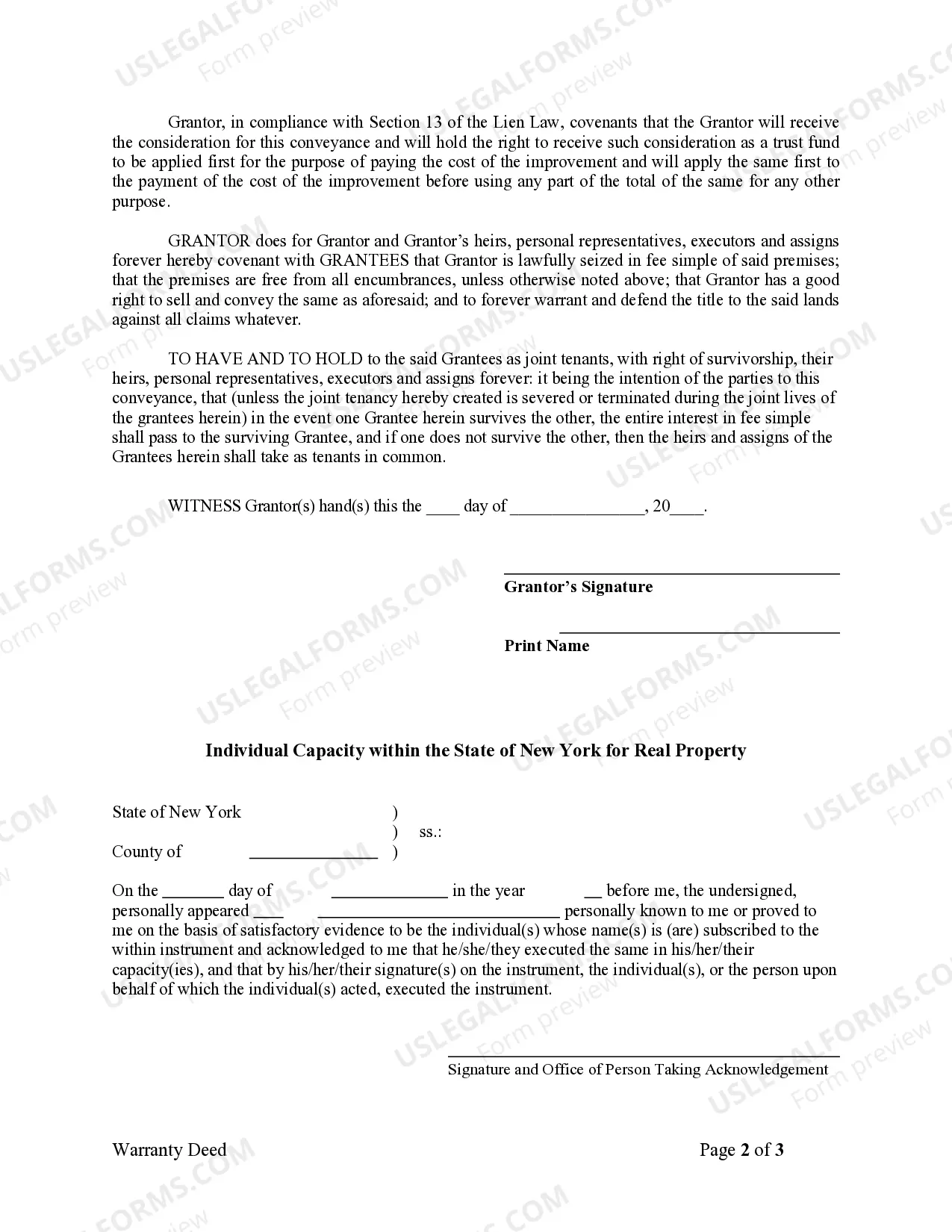

- Clauses that confirm the Grantor's legal right to convey the property.

- Statements regarding the handling of consideration and rights of survivorship between spouses.

When to use this form

This form is typically used when an individual wishes to transfer real estate to a married couple. It is appropriate in situations such as estate planning, gifting property to a spouse, or when purchasing property together as a married couple. It's crucial to use this form if the Grantor wants to ensure the property is held by the Grantees as joint tenants with rights of survivorship.

Who can use this document

This form is intended for:

- Individuals who own property and wish to transfer it to their spouse or to a married couple.

- Married couples receiving property as a gift or part of an estate transfer.

- Individuals seeking to formalize property ownership between spouses for legal clarity and protection.

Instructions for completing this form

- Identify the parties involved: fill in the Grantor's name and the names of the Grantees (husband and wife).

- Specify the property: include a complete legal description of the property being transferred.

