Montana Lease Subordination Agreement

What this document covers

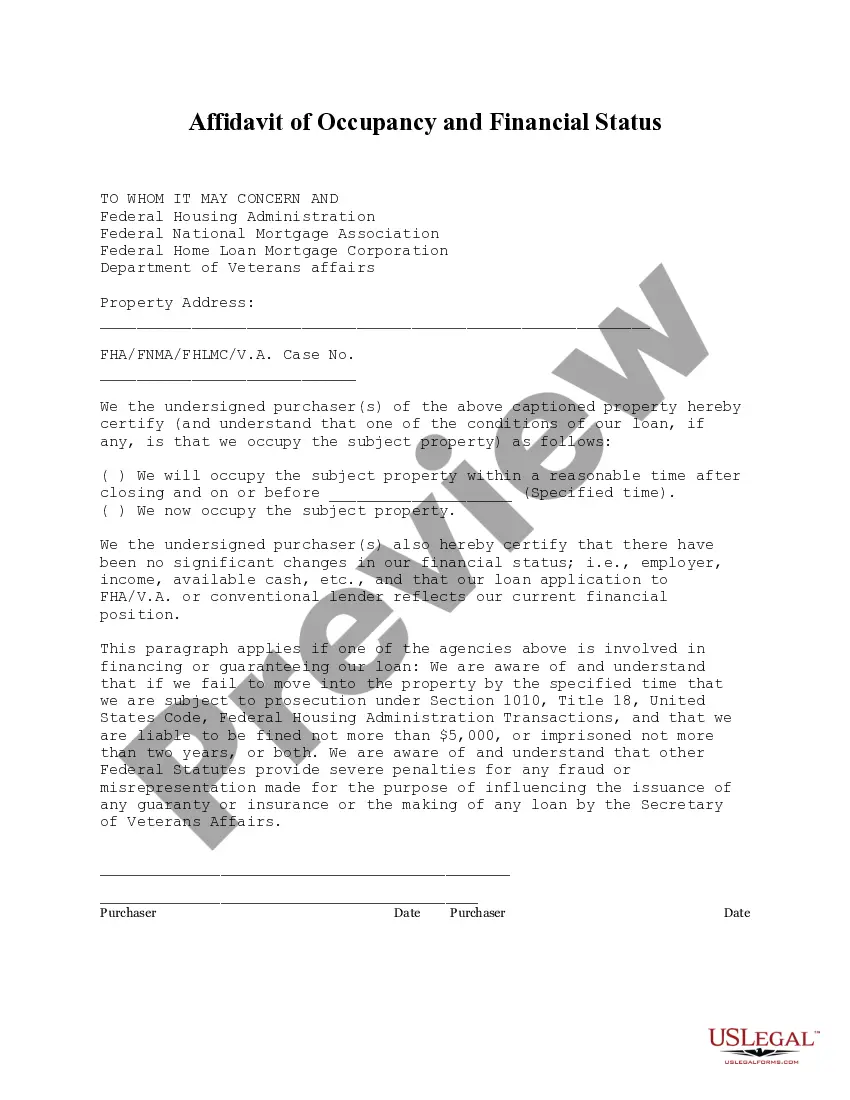

A Lease Subordination Agreement is a legal document that allows a lien holder's claim, typically from a mortgage or deed of trust, to be placed behind a mineral, oil, or gas lease. This agreement ensures that the lease has priority over the lien, allowing lessees to utilize the leased property without interference from the lien holder. The subordination arrangement is vital when property owners seek additional financing or make improvements on the property while maintaining their lease agreements with tenants or lessees.

