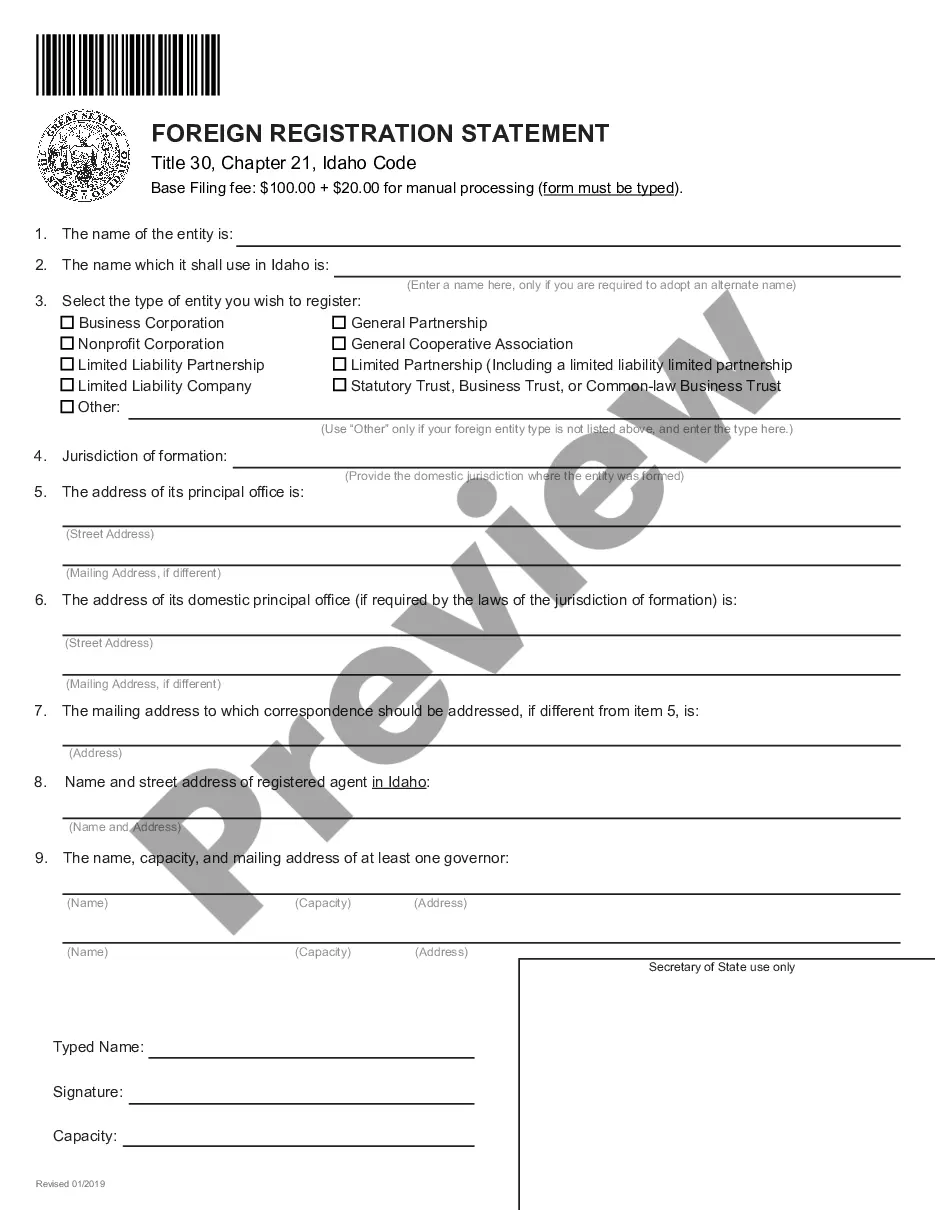

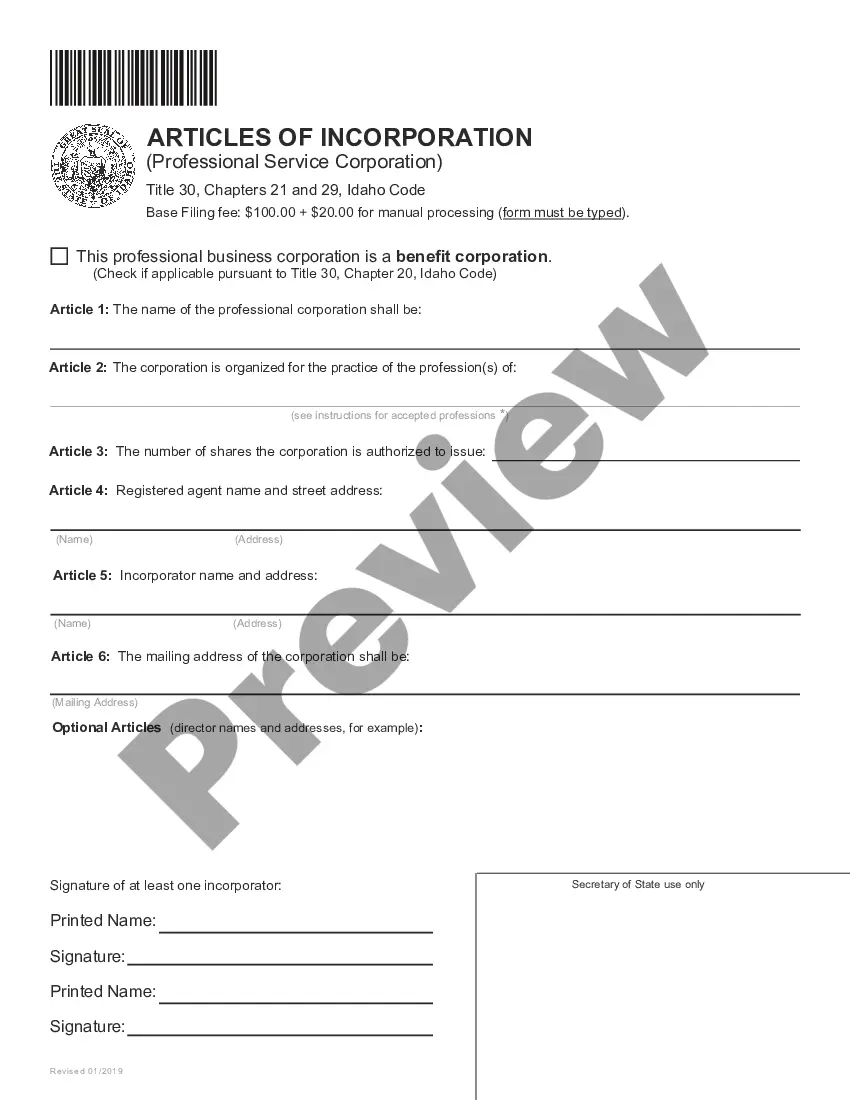

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Idaho Articles of Incorporation for Domestic For-Profit Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Articles Of Incorporation For Domestic For-Profit Corporation?

Access the most extensive collection of legal documents.

US Legal Forms serves as a resource to locate any form specific to your state in just a few clicks, including Idaho Articles of Incorporation for Domestic For-Profit Corporation templates.

No need to spend hours searching for a court-admissible example.

Make the most of the Preview feature if it's offered to review the document's content. If everything checks out, press the Buy Now button. After selecting a pricing plan, create an account. Payment can be made via credit card or PayPal. Download the file to your device by clicking the Download button. That's it! You must submit the Idaho Articles of Incorporation for Domestic For-Profit Corporation template and verify it. To confirm accuracy, consult your local legal advisor for help. Register and conveniently browse approximately 85,000 useful templates.

- Our certified specialists guarantee you receive updated samples every time.

- To utilize the forms library, select a subscription and create your account.

- If you've already set it up, simply Log In and hit the Download button.

- The Idaho Articles of Incorporation for Domestic For-Profit Corporation document will be promptly stored in the My documents section (one section for each form you download from US Legal Forms).

- To establish a new account, adhere to the brief guidelines provided below.

- If you intend to utilize a state-specific template, ensure to select the correct state.

- If feasible, examine the details to understand the specificities of the document.

Form popularity

FAQ

The primary difference lies in their legal structures and tax implications. A domestic for-profit corporation is a more formal business entity that offers stock options and is subject to corporate tax rates. On the other hand, an LLC provides pass-through taxation and greater flexibility in management. Understanding these distinctions is crucial when deciding whether to pursue the Idaho Articles of Incorporation for Domestic For-Profit Corporation or an LLC for your business.

