Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries

About this form

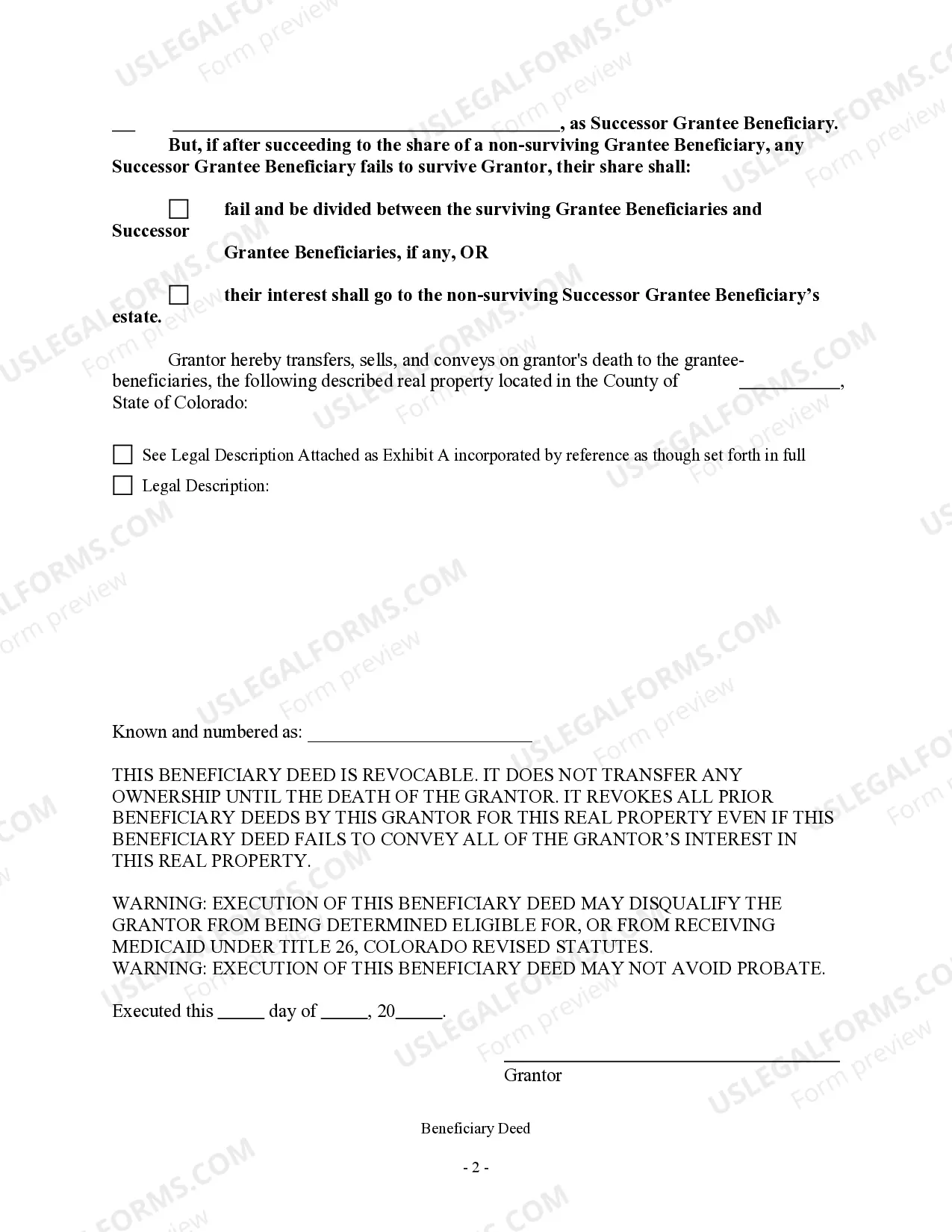

The Transfer on Death Deed (TOD) is a legal document that allows a Grantor to designate up to five Grantee Beneficiaries to receive property upon the Grantor's death. This form ensures that the property transfers directly to the beneficiaries without needing to go through probate, making it a convenient alternative to a traditional will. It differs from similar forms by allowing multiple beneficiaries and includes provisions for Successor Grantee Beneficiaries if the primary beneficiaries are unable to inherit.

