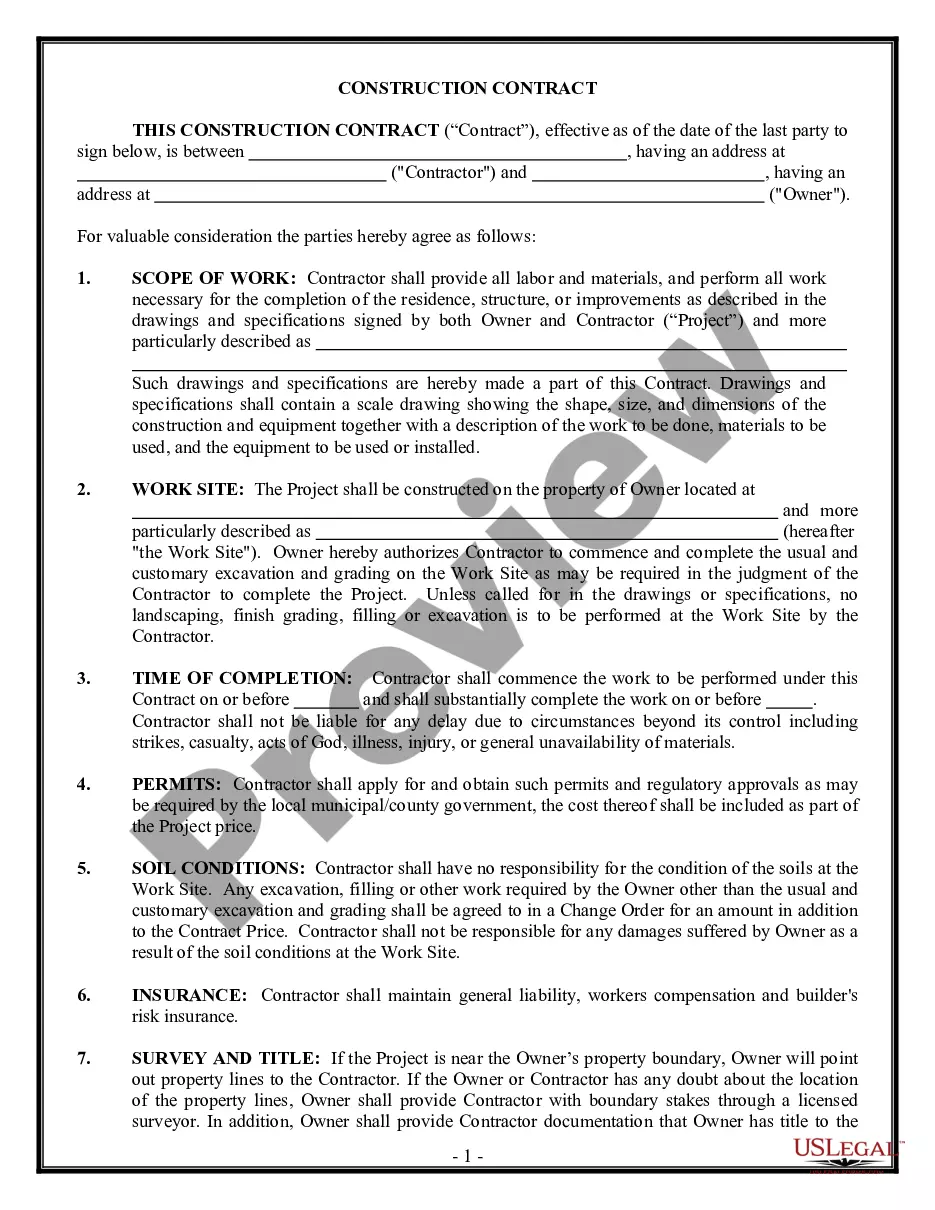

Alabama Construction Contract Cost Plus or Fixed Fee

What is this form?

