Minnesota Dissolution Package to Dissolve Corporation

Understanding this form

The Minnesota Dissolution Package to Dissolve Corporation is a comprehensive collection of legal documents needed to officially dissolve a corporation in Minnesota. This package provides step-by-step instructions and includes all necessary forms, ensuring a smooth voluntary dissolution process for shareholders or incorporators. It differs from similar forms by specifically addressing the requirements for notifying creditors and claimants during the dissolution process.

Form components explained

- Articles of Dissolution: Form for filing the dissolution with the Secretary of State.

- Notice of Intent to Dissolve: Document notifying the intent to dissolve to the Secretary of State.

- Resolution of Directors: Formal adoption of the dissolution by the board of directors.

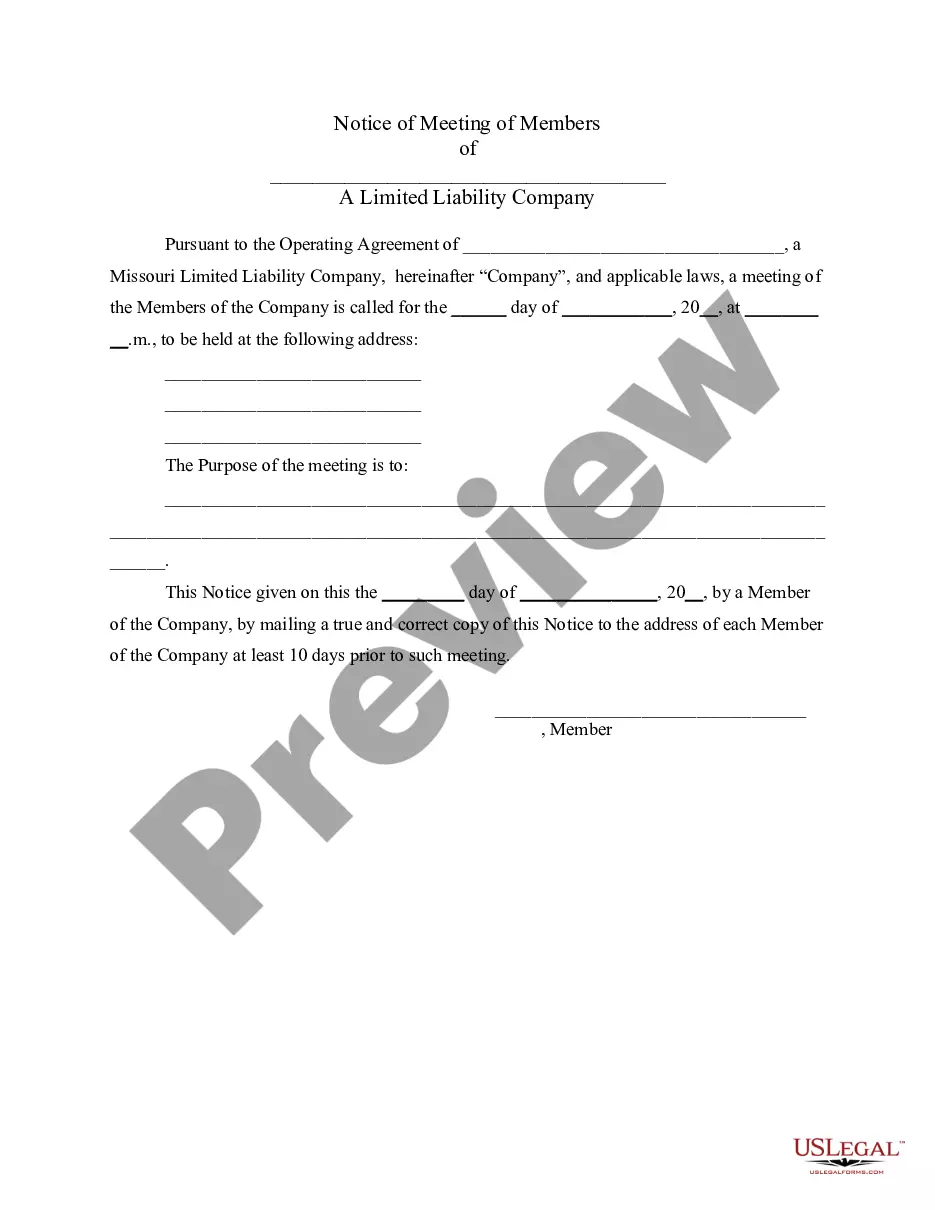

- Notice of Special Meeting: Notification for shareholders regarding the meeting to approve dissolution.

