Tennessee Closing Statement

Understanding this form

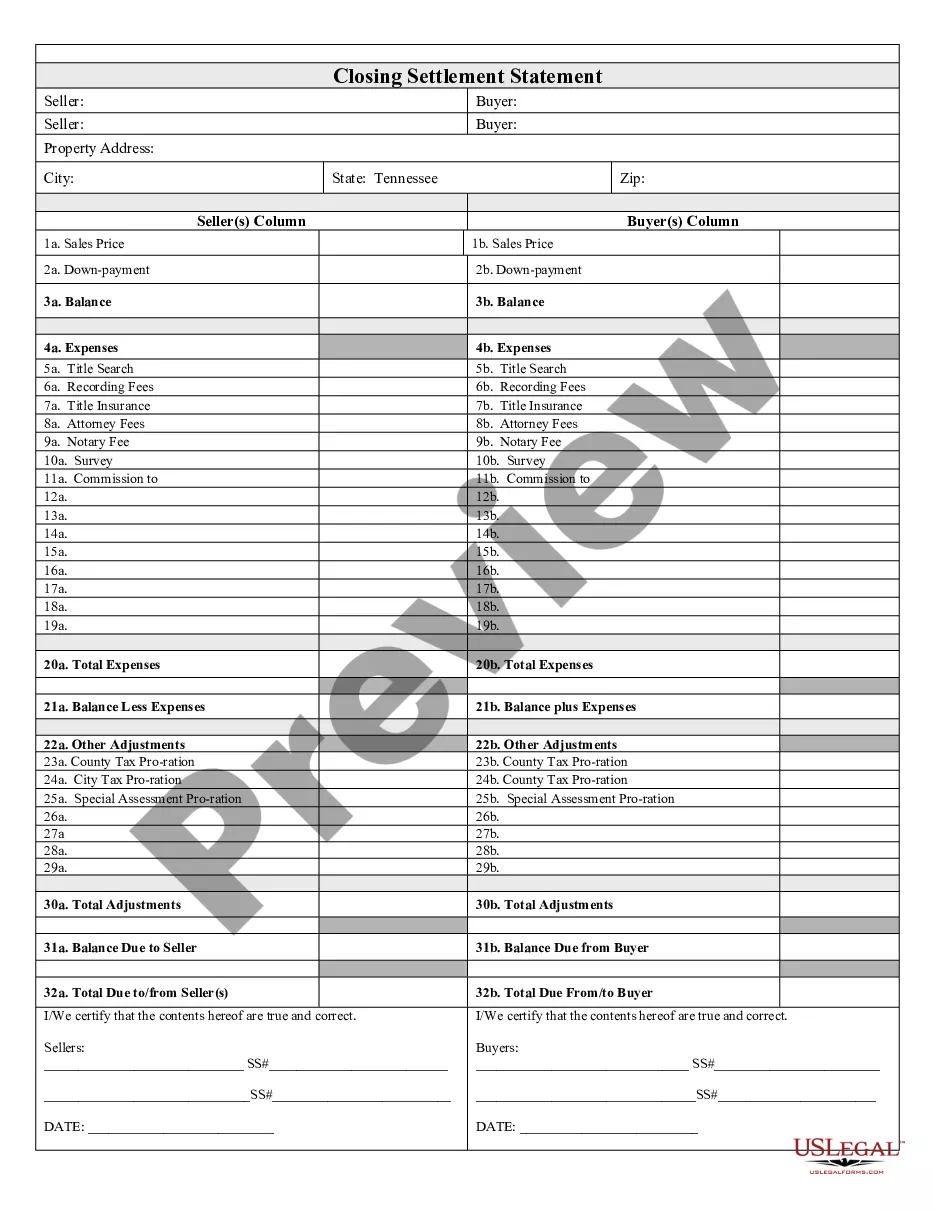

A Closing Statement is a critical document used in real estate transactions, specifically during cash sales or owner financing scenarios. This form summarizes all financial aspects of the sale, including the buyer's and seller's costs and the distribution of funds. Unlike other real estate forms, the Closing Statement is verified and signed by both parties, ensuring clarity and agreement on all financial terms before the transaction is finalized.