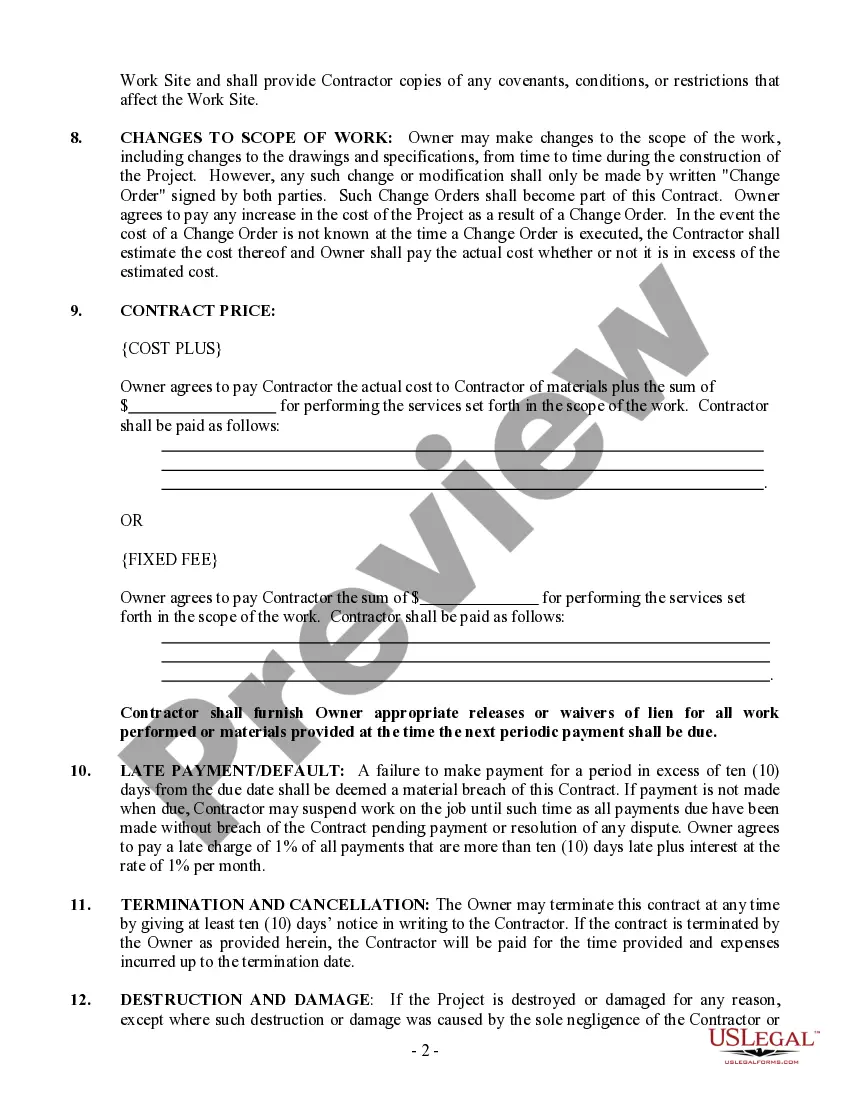

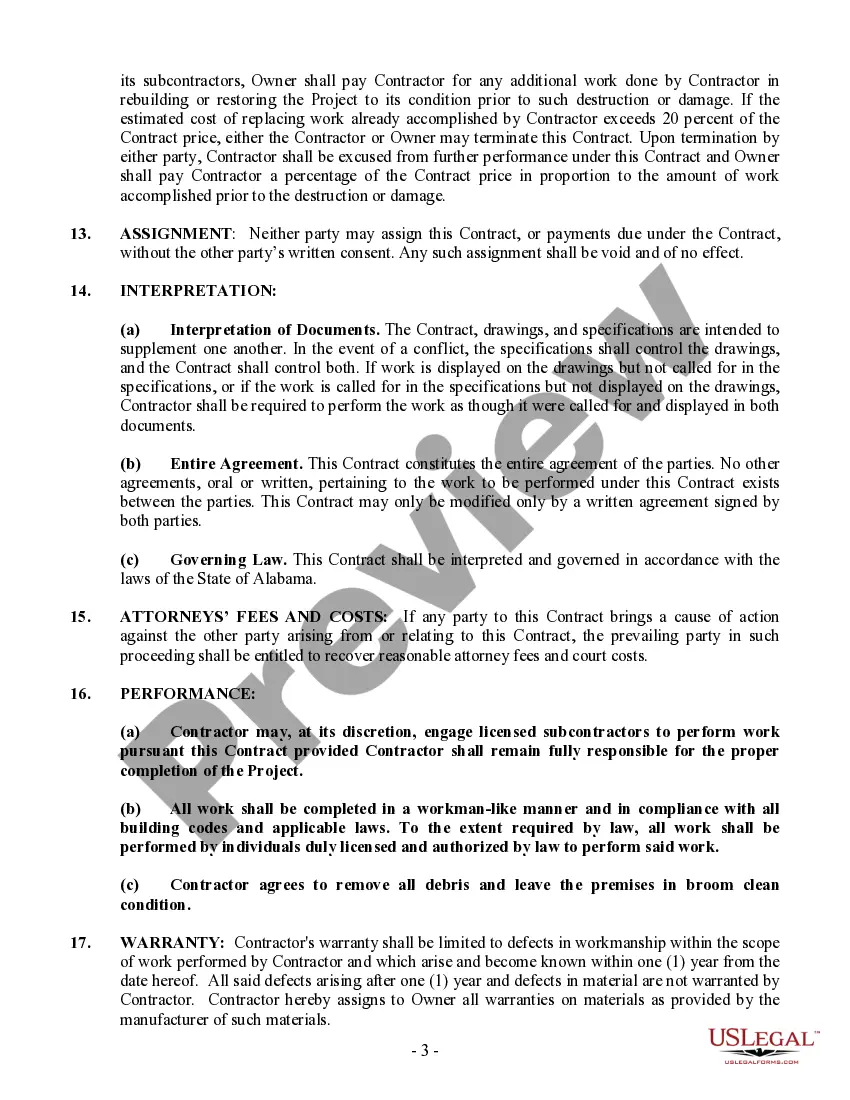

The Construction Contract Cost Plus or Fixed Fee is a legally binding document used to establish the terms of a construction project. This form allows for either a cost-plus payment structure, where expenses are billed plus a fee, or a fixed fee approach, where the total cost is predetermined. It is essential for defining the scope of work, permits, and insurance requirements, and ensures compliance with Alabama state laws, distinguishing it from other construction contracts that may not specify payment types or state-specific requirements.

When this form is needed

This form is suitable for construction projects where the owner and contractor need to clearly define the payment structure. It is useful in situations involving renovations, new builds, or repairs where costs may vary and flexibility is necessary. It is also beneficial when both parties want to explicitly document expectations regarding changes, delays, and insurance liabilities.

Who should use this form

- Property owners looking to engage a contractor for construction work.

- Contractors seeking a clear contractual agreement with clients.

- Anyone involved in residential or commercial construction projects in Alabama.

How to complete this form

- Identify the parties involved: Enter the names and contact details of both the owner and the contractor.

- Specify the work site: Clearly define the location where the construction will take place.

- Outline the scope of work: Describe the tasks and responsibilities expected of the contractor.

- Include payment terms: Decide and indicate whether the agreement is cost-plus or a fixed fee.

- Ensure signatures: Both parties should sign the contract to confirm agreement to the terms.

Notarization guidance

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Avoid these common issues

- Failing to specify the payment type clearly can create confusion.

- Not obtaining necessary permits before construction starts.

- Overlooking the need for insurance coverage in the contract.

- Altering the scope of work without a proper Change Order.

Benefits of using this form online

- Convenience of downloading and filling out the form from anywhere.