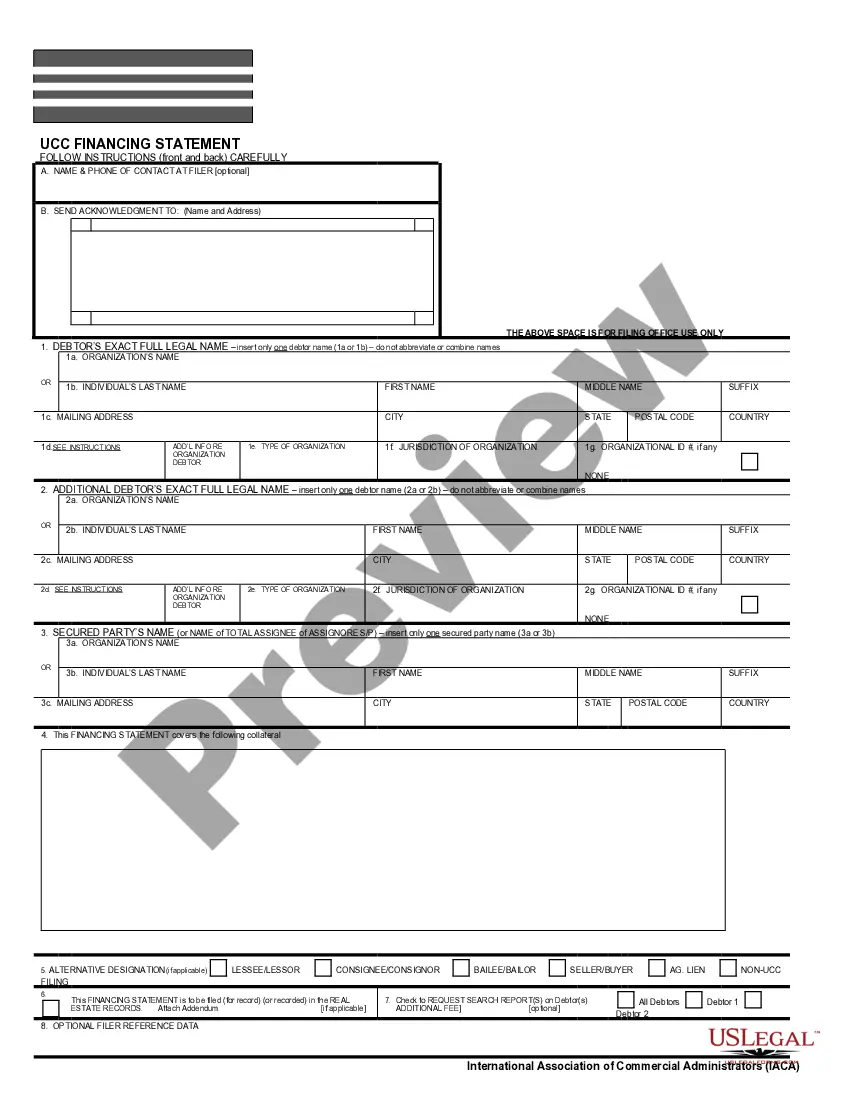

- Claims Notices: Forms for notifying and requesting claims from known and unknown creditors.

When to use this form

This form is used when a corporation in Minnesota needs to be voluntarily dissolved. It is applicable when either the shareholders or incorporators decide to terminate the corporation and file the required documents with the Secretary of State. It is essential to use this package when there are creditors involved, ensuring all legal obligations are met before the dissolution is finalized.

Intended users of this form

- Incorporators of a corporation wishing to dissolve the business.

- Shareholders who have agreed to voluntarily dissolve the corporation.

- Corporate directors seeking to formalize the dissolution process.

Instructions for completing this form

- For corporations that have not issued stock: Complete the Articles of Dissolution with the corporation's name, date of incorporation, and signatures from a majority of incorporators or directors.

- If stock has been issued: Adopt a resolution to dissolve at a board meeting and notify shareholders of a special meeting to discuss the dissolution.

- File the Notice of Intent to Dissolve with the Secretary of State, including approval details and signatures from authorized individuals.

- Notify known claimants by mailing a claims notice and publish a notice for unknown claimants to limit potential liabilities.

- After the requisite waiting period, file the final Articles of Dissolution to complete the process.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to notify all creditors and claimants properly.

- Not obtaining the necessary approvals from shareholders or directors.

- Inaccurate filing of the Articles of Dissolution or Notice of Intent to Dissolve.

- Missing the deadlines for submitting claims notices to creditors.

Why complete this form online

- Convenience of downloading and completing forms at your own pace.

- Access to attorney-drafted documents tailored to Minnesota law.

- Easy tracking and management of filing requirements.

- Reduced potential for errors with clear instructions and guidance.

Looking for another form?

Form popularity

FAQ

To dissolve a corporation in Minnesota, begin by obtaining approval from your board of directors and shareholders. After that, you will need to file the articles of dissolution with the Minnesota Secretary of State. The Minnesota Dissolution Package to Dissolve Corporation can guide you through this process, ensuring you complete all necessary forms correctly. Don’t forget to address any outstanding debts and notify your employees and creditors.

Dissolving a corporation involves several key steps. First, you must hold a meeting and obtain approval from shareholders. Next, you file your articles of dissolution with the state, which can be efficiently managed using the Minnesota Dissolution Package to Dissolve Corporation. Lastly, settle all financial obligations and notify stakeholders to ensure a smooth closure.

Yes, you typically need to file Form 966 when dissolving an S Corporation. This form notifies the IRS of your decision to dissolve and is a crucial part of the process. Using the Minnesota Dissolution Package to Dissolve Corporation can simplify this step, ensuring you handle the paperwork correctly. Always consult a tax professional for specific advice related to your situation.

Summary dissolution is the most cost-effective way to get divorced in California. There is less paperwork and only one filing fee. However, the couple must meet very specific requirements. Also, California requires a six-month waiting period to terminate any marriage, so summary dissolution does not expedite a divorce.

In most states, "dissolution of marriage" is just another way of saying divorce, and it refers to the process by which a couple can end their marriage permanently.A no-fault divorce is easier and quicker to obtain than a "fault" divorce, but spouses may be required to live apart for a certain amount of time.

An uncontested divorce in Minnesota can take as little as four weeks, although 60 days more likely. More difficult divorce cases where the parties disagree on many issues can end up taking years.

There are court fees to get divorced. You have to pay a filing fee of about $400 to start or respond to a divorce case. There can be other fees if you participate in mediation, have a custody evaluation, or if a guardian ad litem is appointed.