Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act

Description

How to fill out Sections 302A.471 And 302A.473 Of Minnesota Business Corporation Act?

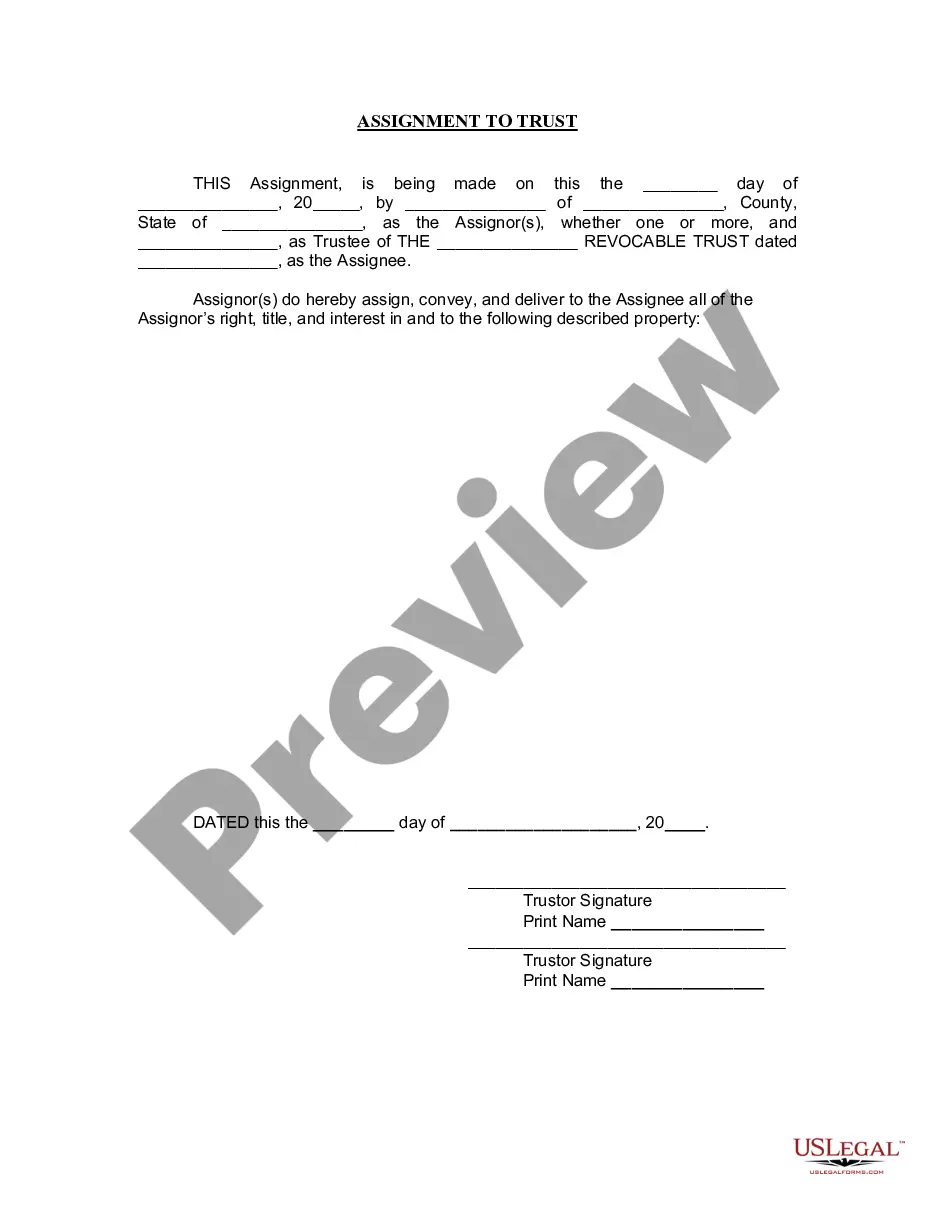

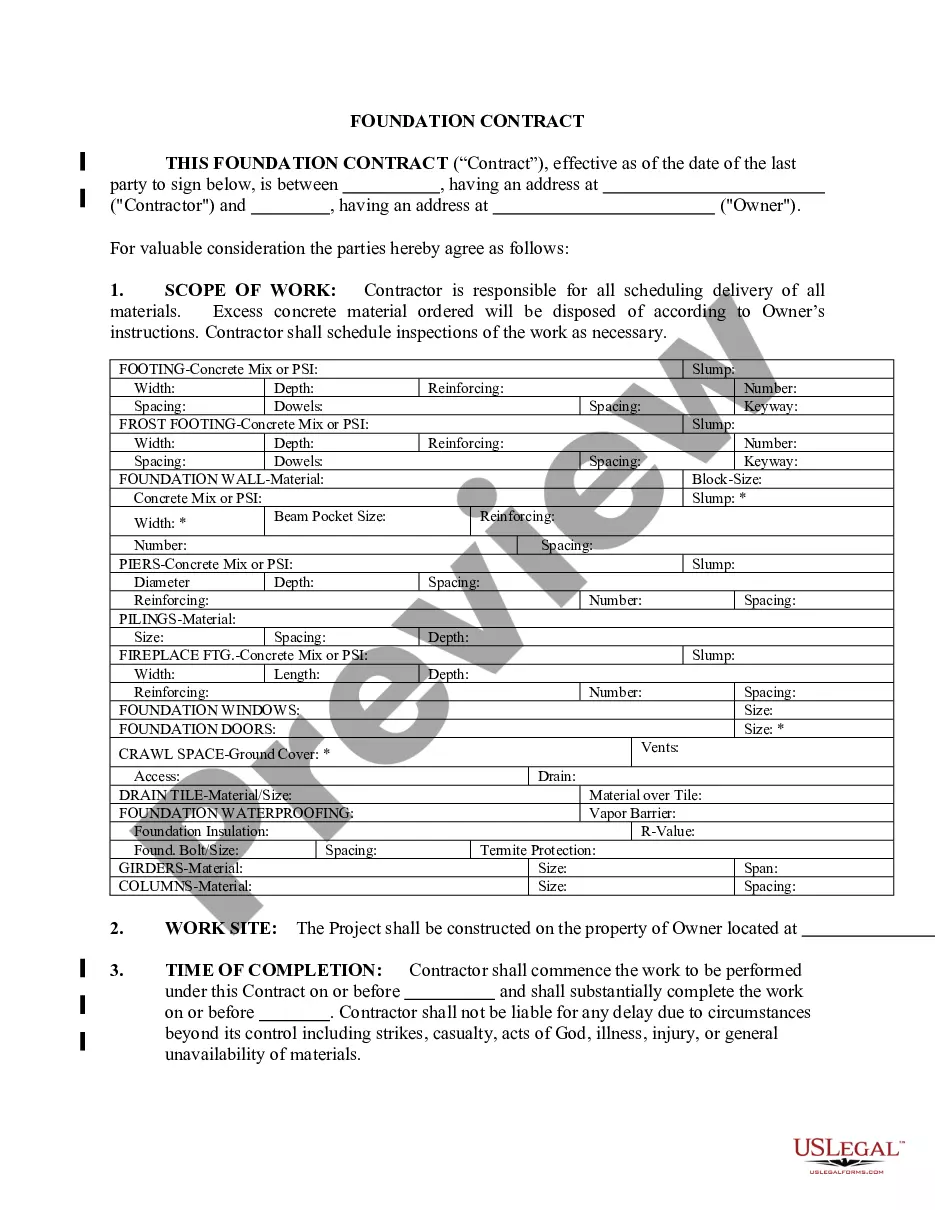

When it comes to drafting a legal document, it’s easier to leave it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a template to use. That doesn't mean you yourself can’t get a sample to use, however. Download Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act right from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. When you are signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act fast:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Click Buy Now.

- Choose the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Minnesota requires that different articles be filed, based on whether the LLC accepted or did not accept contributions. If your LLC accepted contributions, you must first file a notice of dissolution with the Secretary of State by mail or in person. This is followed by filing an articles of termination form.

Under 322C, the ability of a member, or anyone else, to act as an agent of the LLC is to be addressed, if at all, in an operating agreement. An LLC may file statements of authority with the Office of Minnesota Secretary of State (similar to those filed by partnerships) with respect to non-members.