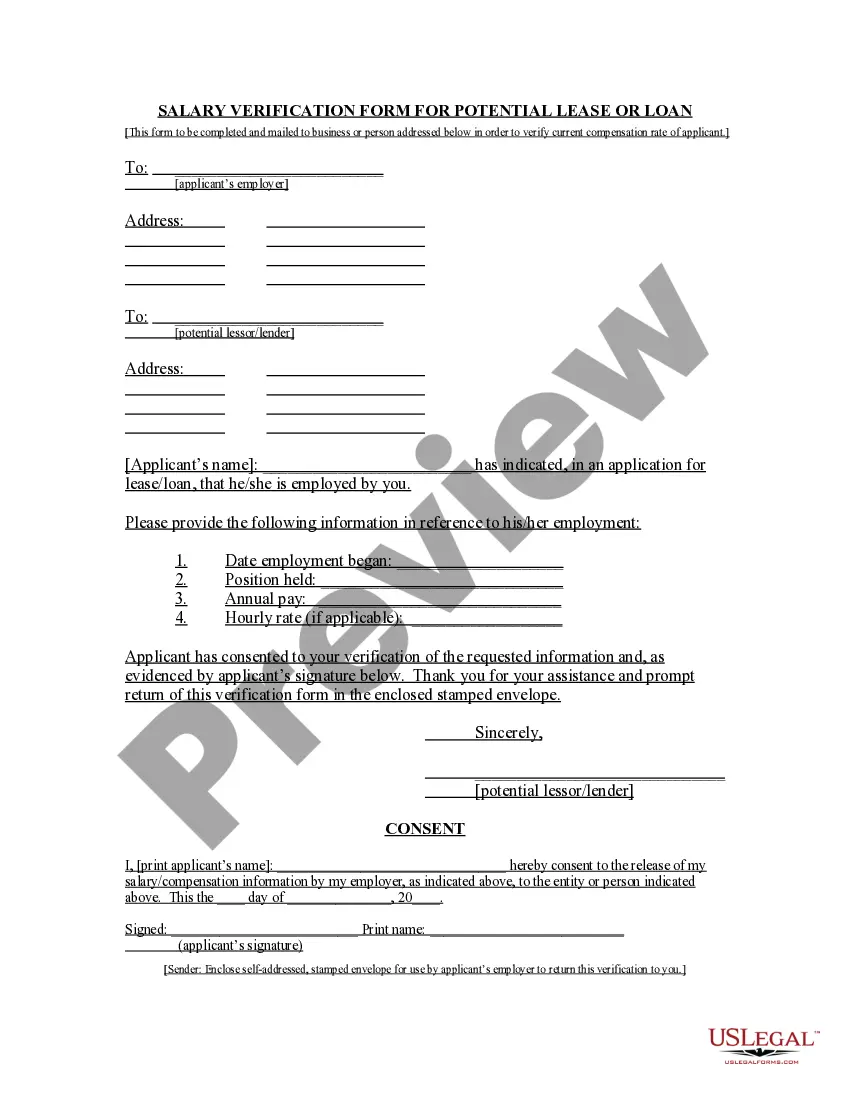

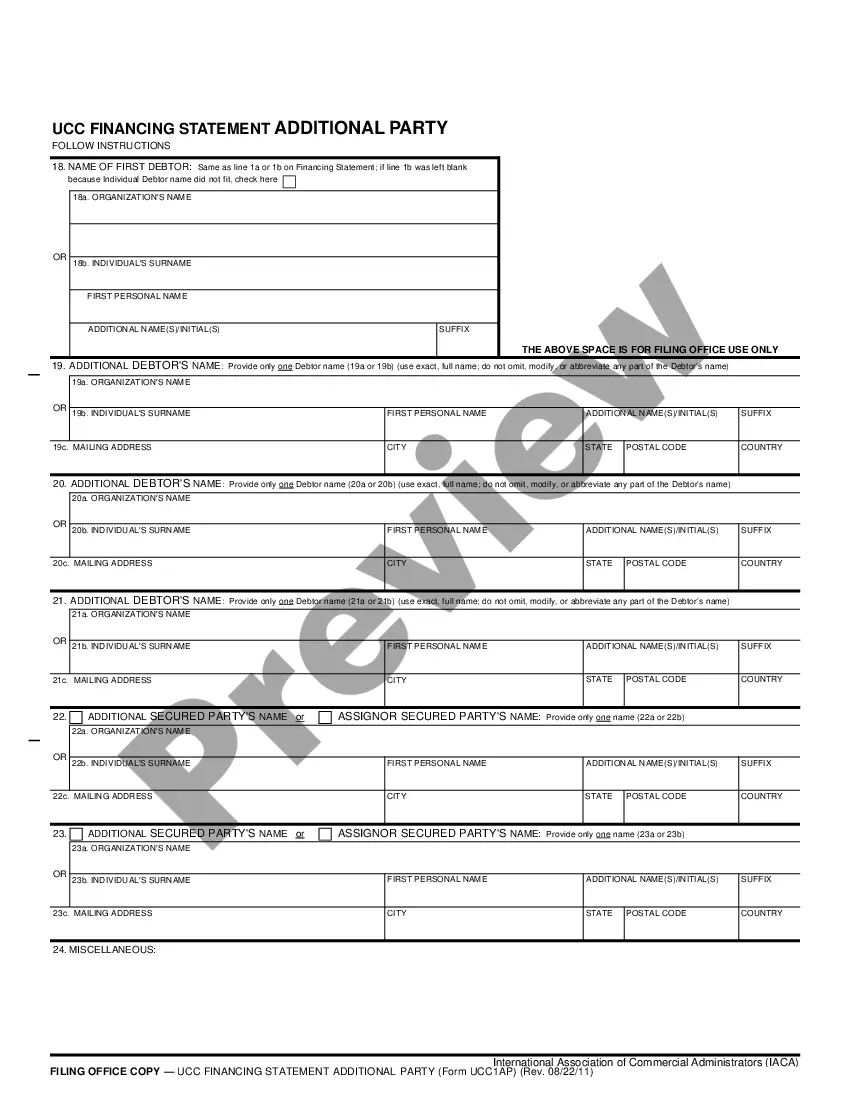

Form components explained

- Identification of parties: Includes details of the lessor, lien holder, and lessee.

- Description of the property: Specifies the lands covered by the mortgage or deed of trust.

- Effective date: Establishes when the subordination takes effect.

- Subordination clause: Details the release of liens to ensure lease priority over mortgage interests.

- Rights retention: Confirms the lien holder retains certain rights against royalty interests or reversionary interests.

Situations where this form applies

This form is typically used when a property owner wants to prioritize a mineral, oil, or gas lease over existing liens from a mortgage or deed of trust. It is essential in scenarios where additional financing is sought, such as applying for a second mortgage, or when a property owner needs to ensure that their lease rights are preserved against existing liens.

Who needs this form

- Property owners (lessors) who hold a mortgage or deed of trust on their property.

- Lien holders who need to subordinate their interests in favor of a lease.

- Lessee entities or individuals looking to secure their leasehold without interference from existing liens.

How to complete this form

- Identify the parties by filling in the names of the lessor, lien holder, and lessee with accurate details.

- Specify the property involved by providing a full description of the lands covered by the mortgage or deed of trust.

- Enter the effective date for the subordination to clarify when the agreement becomes valid.

- Include details about the prior mortgage, including recording information such as volume and page number.

- Ensure signatures are provided by the lien holder to finalize the agreement.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to accurately describe the property involved in the agreement.

- Not providing all required signatures or omitting necessary dates.

- Neglecting to confirm the effective date, which can lead to disputes later.

Benefits of using this form online

- Convenience: Easily download and fill out the Lease Subordination Agreement from anywhere.

- Editability: Customize the form to meet your specific needs without complex legal jargon.

- Reliability: Access forms drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

A written contract in which a lender who has secured a loan by a mortgage or deed of trust agrees with the property owner to subordinate its loan (accept a lower priority for the collection of its debt), thus giving the new loan priority in any foreclosure or payoff.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.However, it's also possible to have other liens. You might have some placed by contractors until work is paid off.

