Minnesota Closing Statement

Overview of this form

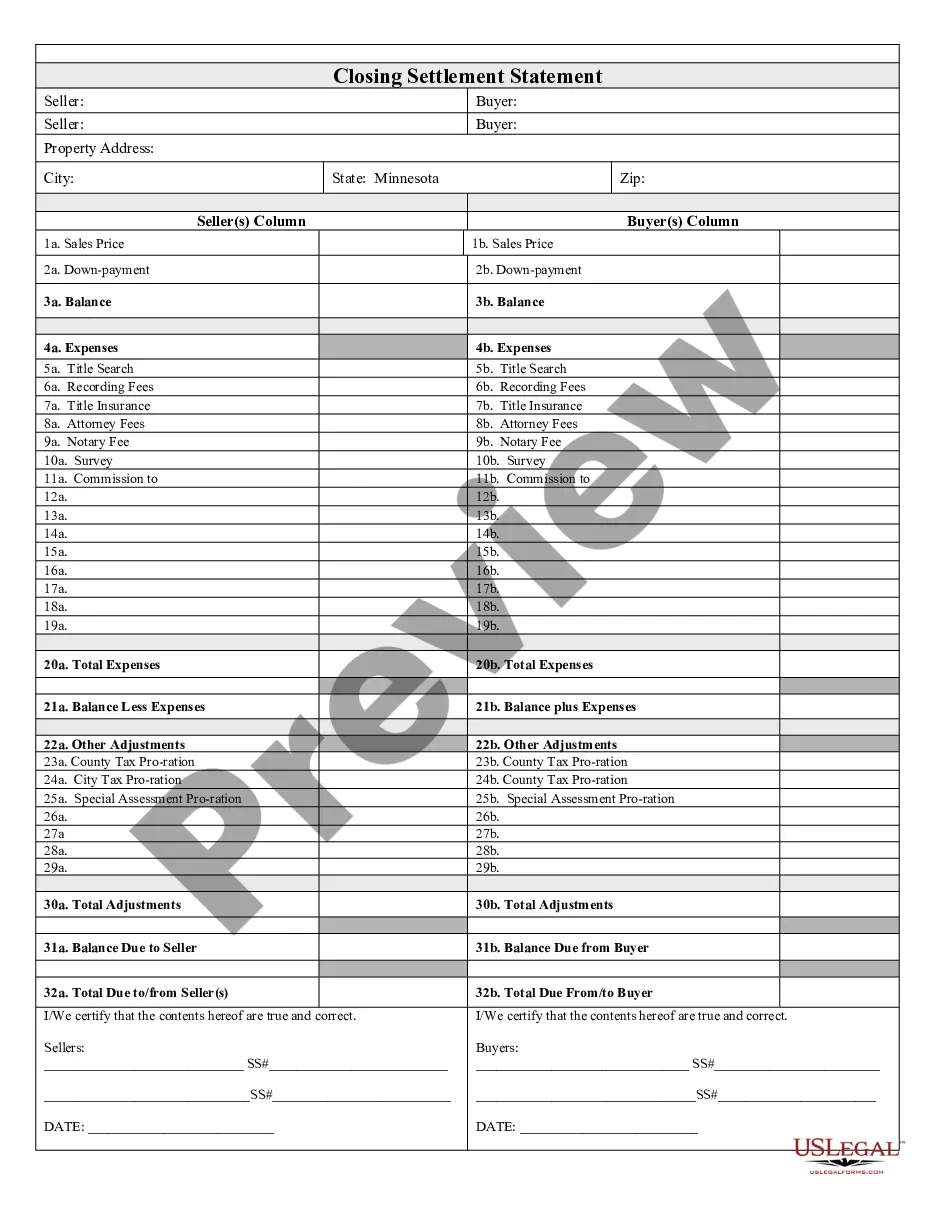

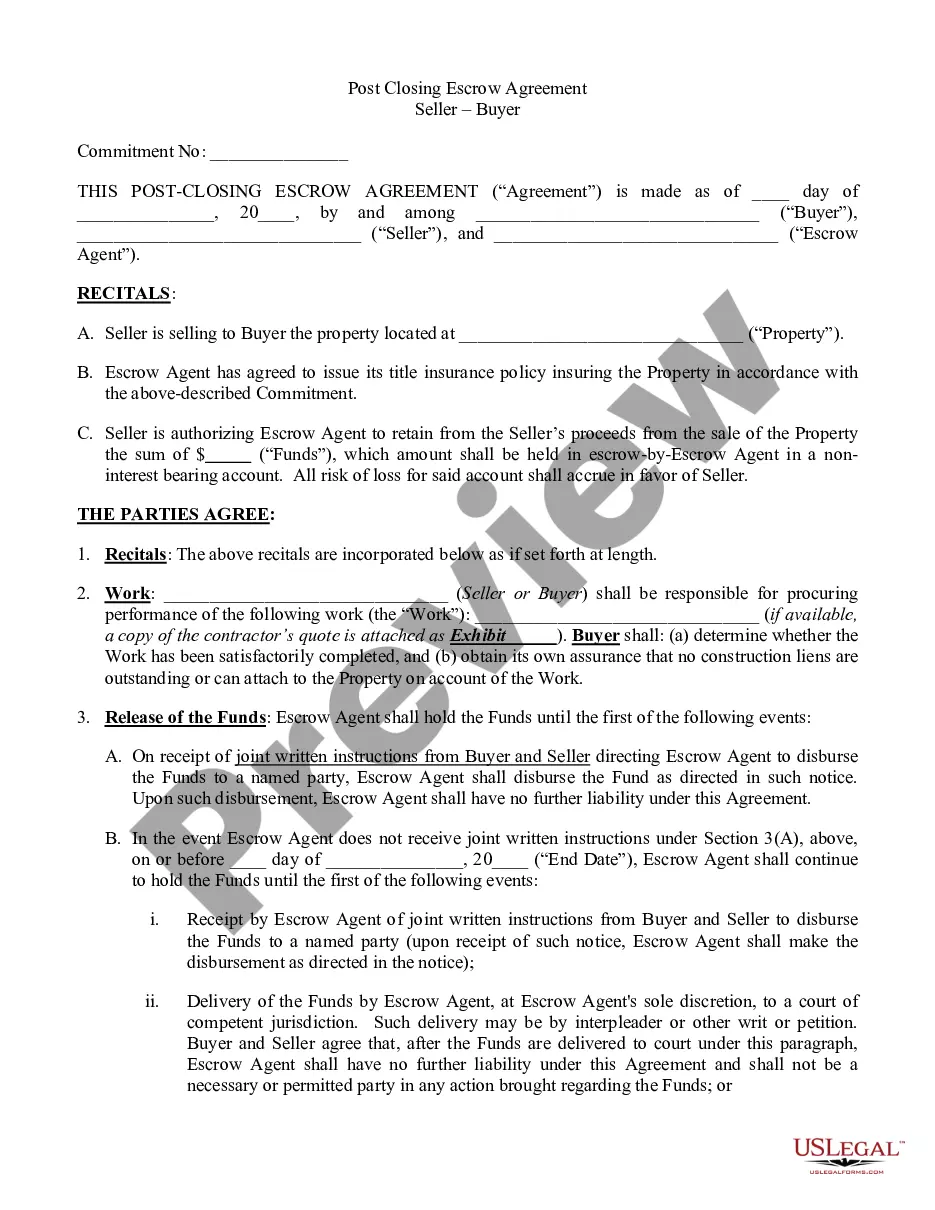

The Closing Statement is a crucial document in real estate transactions, particularly in cash sales or owner financing scenarios. It serves to summarize the financial aspects of the transaction, detailing amounts owed, paid, and any other financial adjustments between the buyer and seller. Unlike other forms, the Closing Statement is verified and signed by both parties, which adds an extra layer of accountability and clarity to the transaction.

Form components explained

- Expenses: Lists various costs associated with the transaction, such as title insurance and attorney fees.

- Title Search: Indicates charges related to the verification of the property's title.

- Recording Fees: Details costs for recording the transaction with local authorities.

- Balance calculations: Includes a breakdown of balances due to and from both buyer and seller.

- County and city tax prorations: Addresses the allocation of taxes between the parties based on the closing date.

- Certification section: Provides space for signatures and ensures that both buyer and seller affirm the accuracy of the information.