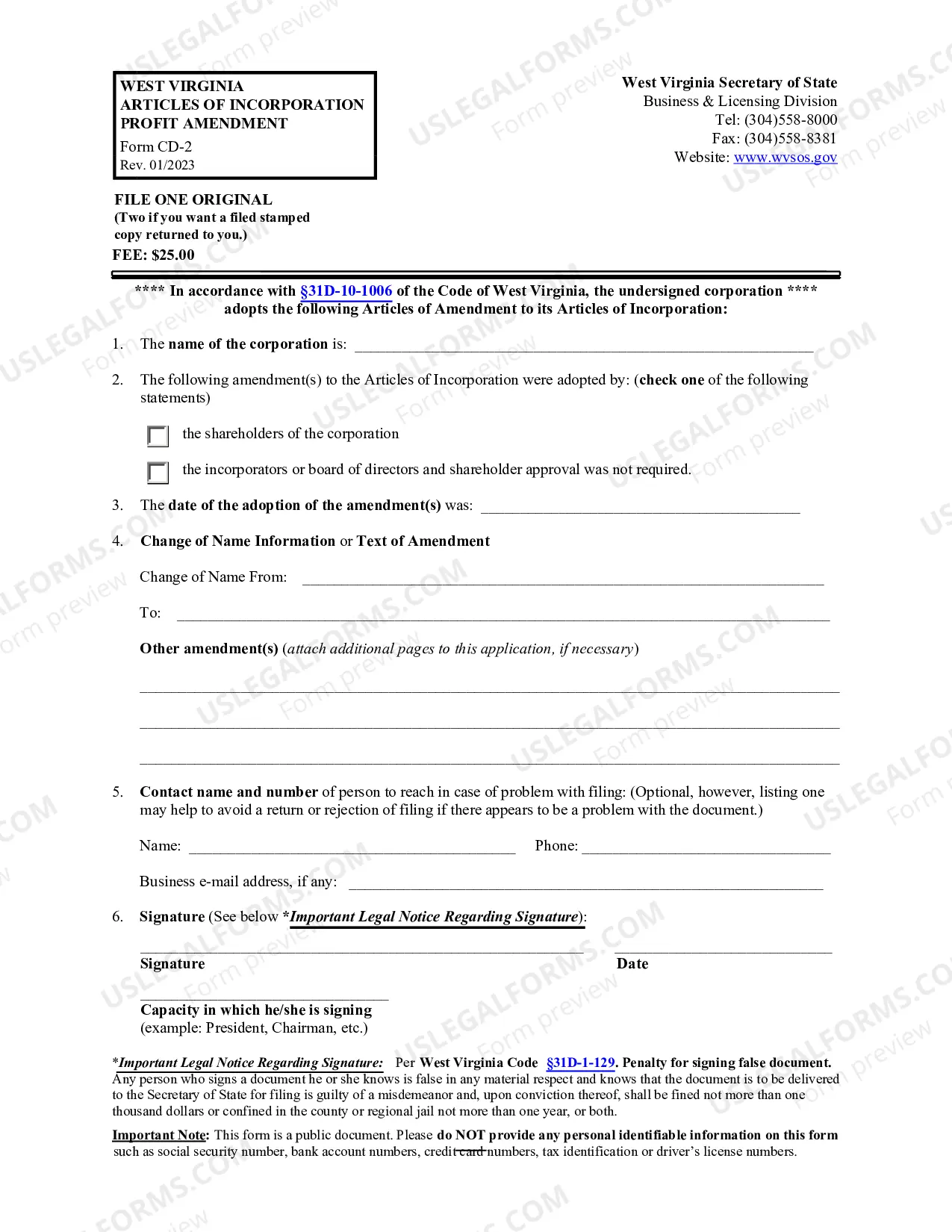

Choose a Corporate Name. Prepare and File Articles of Incorporation. Appoint a Registered Agent. Set Up a Corporate Records Book. Prepare Corporate Bylaws. Appoint Initial Corporate Directors. Hold Your First Board of Directors Meeting. Issue Stock.

Citation Data American Bar Association. Committee on Corporate Laws. Model Business Corporation Act : Official Text with Official Comment and Statutory Cross-References, Revised through June 2005. Chicago, IL :Section of Business Law, American Bar Association, 2005.

