Mississippi Deed of Trust, Security Agreement and Financing Statement

Description

How to fill out Mississippi Deed Of Trust, Security Agreement And Financing Statement?

Obtain a printable Mississippi Deed of Trust, Security Agreement and Financing Statement with just a few clicks from the most extensive collection of legal electronic documents.

Locate, download and print expertly prepared and certified samples on the US Legal Forms website. US Legal Forms has been the top supplier of economical legal and tax templates for US citizens and residents online since 1997.

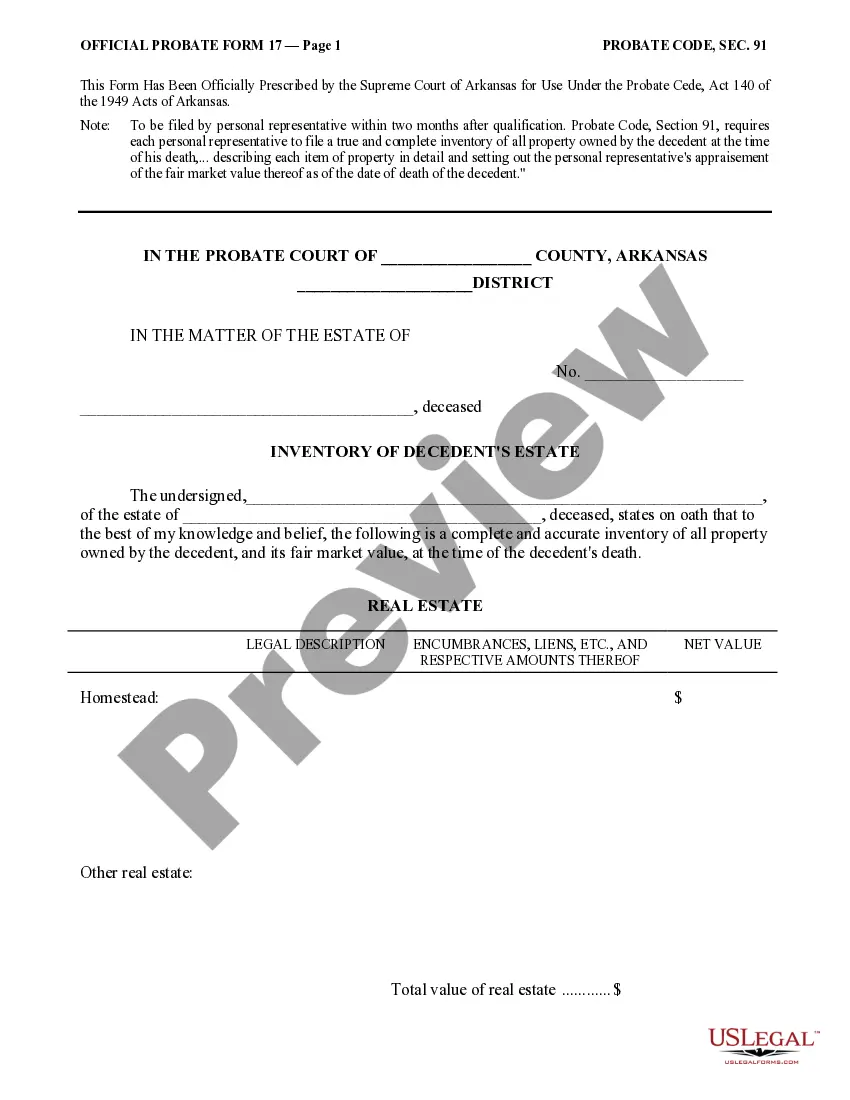

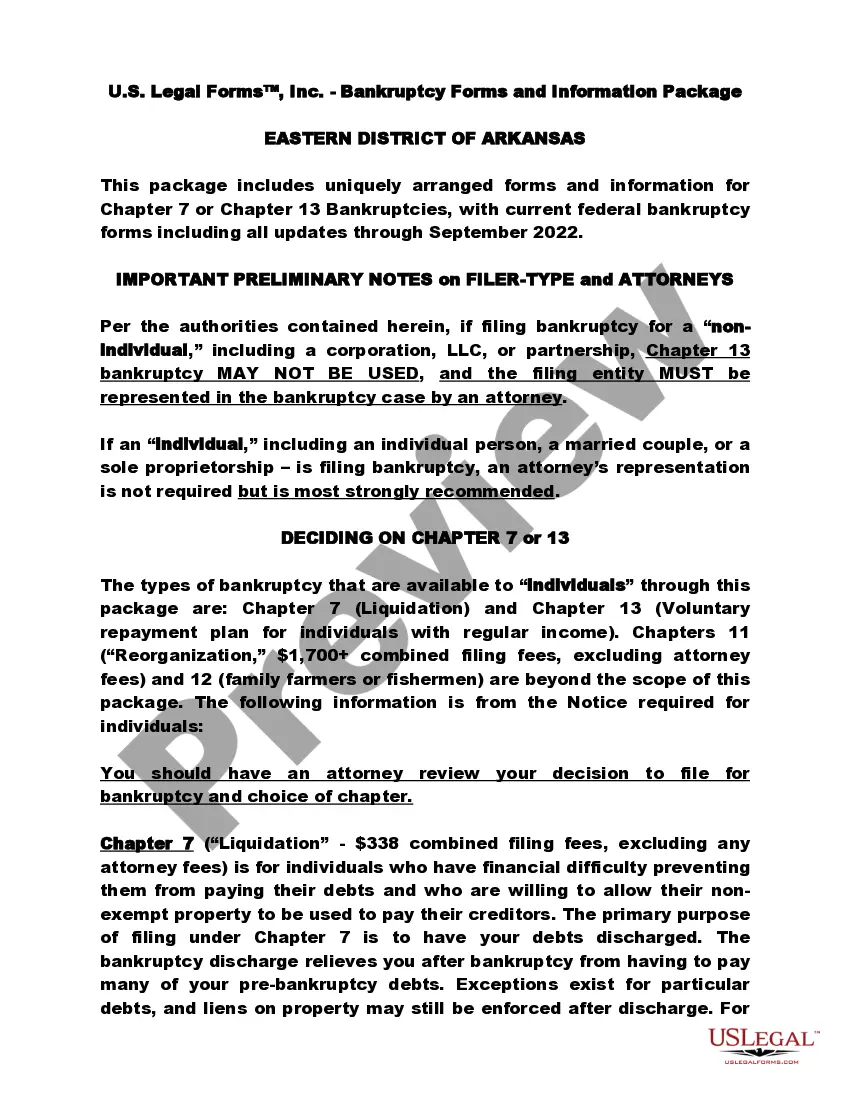

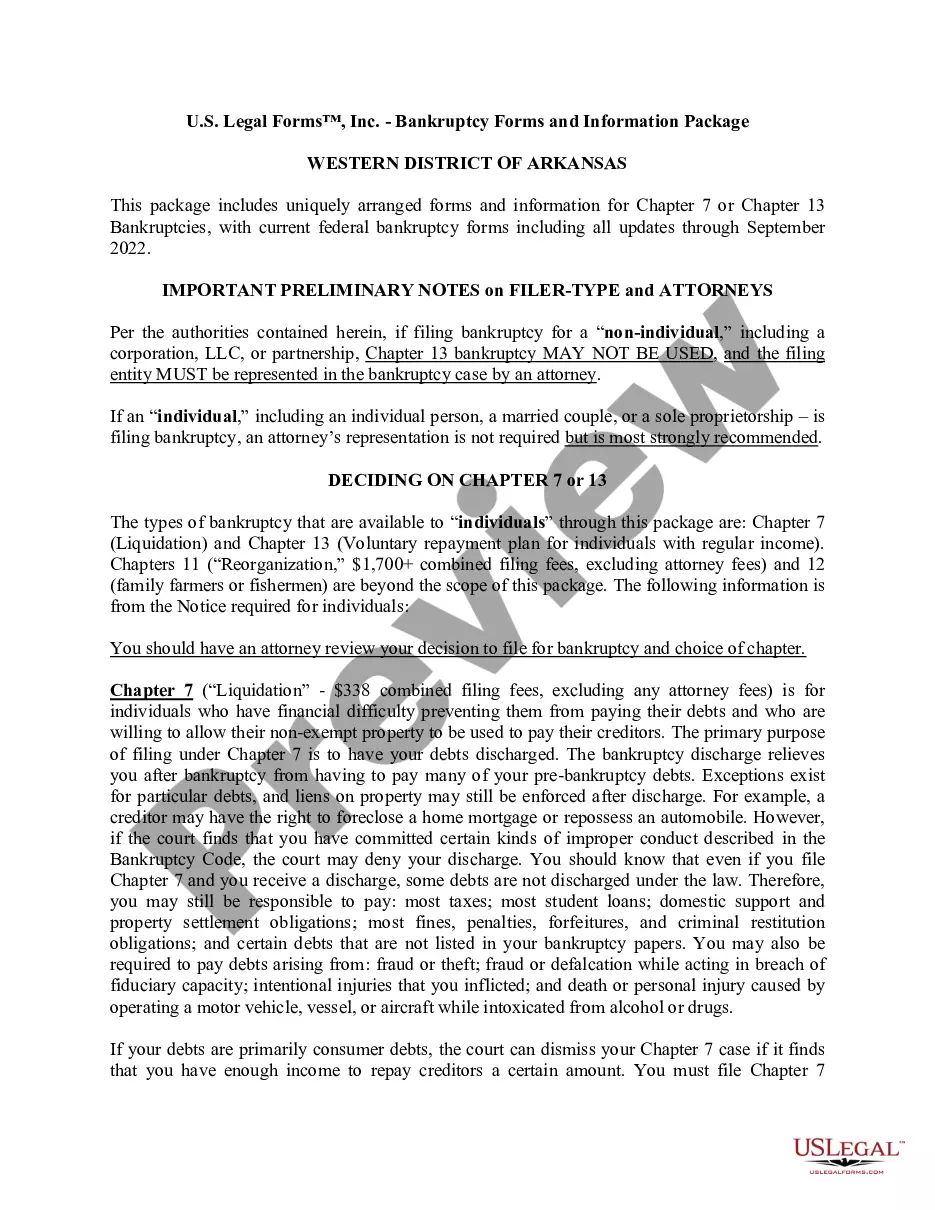

