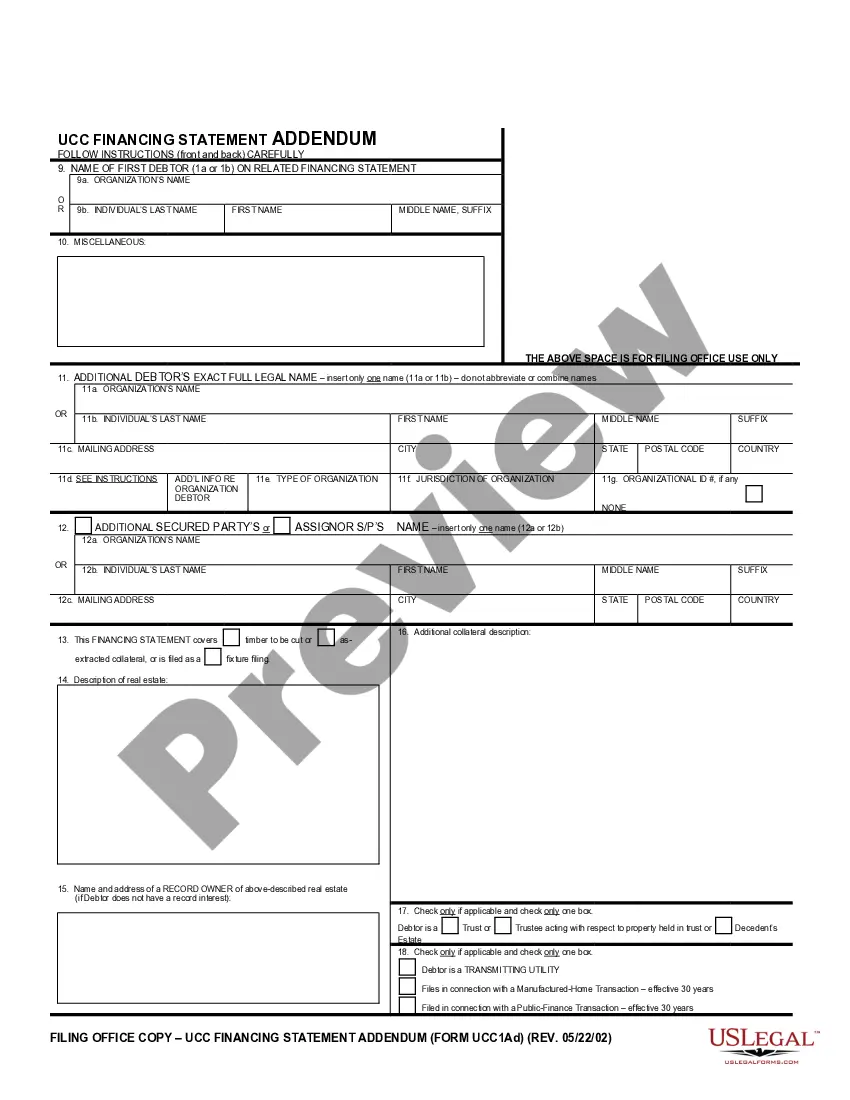

New Jersey UCC1 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Jersey UCC1 Financing Statement?

US Legal Forms is really a special system where you can find any legal or tax form for submitting, such as New Jersey UCC1 Financing Statement. If you’re sick and tired of wasting time seeking appropriate examples and paying money on file preparation/attorney charges, then US Legal Forms is precisely what you’re looking for.

To enjoy all of the service’s advantages, you don't have to install any software but just pick a subscription plan and register an account. If you have one, just log in and look for an appropriate sample, save it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey UCC1 Financing Statement, check out the instructions below:

- make sure that the form you’re looking at applies in the state you want it in.

- Preview the example and read its description.

- Click on Buy Now button to access the sign up webpage.

- Choose a pricing plan and carry on registering by entering some info.

- Select a payment method to complete the sign up.

- Download the document by selecting your preferred file format (.docx or .pdf)

Now, submit the document online or print it. If you are unsure about your New Jersey UCC1 Financing Statement form, contact a lawyer to check it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

