District of Columbia Quitclaim Deed from Personal Representative to a Decedent's Estate.

What is this form?

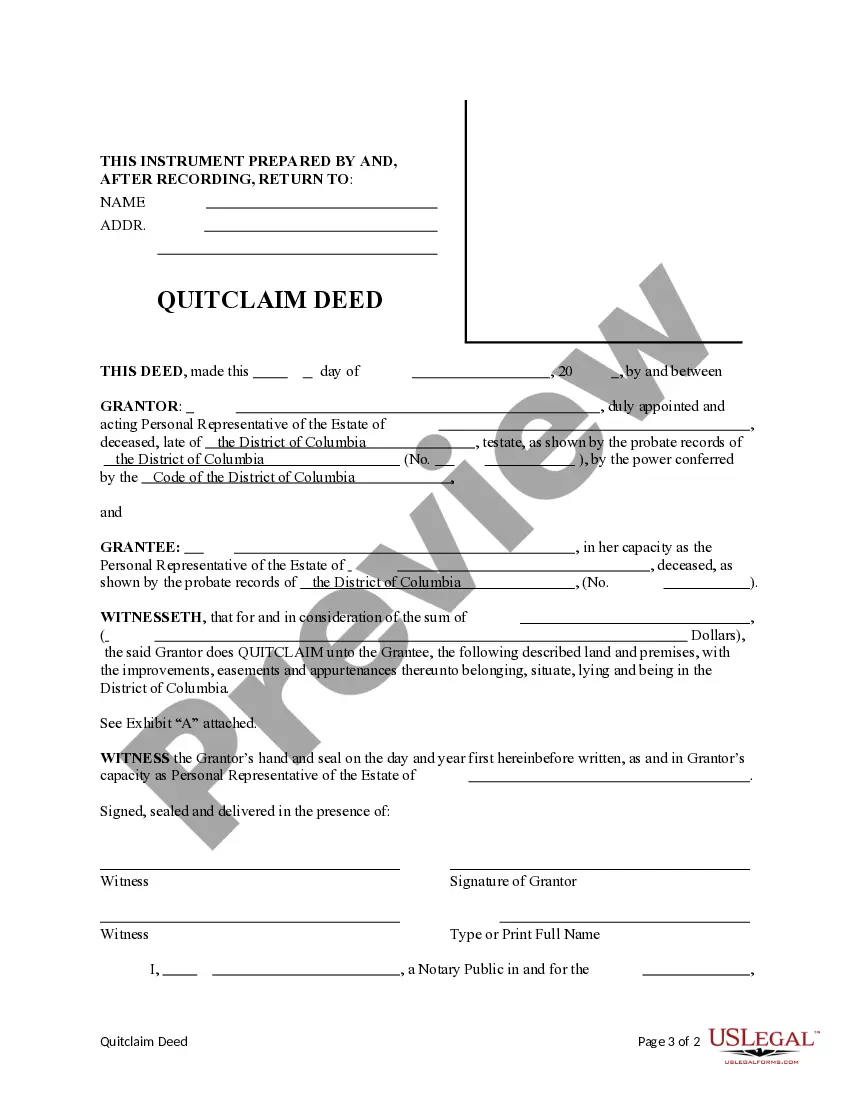

The Quitclaim Deed from Personal Representative to a Decedent's Estate is a legal document used when the personal representative of an estate transfers real property to another decedent's estate. This form effectively conveys any interest the grantor may have in the specified property, ensuring that the transfer is compliant with applicable state laws. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor holds a valid title, making this form simpler and quicker to execute in certain situations.

Main sections of this form

- Names of the grantor (personal representative) and grantee (decedent's estate).

- Description of the property being transferred, including legal description and address.

- Date of the transfer, ensuring proper timing for legal records.

- Signature of the grantor, which authenticates the document.

- Notary acknowledgment, if required for legal validity.

When to use this form

This form is necessary in situations where a personal representative wishes to transfer property belonging to a decedent's estate to another decedent's estate. It is particularly useful when settling estate affairs, transferring assets as part of probate proceedings, or facilitating the distribution of real estate among beneficiaries. This deed can help clarify property ownership and prevent future disputes regarding the property.

Who can use this document

This form is intended for:

- Personal representatives appointed to manage the decedent's estate.

- Executors involved in settling estate claims and distributing property.

- Heirs or beneficiaries interested in the estate's real property holdings.

How to prepare this document

- Identify and enter the names of the grantor (personal representative) and grantee (decedent's estate).

- Provide a detailed legal description of the property being transferred.

- Fill in the date when the transfer will occur.

- Have the grantor sign the document to validate the transfer.

- If required, arrange for the deed to be notarized to comply with local laws.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete legal description of the property.

- Omitting signatures or dates, which may render the deed invalid.

- Not considering state-specific requirements for notarization or recording.

Benefits of completing this form online

- Convenience of completing the form at your own pace and from anywhere.

- Editability to easily correct any errors or update information as needed.

- Access to legally vetted templates drafted by licensed attorneys, ensuring reliability.

Looking for another form?

Form popularity

FAQ

Probate is the court process to distribute someone's estate after their death, even if there is a will, and is notoriously slow in California.Probate tends to be less onerous in most other states, but the process still costs money and delays when beneficiaries can receive their inheritance.

Joint tenancy with right of survivorship. Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Tenancy by the entirety. Community property with right of survivorship.

The Recorder of Deeds is located at 1101 4th Street, SW, Suite 500, Washington, DC 20024, and is open from am to pm for purposes of recording a deed and from am to pm for all other services. You may contact our Customer Service staff by calling (202) 727-5374.

Process of Probate includes applying to the Supreme Court of New South Wales for the Will of the deceased to be declared a valid legal document, allowing the assets in the deceased Estate to be gathered in by the Executor, liabilities paid and the deceased Estate distributed to the beneficiaries named in the Will of

Generally, within a week of receiving the petition for probate, the D.C. Superior Court Probate Division will issue a document called the Letters of Administration.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

A home is sold in probate court when someone dies intestate or without bequeathing their property. When that happens, the state takes over and administers the property's sale. The court wants to be certain the property is marketed and sold at the best possible price.

Probate is the procedure by which a court determines who is entitled to the assets of a person who has died.In essence, much as in a standard sale, the order authorizing the probate sale can be recorded just as a deed would be, and title will then be clear when probate closes.

If the claimant is an entity organized under DC laws or is doing business in DC, the claimant must provide a copy of their current license to file a lien in addition to a certificate of good standing from the Department of Consumer and Regulatory Affairs issued within 180 days prior to the date of filing the lien.