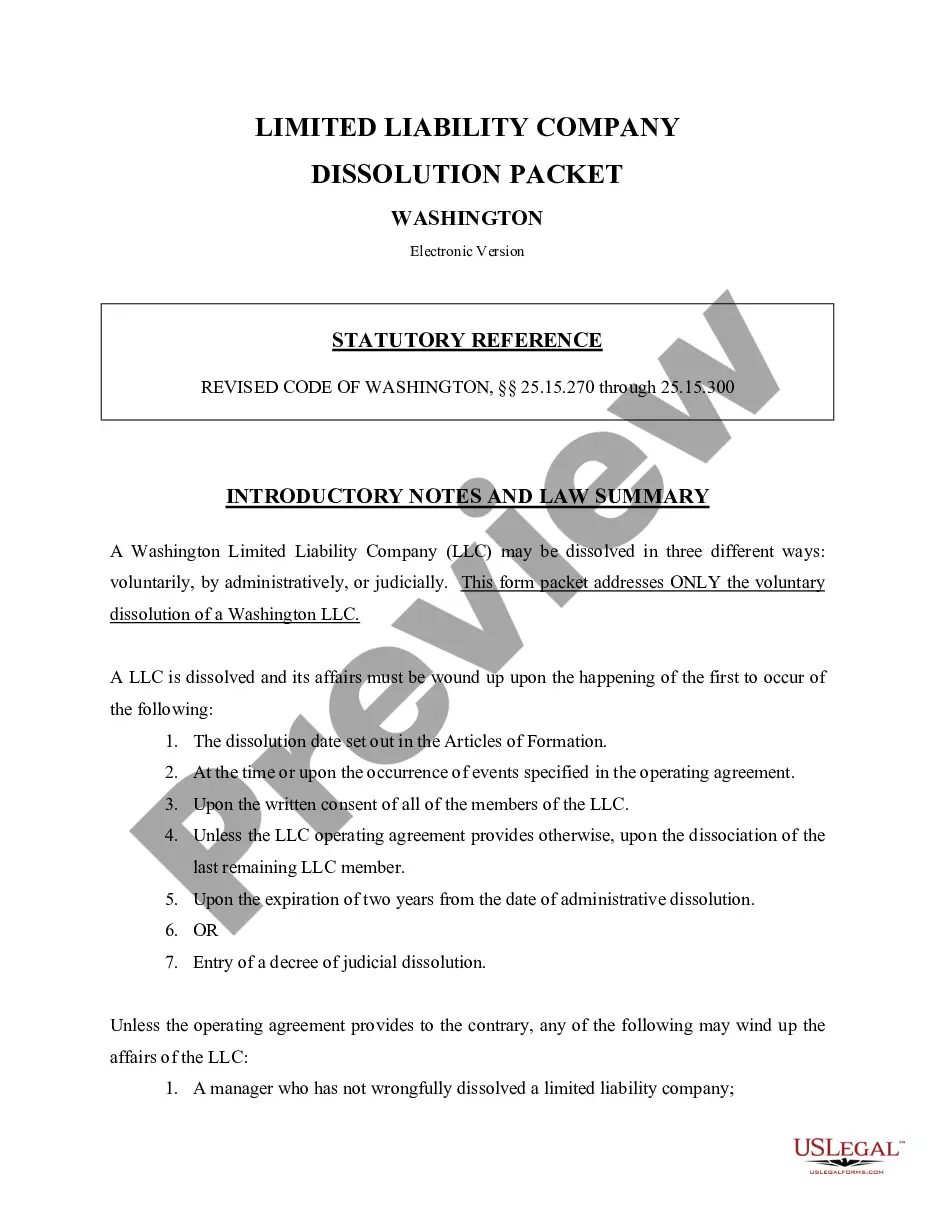

Limited Lliability

Description

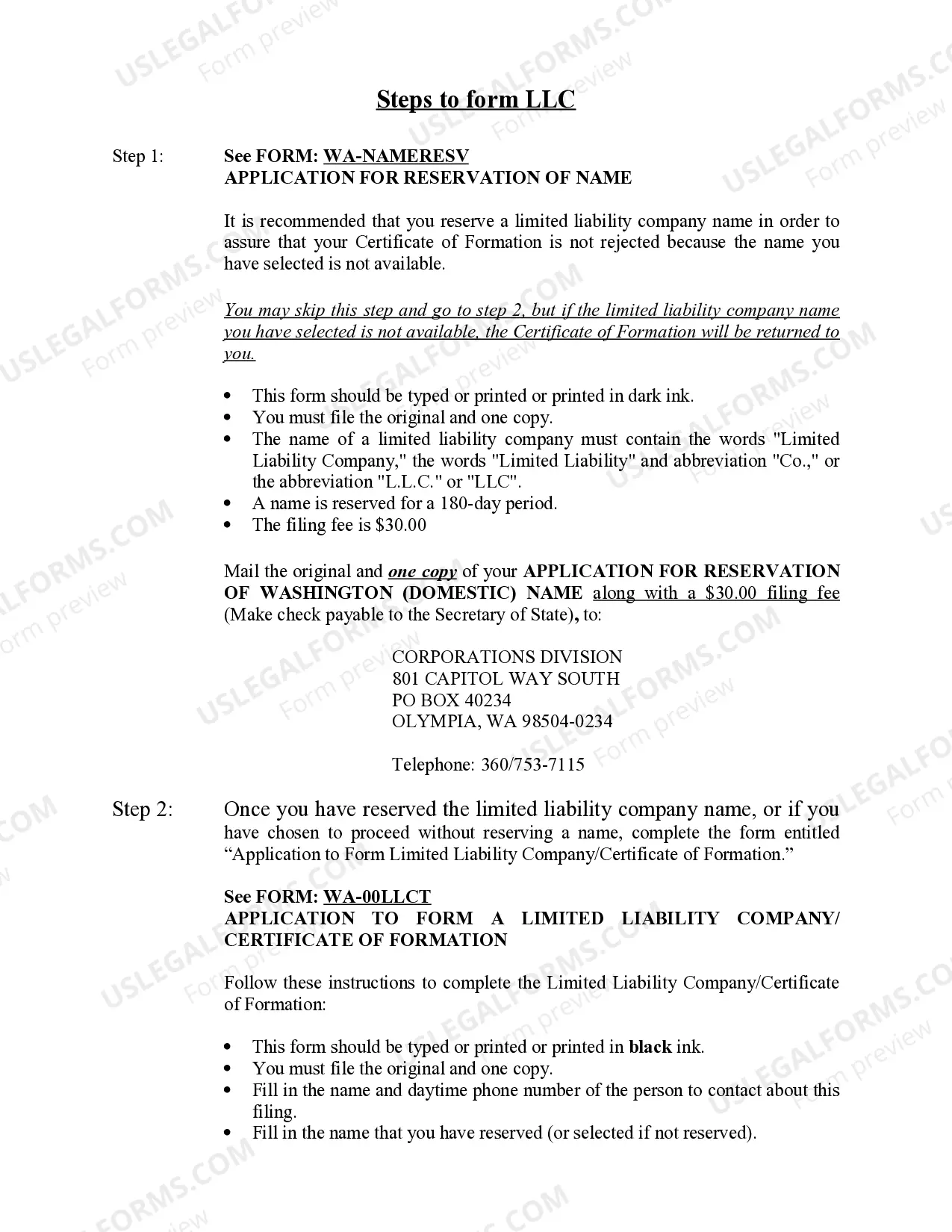

