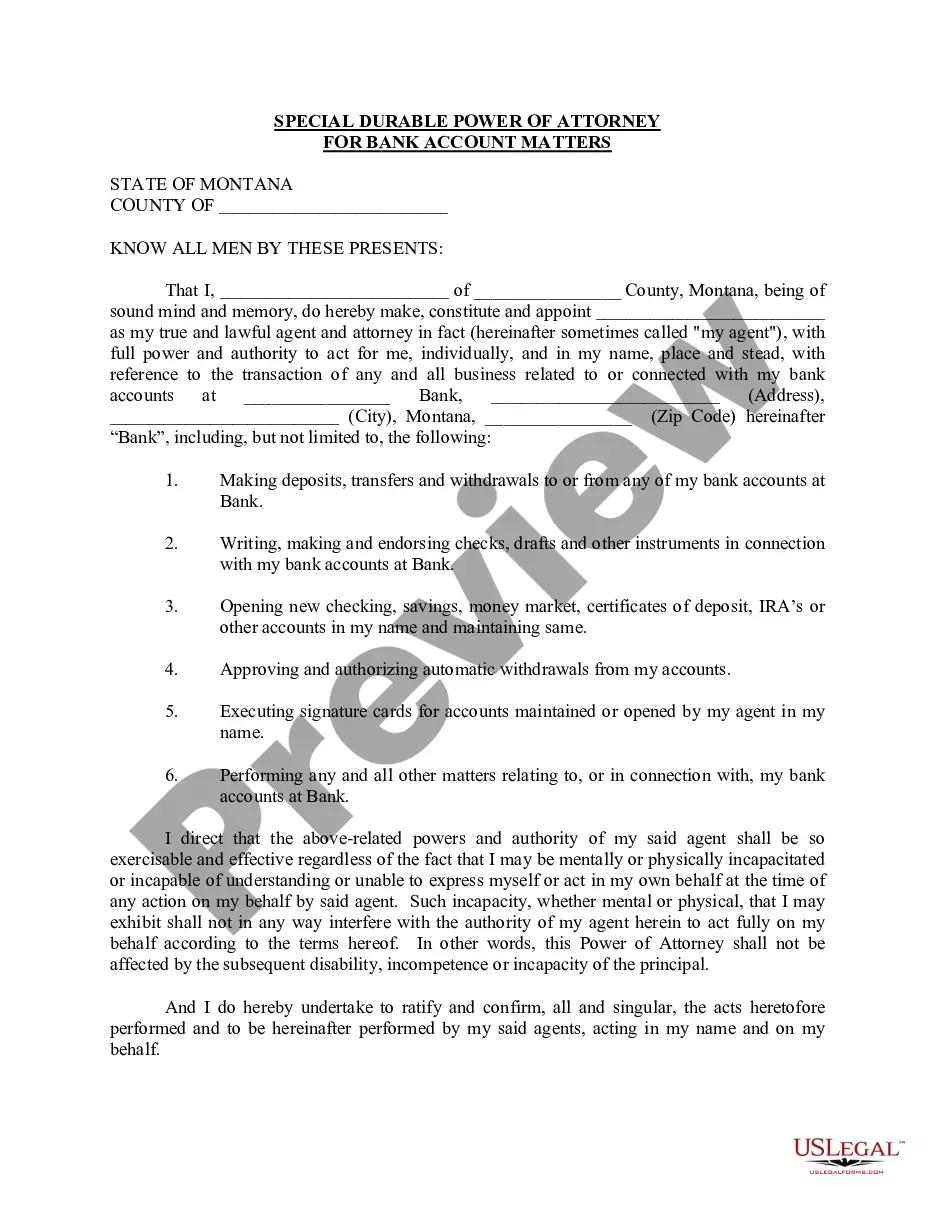

Montana Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Montana Special Durable Power Of Attorney For Bank Account Matters?

Steer clear of costly lawyers and discover the Montana Special Durable Power of Attorney for Bank Account Matters you seek at an affordable rate on the US Legal Forms website.

Utilize our straightforward categories feature to locate and acquire legal and tax documents. Review their descriptions and preview them before downloading.

Make payment via card or PayPal. Choose to receive the form in PDF or DOCX format. Click Download and locate your form in the My documents section. You can save the template to your device or print it out. After downloading, you can complete the Montana Special Durable Power of Attorney for Bank Account Matters manually or with editing software. Print it out and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms provides users with step-by-step instructions on how to obtain and complete each template.

- US Legal Forms members simply need to Log In and retrieve the specific document they require from their My documents section.

- Those who haven't subscribed yet should follow the guidelines below.

- Verify that the Montana Special Durable Power of Attorney for Bank Account Matters is permissible for use in your location.

- If available, review the description and utilize the Preview option prior to downloading the templates.

- If you believe the template fulfills your requirements, click Buy Now.

- If the template is incorrect, use the search bar to find the appropriate one.

- Next, create your account and select a subscription plan.

Form popularity

FAQ

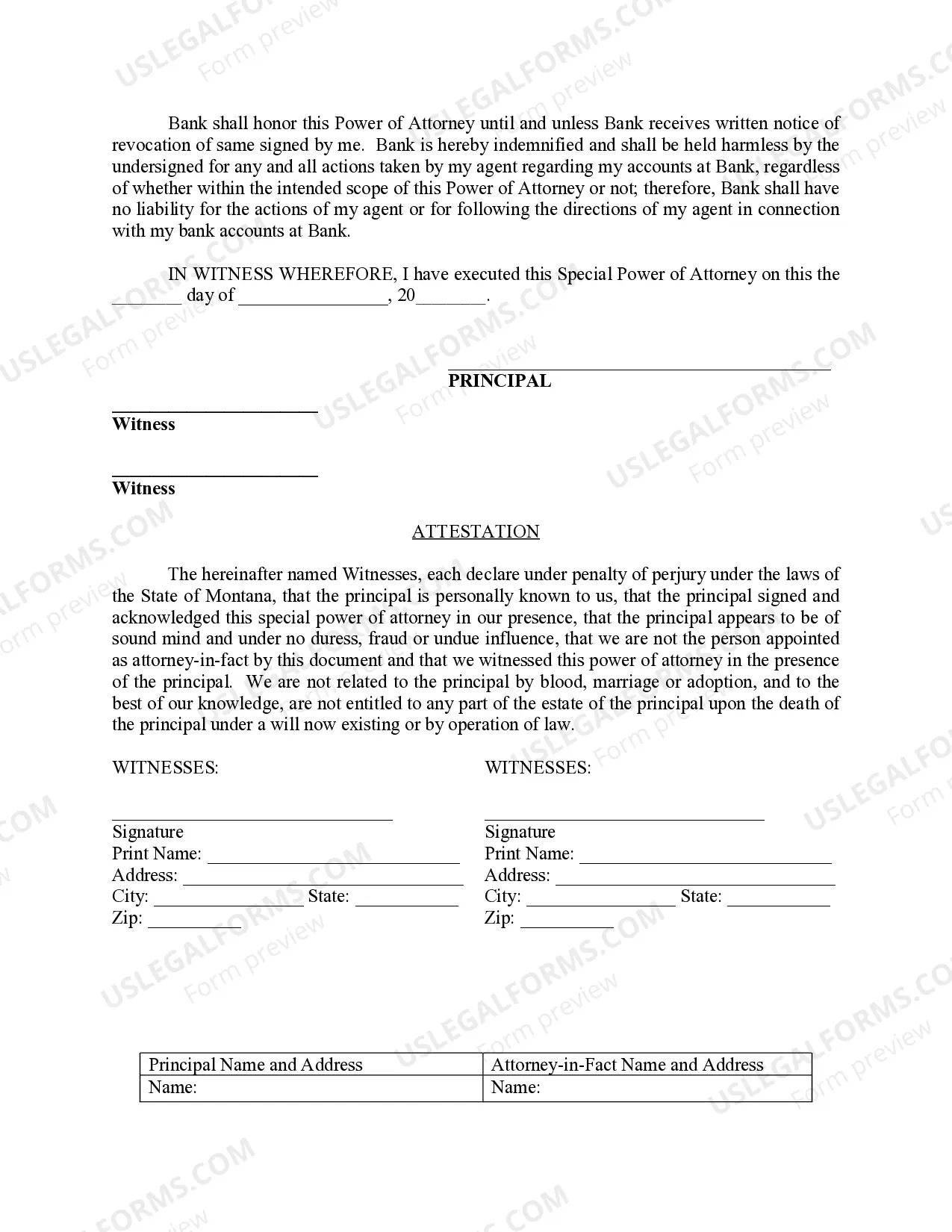

Bank Pays Price for Refusing to Honor Request Made Under a Power of Attorney.But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.

If you want your attorney to deal with any real estate you own in NSW, then the Power of Attorney document must be registered with the NSW Land Registry Services. Otherwise, there is no requirement for your Power of Attorney to be registered.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.