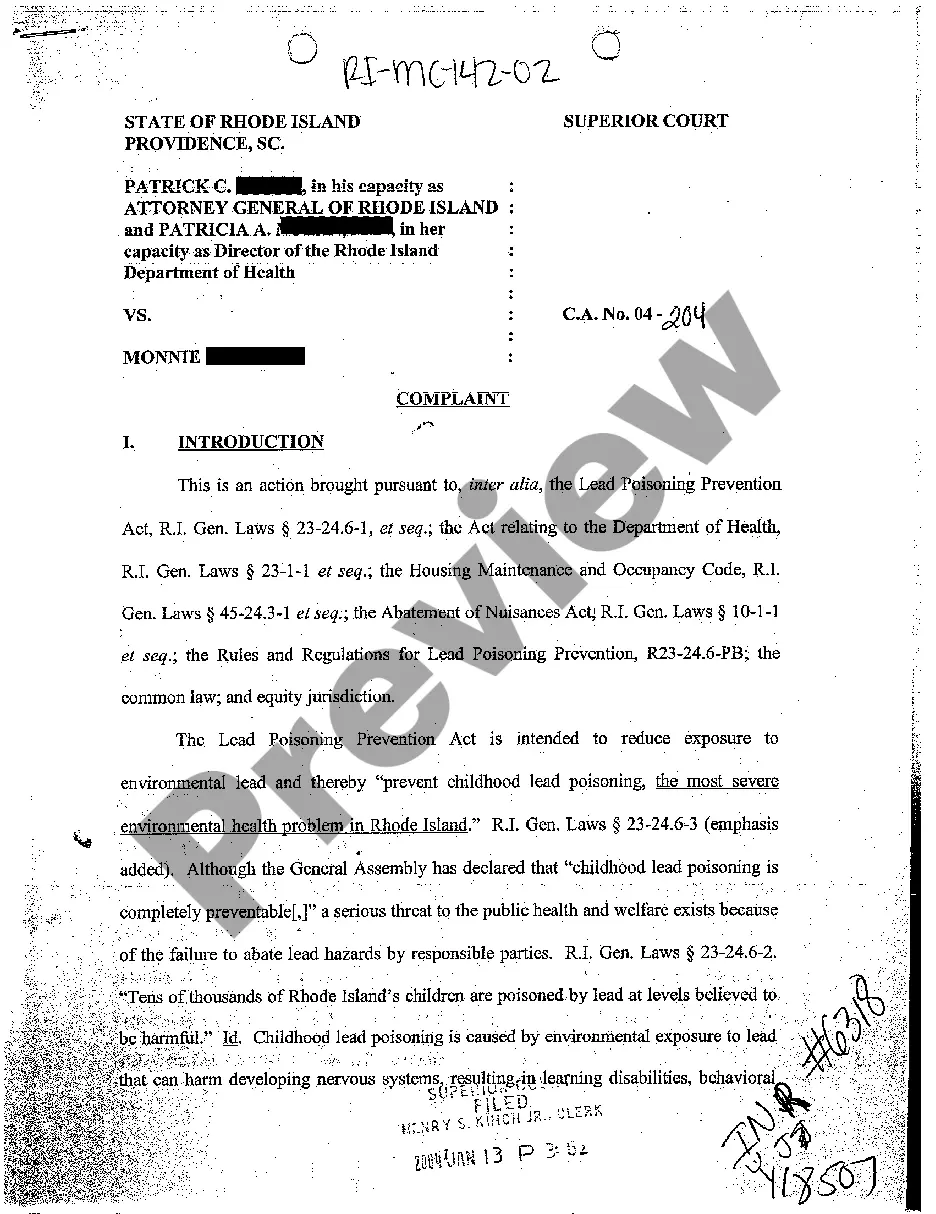

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans.These forms must be filed with agencies located in the state where the borrower's business is incorporated.

When is a UCC-1 Filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.

Having a UCC filed on your business credit report can have negative effects in general on your overall credit risk, scoring and other associated risk analysis, (across all three business credit bureaus) and can even kill your chances at getting financing for your business.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

Searching Secretary of State Records Online. Locate the correct secretary of state's website. UCC financing statement forms must be filed in the state where the borrower is located. Most states have online directories of UCC filings available on the secretary of state's website.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

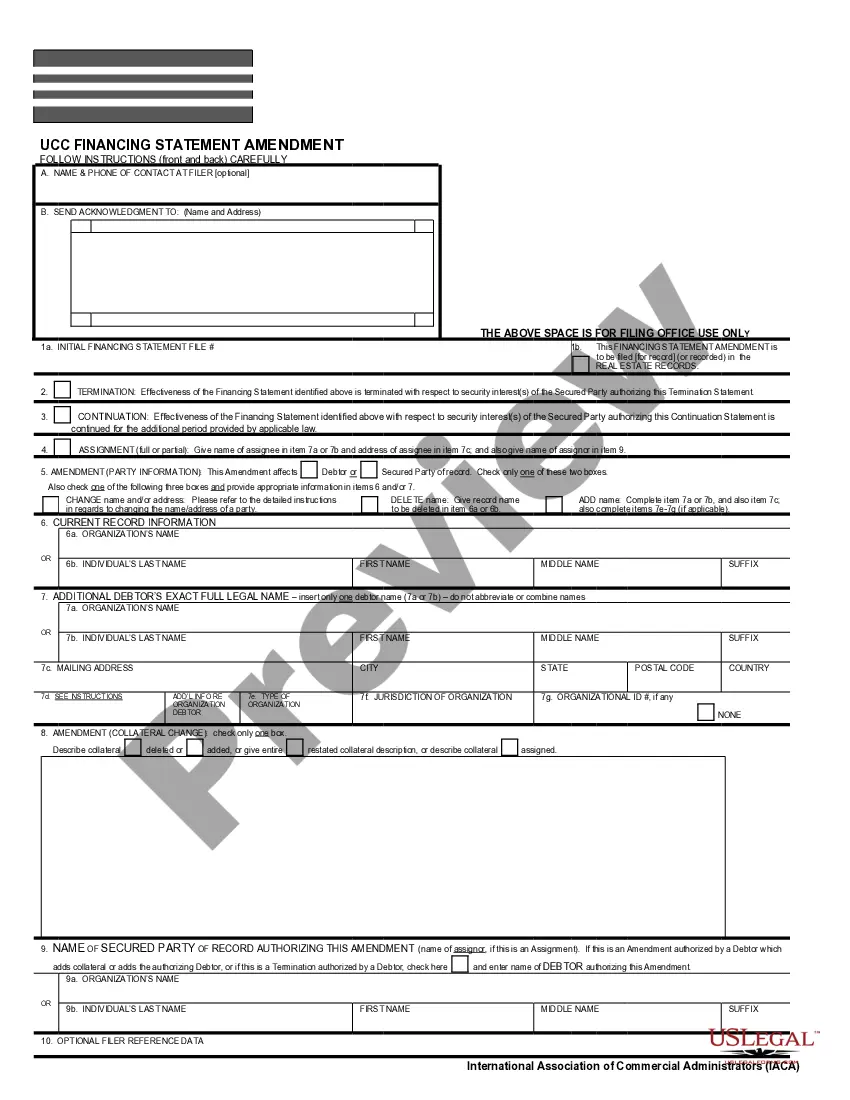

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.