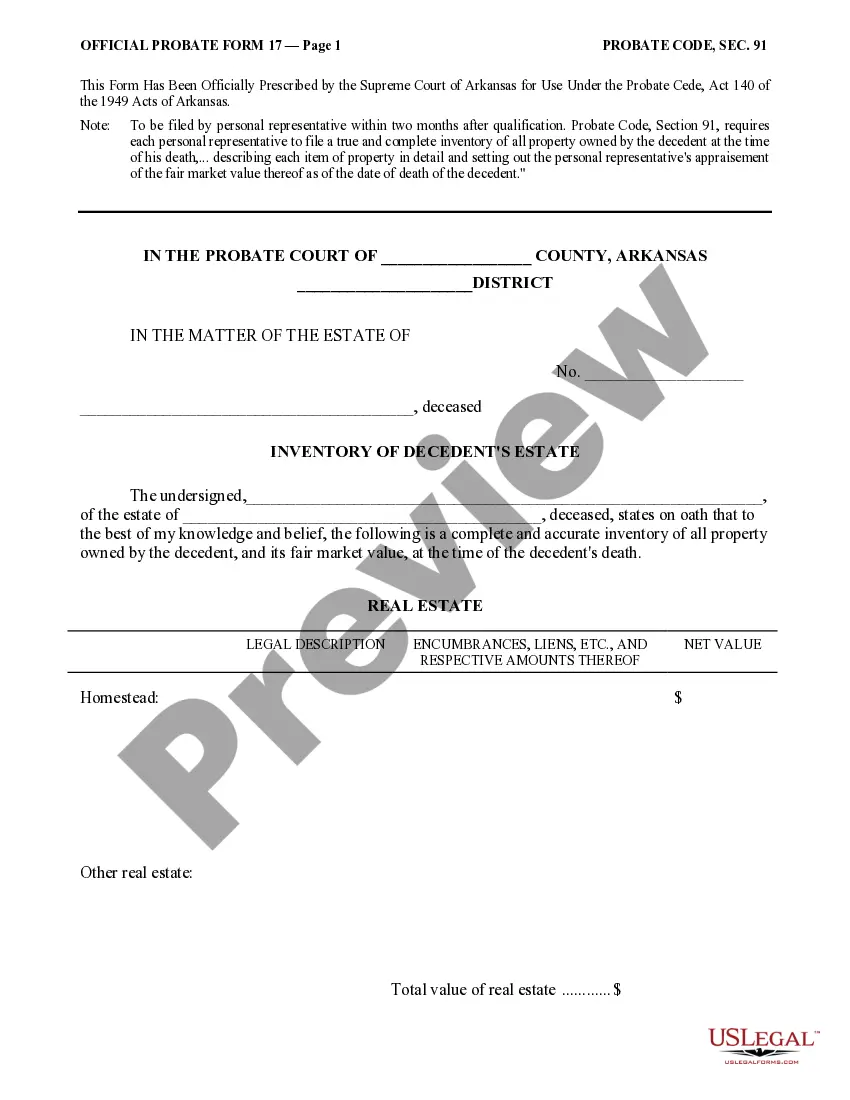

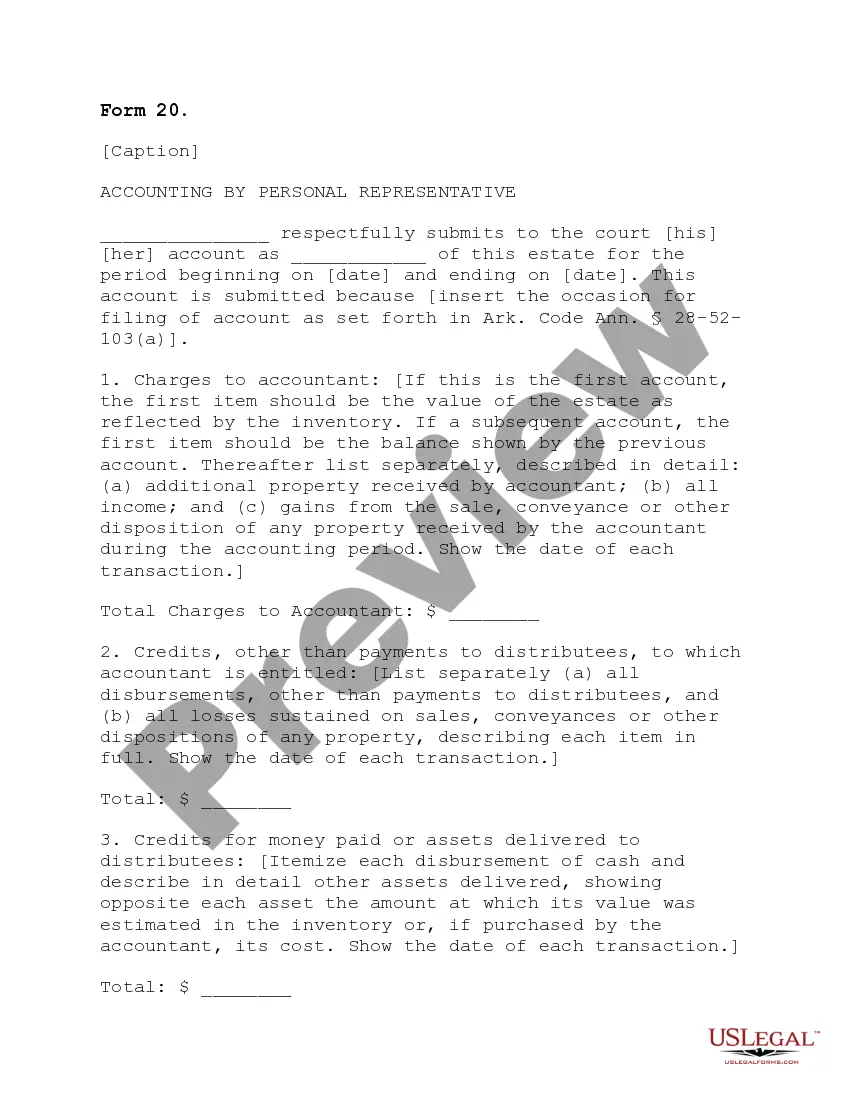

Accounting by Personal Representative of Estate. This official probate court form is used to account to the probate court all the expenses incurred by the estate under the direction of the personal representative.

Arkansas Accounting by Personal Representative of Estate

Description

How to fill out Arkansas Accounting By Personal Representative Of Estate?

Utilizing Arkansas Accounting by Personal Representative of Estate templates crafted by skilled attorneys allows you to avert complications when filling out documentation.

Just download the template from our site, complete it, and ask a lawyer to verify it.

Doing this can assist you in saving considerably more time and expenses than asking for legal assistance to create a document from the ground up for you would.

- If you possess a US Legal Forms subscription, just Log In to your account and return to the form webpage.

- Locate the Download button near the templates you are reviewing.

- Soon after downloading a file, you will find all your saved templates in the My documents section.

- When you lack a subscription, that’s not an issue.

- Simply follow the steps below to enroll for your account online, acquire, and finalize your Arkansas Accounting by Personal Representative of Estate template.

- Double-check and ensure that you’re downloading the correct state-specific form.

Form popularity

FAQ

To file for an executor of an estate in Arkansas, you start by submitting a petition to the probate court along with a copy of the will, if applicable. You should include relevant information such as the deceased’s details and identification of heirs. Utilizing a platform that provides Arkansas Accounting by Personal Representative of Estate can help ensure that you follow all necessary legal steps smoothly and efficiently.

To claim your status as an executor of an estate, you must provide the probate court with the will that names you as executor, if available, and file the appropriate court documents. If there is no will, the court will appoint you as administrator based on state laws. Engaging in professional Arkansas Accounting by Personal Representative of Estate is crucial to properly manage estate assets and distributions.

If there is no will, you can become the executor of an estate by petitioning the probate court for letters of administration. The court will consider your relationship to the deceased and other factors in determining your suitability for this role. Once appointed, you will handle Arkansas Accounting by Personal Representative of Estate to ensure all claims and debts are settled appropriately.