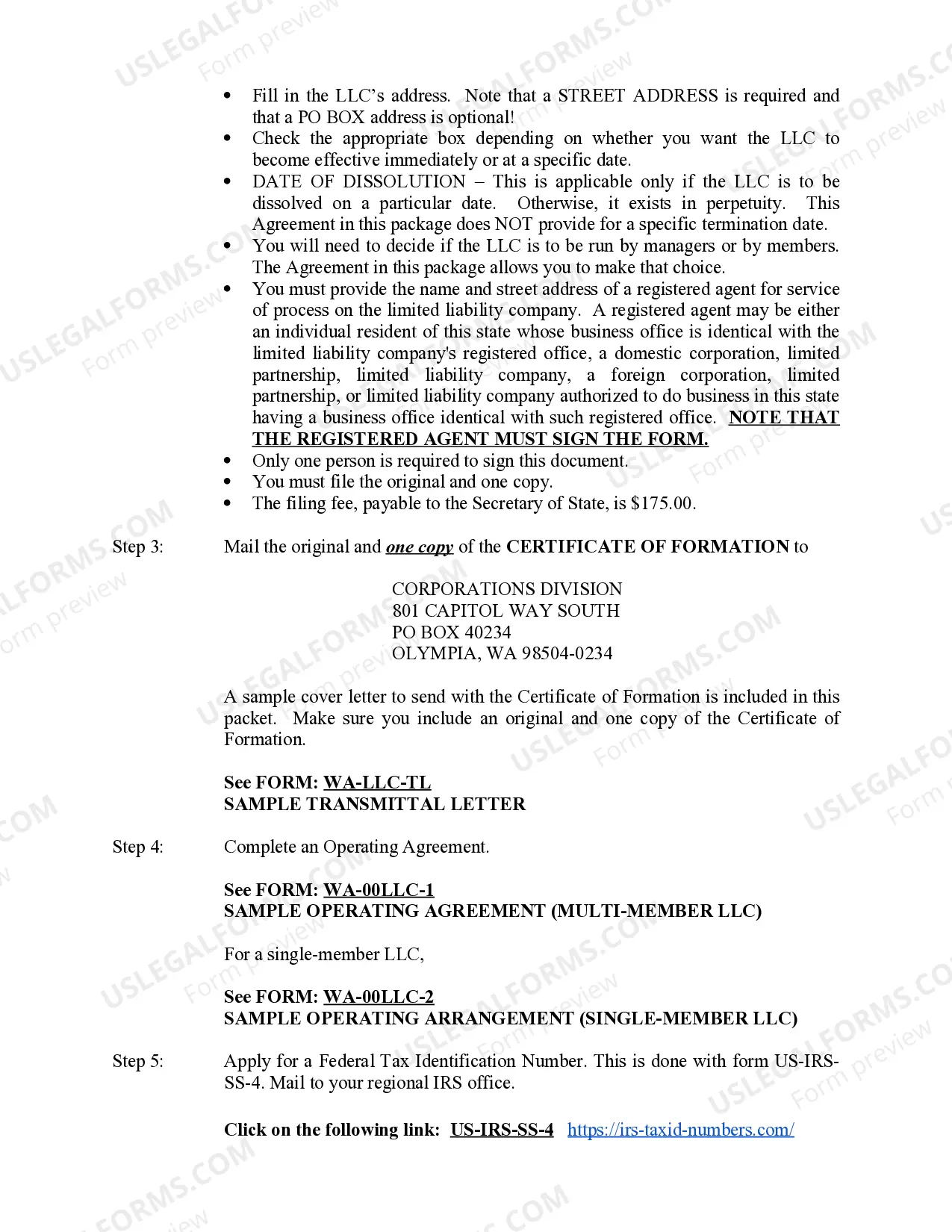

How to fill out Washington Limited Liability Company LLC Formation Package?

- Start by visiting the US Legal Forms website and log in to your account if you're a returning user. Ensure your subscription is active to download templates.

