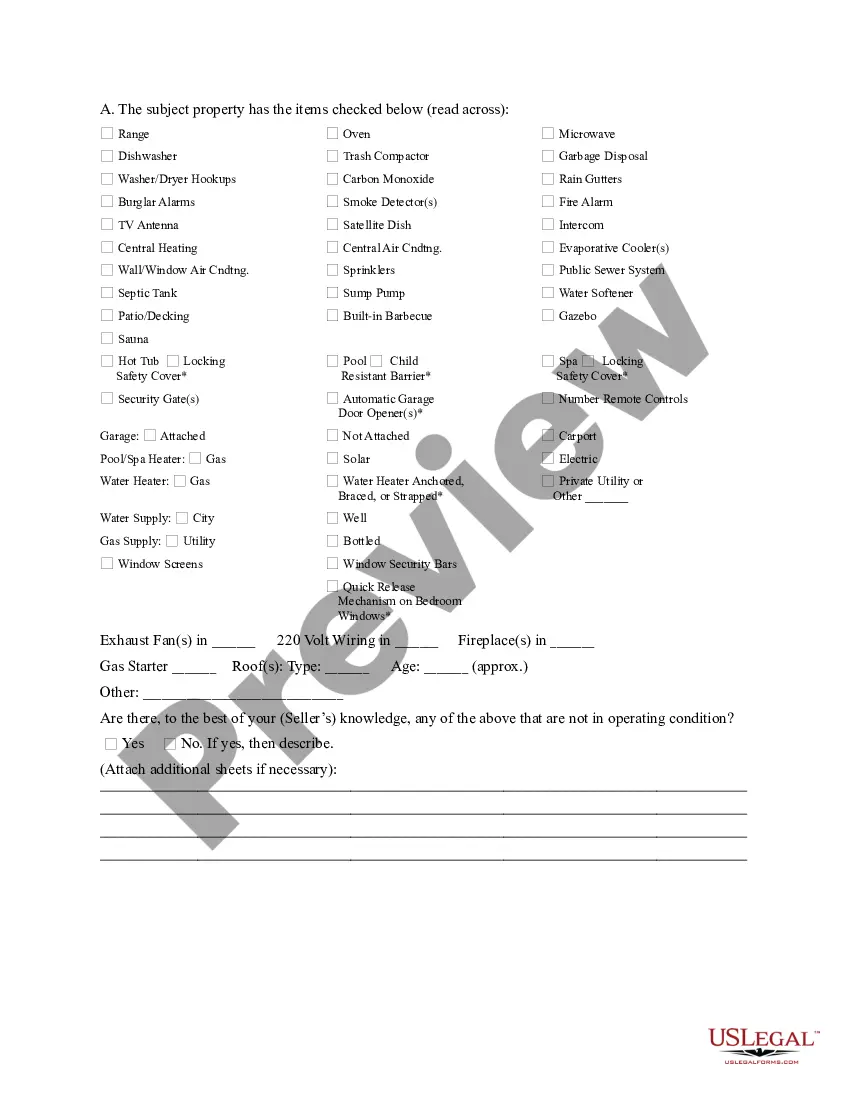

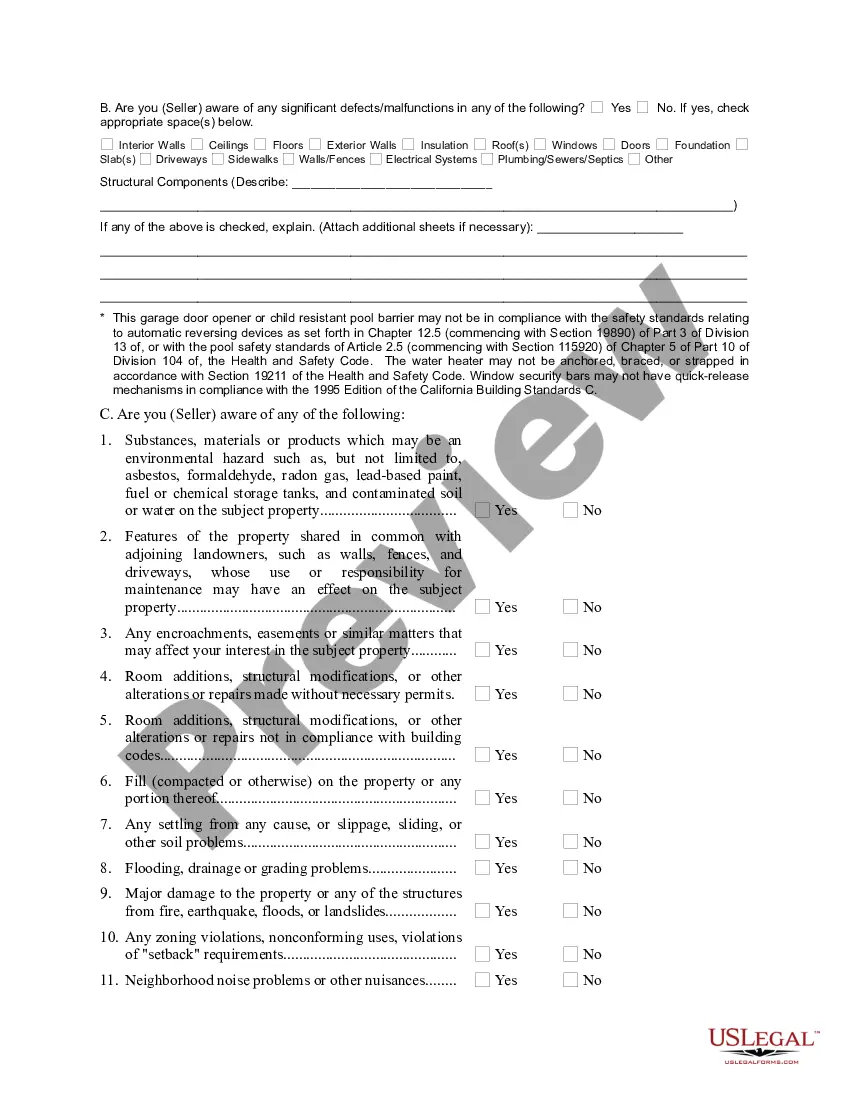

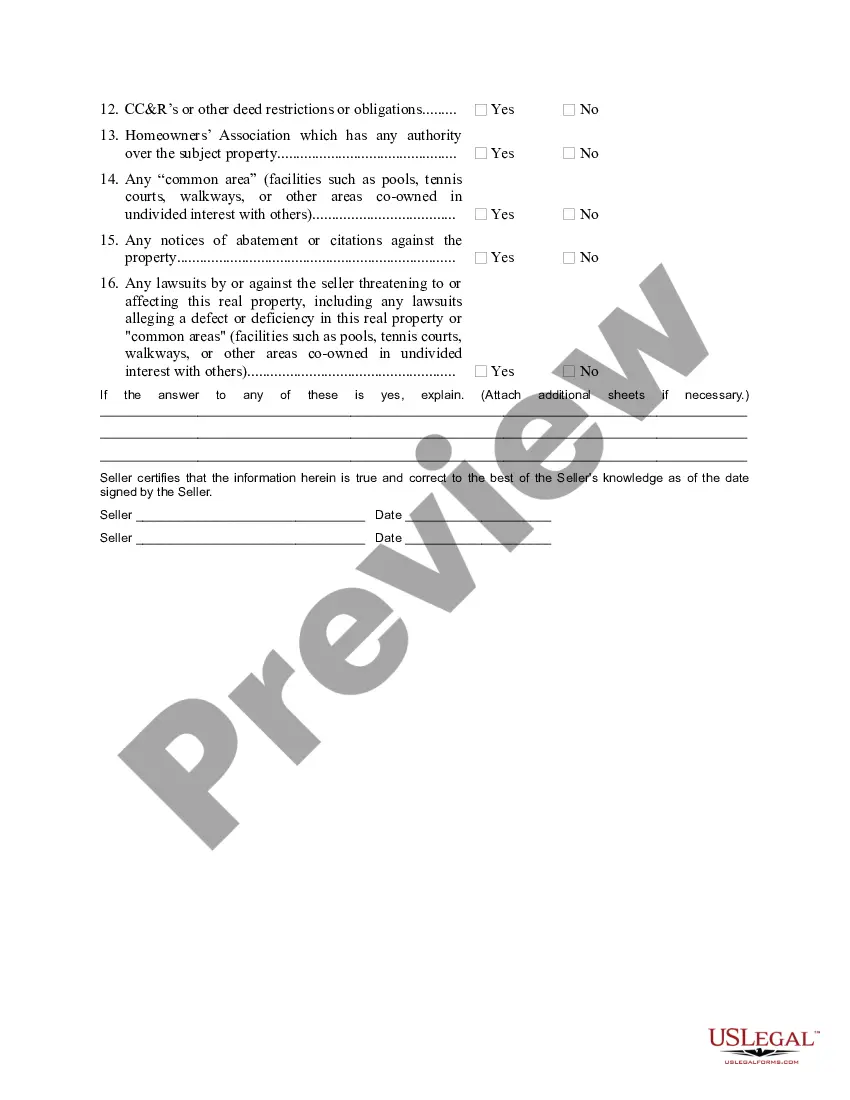

A Real Estate Transfer Disclosure Statement (TDS) is a document that provides a seller with an opportunity to disclose any known material defects in the property to the buyer prior to the transfer of ownership. It is required in most states and is often part of the closing documents. The TDS contains information about the condition of the property, including any known problems such as structural damage, water damage, and environmental hazards. There are two types of Real Estate Transfer Disclosure Statements: the Transfer Disclosure Statement (TDS) and the Natural Hazard Disclosure Statement (NHS). The TDS is required in most states and provides a seller with an opportunity to disclose any known material defects in the property to the buyer prior to the transfer of ownership. The NHS is required in certain states and provides a seller with an opportunity to disclose any known natural hazards in the property to the buyer prior to the transfer of ownership, such as flooding, earthquake, and wildfire.

Real Estate Transfer Disclosure Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Real Estate Transfer Disclosure Statement?

- If you're a returning user, log in to your account and download the Real Estate Transfer Disclosure Statement by clicking the Download button. Ensure your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by checking the Preview mode and form description to confirm you have selected the correct document that meets your needs.