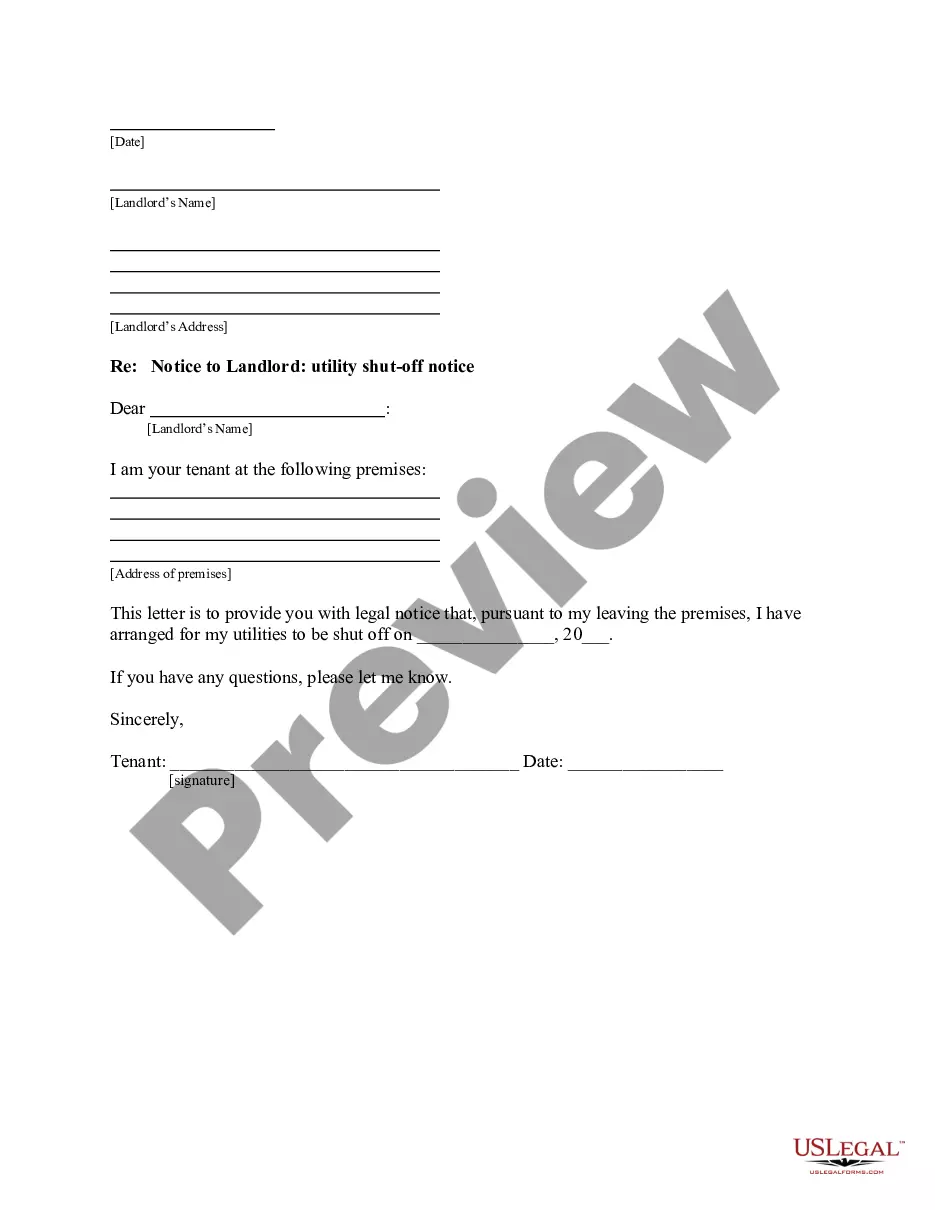

A rental agreement will be void and unenforceable if it allows the landlord to terminate the tenancy of a tenant for a crime committed in relation to the rental property if it does not also include the new domestic abuse protection language set forth in sec. 704.

A Subordination and Non-Disturbance Agreement (SNDA) commonly called a non-disturb is an agreement that your landlord asks its lender to provide. The agreement basically says that if the building goes bankrupt and the lender takes control of the building from the landlord, the lender will honor your lease.

Subordination is the tenant's agreement that its interest under the lease will be subordinate to that of the lender.Attornment is the tenant's agreement to become the tenant of someone other than the original landlord and who has now taken title to the property.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.