Are articles of incorporation public? The answer is yes. These documents, which are filed with the Secretary of State or similar agency to create a new business entity, are available for public viewing.In some states, including Arizona, the articles of incorporation can be downloaded by anyone for free.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

The difference between articles and bylaws, simply put, is that Articles of Incorporation are the official formation documents you must file with the state to start a new business. Corporate bylaws, on the other hand, are a set of internal documents that outline how the company should be run.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

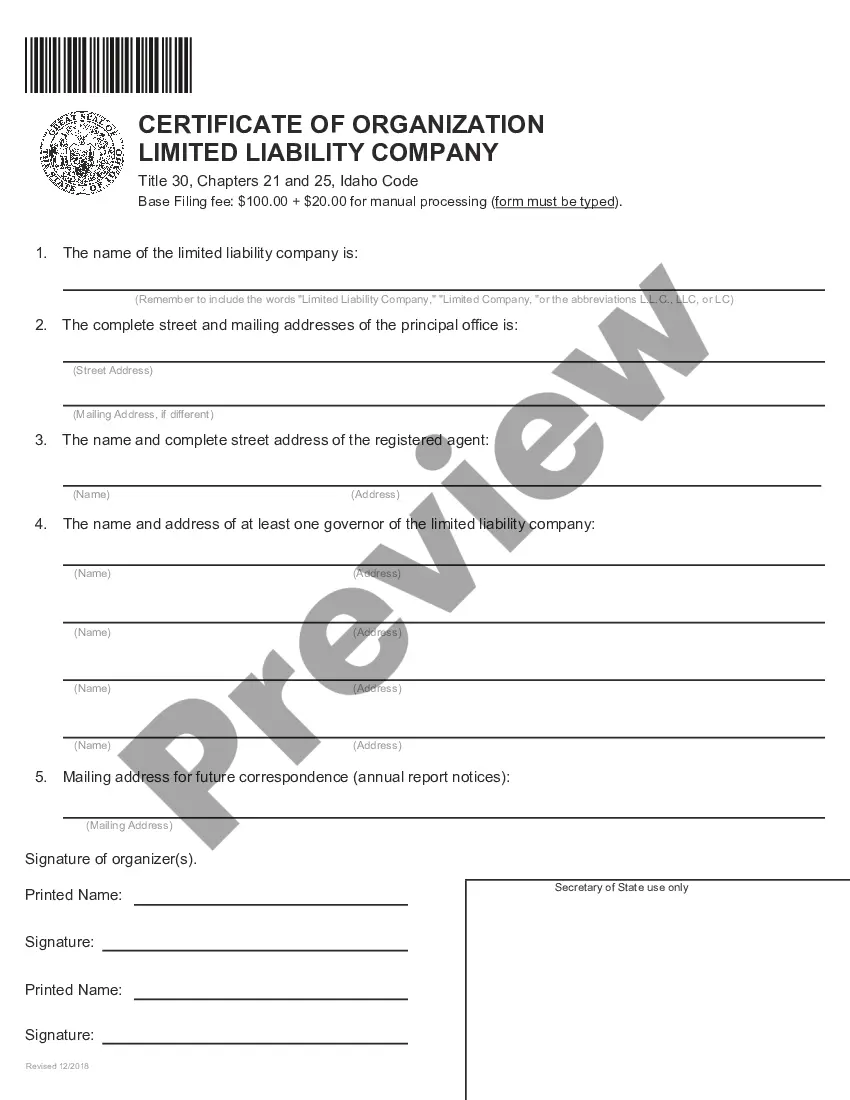

Does an LLC have articles of incorporation that establish the business as a legal entity? Yes, an LLC must file an organizing document with a state agency. However, in the case of an LLC, the document is called the Articles of Organization, not the Articles of Incorporation.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level.Articles of organization are similar to articles of incorporation and are sometimes referred to as a "certificate of organization" or a "certificate of formation."

SEC is mandated by the Corporation Code and the Securities Regulation Code to regulate the corporate sector and the securities markets.Thus, SEC treats the Articles of Incorporation (AOI), By-Laws, and related documents as public records which are available to the public.

They are sometimes referred to as the certificate of incorporation or the corporate charter, or if the business is Limited Liability Companies (LLCs) they are called Articles of Organization.