To file for administration of an estate after a death in Arkansas, you need to submit a petition to the probate court in the county where the deceased lived. This petition will include necessary documents like the death certificate and a request for letters of administration. It's an important step to ensure proper Arkansas Accounting by Personal Representative of Estate, and getting help from a legal service can simplify this process.

To request an estate accounting, you should contact the personal representative of the estate or the probate court managing the estate. It often requires you to file a formal request, outlining your relationship to the estate and your reasons for the accounting. Remember, clarity and patience are key, as the process of Arkansas Accounting by Personal Representative of Estate can take time.

In Arkansas, an executor typically has up to 18 months to settle an estate, although complications may extend this timeline. Timely settlement is essential for fulfilling responsibilities as a personal representative and adhering to Arkansas accounting by personal representative of estate guidelines. Being proactive can help expedite this process and avoid delays.

To do a final accounting for an estate, begin by organizing all financial records, including receipts and bank statements. Then, create a comprehensive report that clearly outlines all transactions and balances. This document should reflect the thoroughness required by Arkansas accounting by personal representative of estate protocol, ensuring every detail is accounted for.

Preparing a final accounting for an estate involves collecting all relevant financial documents and summarizing income, expenses, and distributions. It is crucial to ensure accuracy and compliance with Arkansas accounting by personal representative of estate standards. Using resources like USLegalForms can simplify this process and provide guidance along the way.

Yes, an executor or trustee is required to provide a detailed accounting of the estate's financial activities. This accounting must be submitted to beneficiaries and the court, ensuring compliance with Arkansas accounting by personal representative of estate laws. This process promotes trust and clarity among all stakeholders.

Arkansas Code 28 65 320 outlines the accounting requirements for personal representatives managing an estate. It sets forth the necessity for transparent reporting and adherence to specific timeframes when submitting final accounts. Understanding this code is essential for anyone involved in Arkansas accounting by personal representative of estate activities.