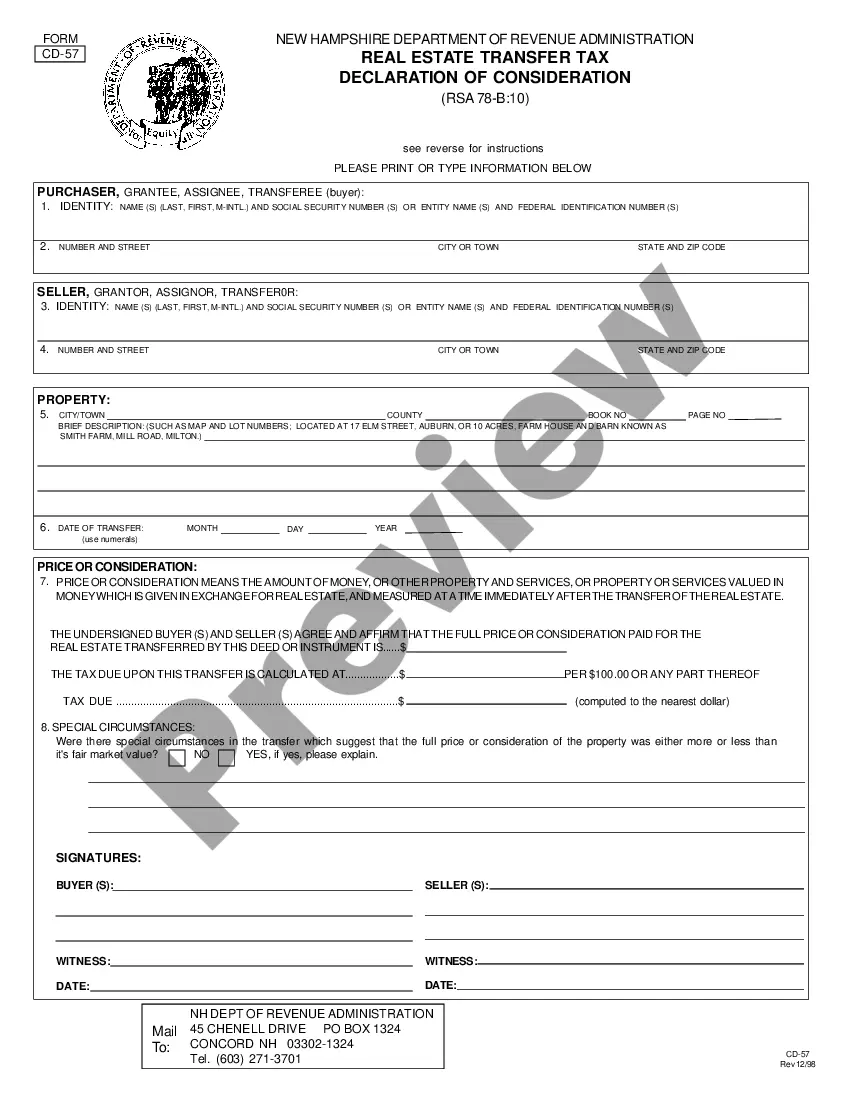

New Hampshire Real Estate Transfer Tax Statement of Consideration for Real Estate Holding Companies

Description

How to fill out New Hampshire Real Estate Transfer Tax Statement Of Consideration For Real Estate Holding Companies?

