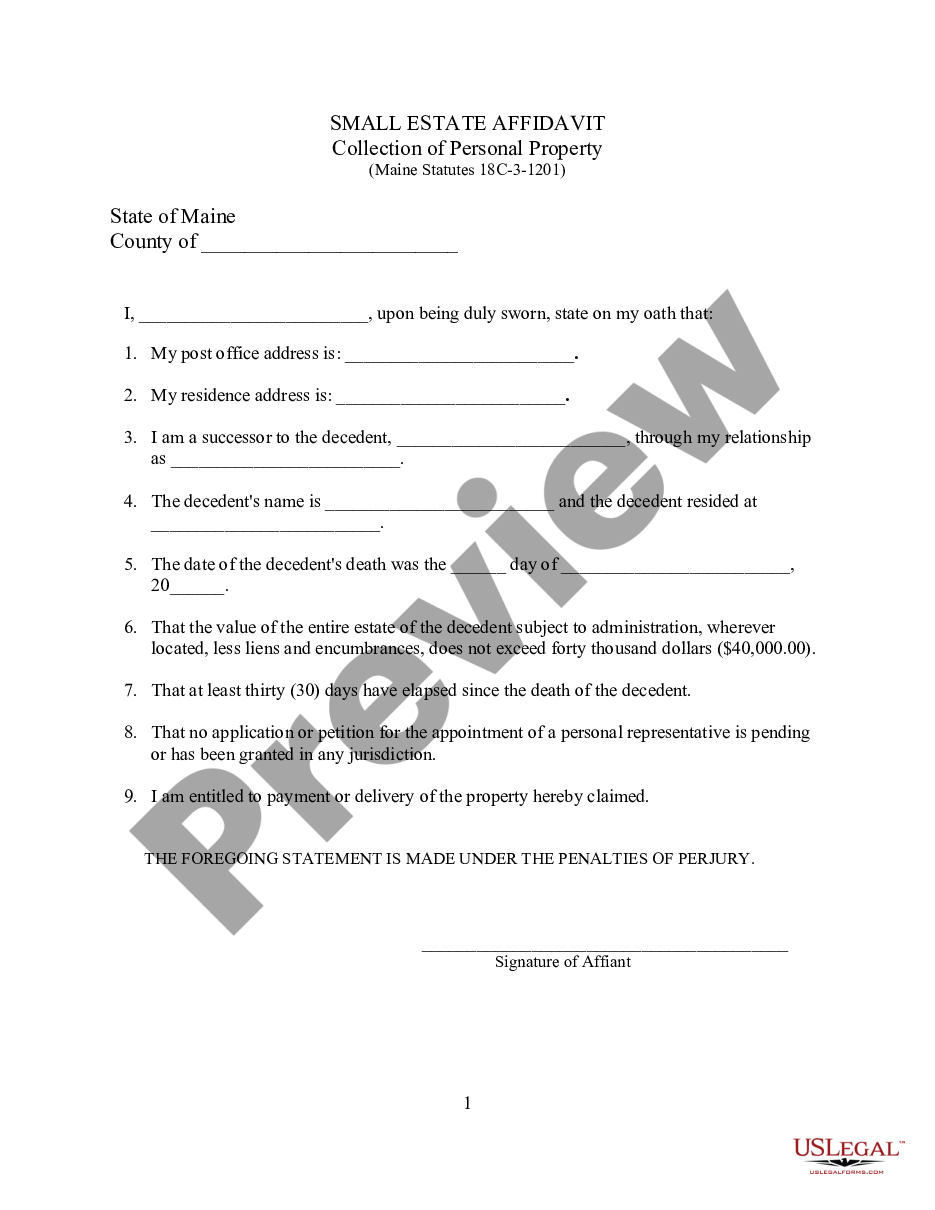

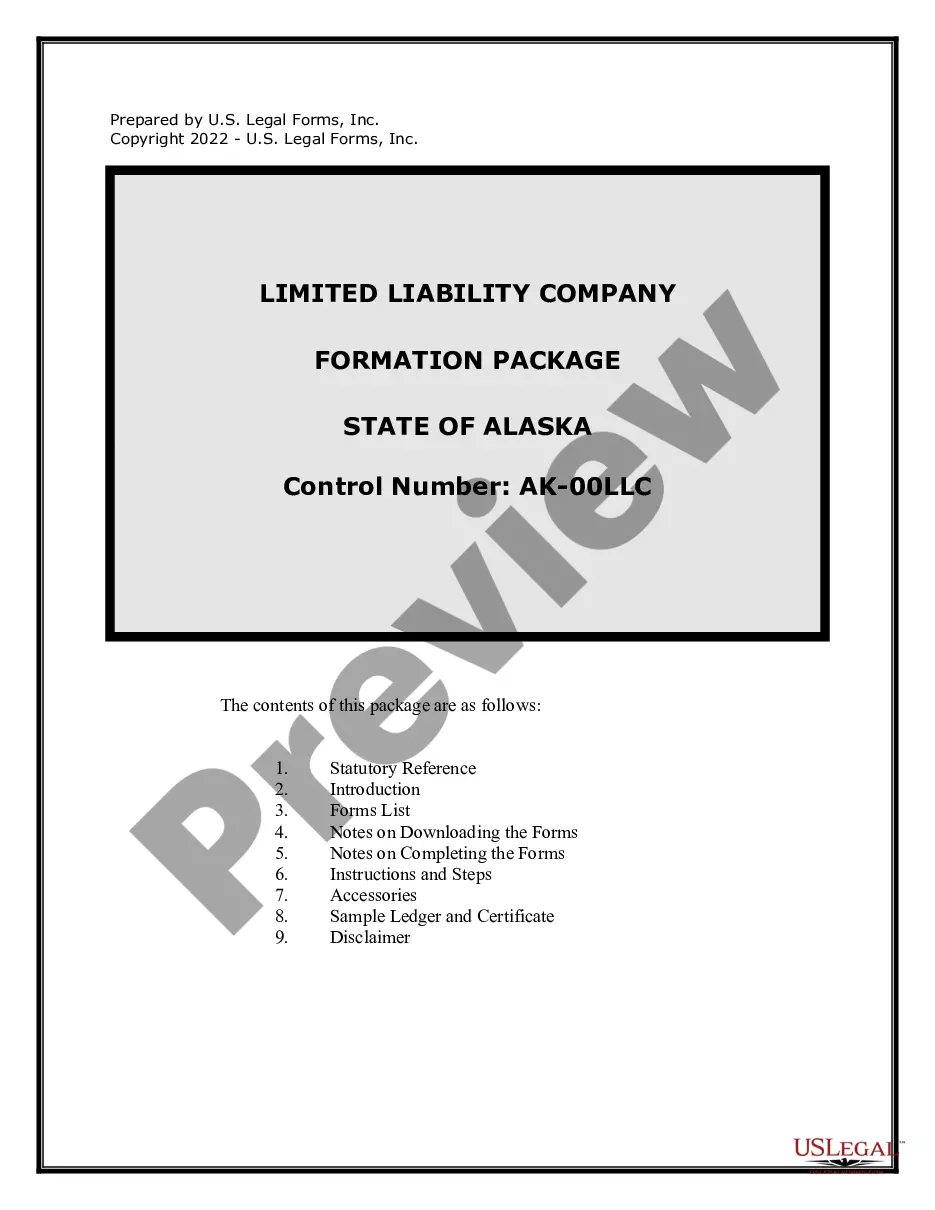

Maine Small Estate Affidavit for Estates Not More Than $40,000

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

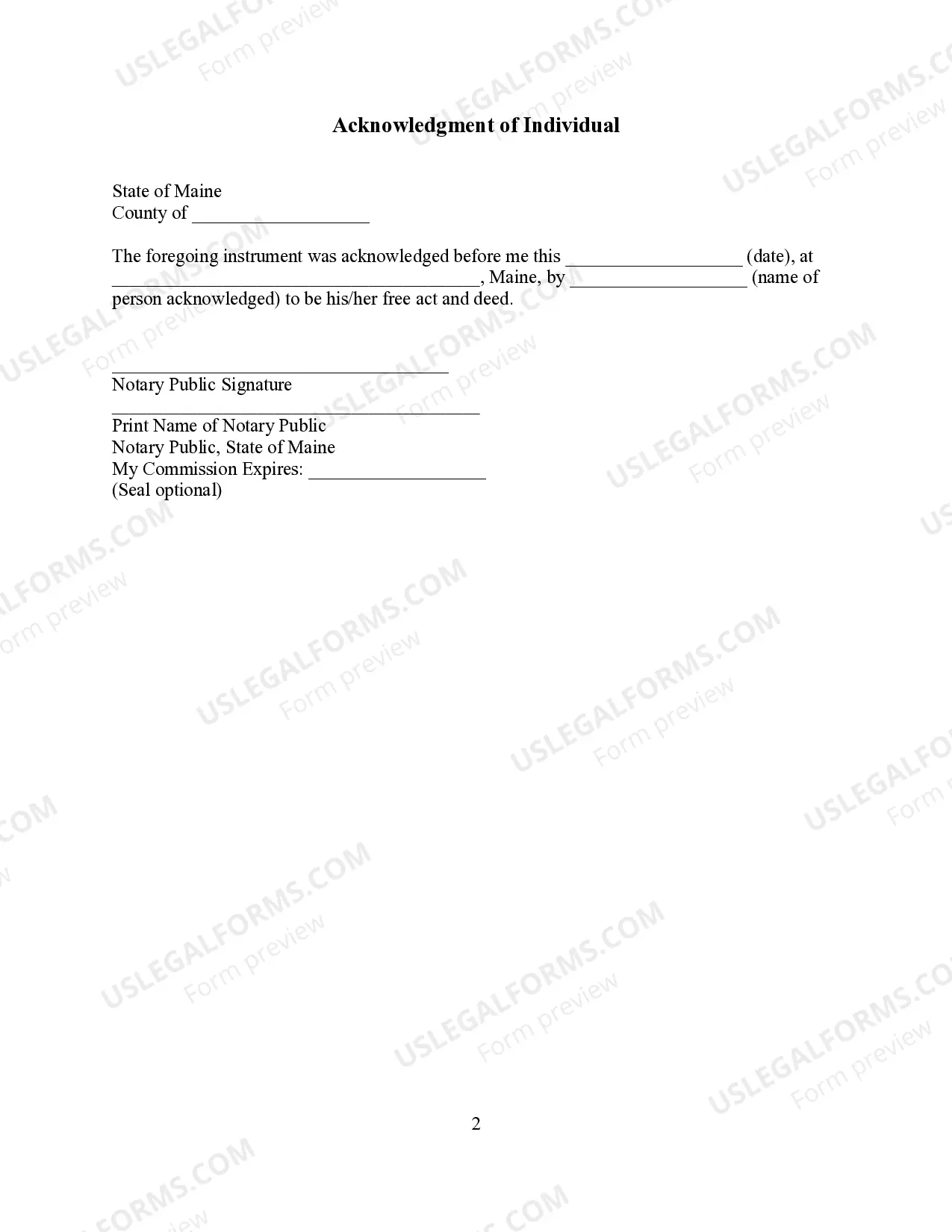

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

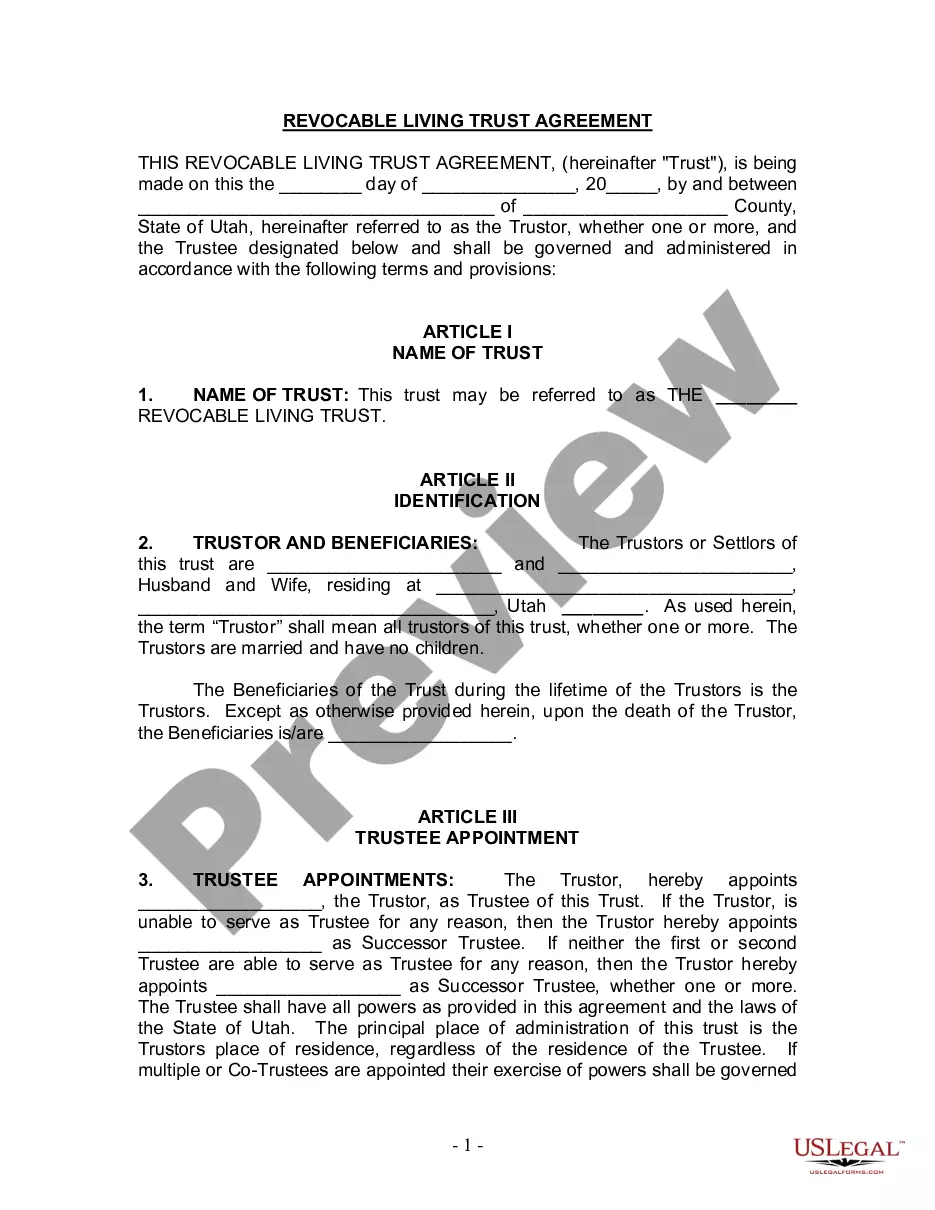

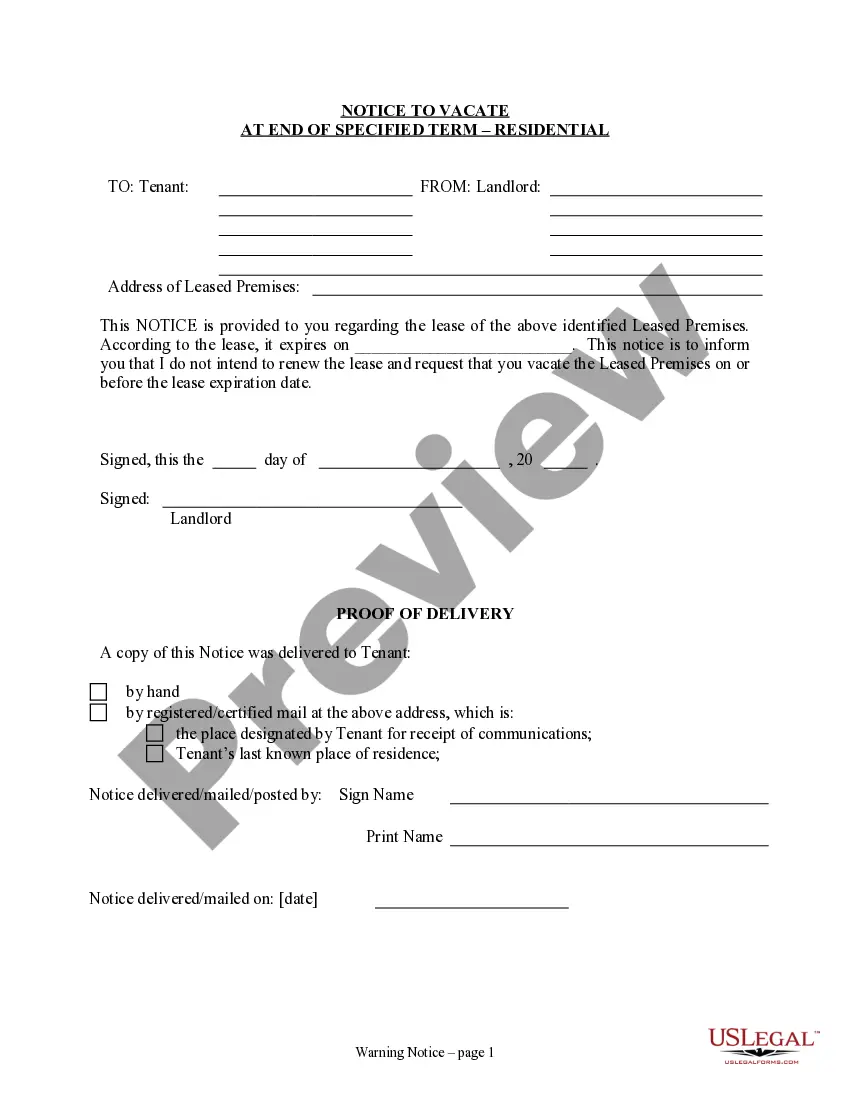

Looking for another form?

How to fill out Maine Small Estate Affidavit For Estates Not More Than $40,000?

Greetings to the most extensive legal documents collection, US Legal Forms. Here you can obtain any template such as Maine