Georgia Amendment to Living Trust

Overview of this form

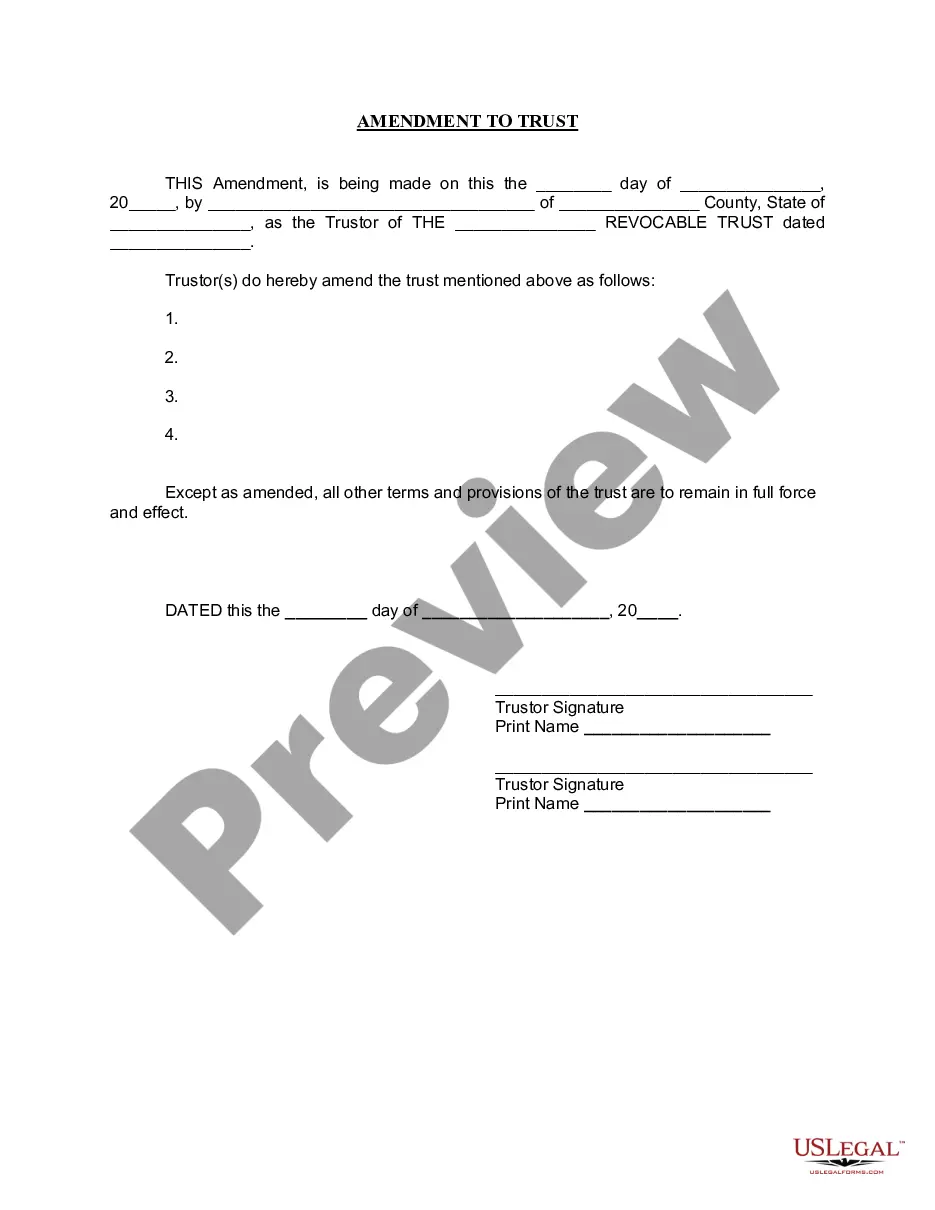

The Amendment to Living Trust is a legal document that allows a Trustor to modify specific provisions within an existing living trust. Unlike creating a new trust, this amendment enables the Trustor to maintain the integrity and original purpose of the trust while making necessary changes to its terms or assets. This form is essential for those managing estate planning, as it ensures that the trust reflects current wishes without the need to dissolve and recreate the entire document.