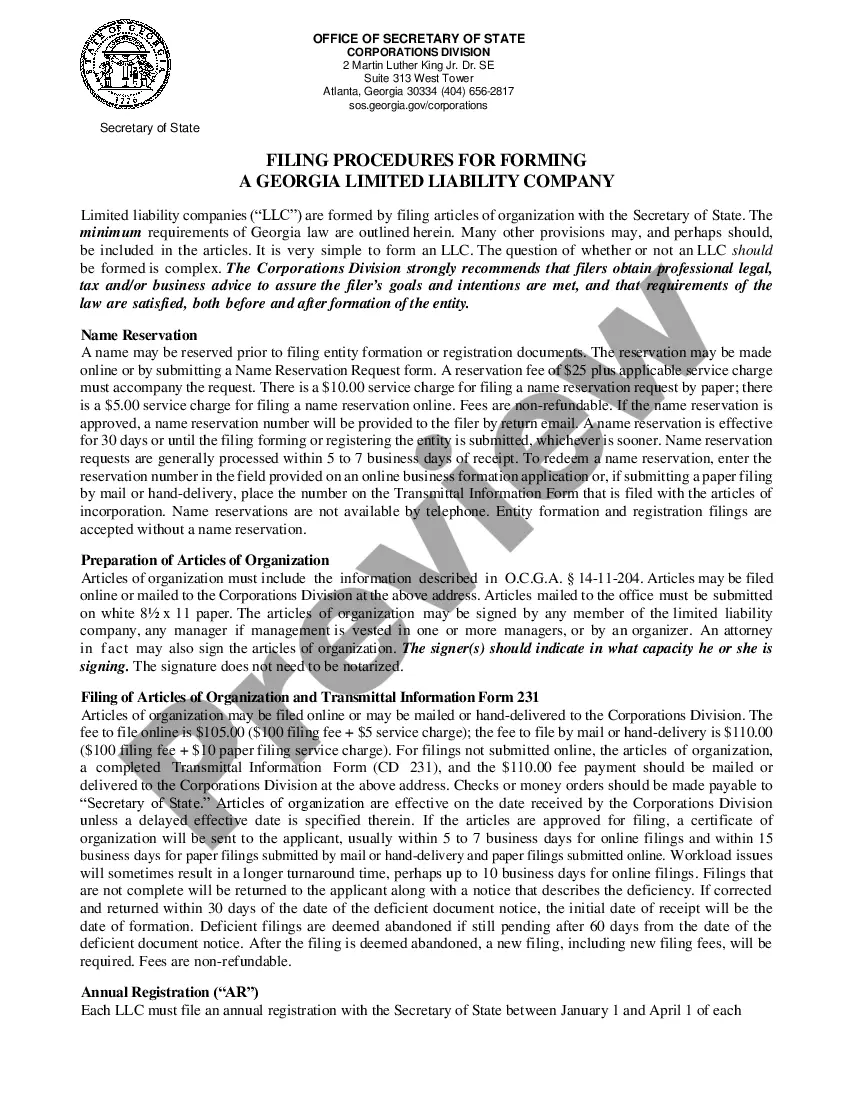

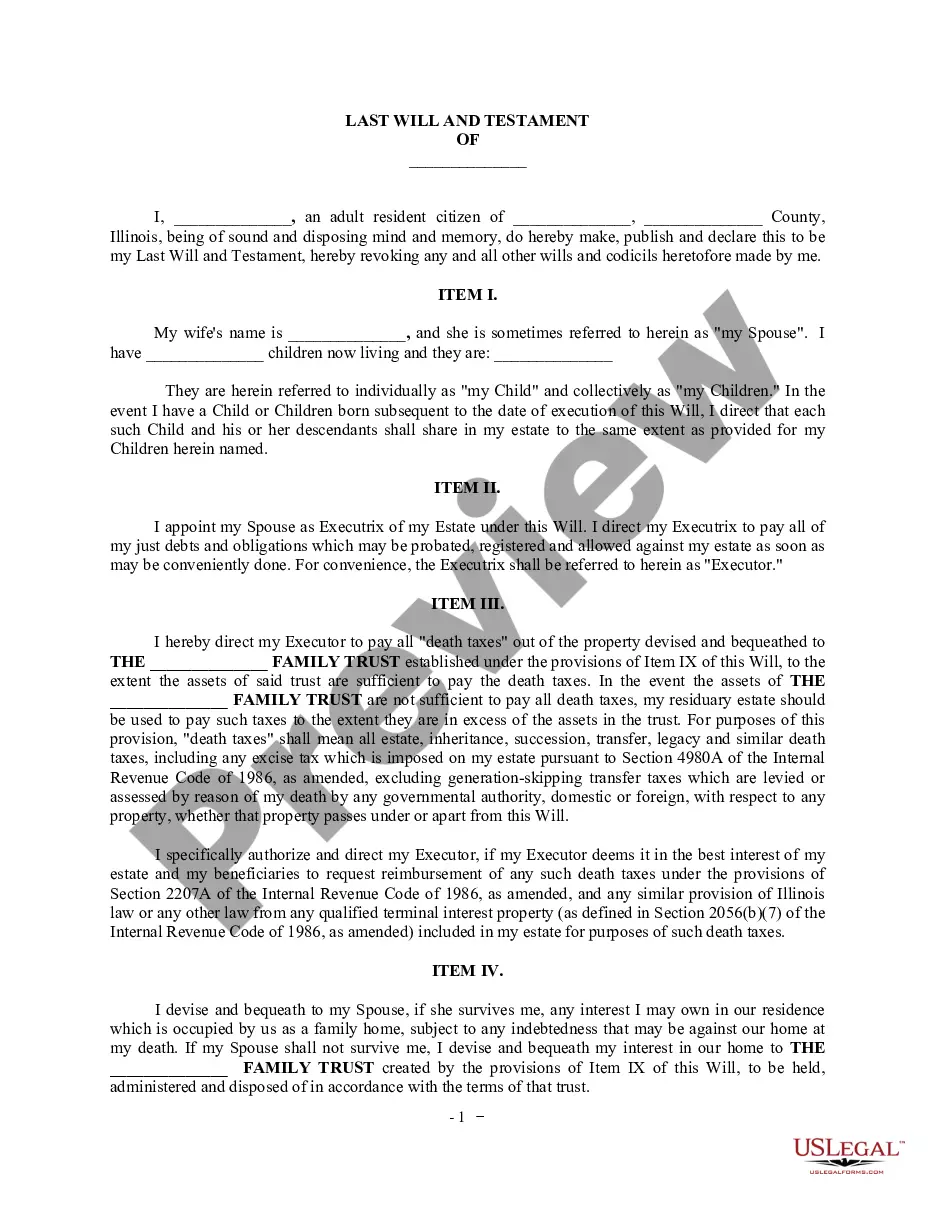

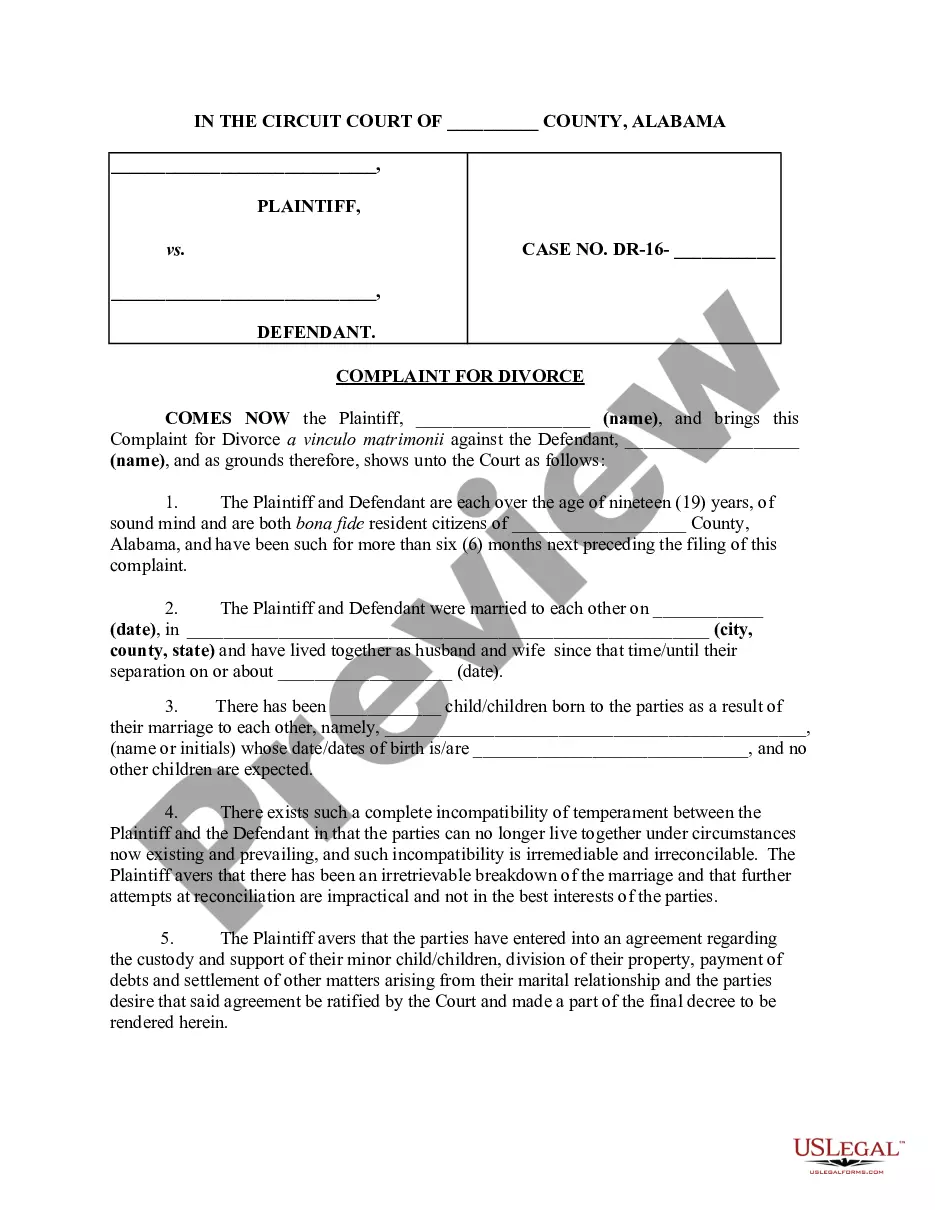

US Legal Forms is actually a unique platform where you can find any legal or tax document for filling out, such as New Hampshire Real Estate Transfer Tax Statement of Consideration for Real Estate Holding Companies. If you’re tired of wasting time searching for perfect samples and paying money on record preparation/attorney fees, then US Legal Forms is exactly what you’re searching for.

To reap all of the service’s advantages, you don't have to download any application but just select a subscription plan and register your account. If you already have one, just log in and get a suitable template, download it, and fill it out. Downloaded files are stored in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Real Estate Transfer Tax Statement of Consideration for Real Estate Holding Companies, check out the guidelines listed below:

- Double-check that the form you’re considering is valid in the state you want it in.

- Preview the sample and look at its description.

- Click on Buy Now button to access the register webpage.

- Pick a pricing plan and proceed registering by entering some info.