- If you need a different template, utilize the Search tab to find the appropriate form that aligns with your requirements.

- Once you find the right document, click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the library.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize the subscription.

- After your purchase, download the form to your device. You can access it anytime from the My documents section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents like the Real Estate Transfer Disclosure Statement. With a vast collection of forms and expert assistance available, you can ensure your documents are accurate and compliant.

Start your journey today by visiting US Legal Forms and experience the ease of accessing legal documents.

Form popularity

FAQ

A seller is required to provide the TDS even when selling property without an agent, such as in a ?for sale by owner? transaction. The TDS also must be provided for sales of a new residential property that is not part of a subdivision, such as a new home or a new four-unit building being built on a lot.

The (TDS) describes the condition of a property and, in the case of a sale, must be given to a prospective buyer as soon as practicable and before transfer of title.

As explained by the State of California Department of Real Estate, a TDS is a form that lets buyers know about any significant defects to the property. Sellers have a duty to disclose comprehensive information about the property.

A transfer disclosure statement (TDS) is required by California law in Section 1102 of the California Civil Code. This document is one of the seller disclosures that buyers receive during their contract contingency period. Its purpose is to let a buyer know of major defects in a property as required by California law.

Other exemptions from of the TDS include transfers from one co-owner to another, transfers made to a spouse or child, grandchild, parent, grandparent or other direct ancestor or descendent; transfers between spouses in connection with dissolution of marriage, and various transfers to the state for failure to pay

First, this form must be completed in the seller's handwriting. An agent may not complete this form for a seller under any circumstances. If you are unable to fill it out, ask a close relative to do it for you, but do not ask your agent.

A seller is required to provide the TDS even when selling property without an agent, such as in a ?for sale by owner? transaction. The TDS also must be provided for sales of a new residential property that is not part of a subdivision, such as a new home or a new four-unit building being built on a lot.

The seller is required to complete a Transfer Disclosure Statement (TDS).