What’s included in this form

- Identification of the Grantor and Grantee Beneficiaries.

- Description of the property being transferred.

- Specifications for Successor Grantee Beneficiaries.

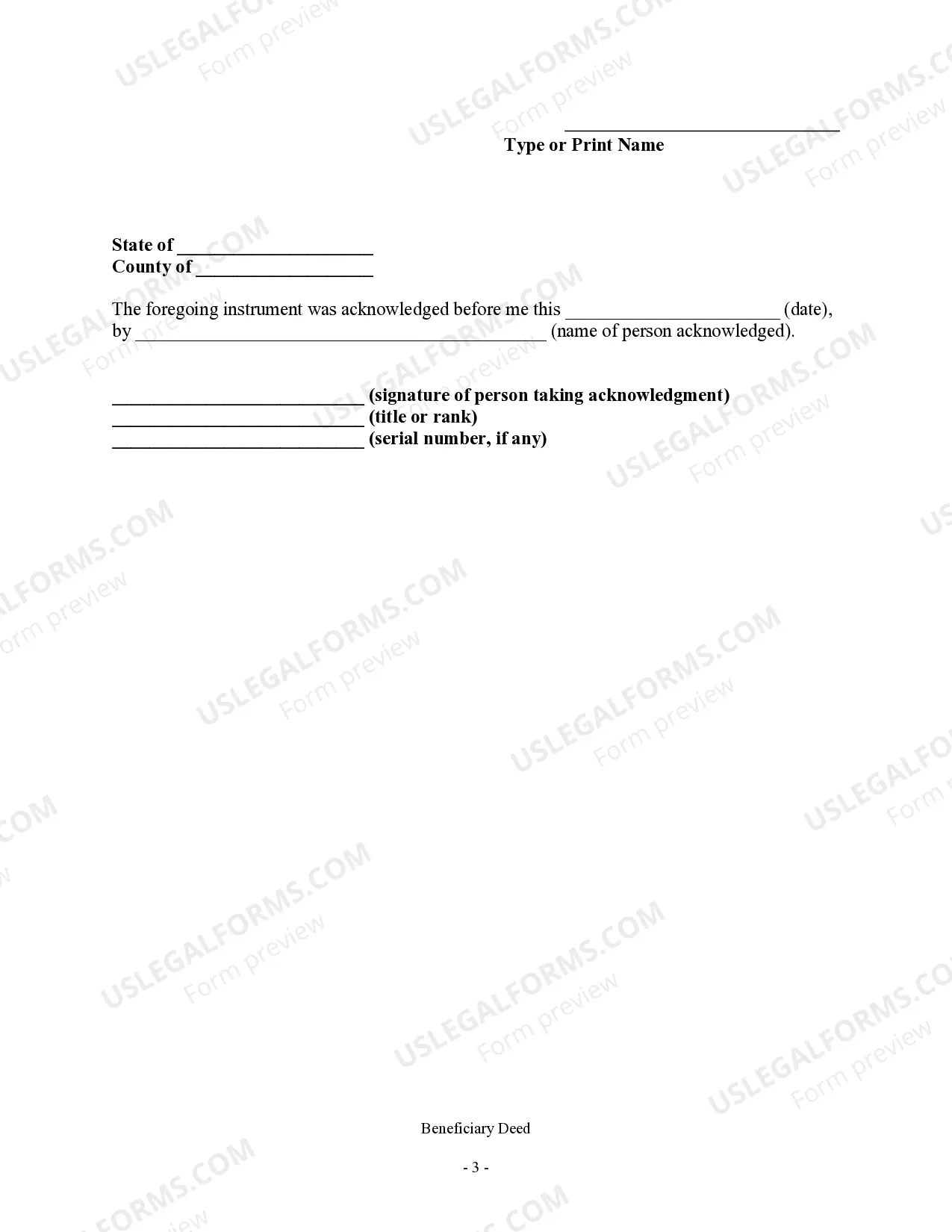

- Signature and date fields for the Grantor.

- Compliance statement with state laws.

When to use this document

This form is useful when an individual wants to ensure that their property automatically transfers to multiple beneficiaries upon their death, thereby avoiding the lengthy probate process. It can be utilized in estate planning to simplify the transfer process and provide clarity on property distribution among loved ones.