- Pick a payment method to finish the sign up.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are unsure regarding your New Hampshire Real Estate Transfer Tax Statement of Consideration for Real Estate Holding Companies template, contact a legal professional to review it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

The owner has to pay an amount of around Rs 200 to Rs 1,000 per square foot as Transfer fee so as to get the NOC, thus taking the amount payable to the builder up to as high as Rs 15 lakh, in some cases. Transfer fee is being charged by cooperative societies and service societies as well.

Real estate transfer taxes are taxes imposed on the transfer of title of real property. In. most cases it is an ad valorem tax that is based on the value of the property transferred. A. majority of states and the District of Columbia provide for this tax but 13 states do not.

New Hampshire's real estate transfer tax is pretty straightforward for arm's-length transfers of real estate, imposing a 1.5 percent aggregate tax (0.75 percent paid by buyer and seller) on the consideration paid for the property.

Take the purchase price of the property and multiply by 1.5%. $300,000 x .015 = $4,500 transfer tax total. Divide the total transfer tax by two. In NH, transfer tax is split in half by buyer and seller. $4,500 / 2 = $2,250.

In California, the seller traditionally pays the transfer tax. Depending on local market conditions, transfer taxes can become a negotiating point during closing. For instance, in a strong seller's market, the seller may have multiple offers and will likely find a buyer who agrees to pay the transfer tax.

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property that's changing hands. State laws usually describe transfer tax as a set rate for every $500 of the property value.

In California, the seller traditionally pays the transfer tax. Depending on local market conditions, transfer taxes can become a negotiating point during closing. For instance, in a strong seller's market, the seller may have multiple offers and will likely find a buyer who agrees to pay the transfer tax.

It's higher than the buyer's closing costs because the seller typically pays both the listing and buyer's agent's commission around 6% of the sale in total. Fees and taxes for the seller are an additional 2% to 4% of the sale.