Louisiana Financial Account Transfer to Living Trust

Overview of this form

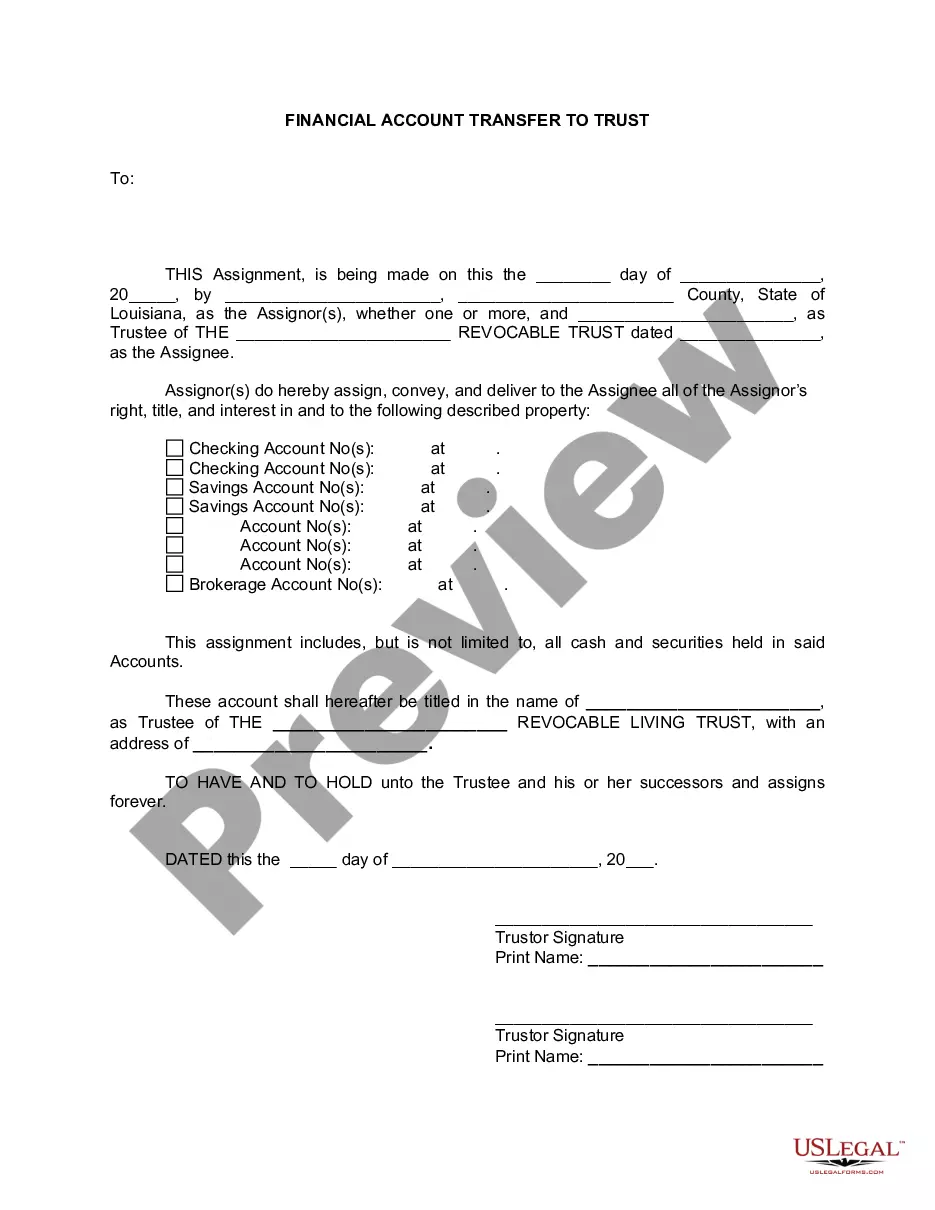

The Financial Account Transfer to Living Trust form is a legal document used to transfer ownership of bank and financial accounts into a living trust. This form facilitates the process of estate planning by ensuring that your assets are managed according to your wishes while you are alive and can help avoid probate upon your passing. Unlike a standard property transfer, this form specifically addresses financial accounts and aligns them with the directives of your living trust.

What’s included in this form

- Assignor's declaration of rights and interests in the property.

- Identification of the Trustee and the living trust name.

- Space for signatures of the Assignor(s) responsible for the transfer.