Small Estate Affidavit for Estates Not Exceeding 40,000 forms and preserve them (as many as you desire or require). Prepare official documents in a few hours, instead of days or weeks, without overspending on a lawyer.

Acquire the state-specific template in just a few clicks and be confident knowing it was created by our skilled legal experts.

If you’re an existing subscriber, simply Log In to your account and then select Download near the Maine Small Estate Affidavit for Estates Not Exceeding 40,000 you need. Since US Legal Forms is an online solution, you’ll consistently have access to your downloaded templates, regardless of the device you are using. Locate them within the My documents section.

Download the file in the format you need (Word or PDF). Print the document and complete it with your/your business's information. Once you’ve filled out the Maine Small Estate Affidavit for Estates Not Exceeding 40,000, send it to your attorney for verification. It’s an extra step but a crucial one for ensuring you’re completely protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If you don’t have an account yet, what are you waiting for.

- Review the instructions below to get started.

- If this is a state-specific form, verify its validity in your state.

- Examine the description (if provided) to see if it’s the right template.

- View additional content using the Preview feature.

- If the document meets all of your requirements, click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a credit card or PayPal account to subscribe.

Form popularity

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Fortunately, not all property needs to go through this legal process before it passes to your heirs.The quick rule of thumb is probate is not required when the estate is small, or the property is designed to pass outside of probate. It doesn't matter if you leave a will.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process.This procedure asks the court to allow you to divide and distribute their property to people who either have a legal right to inherit or listed in the testator's will.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

As the applicant, you must pay a filing fee based on the estimated value of the probate estate. The fee varies depending on the size of the estate from $20.00 for an estate of $10,000 or less to $950.00 for an estate of $2,000,000 plus $100.00 for each additional $500,000.