- Include any reservations of rights: note any reserved rights to oil, gas, or minerals if applicable.

- Complete the date of execution: enter the date when the deed is being signed.

- Sign the form: the Grantor must sign the deed in the presence of a notary public if required.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes

- Failing to provide an accurate legal description of the property.

- Not including the necessary signatures or notarizations.

- Forgetting to mention any reserved rights on the property.

- Leaving out the date of execution, which is essential for the validity of the document.

Why complete this form online

- Convenience: easily download the form from any device at any time.

- Editability: customize the document to fit your specific circumstances easily.

- Reliability: forms are drafted by licensed attorneys to ensure accuracy and legality.

Form popularity

FAQ

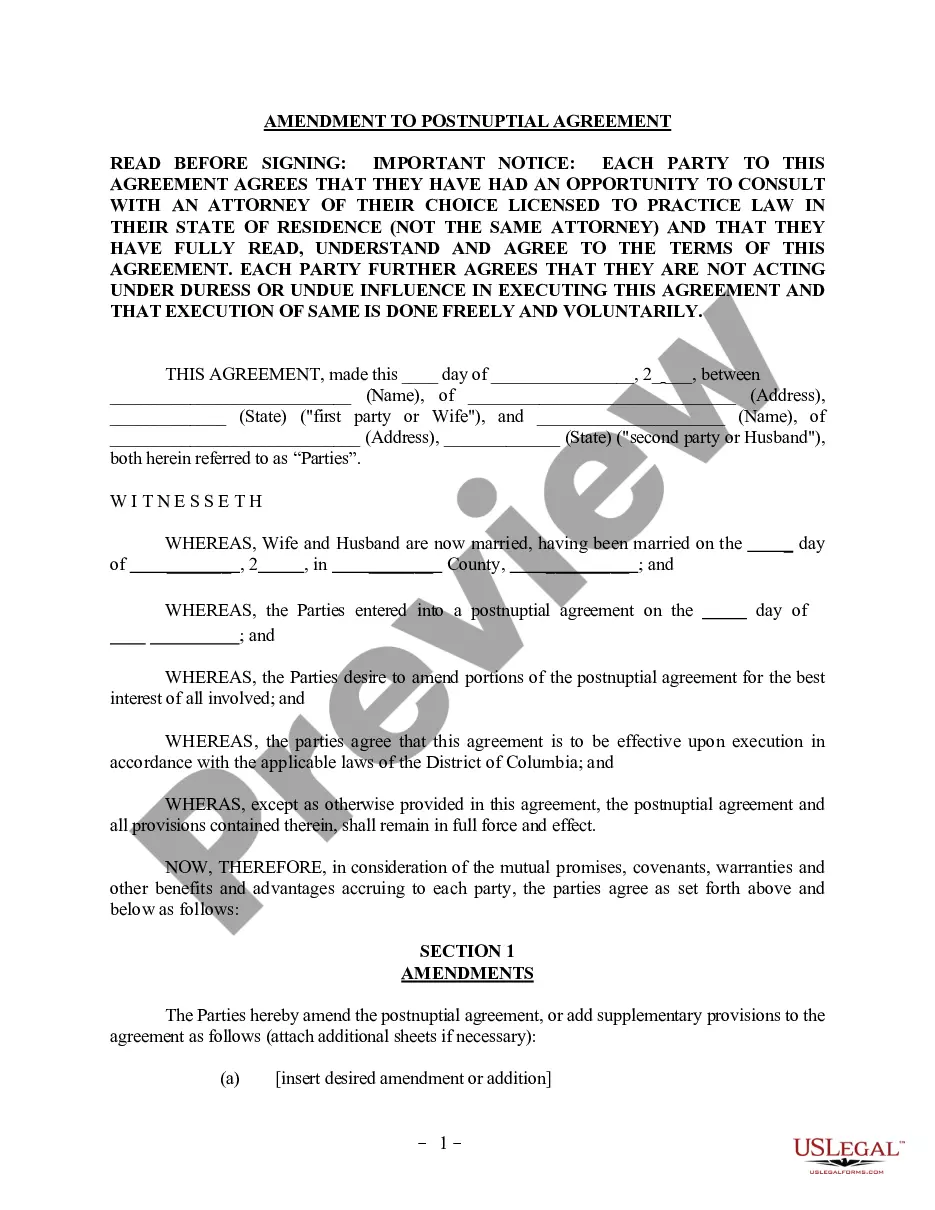

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

Title the deed and list the amount given for the transfer. If it is a quitclaim deed, title the deed Quitclaim Deed; for warranty deeds, title the deed Warranty Deed. Write In consideration of dollar amount to list the amount given for the transfer. List the names of the parties involved.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.