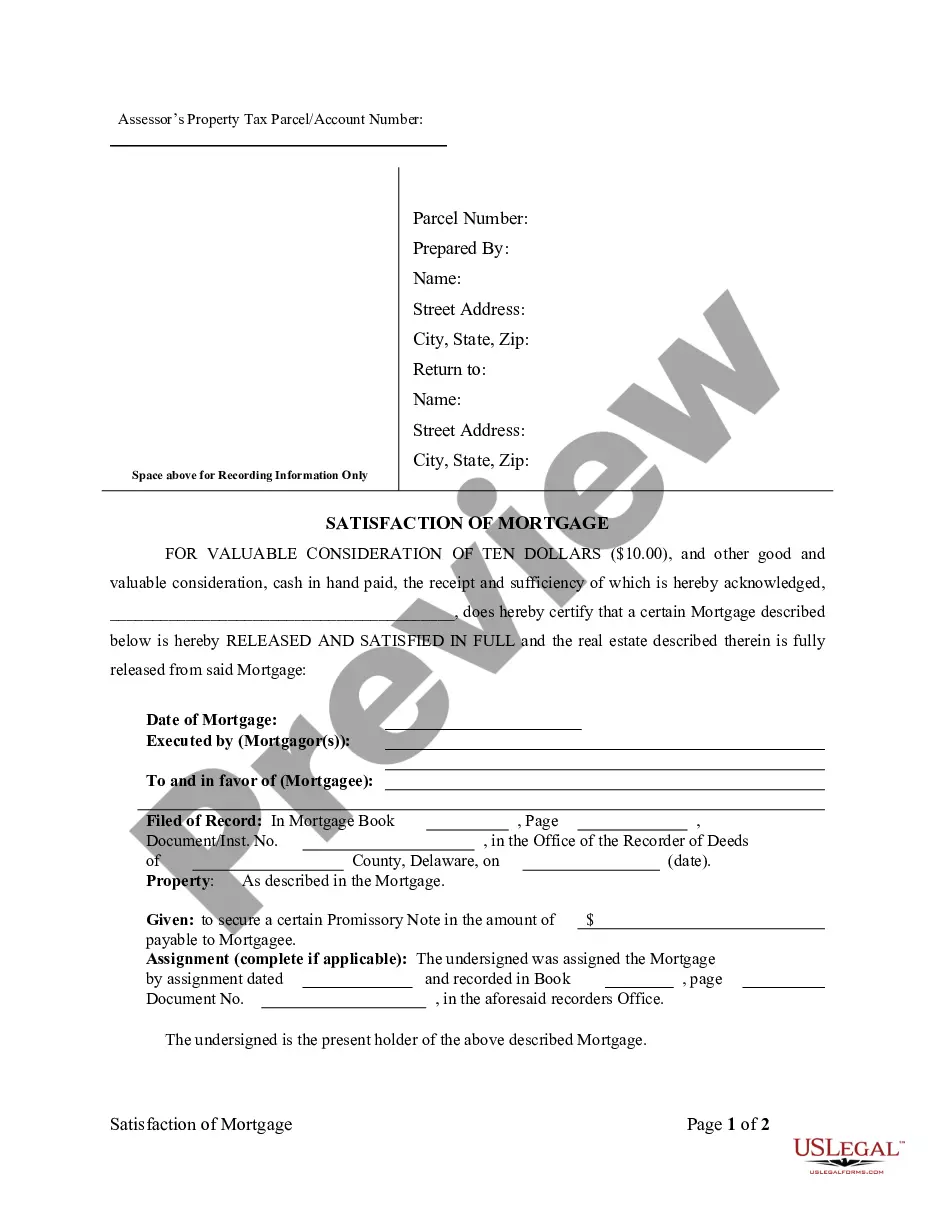

Delaware Satisfaction, Release or Cancellation of Mortgage by Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Satisfaction, Release Or Cancellation Of Mortgage By Individual?

The greater the documentation you have to complete - the more anxious you are.

You can discover countless Delaware Satisfaction, Release or Cancellation of Mortgage by Individual forms online, but you may not know which ones to trust.

Eliminate the inconvenience and simplify the process of finding templates using US Legal Forms.

With US Legal Forms, achieve more for less!

- Obtain precisely prepared documents that conform to state regulations.

- If you have a subscription to US Legal Forms, Log In to your account, and you will see the Download button on the Delaware Satisfaction, Release or Cancellation of Mortgage by Individual’s page.

- If you haven't utilized our service before, complete the registration process with these steps.

- Verify that the Delaware Satisfaction, Release or Cancellation of Mortgage by Individual is acceptable in your jurisdiction.

- Double-check your selection by reviewing the description or using the Preview option if available for the specific record.

Form popularity

FAQ

To stop a foreclosure in Delaware, you must act quickly and explore available options such as negotiating with your lender or filing for bankruptcy. Engaging a legal professional can provide valuable support in navigating the complex procedures. Additionally, using a reliable service like US Legal Forms can help you find the right documents needed to initiate a foreclosure prevention measure. Remember, understanding your rights is essential for a successful outcome.