The Canada Business Corporations Act (CBCA) is the federal law that regulates business structures in Canada.The CBCA covers the rules for founding a corporation or other business structure in Canada, the reporting requirements it operates under, and the approved procedure for dissolving the company when it closes up.

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

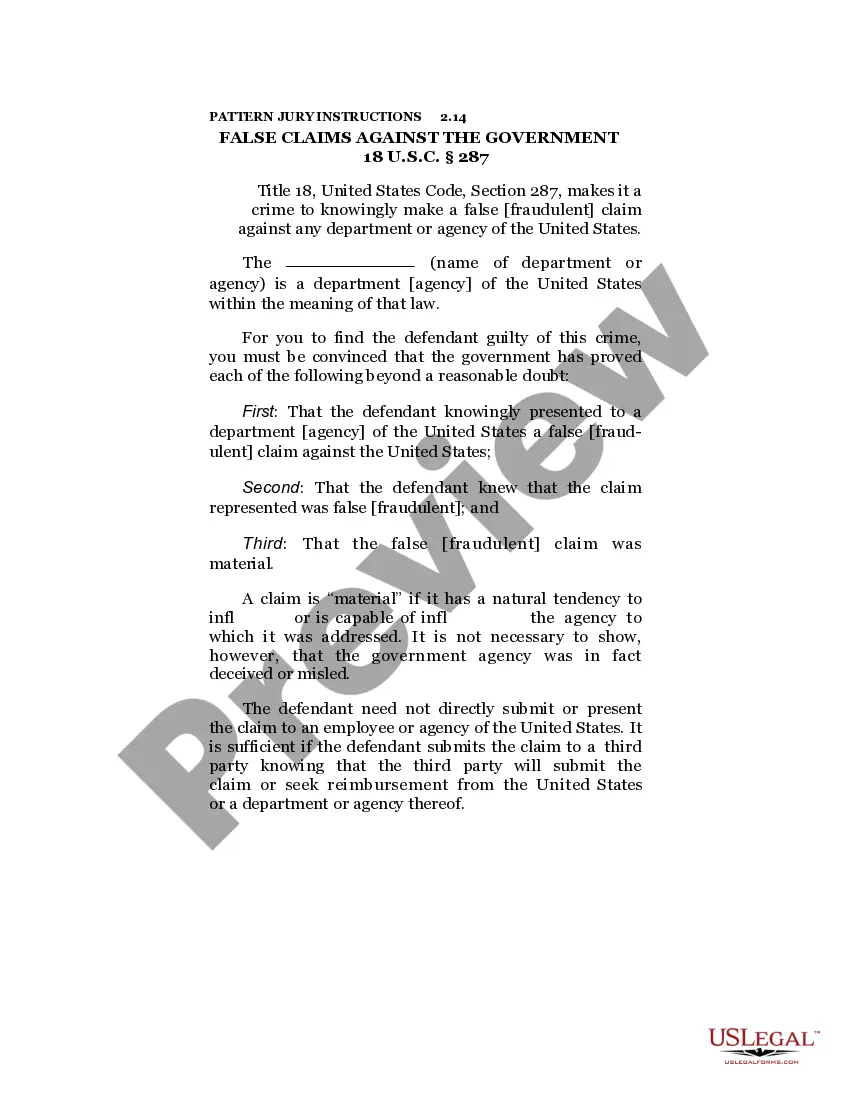

The MBCA contains comprehensive laws on doing business as a corporation. It covers a number of topics, like the steps involved in forming a corporation, limited liability and its effects, exceptions to the concept of limited liability, corporate management structure, and voting and shareholders' rights.

Despite criticism of Delaware's corporate statutes by the drafters of the original Model Business Corporation Act (MBCA), there has been a constructive symbiosis between the MBCA and Delaware's corporation law, including its statutory component: each set of statutes has been informed by drafting and case-law experience

This statute covers, among other things, incorporation of the corporation, its capacity and powers, management as well as matters relating to shareholders and various corporate transactions, such as amendments to the corporation's articles and by-laws, amalgamations, continuances and dissolution.