Illinois Inventory is an online interactive inventory system that provides access to real-time inventory data for businesses in the state of Illinois. The system enables companies to manage their inventory more efficiently and helps them optimize their supply chain. With Illinois Inventory, businesses can view inventory levels, track inventory movements, and receive alerts when inventory levels fall below predetermined thresholds. There are two types of Illinois Inventory: basic and advanced. The basic version provides basic inventory management functionality, while the advanced version offers additional features such as order tracking, item tracking, and forecasting.

Illinois Inventory

Description

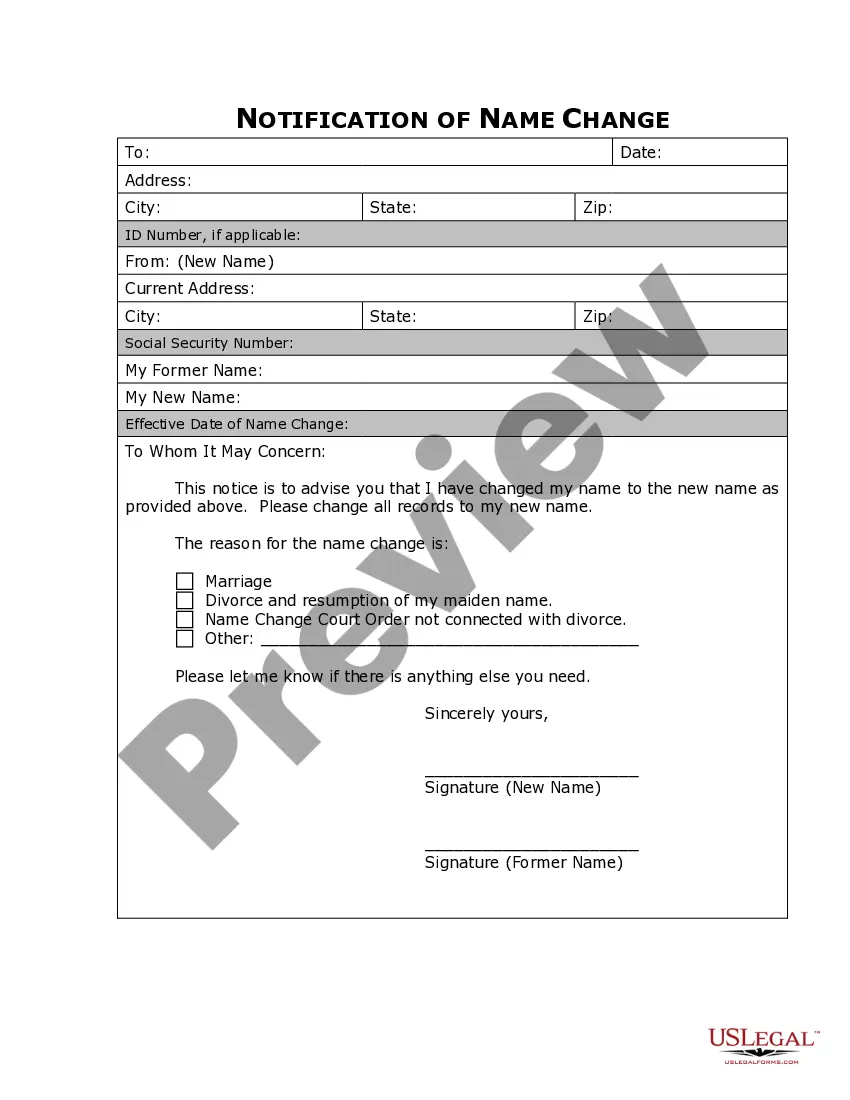

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Inventory?

How much duration and effort do you typically allocate to crafting formal documentation.

There’s a superior alternative to obtaining such forms than employing legal professionals or squander hours hunting online for an appropriate template. US Legal Forms is the premier online repository that offers professionally created and validated state-specific legal documents for any purpose, like the Illinois Inventory.

Another advantage of our library is that you can access previously downloaded documents which you securely maintain in your profile under the My documents tab. Retrieve them at any time and re-complete your paperwork as often as necessary.

Conserve time and energy organizing official documents with US Legal Forms, one of the most dependable online services. Register with us today!

- Inspect the form content to verify it complies with your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template doesn’t fulfill your requirements, find another one using the search bar at the top of the page.

- If you are already signed up for our service, Log In and download the Illinois Inventory. Otherwise, continue to the next steps.

- Click Buy now once you discover the appropriate document. Select the subscription plan that fits you best to access the full range of our library.

- Create an account and pay for your subscription. You can complete the transaction with your credit card or through PayPal - our service is entirely secure for that.

- Download your Illinois Inventory onto your device and finish it either with a printed hard copy or electronically.

Form popularity

FAQ

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

For tax years beginning January 1, 2022, it is $2,425 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,425 or less, your exemption allowance is $2,425. If income is greater than $2,425, your exemption allowance is 0. For the 2021 tax year, it is $2,375 per exemption.

For example, if you purchase an item in a state with an 8.00% sales tax and the tax is collected by the seller, you do not owe any Illinois use tax. On the other hand, if you purchase an item in a state with a 5.00% sales tax, you owe the State of Illinois 1.25%.

Illinois Use Tax rates are 6.25 percent of the purchase price of general merchandise and 1.00 percent of the purchase price of qualifying food, drugs, and medical appliances. medical appliances that replace a malfunctioning part of the human body (such as wheel chairs and hearing aids).

Illinois use tax rates are 6.25 percent of the purchase price of general merchandise and 1 percent of the purchase price of qualifying food, drugs, and medical appliances.

Identity Verification Letters Information. Letters and Notices for Individual Income Tax. Deficiencies, Assessments, or Claim Denials.

Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

Use Tax is a sales tax that you, as the purchaser, owe on items that you buy for use in Illinois. If the seller does not collect at least 6.25 percent sales tax, you must pay the difference to the Illinois Department of Revenue.