This form is a Quitclaim Deed where the grantor is an individual and the grantees are four individuals taking the property as joint tenants with the right of survivorship. Grantor conveys and quitclaims any interest have in the described property to grantees. This deed complies with all state statutory laws.

Maryland Quitclaim Deed - Individual to Four Individuals

Description

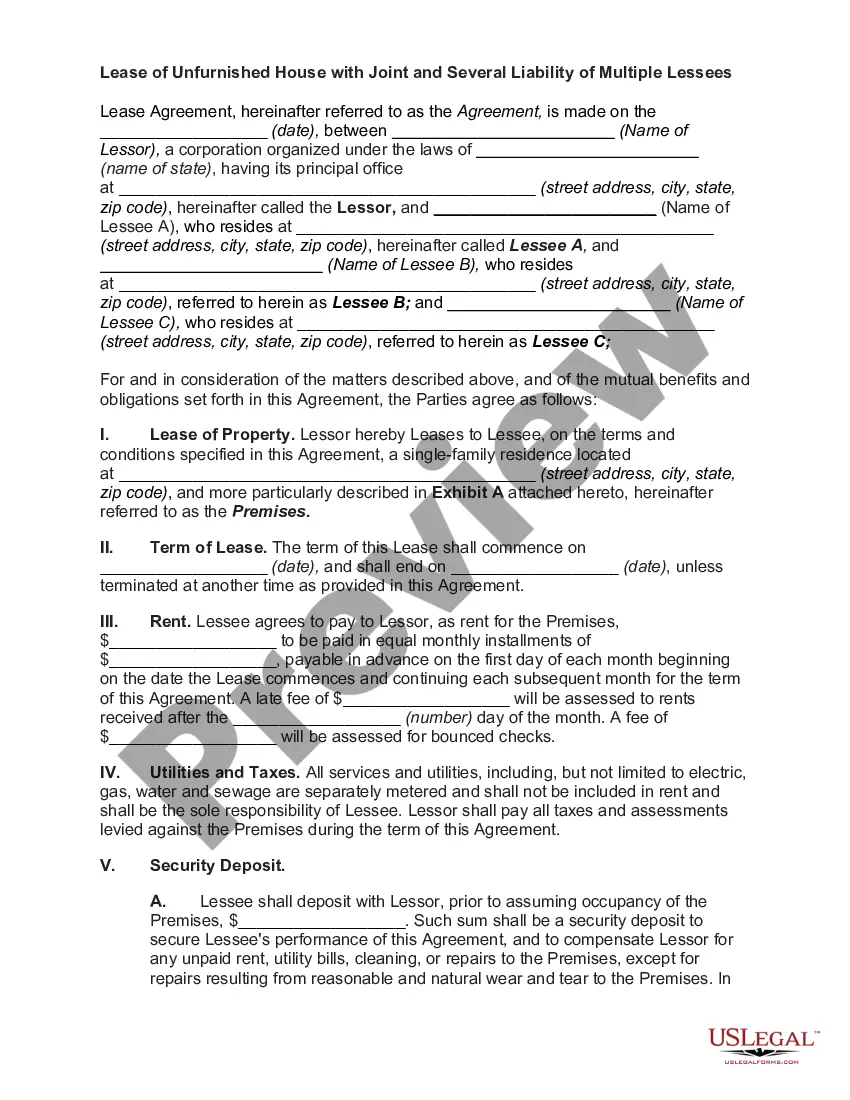

How to fill out Maryland Quitclaim Deed - Individual To Four Individuals?

You are invited to the most extensive collection of legal documents, US Legal Forms. Here you can obtain any template, such as the Maryland Quitclaim Deed - Individual to Four Individuals forms, and download them (as many as you desire). Create official documents within a couple of hours, instead of days or even weeks, and without incurring exorbitant fees with a legal expert. Acquire your state-specific template with just a few clicks, confident in the knowledge that it was prepared by our state-accredited legal experts.

If you’re already a member, simply Log In to your account and click Download next to the Maryland Quitclaim Deed - Individual to Four Individuals that you need. Since US Legal Forms is an online platform, you will always have access to your downloaded documents, no matter what device you are using. Find them in the My documents section.

If you don’t have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific template, check its validity in your residing state.

- Review the description (if available) to ascertain if it’s the correct template.

- Explore more information using the Preview feature.

- If the template satisfies all your requirements, just click Buy Now.

- To establish your account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Save the document in your preferred format (Word or PDF).

- Print the document and fill it out with your or your business’s details.

Form popularity

FAQ

The most common use of a quitclaim deed is to transfer property between family members, such as from parents to children. The Maryland Quitclaim Deed - Individual to Four Individuals simplifies these transactions by allowing for an easy transfer of rights. It is also widely used in divorce settlements and to clear up title issues.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.