Satisfaction and release typically describe the conclusion of a mortgage agreement, indicating that the debt is settled. Satisfaction implies that the lender acknowledges that the obligation has been fulfilled, while a release serves as the formal document showing that the mortgage lien is removed. Clarity on these terms is vital in navigating Delaware Satisfaction, Release or Cancellation of Mortgage by Individual.

A release of mortgage and satisfaction of mortgage often refer to the same end result: the removal of a lien on a property. However, they may differ slightly in terms of terminology used in various regions or contexts. In jurisdictions involved in Delaware Satisfaction, Release or Cancellation of Mortgage by Individual, it's essential to understand both terms and their implications on property ownership.

The right of rescission in Delaware allows consumers to cancel certain transactions, including mortgages, within three days of signing. This right ensures consumers have time to reconsider significant financial decisions. It plays a vital role in the context of Delaware Satisfaction, Release or Cancellation of Mortgage by Individual, providing safeguards for borrowers.

To obtain a partial release of your mortgage, start by checking the terms of your current mortgage agreement. You will typically need to submit a written request to your lender, detailing the property you wish to release. It’s important to provide any necessary documentation and ensure you meet the lender's conditions. By utilizing USLegalForms, you can access the relevant forms and guidance to streamline the process of achieving a Delaware Satisfaction, Release or Cancellation of Mortgage by Individual.

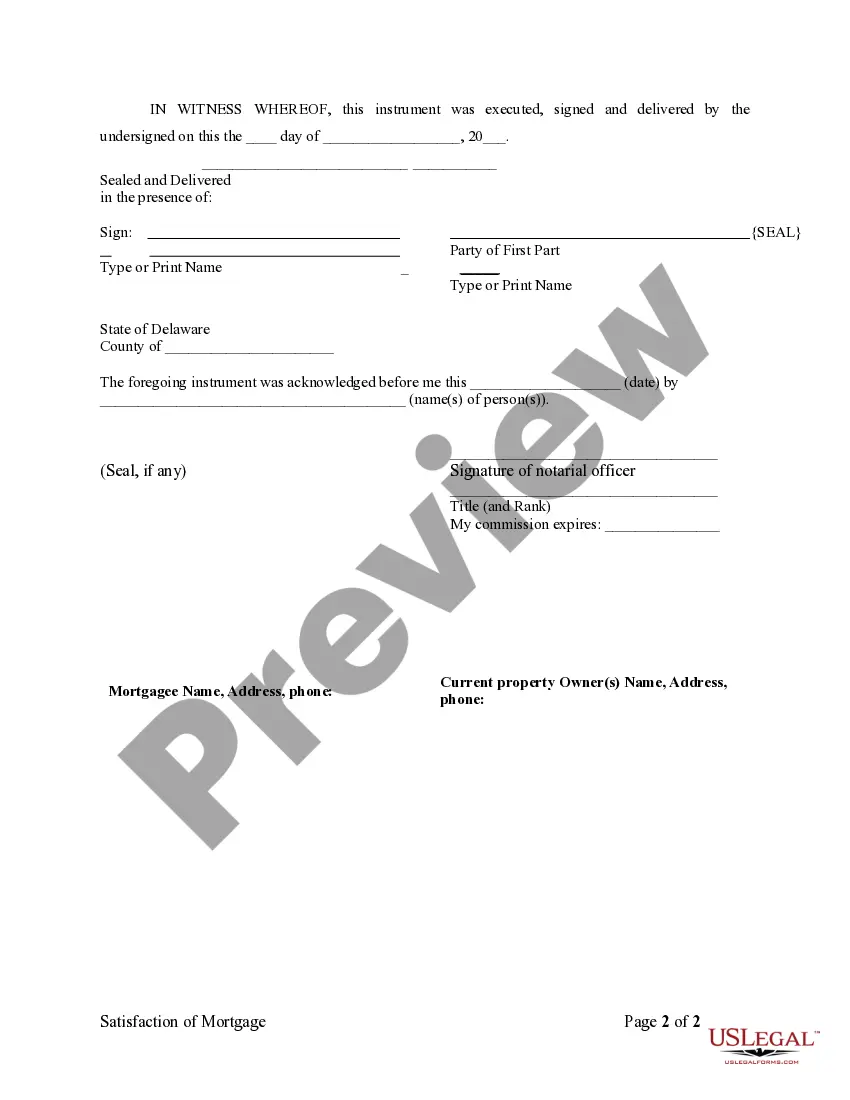

Yes, a satisfaction of mortgage in Delaware generally needs to be notarized to ensure its validity. Notarization adds a layer of authenticity, confirming the signatures are legitimate. You can complete this step by visiting a notary public with your signed satisfaction form. If you are unsure about the process, uslegalforms can guide you on the notarization requirements and help you get everything in order.

To record a satisfaction of your mortgage in Delaware, you must file the completed satisfaction form with the county recorder's office where your property is located. Make sure to submit any required fees along with your form. After recording, you will receive an official copy that proves the mortgage has been satisfied. Using uslegalforms helps streamline this process by offering easy-to-follow instructions and necessary documents.

Filling out a satisfaction of mortgage form in Delaware is a straightforward process. Start by entering your information, including the lender's name, the borrower's name, and the mortgage details. Ensure that you indicate the specific details of the mortgage being satisfied, and then sign the form. If you need assistance, uslegalforms can provide templates and guidance to make this process easier for you.