Kansas Limited Liability Company LLC Formation Package

Description

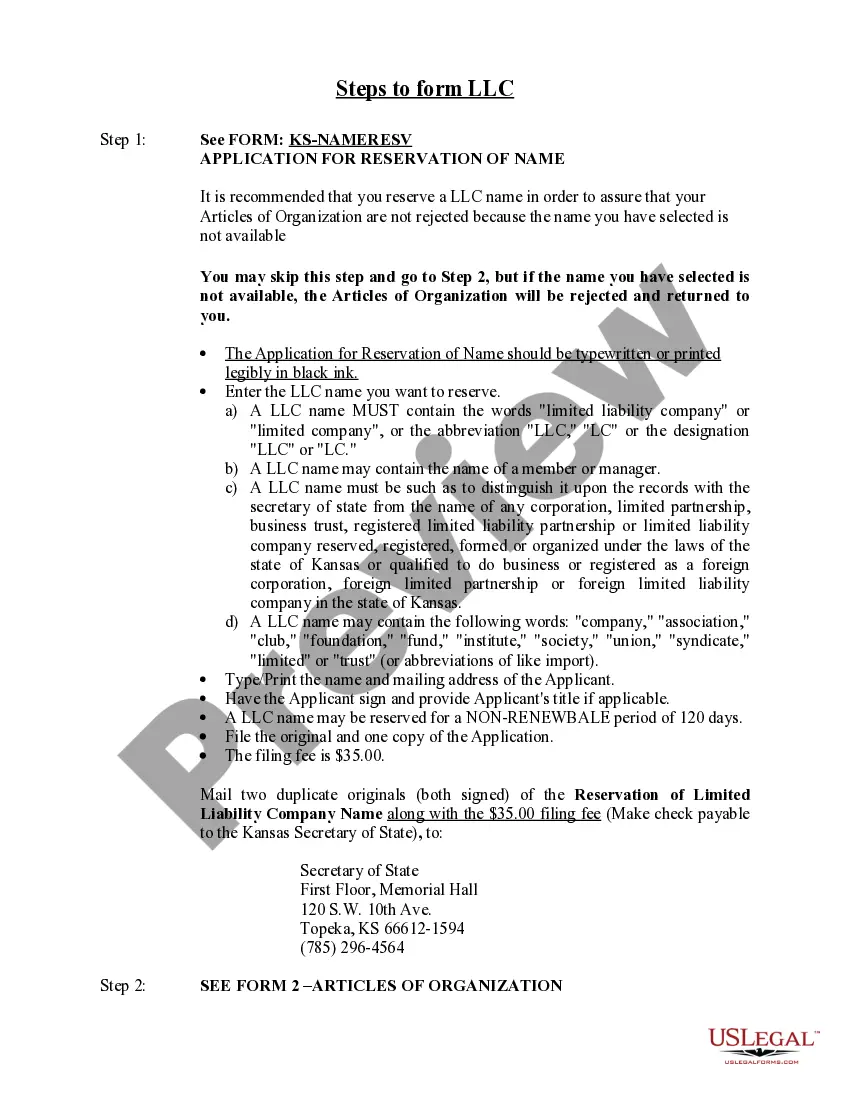

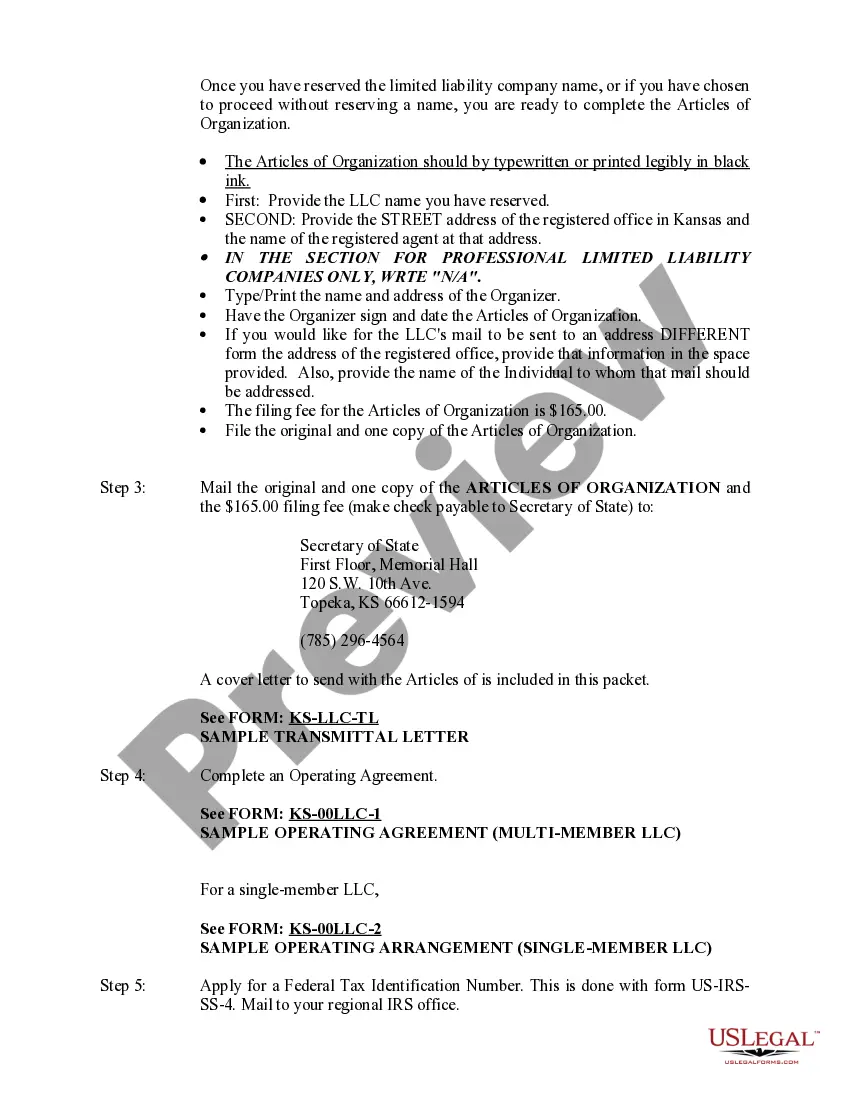

How to fill out Kansas Limited Liability Company LLC Formation Package?

Looking for the Kansas Limited Liability Company LLC Formation Package forms and completing them could be a challenge.

To conserve time, expenses, and energy, utilize US Legal Forms and quickly locate the correct template tailored for your state with just a few clicks.

Our lawyers prepare each document, so you merely need to complete them. It's really that straightforward.

- Log in to your account and return to the form's page to download the document.

- Your downloaded samples are stored in My documents and remain available at all times for future use.

- If you haven’t signed up yet, you must create an account.

- Review our comprehensive instructions on how to obtain the Kansas Limited Liability Company LLC Formation Package form in just a few minutes.

- To acquire a qualified sample, verify its relevance for your state.

- Examine the example using the Preview option (if it’s accessible).

- If there’s a description, read it to grasp the details.

Form popularity

FAQ

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

But even though an inactive LLC has no income or expenses for a year, it might still be required to file a federal income tax return.An LLC may be disregarded as an entity for tax purposes, or it may be taxed as a partnership or a corporation.

A separate legal entity created by a state filing. The S corporation is a corporation that has filed a special election with the IRS to be treated like a partnership (or LLC) for tax purposes. Therefore, S corporations are not subject to corporate income tax.

Since the federal government does not recognize an LLC as a classification for federal tax purposes, such entities must figure out how they should file their federal returns. Here are three of the most common questions about LLCs.

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

LLCs are great because they are flexible when it comes to determining how you want to be taxed. You have the option of taxing your LLC like a sole proprietorship, a partnership or a corporation by filing the appropriate forms with the IRS.

A limited liability company (LLC) is not a separate tax entity like a corporation; instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.The LLC itself does not pay federal income taxes, although some states impose an annual tax on LLCs.

In addition to "president" and "CEO," common titles used by LLC chief executives are "principal," "founder," "consultant" and "owner." Along with being correct and true, these titles accurately represent your position in the company.

The President is essentially the highest ranking manager in the LLC. The Operating Agreement typically gives the President general management powers of the business of the LLC, as well as full power to open bank accounts. Other titles of LLC officers and managers are Secretary and Treasurer for example.