What’s included in this form

- Balance: Summary of funds due to/from both parties.

- Expenses: Detailed listing of costs incurred during the transaction.

- Title Search: Costs associated with verifying property ownership.

- Recording Fees: Expenses related to filing the transaction with local authorities.

- Title Insurance: Protection against potential disputes over property ownership.

- Attorney Fees: Fees paid for legal services during the transaction.

- Survey: Costs for property surveying.

- Commission: Fees for real estate agents involved in the sale.

- Adjustments: Any prorated taxes or assessments that affect the final balance.

- Certification: Signatures from both the seller and buyer affirming the accuracy of the statement.

When this form is needed

Use the Closing Statement during real estate transactions to provide a comprehensive overview of all financial elements involved. It is essential when the property is sold for cash or through owner financing, ensuring that both parties are aware of all costs, adjustments, and the final amounts due. This document is typically completed and exchanged at the closing meeting, marking the official transfer of property ownership.

Intended users of this form

- Homeowners selling their property directly without a realtor.

- Buyers purchasing property via cash payment or owner financing.

- Real estate professionals facilitating transactions between buyers and sellers.

- Attorneys involved in the closing process for real estate transactions.

How to prepare this document

- Identify the parties: Clearly state the names of the buyer and seller.

- List property details: Specify the property address and legal description.

- Detail financial amounts: Fill in expenses, credits, and any commissions applicable to the transaction.

- Calculate total amounts: Ensure all totals are accurate, including the final balance due to/from each party.

- Obtain signatures: Both the buyer and seller must sign and date the form to certify its accuracy.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failure to include all expenses, leading to disputes about final amounts.

- Not obtaining signatures from both parties, which can invalidate the document.

- Leaving out critical property details or misidentifying the property.

- Failing to accurately calculate prorated taxes or adjustments.

Benefits of using this form online

- Convenience: Downloadable form allows users to complete it at their convenience.

- Editability: Ability to customize sections based on the specific transaction details.

- Reliability: Access to forms drafted by licensed attorneys ensures legality and accuracy.

Looking for another form?

Form popularity

FAQ

(In the trial court, the first name listed is the plaintiff, the party bringing the suit. The name following the "v" is the defendant. If the case is appealed, as in this example, the name of the petitioner (appellant) is usually listed first, and the name of the respondent (appellee) is listed second.

The defendant usually goes second. The plaintiff or prosecution is usually then permitted a final rebuttal argument. In some jurisdictions, however, this form is condensed, and the prosecution or plaintiff goes second, after the defense, with no rebuttals.

In a criminal trial by judge alone, these final arguments are delivered by Crown and defence counsel after the defence's case is finished. If defence counsel has presented evidence then she or he will be the first to make final arguments. Crown counsel will speak last.

A summary of the evidence. any reasonable inferences that can be draw from the evidence. an attack on any holes or weaknesses in the other side's case. a summary of the law for the jury and a reminder to follow it, and.

Stay Physically Close To Each Other. Agree To Make Small Changes. Use A Safe Word. Go Ahead And Take A Break. Agree To Disagree. Take The Argument Somewhere Else. Disagree Through A Different Medium. Go For A Walk Together.

Unlike the buyer, who may have to attend the closing to sign original loan documents delivered by the lender to the closing, you, as the seller, may or may not need to attend. For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents.

In closing argument, the prosecutor gives a beginning closing argument, followed by the defense;s final summation, followed by the prosecutor's final summation.

Each closing argument usually lasts 20-60 minutes. Some jurisdictions limit how long the closing may be, and some jurisdictions allow some of that time to be reserved for later.

Unlike the buyer, who may have to attend the closing to sign original loan documents delivered by the lender to the closing, you, as the seller, may or may not need to attend. For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents.