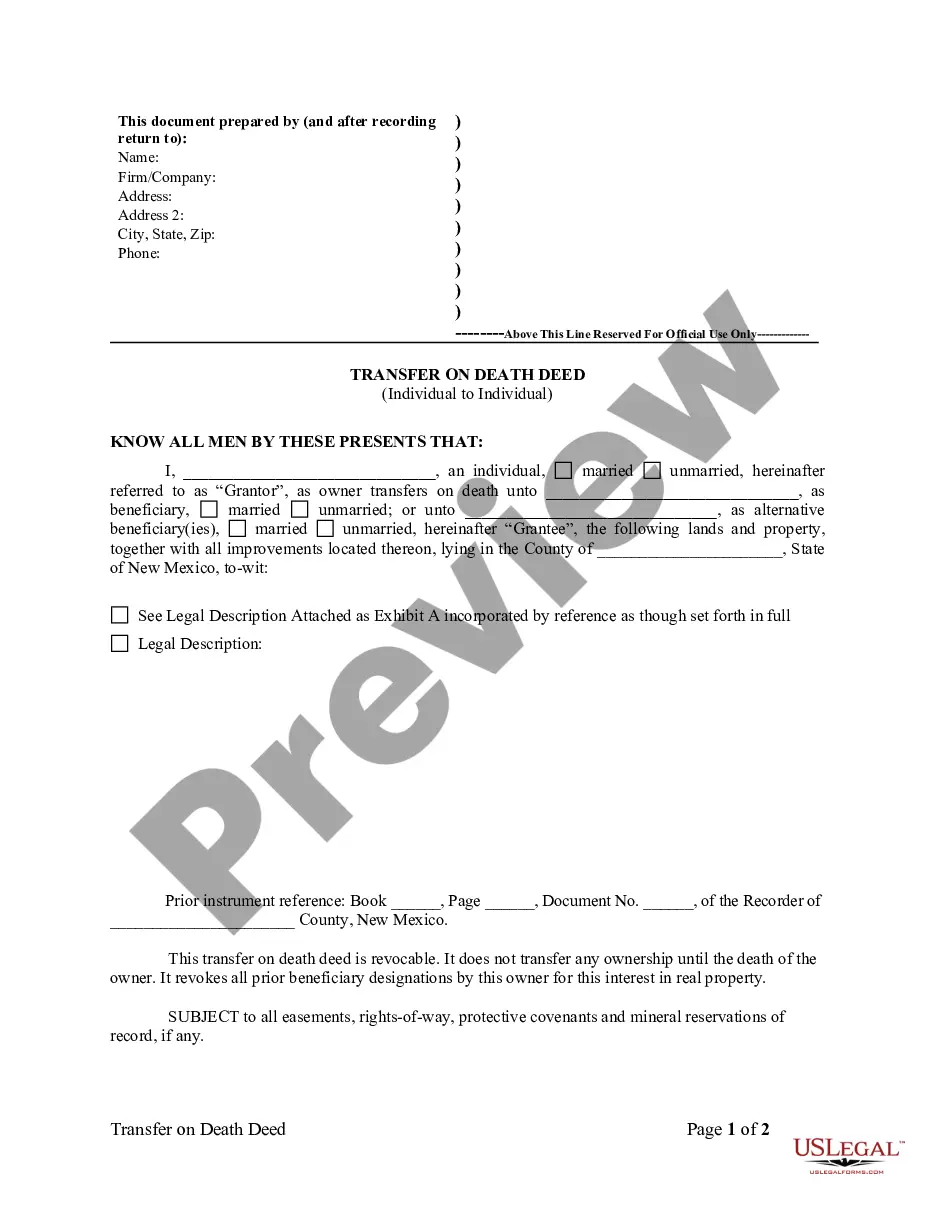

New Mexico Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

