Illinois Closing Statement

Overview of this form

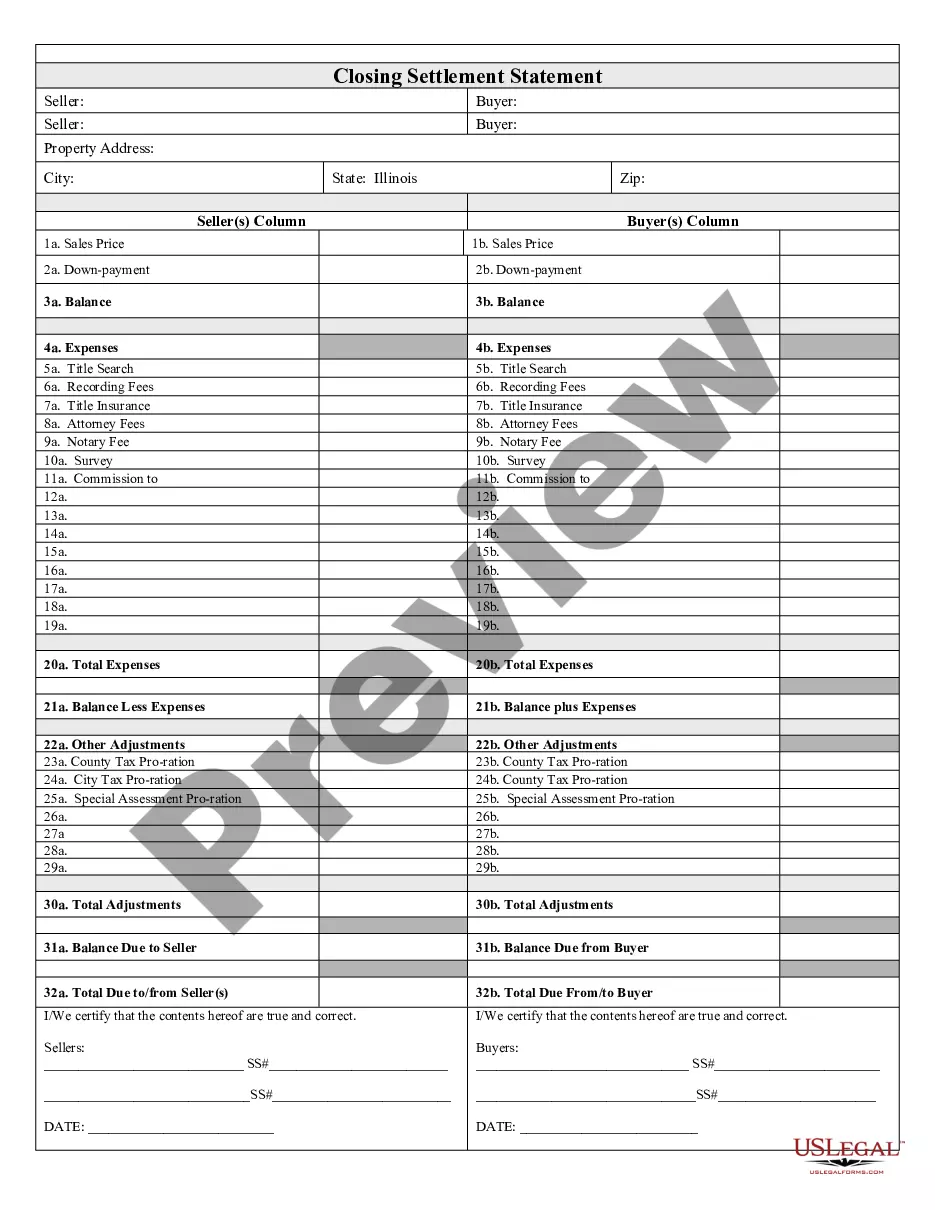

The Closing Statement is a critical document used in real estate transactions, particularly in cash sales or owner-financed sales. This form serves as a settlement statement that outlines all financial aspects of the transaction, verified and signed by both the seller and the buyer. It provides a clear account of expenses and assists in ensuring that all parties understand the financial terms of the deal, thus preventing disputes and promoting transparency.

Main sections of this form

- Balance: Indicates the final financial status after all expenses are accounted for.

- Expenses: Lists the costs incurred during the transaction, such as title searches and recording fees.

- Title Insurance: Related to the protection against potential defects in the title.

- Attorney Fees: Specifies any legal fees associated with the real estate transaction.

- Commission: Outlines any commission payable to real estate agents involved.

- Adjustments: Details any prorated taxes or special assessments applicable at the time of sale.

- Certification: Both parties confirm that the information is accurate by signing the statement.

When to use this form

This form should be used in situations where a real estate transaction is taking place, specifically for cash sales or transactions involving owner financing. It is essential during the closing phase, where final financial calculations need to be made and documented. Utilizing a Closing Statement ensures clarity and accountability for both buyers and sellers, facilitating a smooth transaction process.

Who should use this form

- Sellers of residential or commercial properties.

- Buyers engaging in cash transactions or owner-financed deals.

- Real estate agents or brokers facilitating the transaction.

- Attorneys involved in real estate transactions.

Completing this form step by step

- Gather essential information about the buyer, seller, and property involved in the transaction.

- Document all relevant expenses including title insurance, attorney fees, and any commissions.

- Calculate the balance due to or from each party after listing total expenses and adjustments.

- Ensure that both the buyer and the seller review the statement for accuracy.

- Have both parties sign and date the form to certify that the information is correct.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Forgetting to include all applicable expenses, leading to discrepancies in the final balance.

- Not obtaining signatures from both parties, which can invalidate the form.

- Failing to review the statement for accuracy before signing.

- Misunderstanding prorations and how they affect the balance calculations.

Benefits of using this form online

- Convenient access: Download the form anytime, anywhere, streamlining the process.

- Editability: Customize the document to fit your specific transaction needs.

- Reliability: Forms are created by licensed attorneys to ensure compliance with legal standards.

Quick recap

- The Closing Statement is vital for documenting financial aspects of real estate transactions.

- All parties should review the document carefully to avoid common mistakes.

- This form enhances transparency and helps prevent disputes in the transaction process.

Looking for another form?

Form popularity

FAQ

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing. In California, both the buyer and the seller sign the HUD-1 settlement statement at closing.

Although different people use different terms, the "closing" or the "settlement" refers to the same finalization of your home purchase. At the closing or settlement date, the seller receives the sale proceeds, and the buyer pays any required expenses to close the transaction, known as closing costs.

The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

A closing statement is a document that records the details of a financial transaction. A home buyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

Closing costs are all of the fees and expenses associated with the closing or settlement of a real estate transaction, and they can vary dramatically. The buyer typically pays the closing costs, while other costs are usually the responsibility of the seller.

It outlines the final terms and costs of the mortgage. It's one of the most important pieces of paperwork you'll receive, so check it over carefully. In August 2015, under the direction of the Consumer Financial Protection Bureau (CFPB), the Closing Disclosure Form replaced the HUD-1 settlement statement.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market. The HUD-1 settlement statement is a type of closing statement used in reverse mortgages.

The attorney is responsible for preparing all necessary closing documents, scheduling the closing, explaining all necessary closing documents and having them properly executed and recorded. You will receive copies of most closing documents, including an itemized record of all money paid by you on your behalf.