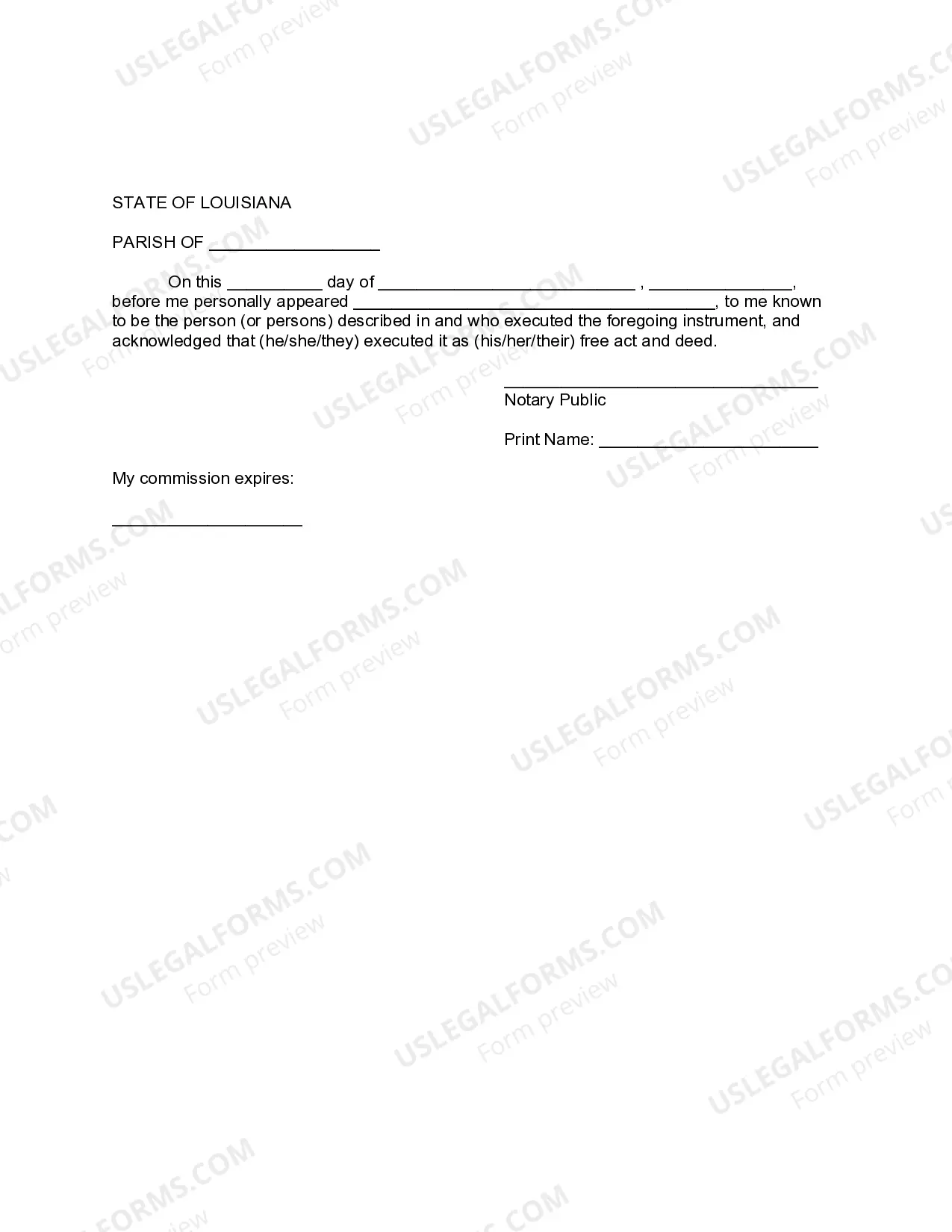

- Notary acknowledgment to validate the transfer before a public official.

When to use this document

This form is typically used when an individual wants to consolidate their financial assets under the management of a living trust. Scenarios include when planning for incapacity, ensuring smoother asset distribution after death, or simplifying the management of financial accounts while alive. If you have multiple bank or investment accounts that you wish to include in your trust, this form is essential.

Who should use this form

- Individuals who have established a living trust and wish to transfer financial accounts into it.

- Trustors looking to manage their estate efficiently.

- Anyone involved in estate planning who wants to ensure their financial accounts are appropriately handled according to their wishes.

How to prepare this document

- Identify the Assignor(s) who owns the financial accounts being transferred.

- Specify the name of the living trust along with the correct trustee information.

- List all financial accounts, including bank and investment accounts, that are being transferred.

- Ensure that all Assignors sign the document in the presence of a notary public.

- Complete the date and notarization section to finalize the transfer.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all relevant financial accounts in the transfer.

- Not signing the form in the presence of a notary public.

- Using incorrect naming conventions for the trust or trustee.

Benefits of completing this form online

- Convenience of completing the form from anywhere at any time.

- Editability allows users to adjust details as necessary.

- Reliable access to forms drafted by licensed attorneys for legal compliance.

Looking for another form?

Form popularity

FAQ

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.