Nevada Warranty Deed to Child Reserving a Life Estate in the Parents

What this document covers

The warranty deed to child reserving a life estate in the parents is a legal document that allows parents to transfer property ownership to their child while retaining the right to live in and use the property during their lifetime. This type of deed offers a way to pass on real estate to the next generation while ensuring the parents maintain control over the property until they pass away or choose to relinquish their rights. Unlike other types of deeds, a warranty deed provides a guarantee that there are no hidden claims against the property, making it a secure option for both parties.

Key parts of this document

- Identification of grantors (the parents) and grantee (the child)

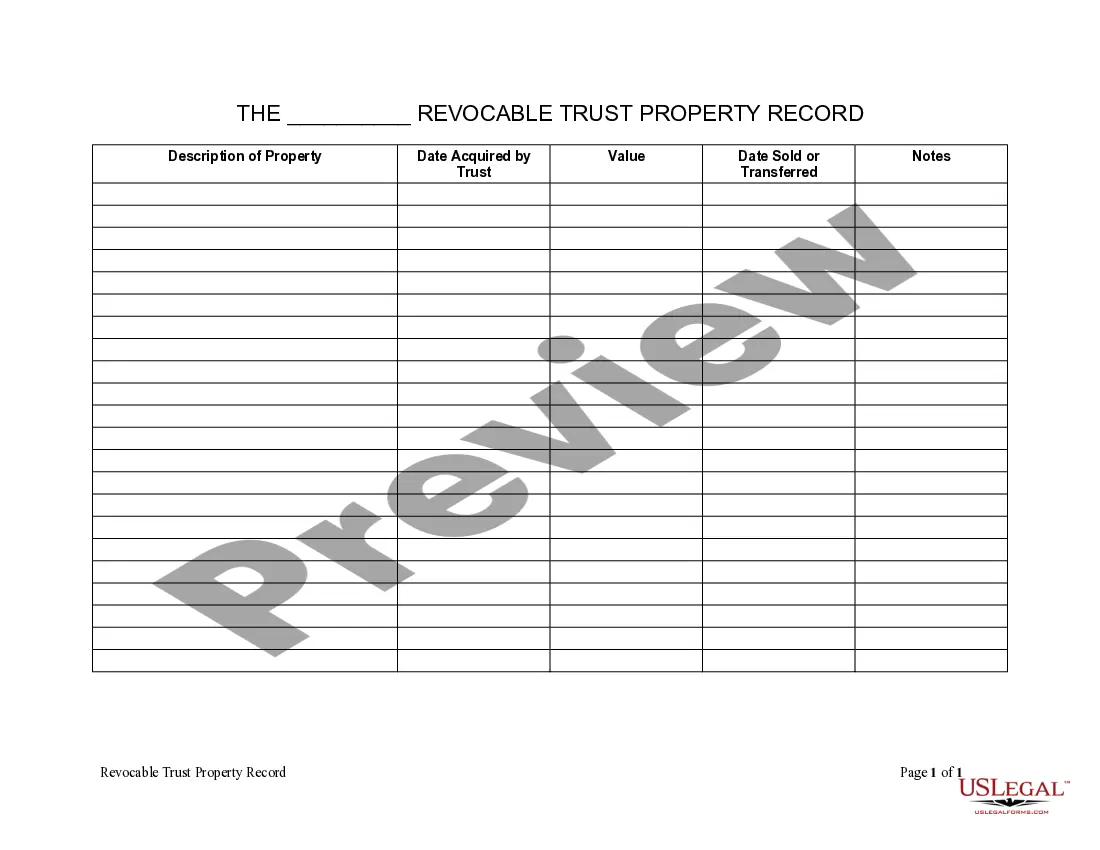

- Description of the property being transferred, including location details

- Reservation of a life estate for the grantors, specifying their continued rights

- Consideration amount, which is often nominal (e.g., ten dollars)