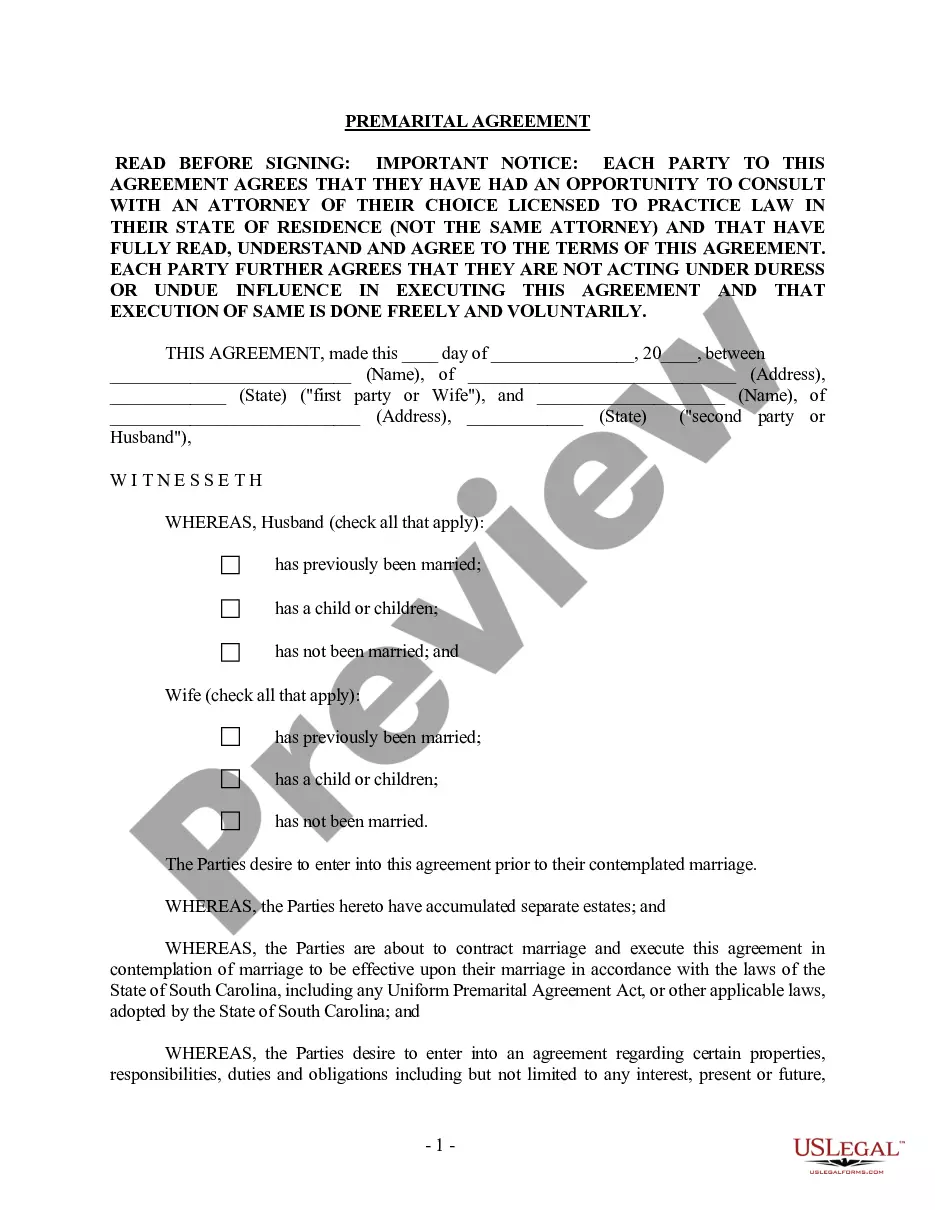

What is this form?