- Editability allows users to tailor specific clauses to their needs.

- Reliability of forms drafted by licensed attorneys ensures legal compliance.

Form popularity

FAQ

A cost-plus contract, also known as a cost-reimbursement contract, is a form of contract wherein the contractor is paid for all of their construction-related expenses. Plus, the contractor is paid a specific agreed-upon amount for profit.

Cost Plus Contract Disadvantages For the buyer, the major disadvantage of this type of contract is the risk for paying much more than expected on materials. The contractor also has less incentive to be efficient since they will profit either way.

Firm Fixed Price (FFP) The price will be set on the buyer's request. A FFP should be used for a product or service that is a repeated process. As an example, a car manufacturer would enter into a FFP contract for a standard model car. The manufacturer knows what it takes to complete the car and the associated cost.

In the cost plus a percentage arrangement, the contractor bills the client for his direct costs for labor, materials, and subs, plus a percentage to cover his overhead and profit. Markups might range anywhere from 10% to 25%.

A cost-plus contract is an agreement to reimburse a company for expenses incurred plus a specific amount of profit, usually stated as a percentage of the contract's full price.

A Cost-Based Pricing Example Suppose that a company sells a product for $1, and that $1 includes all the costs that go into making and marketing the product. The company may then add a percentage on top of that $1 as the "plus" part of cost-plus pricing. That portion of the price is the company's profit.

A fixed price contract sets a total price for all construction-related activities during a project. Many fixed price contracts include benefits for early termination and penalties for a late termination to give the contractors incentives to ensure the project is completed on time and within scope.

A cost plus percentage of cost contract or CPPC is a cost reimbursement contract containing some element that obligates the non-state entity to pay the contractor an amount, undetermined at the time the contract was made and to be incurred in the future, based on a percentage of future costs.