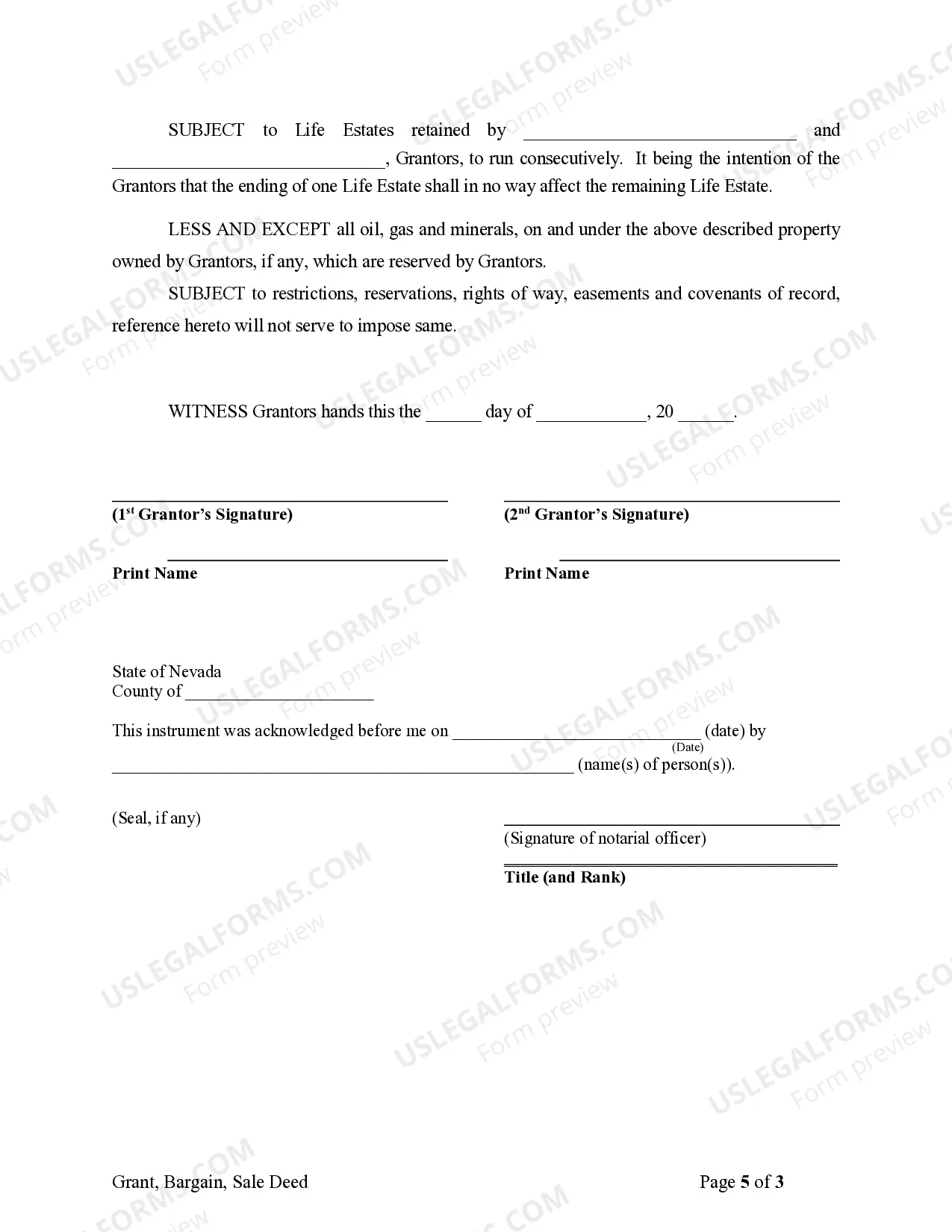

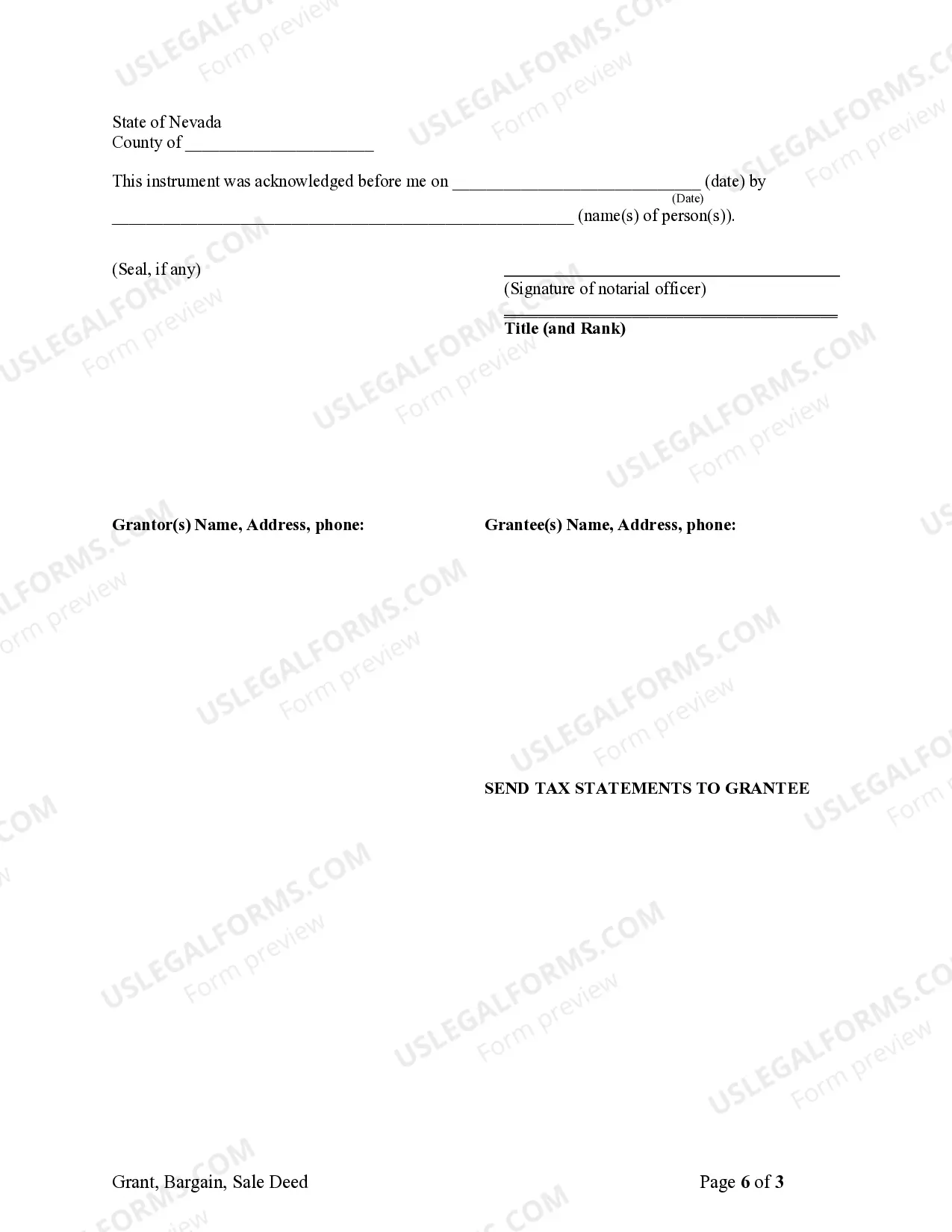

- Signature lines for all parties to formalize the transaction

When this form is needed

This warranty deed should be used when parents wish to transfer ownership of real estate to their child while still wanting to occupy or manage the property for the remainder of their lives. Common situations include estate planning, transferring family homes, or avoiding probate complications in the future.

Who needs this form

This form is intended for:

- Parents who own property and wish to transfer it to their child

- Individuals involved in estate planning and looking to manage their assets efficiently

- Anyone wanting to preserve their rights to a property while ensuring its future transfer

Completing this form step by step

- Identify the parties involved by entering the names of the grantors (parents) and the grantee (child).

- Clearly describe the property being transferred, including its physical address and any necessary legal description.

- Enter the nominal consideration amount (such as ten dollars) that represents the value of the transfer.

- Specify the date of the transaction and the signature lines for all grantors to sign.

- Finalize the document by ensuring all required areas are properly filled out and the deed is executed according to state laws.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Avoid these common issues

- Failing to include all grantors' names and signatures.

- Not accurately describing the property, which can lead to disputes.

- Forgetting to state the reserved life estate clearly, potentially causing confusion about rights.

- Not completing the form according to state-specific requirements, which may invalidate the deed.

Why use this form online

- Convenience of completing the form at your own pace without requiring in-person visits.

- Editability allows you to easily make corrections before finalizing the deed.

- Reliability with forms drafted by licensed attorneys to ensure legal compliance.

Form popularity

FAQ

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner.

The creation of a life estate is accomplished by the language to Recipient for life or, if it is to be a life estate pur autre vie, to recipient for the life of (another person). The holder of the life estate is called the life tenant. If the property is to return to the original owner after the death of the life

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

Can a life estate deed be contested? The answer is YES! The Life estate is an agreeable choice, particularly where there is an advantage in having the life estate revert back to its real owner (Grantor or Life Tenant).

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

Almost all deeds creating a life estate will also name a remaindermanthe person or persons who get the property when the life tenant dies.The life tenant is the owner of the property until they die. However, the remainderman also has an ownership interest in the property while the life tenant is alive.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.