Claims Register - B 133

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Claims Register - B 133?

Utilize the most extensive legal catalogue of forms. US Legal Forms is the best platform for getting up-to-date Claims Register - B 133 templates. Our service provides a huge number of legal forms drafted by licensed legal professionals and sorted by state.

To get a template from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our service, log in and choose the document you need and purchase it. Right after buying templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

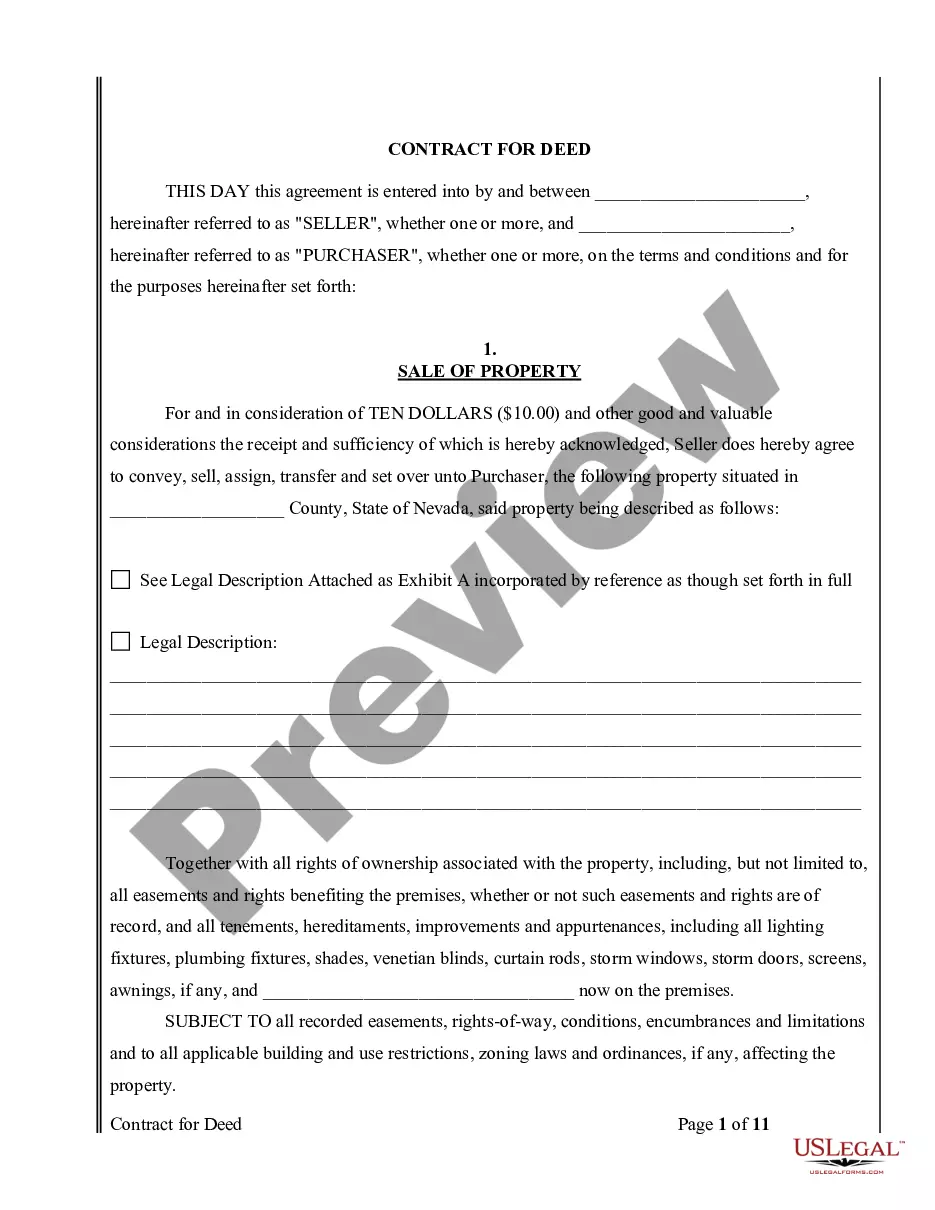

- In case the template has a Preview function, use it to review the sample.

- If the template doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr debit/credit card.

- Choose a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill in the Form name. Join a huge number of happy customers who’re already using US Legal Forms!

Form popularity

FAQ

The bankruptcy claims and noticing agent will coordinate with the debtor and its professionals to gather and analyze all necessary data to help the debtor prepare its bankruptcy petition, as well as an accurate set of the debtor's schedules of assets & liabilities and its statement of financial affairs, which will

A request for payment that you or your health care provider submits to your health insurer when you get items or services you think are covered.

Why Would a Creditor Not File a Proof of Claim?A creditor might not file a proof of claim in your bankruptcy if: you have a no-asset Chapter 7 bankruptcy (meaning you don't have any property the bankruptcy trustee can distribute to your creditors, so they won't get paid) you owe the creditor a very small sum, or.

Formal Proof of Claim the debtor's name and the bankruptcy case number. the creditor's information, including a mailing address. the amount owed as of the petition date. the basis for the claim (such as goods or services purchased, a loan or credit card balance, a personal injury or wrongful death award), and.

Chapter 11 creditors are not required to file a Proof of Claim because the debtor is required to file a Schedule of Assets and Liabilities.If it is not filed, the Bankruptcy Court will consider the customer's Schedule of Liabilities as accurate and make any distributions accordingly.

Under the bankruptcy procedural rules, and except as otherwise provided under those rules, an unsecured creditor must file a proof of claim in order for the unsecured creditor's claim to be allowed.

A claims register refers to a register maintained by a bankruptcy court clerk that contains a list of all of the proofs of claim that have been filed with the bankruptcy court. It will not include claims listed by the debtor on its schedules clerk. A bankruptcy court takes judicial notice of the claims register.

§101 (5). A claim may be secured or unsecured. A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

An insurance claims register provides a. follow-up procedures for insurance claims. Pending or resubmitted insurance claims may be tracked through a. tickler file. Ways to file pending insurance claims.