Intended users of this form

- Individuals looking to designate multiple beneficiaries for property.

- Grantors who want to avoid probate for their assets.

- Those who wish to have clarity in their estate planning process.

Instructions for completing this form

- Identify the Grantor and full names of the Grantee Beneficiaries.

- Clearly describe the property being transferred, including its legal description.

- Designate Successor Grantee Beneficiaries if the primary beneficiaries are unavailable.

- Sign and date the form in front of a witness if required by your state.

- Confirm that the form complies with state laws by reviewing it before use.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately describe the property.

- Not naming Successor Grantees when needed.

- Overlooking signature and date requirements.

- Assuming the form is valid without state-specific review.

Why use this form online

- Convenient access to forms created by licensed attorneys.

- Editability allows users to customize details as needed.

- Secure download, ensuring privacy and confidentiality.

- Instant availability, saving time compared to traditional methods.

Looking for another form?

Form popularity

FAQ

Writing a beneficiary deed requires specific information, including the grantor's name, a legal description of the property, and the beneficiary names. You should structure the deed clearly, specifying how the property will transfer upon your death. It's important to ensure that it meets Colorado state requirements, as mistakes can lead to confusion or legal issues later. Resources like uslegalforms can provide templates and guidance to help you write an effective Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries.

Filling out a Colorado beneficiary deed involves providing key information such as your name, the description of the property, and the names of your chosen beneficiaries. It’s important to use clear and concise language while ensuring compliance with state requirements. Additionally, be mindful of including any necessary witness signatures or notarization, which can validate the document. For a seamless process, you can utilize tools available on uslegalforms to guide you through the details.

To transfer a Colorado Transfer on Death Deed to two beneficiaries, you must clearly list both names in the deed. It is essential to specify how the property will be divided between the beneficiaries—equally or in other proportions. The proper wording in the deed is crucial to ensure that your intentions are carried out as you wish. You may want to consult legal resources or platforms like uslegalforms for assistance in drafting the deed correctly.

Yes, Colorado allows the use of Transfer on Death Deeds. This legal instrument enables you to designate beneficiaries who will inherit your property upon your passing, thus avoiding probate. The state’s acceptance of TOD deeds makes estate planning more straightforward and efficient for individuals and families. If you’re considering this option, ensure that your deed is properly drafted to comply with Colorado laws.

A Colorado Transfer on Death Deed, or TOD deed, and a beneficiary deed serve a similar purpose, but there are key differences. A TOD deed allows you to transfer property ownership to beneficiaries upon your death without going through probate, while a beneficiary deed, specifically named in Colorado law, accomplishes the same goal but might have variations in how it’s structured. Both deeds can name multiple beneficiaries, but the specific language and stipulations may differ. Understanding these distinctions can help you choose the right option based on your needs.

While you can complete a Transfer on Death Deed in Colorado without a lawyer, consulting one can be beneficial for ensuring compliance and accuracy. An attorney can help clarify your options and ensure the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries meets all legal requirements. If you prefer, platforms like US Legal Forms provide templates and guidance for creating your deed correctly.

Filing a Transfer on Death Deed in Colorado involves several key steps. First, create the deed that complies with state guidelines, ensuring it specifies that it is a Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries. Then, sign the document before a notary public and submit it to your local county clerk and recorder. This simple process allows your chosen beneficiaries to inherit your property directly.

Yes, Colorado is a TOD state, which means it allows property owners to designate beneficiaries who will inherit their real estate automatically upon their death. This process simplifies the transfer of ownership and helps avoid probate, making it easier for your heirs. Utilizing the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries enhances your estate planning significantly.

To file a Transfer on Death Deed (TOD) in Colorado, you must first create the deed according to state laws. Once you draft the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries, you need to sign it in front of a notary public. After signing, file the deed with the county clerk and recorder's office in the county where the property is located. This ensures your deed is legally recognized and effective upon your passing.

While a Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries offers several advantages, one notable disadvantage is that it may delay the full transfer of property until the grantor's death. This could cause complications if there are disagreements among beneficiaries or if any incumbent debts exist. It's vital to weigh these factors before deciding if a TOD is the right choice for your estate planning needs.