When this form is needed

This form is used during the closing process of a real estate transaction when a property is sold for cash or through owner financing. It is necessary for finalizing the sale, ensuring that all financial obligations are met, and that both parties agree on the details of the transaction. Essentially, it helps to formalize the agreement between the buyer and seller regarding the transfer of ownership and associated costs.

Who should use this form

This Closing Statement is beneficial for:

- Homebuyers engaged in cash transactions or financing through a private seller.

- Real estate sellers looking to document the financial aspects of the sale.

- Real estate agents who facilitate transactions and need to ensure accurate financial reporting.

- Attorneys specializing in real estate matters, ensuring that their clients' interests are protected.

Completing this form step by step

- Identify the parties involved: Clearly specify the names of the buyer and seller.

- Enter the property details: Provide a complete description of the real estate being sold.

- List all expenses: Document all costs related to the transaction, including title insurance and fees.

- Calculate balances: Determine the total amounts due and any adjustments or prorations that apply.

- Sign and date: Ensure both parties sign and date the form to validate the agreement.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately list all expenses, resulting in financial discrepancies.

- Omitting signatures from either the buyer or seller, which can render the document invalid.

- Neglecting to check for local tax prorations, leading to misunderstandings about tax obligations.

Why use this form online

- Convenience: Download the form instantly without the need to visit a legal office.

- Editability: Fill in the required details at your own pace and save your progress.

- Reliability: Obtain a professionally drafted Closing Statement that meets legal standards.

Summary of main points

- The Closing Statement is essential for documenting the financial terms of a real estate transaction.

- Both the buyer and seller must review and sign the form for it to be valid.

- Common mistakes include missing expenses and signatures; avoid these for a smoother closing process.

Looking for another form?

Form popularity

FAQ

Closing an estate in Minnesota involves several key steps, starting with filing the will and petitioning for probate. After this, you must notify heirs, inventory assets, and settle debts. Finally, you'll prepare a Minnesota Closing Statement to finalize the distribution of the estate. For a smooth process, consider using US Legal Forms, as it provides the necessary templates and guidance to navigate estate closing effectively.

In Minnesota, sellers must provide a Minnesota Closing Statement that details the condition of the property and any known issues. This includes information about structural defects, pest infestations, and environmental hazards. Buyers should carefully review this document to understand what they are purchasing. Utilizing platforms like US Legal Forms can help ensure that you comply with all disclosure requirements.

You can obtain your Minnesota property tax statement through your local county's website or tax assessor’s office. Each county in Minnesota has its own process for distributing these statements, often providing online access for convenience. If you encounter challenges, UsLegalForms offers resources that can guide you in retrieving your property tax statement efficiently. Make sure to check your county's guidelines for the most accurate information.

While many Minnesota court records are accessible online, not all records may be available due to privacy concerns or specific case types. You can visit the Minnesota Judicial Branch website to find resources and links to available records. Additionally, for more detailed information, services like UsLegalForms can assist you in navigating the process of obtaining court records. Always check for the latest updates on accessibility.

You should typically receive your Minnesota Closing Statement at least three days before your closing date. This timeframe allows you to review the statement and address any discrepancies with your lender or real estate agent. It is crucial to verify the details to ensure a smooth closing process. If you have not received it within this timeframe, consider reaching out to your closing agent for clarification.

The virus which causes COVID-19 is thought to be mostly spread by respiratory droplets released when people talk, cough or sneeze. Wearing a mask stops these droplets from spreading to others. This is extra important because 30-45% of people with COVID-19 do not have symptoms but can still spread the virus.

The Centers for Disease Control and Prevention (CDC) report there is no evidence to suggest that COVID-19 can be transmitted through food grown in the United States or imported from other countries. However, food safety is important at all times and the MDA helps to ensure that food is produced and sold in a safe manner.

Saliva tests are provided to all Minnesotans at no cost, whether or not you have insurance.

As of July 25, 2020, per the Governor's Executive Order 20-81, people in Minnesota are required to wear a face covering in all indoor businesses and public indoor spaces, unless alone.

Like other outdoor activities, going to a playground is allowed under the stay at home order. Families and guardians should be careful to ensure children wash hands after touching play structures and maintain six feet of space from other children as much as possible. Although the Governor's order doesn't close playgrounds, they may be closed by local authorities.