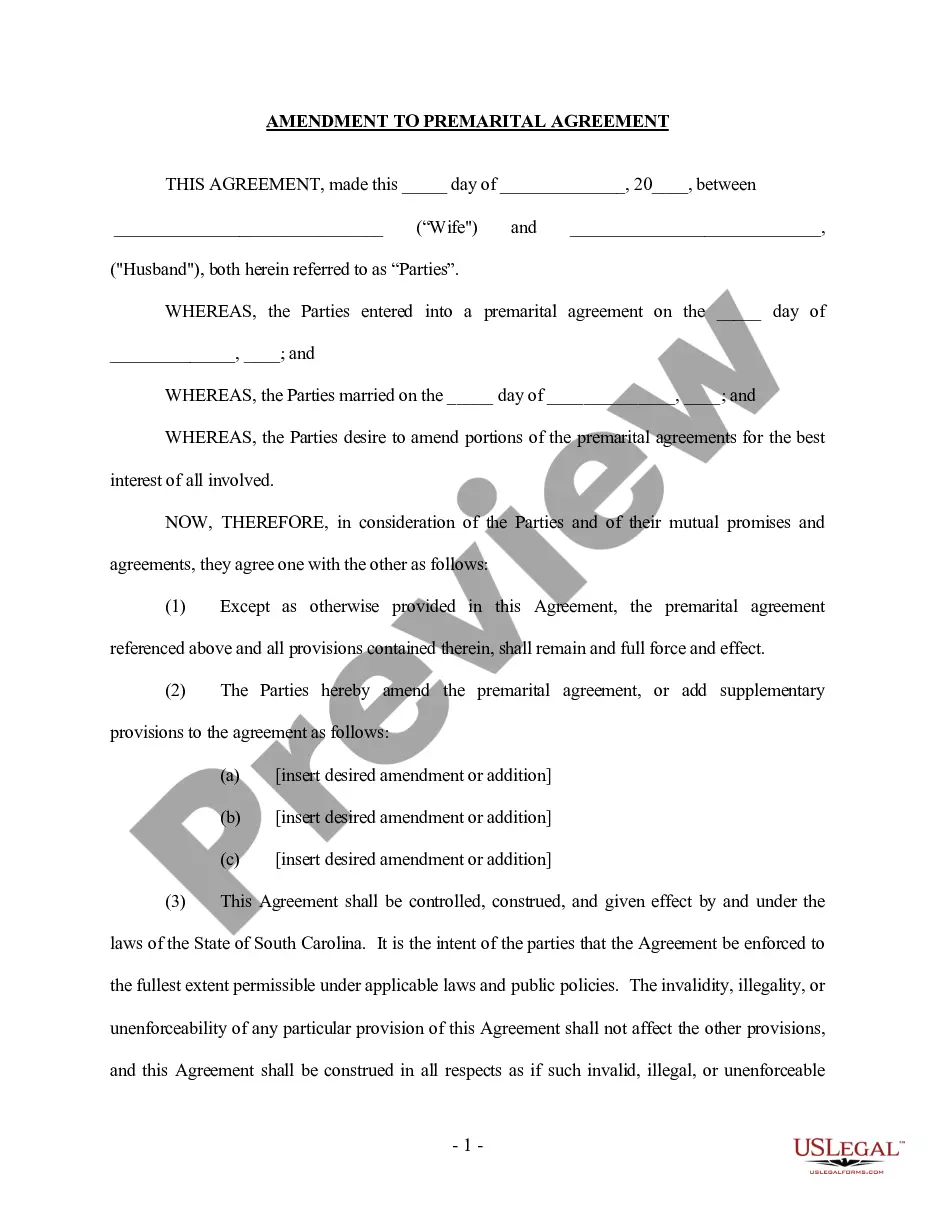

The Transfer on Death Deed, also known as a Beneficiary Deed for Individual to Individual, is a legal document used to transfer ownership of real property upon the death of the original owner, referred to as the Grantor. This deed allows the specified Grantee to receive property without going through probate, making it distinct from traditional conveyance methods. This form is revocable, meaning the Grantor can change or cancel it at any time before their death.

Form components explained

- Prior instrument reference that cites previous ownership documentation.

- Details of the Grantor and Grantee, including names and addresses.

- A clause stating the deed is revocable and does not transfer ownership until the Grantor's death.

- Provisions regarding easements, rights-of-way, and protective covenants.

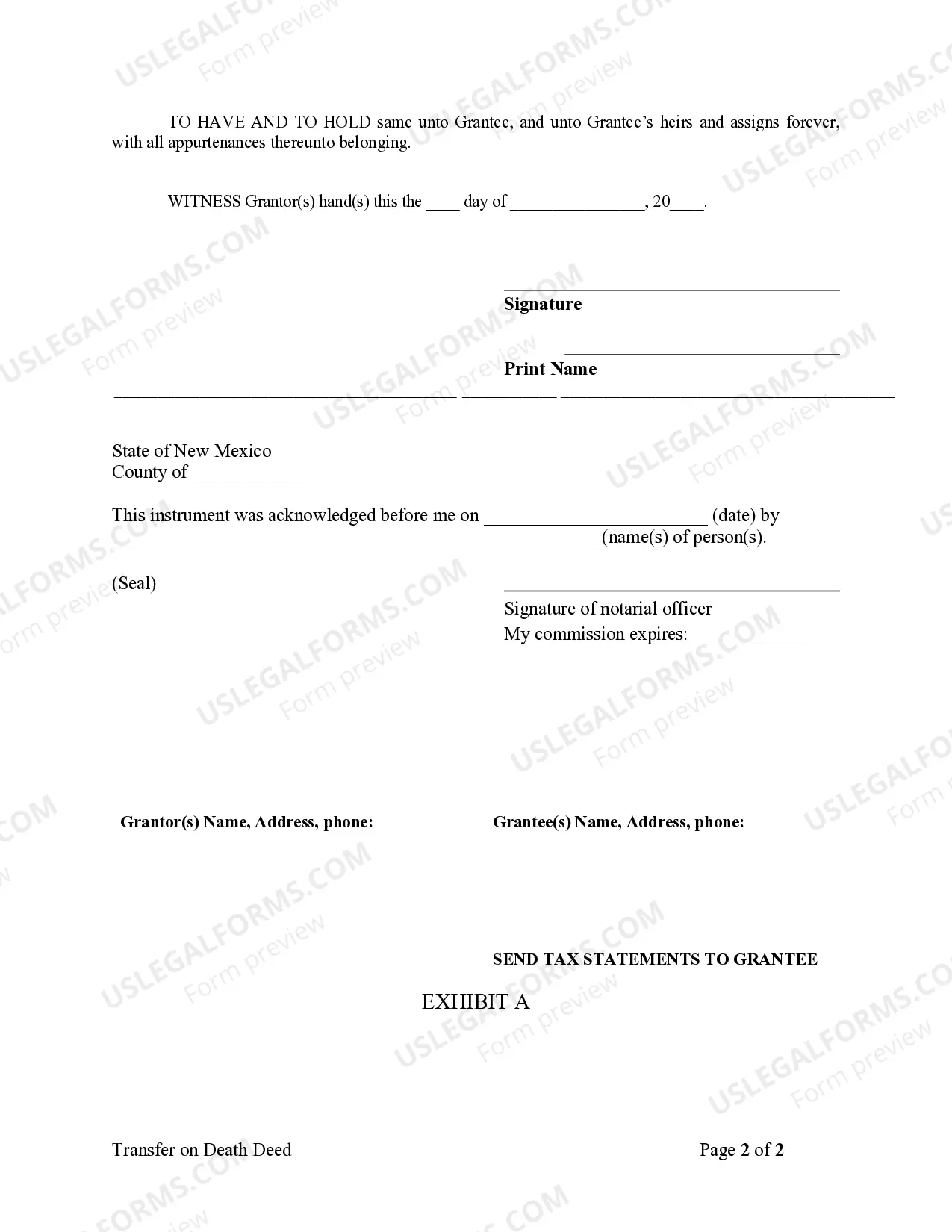

- Signature line for the Grantor and notary acknowledgment.

When to use this document

This form is ideal when an individual wishes to ensure that their property automatically transfers to a designated beneficiary upon their passing. It is particularly useful for those who want to avoid the complexities and costs associated with the probate process. Common scenarios include estate planning for individuals who own a home or land and want to specify who will inherit it after they die.

Who should use this form

This form is suitable for:

- Individual property owners in New Mexico who wish to designate a beneficiary for their real property.

- Those who want to manage their estate without involving the probate court.

- Anyone looking to make their estate plan more straightforward and efficient.

Completing this form step by step

- Identify the parties involved: the Grantor (property owner) and Grantee (beneficiary).

- Specify the property being transferred by referencing its legal description and prior instrument details.

- Fill in the date of signing and review any existing covenants that may affect the property.

- Sign the deed in front of a Notary Public to ensure its validity.

- Store the completed deed in a safe place and ensure the Grantee is aware of its existence.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to sign the form in front of a Notary Public, which can invalidate the deed.

- Not providing a complete legal description of the property.

- Overlooking existing covenants or rights that may affect the transfer of the property.

- Not informing the Grantee of the Transfer on Death Deed and its implications.

Benefits of completing this form online

- Convenient download and immediate access to tailored legal forms.

- Designed by licensed attorneys to ensure compliance with state laws.

- Ability to edit the form as needed before finalizing signatures.

Looking for another form?

Form popularity

FAQ

Transfer-on-death (TOD) arrangements may be used to pass certain assets to designated beneficiaries. A beneficiary form states who will directly inherit the asset at your death.TOD arrangements require minimal paperwork to establish.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

The transfer on death designation lets beneficiaries receive assets at the time of the person's death without going through probate.With TOD registration, the named beneficiaries have no access to or control over a person's assets as long as the person is alive.

Overall, New Mexico's statutory transfer on death deed is a flexible estate planning tool that allows owners of real property in the state to convey a potential future interest in real property to one or more beneficiaries.

A transfer on death (TOD) account will avoid probate because assets transfer automatically to a beneficiary when the owner dies.

Receiving an inheritance can be an unexpected windfall. However, it doesn't avoid taxes.In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

As Fidelity Investments notes, a TOD is a provision of a brokerage account that allows the account's assets to pass directly to an intended beneficiary; the equivalent of a beneficiary designation. Though laws governing estate planning vary by state, many bank accounts, investment accounts and even deeds are

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.