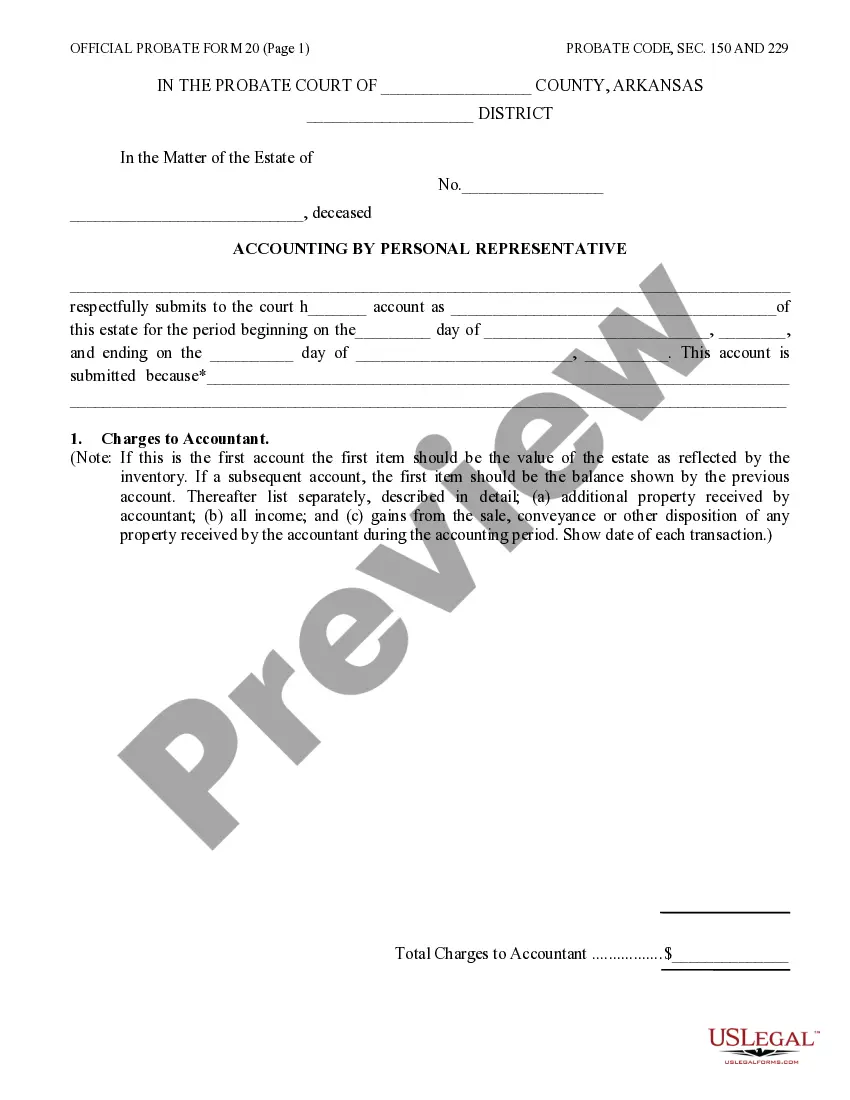

Download the form in Word or PDF format. After downloading your Mississippi Deed of Trust, Security Agreement and Financing Statement, you can complete it in any online editor or print it and fill it out by hand. Use US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Users who already possess a subscription need to Log In directly to their US Legal Forms account, retrieve the Mississippi Deed of Trust, Security Agreement and Financing Statement and find it saved in the My documents section.

- Clients who do not have a subscription must follow the steps outlined below.

- Ensure your template complies with your state’s regulations.

- If available, review the form’s description to learn more.

- If possible, preview the form to explore more details.

- Once you’re confident the template fits your needs, simply click Buy Now.

- Create a personal account.

- Select a subscription plan.

- Make payment through PayPal or credit card.

Form popularity

FAQ

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

Name of the trust. Address of the trust. Objects of the trust (Charitable or Religious) One settlor of the trust. Two trustees of the trust (minimum)

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A deed of trust includes most of the same information as a mortgage, including: The original loan amount. A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary.