Minnesota Letter from Landlord to Tenant Returning security deposit less deductions

What is this form?

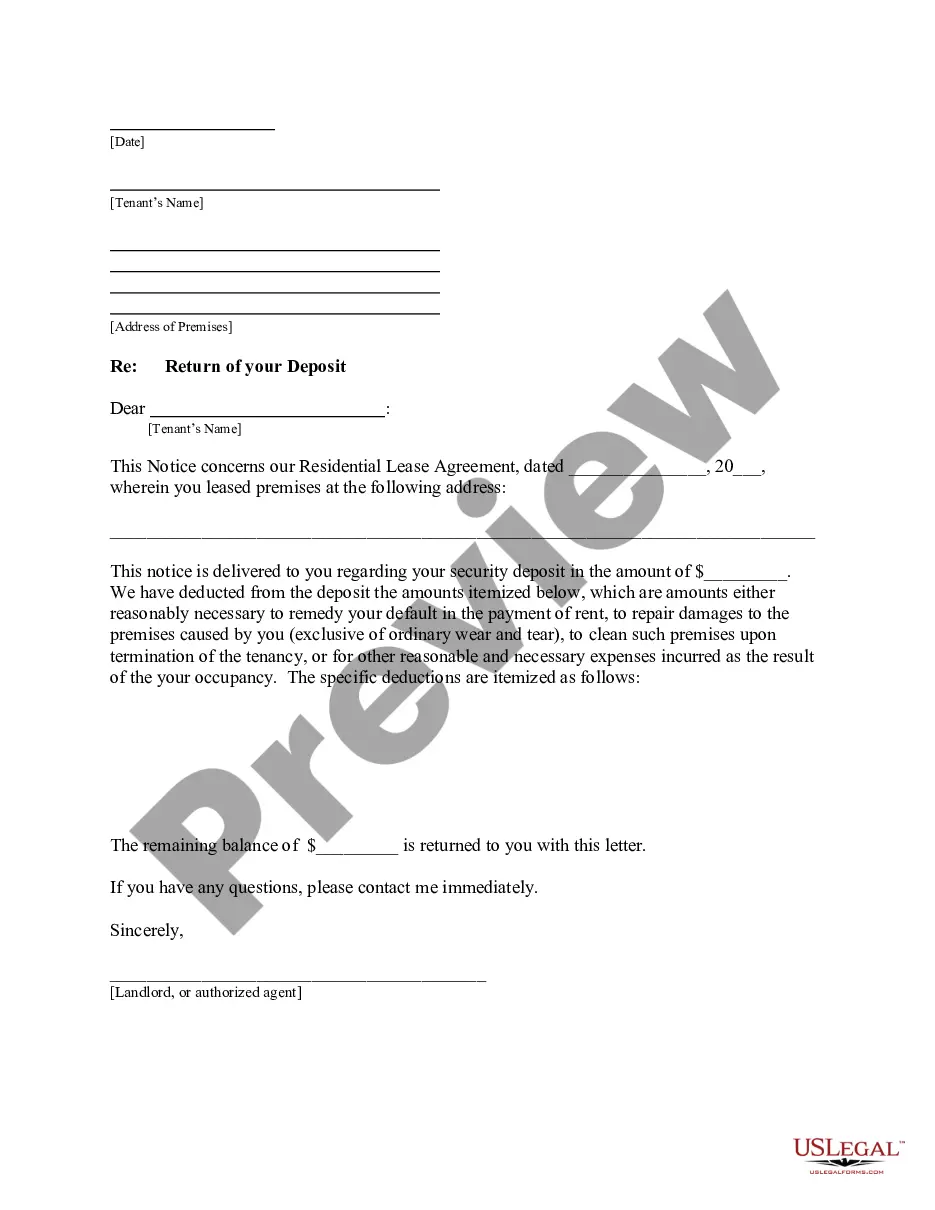

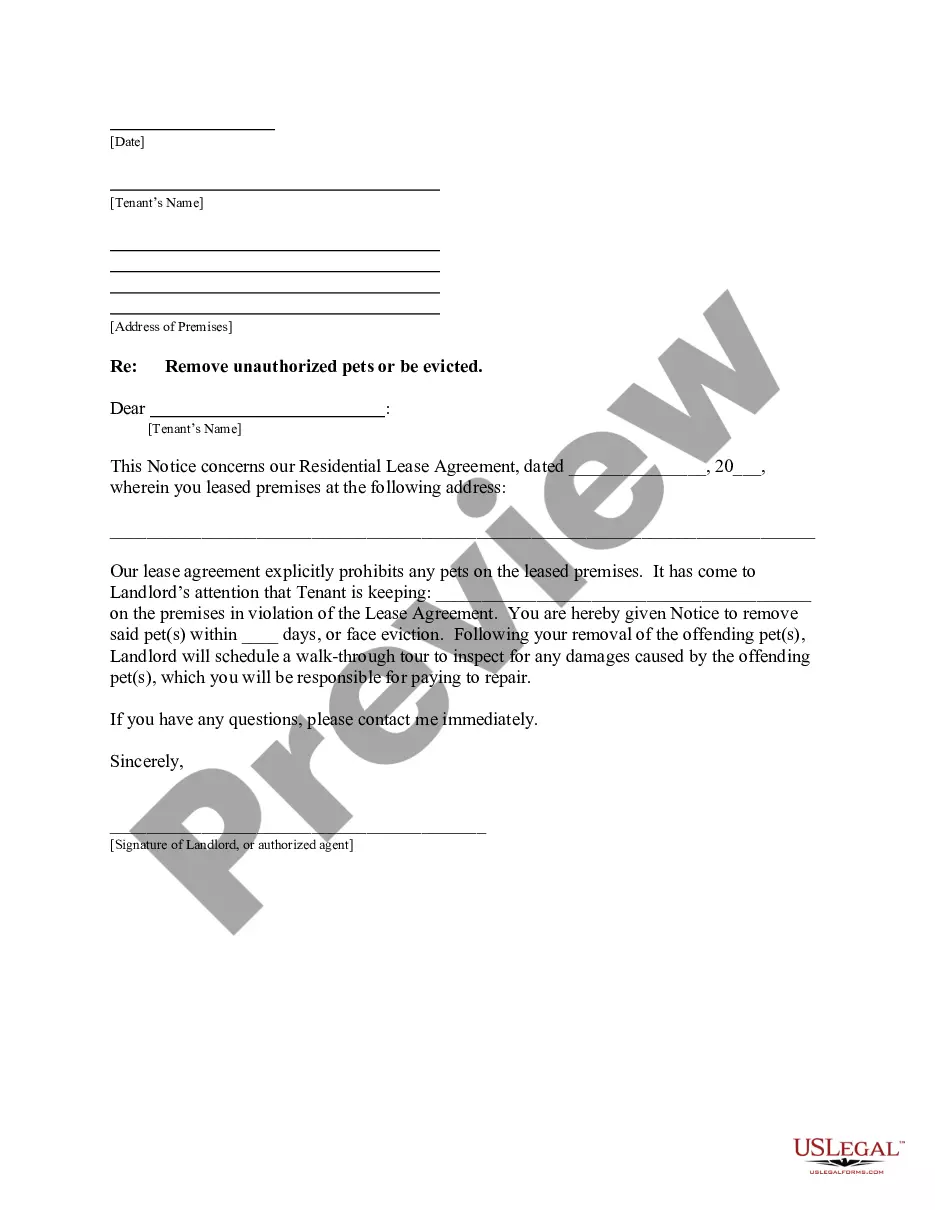

This letter from landlord to tenant returning the security deposit less deductions serves as an official communication from the landlord to the tenant. It details any deductions made from the security deposit for repairs, unpaid rent, or cleaning beyond normal wear and tear. This form ensures transparency and compliance with rental agreements, acting as a critical document to clarify the financial responsibilities at the end of the tenancy.

Situations where this form applies

This form is used when a tenant vacates a rental property, and the landlord needs to provide an account of how the security deposit is being returned. It is essential for outlining any deductions taken for damages beyond normal wear and tear, unpaid rent, or necessary cleaning costs. Using this form helps protect the landlord's rights while providing the tenant with necessary information regarding their security deposit.

Who this form is for

- Landlords who need to return a tenant's security deposit

- Property management companies handling rental properties

- Tenants seeking clarity on deductions made from their security deposit

Steps to complete this form

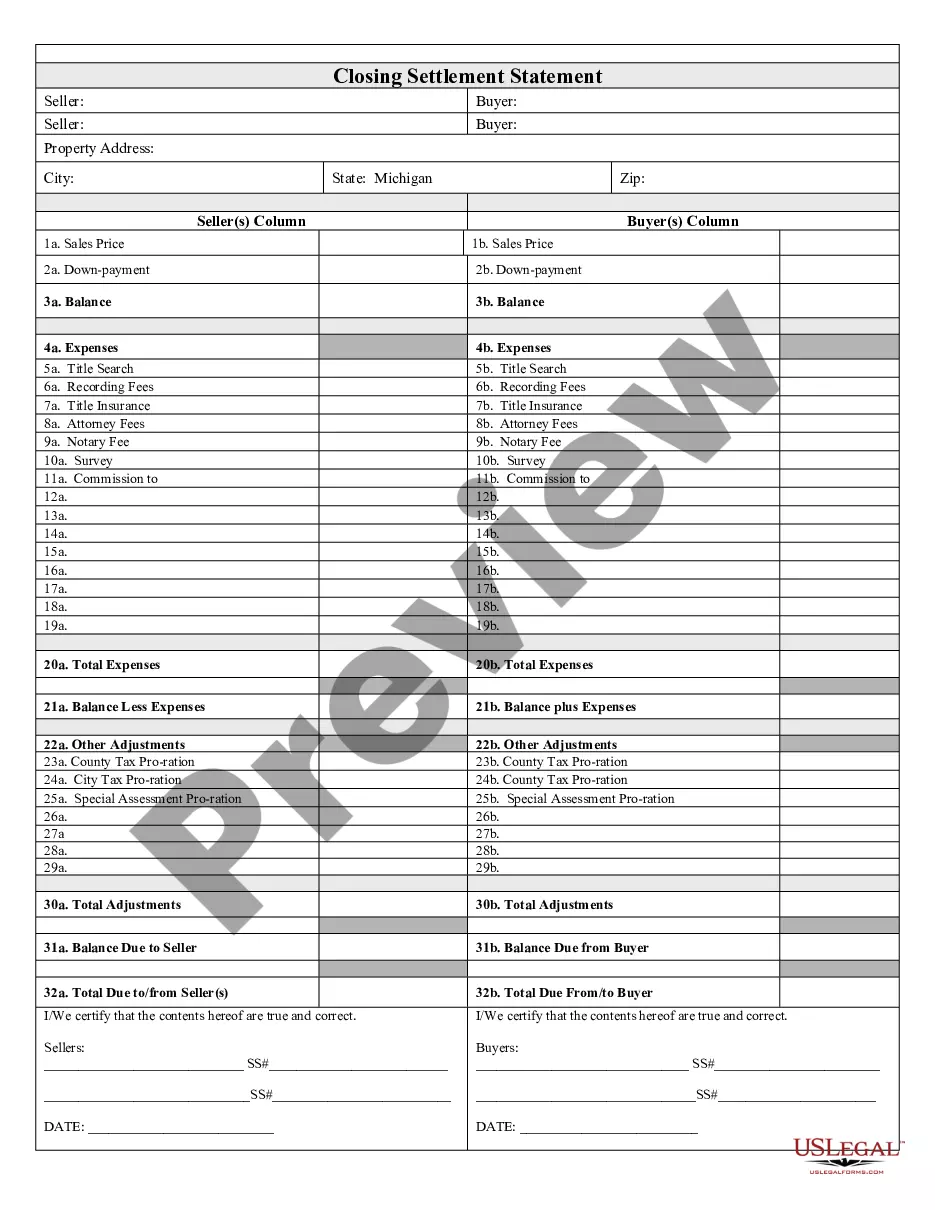

- Identify the parties involved by including both landlord and tenant names.

- Specify the property address where the rental agreement is applicable.

- Enter the total amount of the security deposit initially paid by the tenant.

- Detail and itemize any deductions being taken from the security deposit.

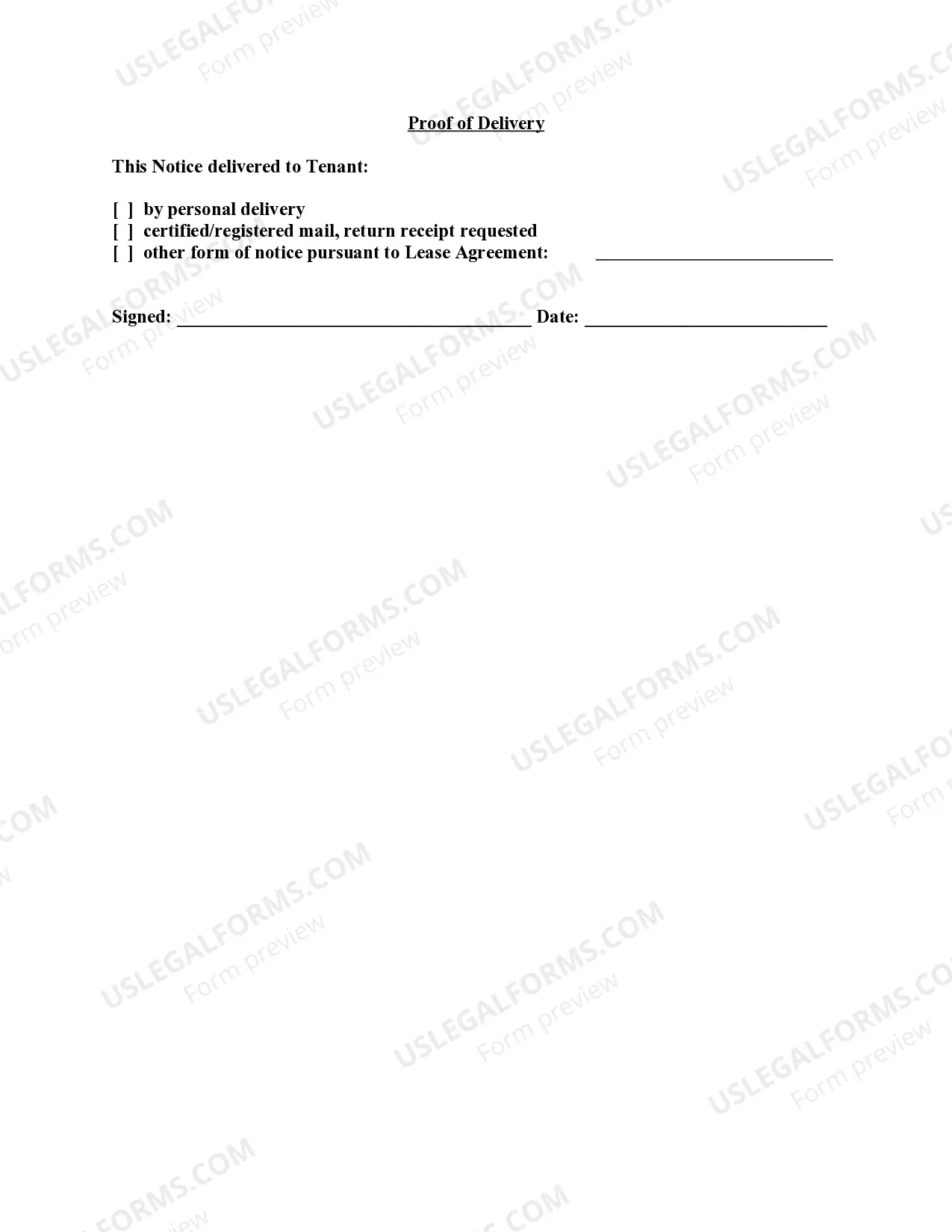

- Include the date when the notice is delivered and sign the document.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to itemize all deductions clearly, leading to tenant disputes.

- Not specifying the reason for each deduction.

- Missing the signature or date on the form, which may invalidate it.

Advantages of online completion

- Easy access to professionally drafted forms that comply with legal standards.

- Editable templates that allow landlords to customize based on specific situations.

- Convenient downloading and printing directly from your device.

Looking for another form?

Form popularity

FAQ

In Minnesota, landlords must return the security deposit within 21 days after the tenant vacates the property, along with an itemized list of any deductions. This Minnesota Letter from Landlord to Tenant Returning security deposit less deductions should detail any damages or unpaid rent that justifies the deductions. Failing to comply with this law may lead to penalties against the landlord. For detailed information, you can explore resources on the US Legal Forms platform to ensure compliance.

To create a Minnesota Letter from Landlord to Tenant Returning security deposit less deductions, start by including your contact information and the tenant's details. Clearly state the amount of the security deposit being returned and list any deductions made, providing reasons for each deduction. It's essential to maintain a professional tone and ensure the letter is signed and dated. For more guidance, consider using the US Legal Forms platform, which offers templates specifically designed for this purpose.

In Minnesota, a landlord can deduct amounts from a security deposit for unpaid rent, damages beyond normal wear and tear, and cleaning costs if the unit was left in an unsatisfactory condition. It is important to note that the landlord must provide an itemized list of these deductions in a Minnesota Letter from Landlord to Tenant Returning security deposit less deductions. This transparency helps ensure that tenants understand why specific amounts were withheld. For further assistance, you can utilize the services offered by US Legal Forms to draft a compliant letter that meets Minnesota regulations.

A sample letter for the return of a security deposit should include your name, the tenant's name, the rental property's address, and a clear statement about the returned amount. You should also itemize any deductions taken, if applicable, and provide a total amount returned to the tenant. Using resources from uslegalforms can help you draft a professional and compliant Minnesota Letter from Landlord to Tenant Returning security deposit less deductions.

A letter of reconciliation for a security deposit is a document that outlines the final accounting between the landlord and tenant regarding the security deposit. This letter details the condition of the property, any deductions made, and the amount being returned. It's essential for maintaining transparency and can serve as a record in case of disputes. A well-crafted Minnesota Letter from Landlord to Tenant Returning security deposit less deductions can act as this reconciliation letter.

If you believe the deductions from your security deposit are unjustified, gather evidence such as photographs and correspondence with your landlord. You can then communicate your concerns in writing, referencing the Minnesota Letter from Landlord to Tenant Returning security deposit less deductions as a guideline. If the issue persists, consider seeking assistance from local tenant rights organizations or legal services to understand your options.

To write a Minnesota Letter from Landlord to Tenant Returning security deposit less deductions, start by including your contact information and the tenant's details. Clearly state the purpose of the letter, which is to notify the tenant about the security deposit and any deductions taken. Be sure to itemize the deductions and provide a total sum being returned. This letter acts as both a legal notice and a record of the transaction.