Key components of this form

- Date of amendment

- Name and county of the Trustor

- Name of the existing revocable trust

- Details of the amendments made

- Signatures of the Trustor(s)

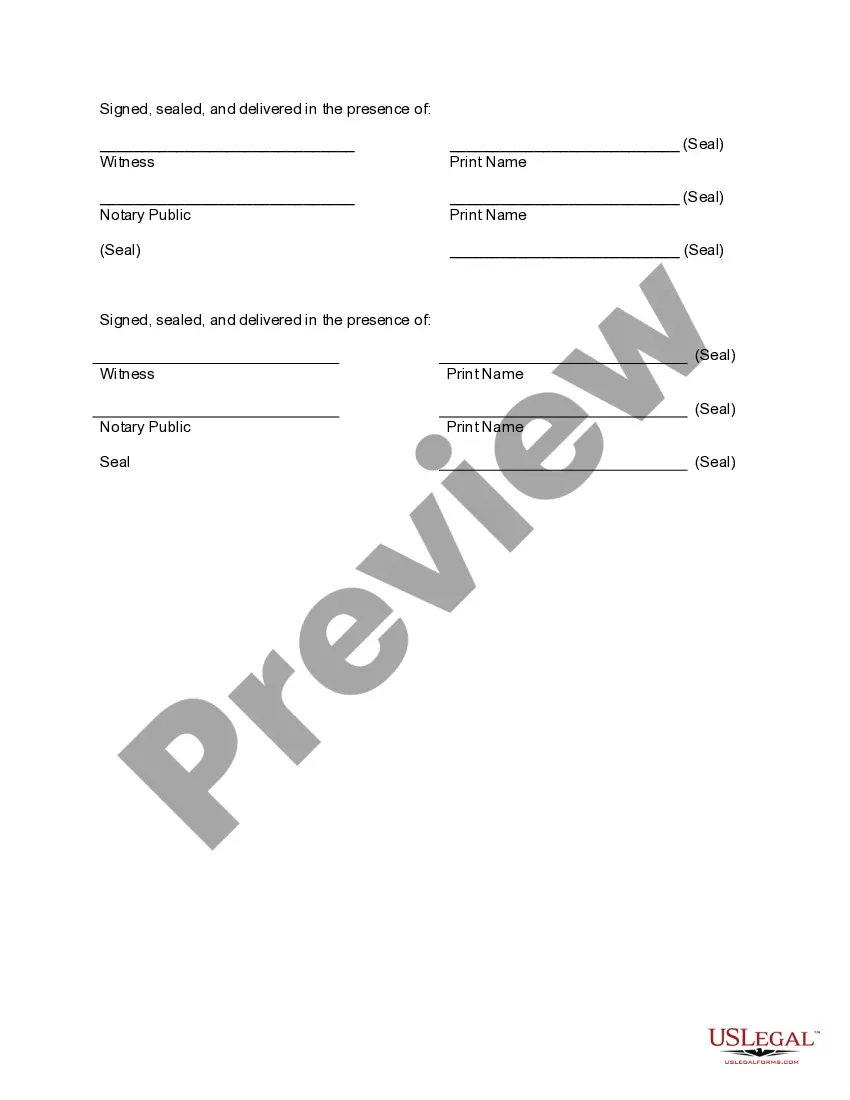

- Notary public and witness sections

When to use this form

This form should be used when a Trustor wishes to make changes to an existing living trust, such as altering the allocation of assets, changing beneficiaries, or updating provisions that reflect current circumstances or intentions. It is vital for Trustors who need to adjust their estate planning to ensure their wishes are accurately represented in their trust.

Who should use this form

- Individuals who have established a living trust and wish to amend its terms.

- Trustors who want to change asset distribution within the trust.

- Owners of revocable trusts who need to update beneficiaries or provisions.

