Illinois UCC3 Financing Statement Amendment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois UCC3 Financing Statement Amendment?

Searching for Illinois UCC3 Financing Statement Amendment forms and completing them can be rather challenging.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate template specifically for your state in just a few clicks.

Our lawyers prepare every document, so all you need to do is complete them. It is truly effortless.

Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- All your downloaded templates are stored in My documents and can be accessed at all times for future use.

- If you haven’t registered yet, you will need to sign up.

- Review our comprehensive instructions on how to obtain the Illinois UCC3 Financing Statement Amendment form in just a few minutes.

- To obtain a valid template, verify its relevance for your state.

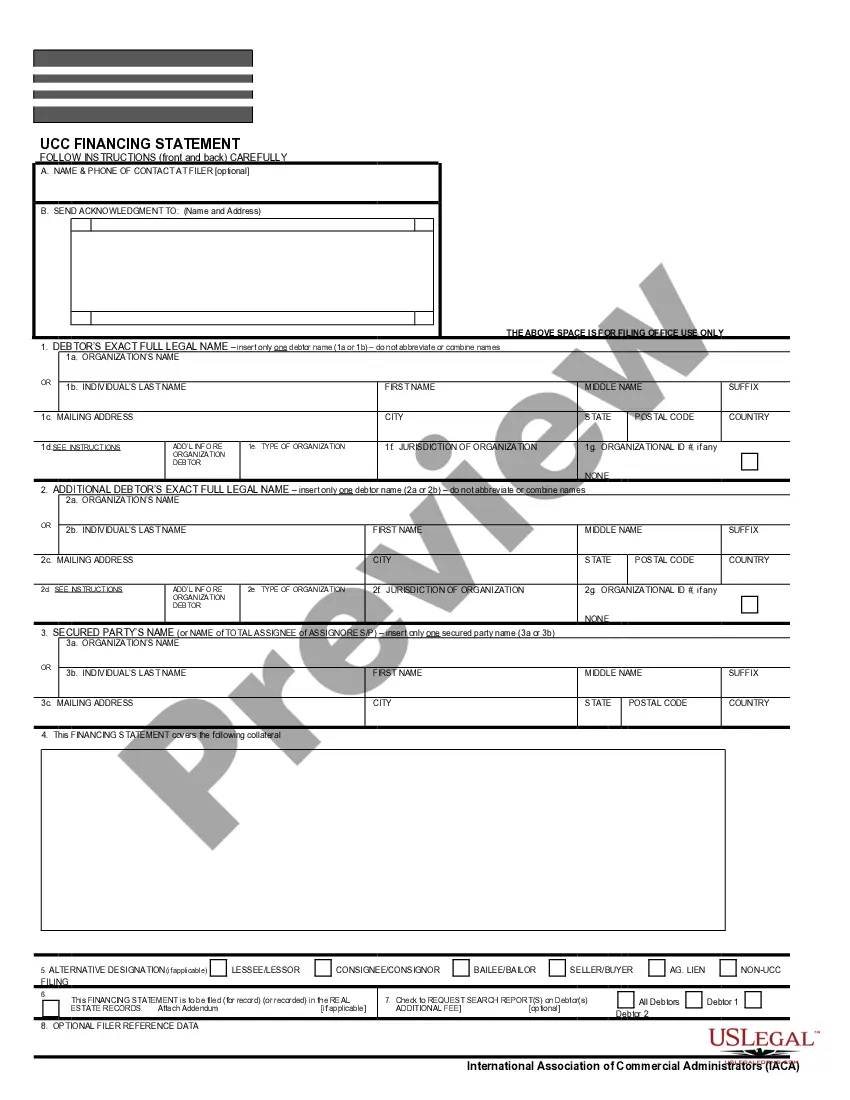

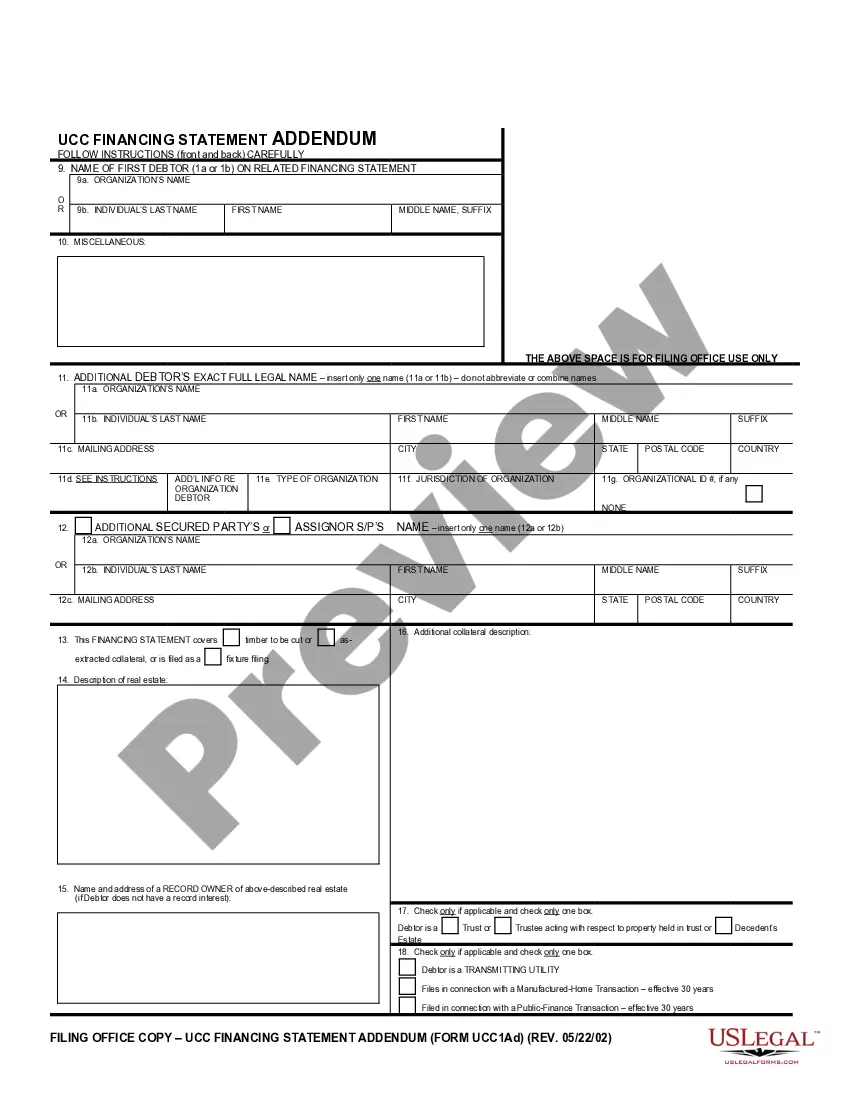

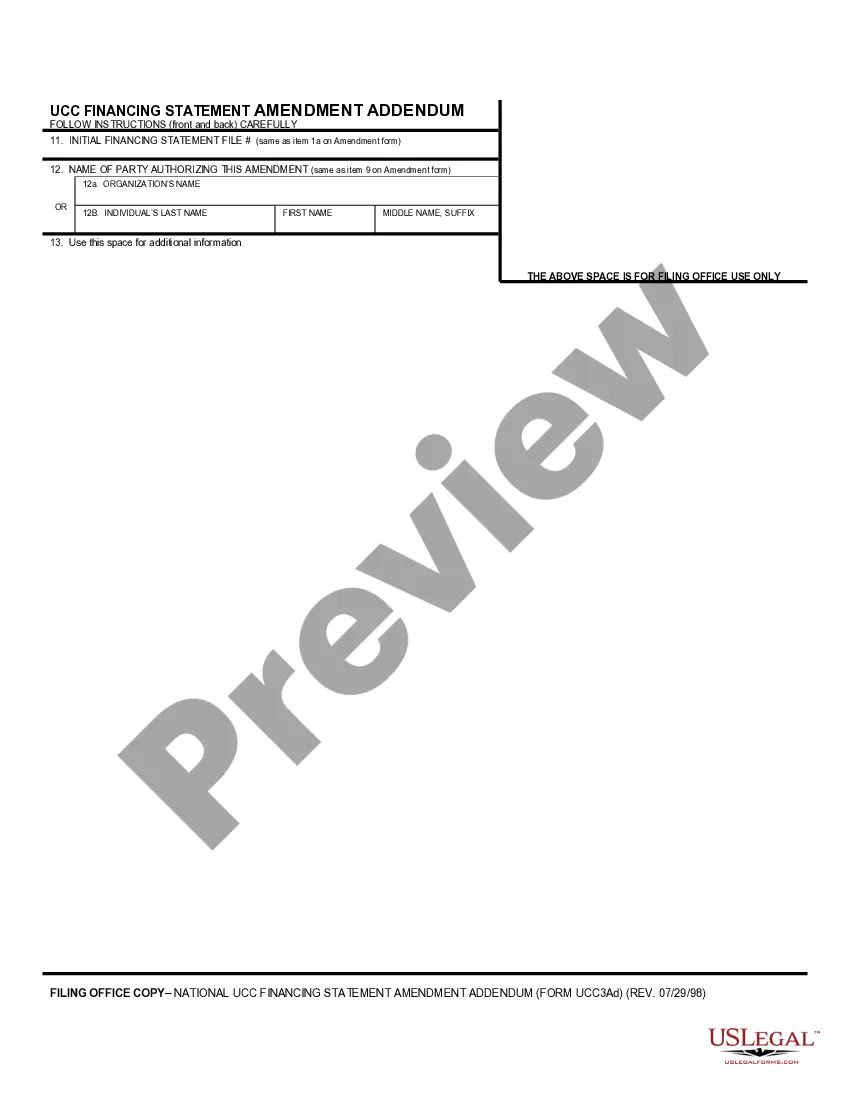

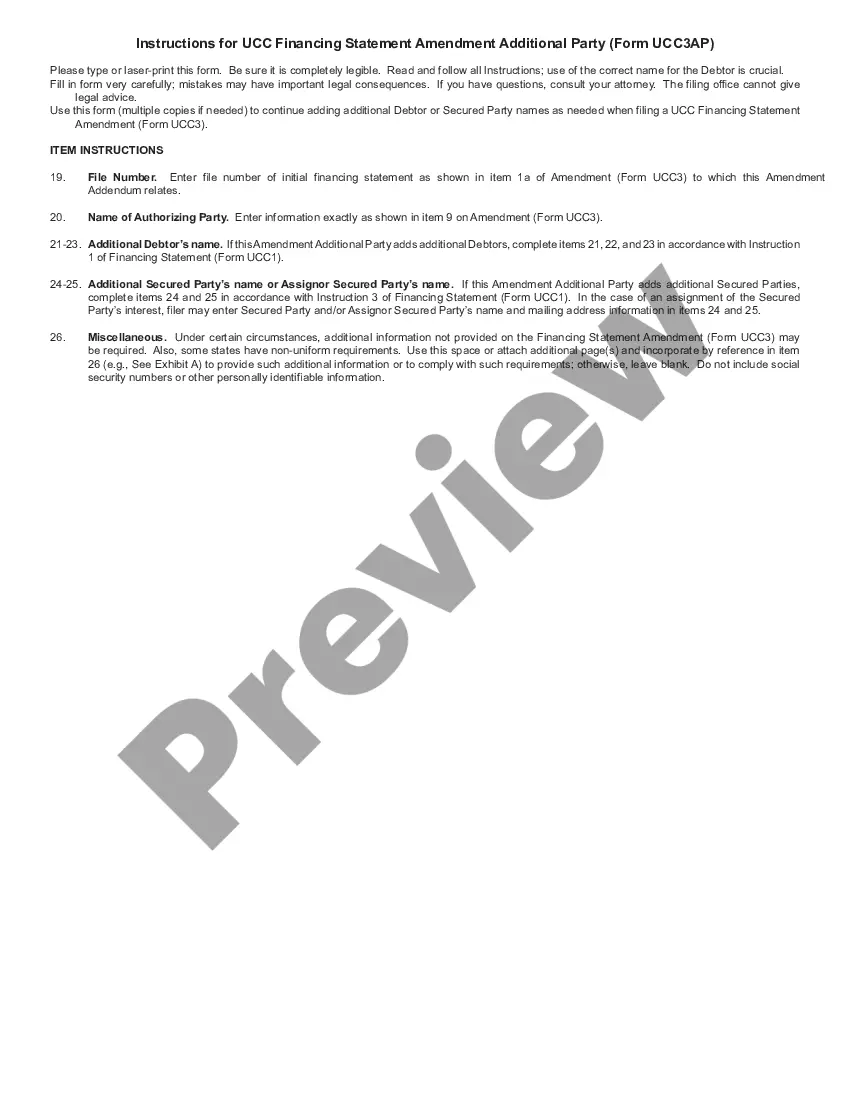

- Examine the template using the Preview option (if it’s offered).

- If there’s a description, read it to comprehend the details.

- Click Buy Now if you’ve discovered what you’re looking for.

- Choose your plan on the pricing page and create your account.

- Indicate whether you wish to pay by credit card or through PayPal.

- Download the template in your preferred file format.

- You can print the Illinois UCC3 Financing Statement Amendment form or complete it using any online editor.

- Don't worry about errors, as your template can be utilized and submitted multiple times, and printed as often as you wish.

Form popularity

FAQ

You can file a UCC financing statement in Illinois with the Secretary of State's office. They offer both in-person services and online options for your convenience. By filing through the proper channels, you establish your legal claim to the collateral you are financing. Platforms like USLegalForms can assist you with the filing process, ensuring everything is handled accurately.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

How long does a UCC filing last? A UCC-1 filing is good for five years. After five years, it is considered lapsed and no longer valid.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.