Steps to complete this form

- Enter the date of the amendment.

- Provide your name, county, and state as the Trustor.

- Specify the name of the revocable trust being amended.

- Clearly outline the amendments being made to the trust.

- Sign the form in front of a notary public, including printed names.

- Ensure a witness is present to sign the document as required.

Notarization requirements for this form

Yes, this form must be notarized to be legally valid. US Legal Forms offers integrated online notarization, allowing you to complete the notarization process easily through a secure video call, ensuring that your document is properly executed without the need for travel.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify all details of the amendments clearly.

- Not having the form signed in front of a notary.

- Missing the witness's signature, if applicable.

- Using incorrect information about the existing trust.

Benefits of completing this form online

- Convenient access to a professionally drafted document.

- Editable format to tailor the document to specific needs.

- Reliable service ensures that form meets current legal standards.

Looking for another form?

Form popularity

FAQ

To write a codicil to a trust, start by reviewing your existing trust document for necessary details. Clearly state your intent to amend the trust, and outline the specific changes you wish to make. Ensure your codicil complies with Georgia laws regarding amendments to living trusts. If you want to ensure everything is correct, consider using a reliable platform like US Legal Forms, which provides templates and guidance for creating effective Georgia Amendment to Living Trust documents.

Yes, a trust can be altered, amended, or even revoked based on your wishes. A Georgia Amendment to Living Trust allows you to make necessary changes during your lifetime. It's important to consult with professionals who can guide you through this process, ensuring everything aligns with your intentions. Tools like uslegalforms can provide you with the templates and support you need for a smooth amendment.

A codicil typically applies to wills, whereas an amendment modifies a trust. In the context of a Georgia Amendment to Living Trust, you change or add specific provisions directly in the trust document. Understanding this difference helps you choose the correct method for your estate planning needs.

Amending a trust, such as a Georgia Amendment to Living Trust, is generally straightforward. You simply need to follow the guidelines set forth in the original trust document. Many choose to work with a legal service or consultant to ensure the amendment meets all legal requirements. With resources available, you can efficiently navigate this process.

The downside of putting assets in a trust includes the potential loss of control over those assets. Once assets are transferred, the trustee gains authority and may have different management approaches compared to the original owner. Additionally, creating a Georgia Amendment to Living Trust may require ongoing legal support and fees. Weighing these factors can help you determine if transferring assets aligns with your long-term goals.

One downfall of having a trust is the complexity and time required for its establishment and maintenance. Trusts necessitate careful documentation and, at times, ongoing management, which may be challenging for some individuals. Additionally, a Georgia Amendment to Living Trust can require legal assistance, leading to potential costs. Understanding these challenges can help you make an informed decision about whether a trust aligns with your needs.

Writing an amendment to a living trust involves several key steps. First, outline the specific changes you wish to make, and then draft the amendment clearly to avoid confusion. Include the date of the original trust and specify how the new amendment modifies the existing terms. For help with this process, the US Legal Forms platform provides templates and resources for creating a Georgia Amendment to Living Trust that are both user-friendly and legally sound.

To amend a trust in Georgia, you generally need to follow the original trust's guidelines. Most amendments must be in writing and signed by the trustee, and they should specify the amendments clearly. Utilizing the Georgia Amendment to Living Trust ensures that necessary changes are legally recognized. It's advisable to consult a legal expert to ensure compliance with all requirements when making significant updates.

Deciding whether your parents should put their assets in a trust depends on their specific circumstances. A trust can provide benefits such as avoiding probate and managing assets efficiently, especially through a Georgia Amendment to Living Trust for future changes. However, it’s essential to evaluate their needs and estate planning goals carefully. Consulting with an estate planning expert can provide valuable insights tailored to their situation.

While family trusts offer benefits, they also have some disadvantages. One significant drawback is the potential for family conflicts, as differing opinions on trust management can lead to disputes. Additionally, setting up a Georgia Amendment to Living Trust can incur legal fees, which may be a consideration for some families. Being aware of these potential downsides can help you plan more effectively.