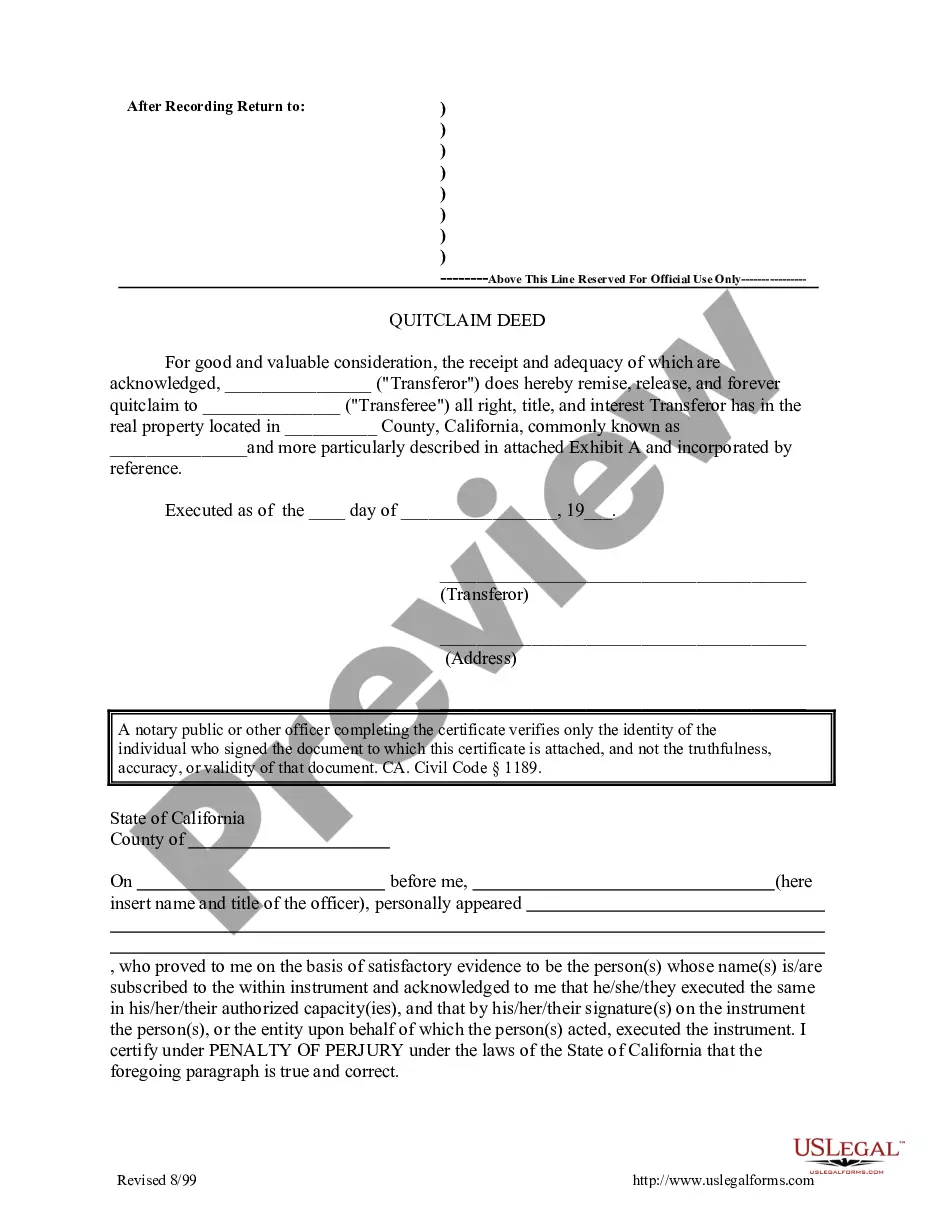

- If this is your first visit, explore the Preview mode and the descriptions of the limited liability forms. Confirm that the document aligns with your specific requirements and local laws.

- Should you need to search for additional templates, utilize the Search tab to find more options. Select the suitable one before proceeding.

- Click the Buy Now button on your chosen form and select your preferred subscription plan. You must create an account to gain access to the comprehensive library.

- Complete your purchase by entering your payment details, either via credit card or your PayPal account.

- After the transaction, download the form to your device. It will also be available in the My Documents section of your profile for future reference.

In conclusion, US Legal Forms simplifies the process of obtaining essential legal documents, including those pertaining to limited liability. With a robust selection and expert assistance, you can ensure your paperwork is both accurate and legally compliant.

Don’t wait—sign up now to unlock the best legal resources at your fingertips!

Form popularity

FAQ

An example of a limited liability company in the US is a local catering business established as an LLC. This allows the owner to benefit from limited liability, protecting their personal assets from business-related debts. Furthermore, it provides tax flexibility and easier management practices. To create a similar LLC, you can rely on uslegalforms to navigate the legal requirements efficiently.

A limited liability company is a business structure that combines the characteristics of a corporation and a partnership. It provides personal liability protection to its owners, also known as members, while allowing flexible management options. This structure is favored for its blend of limited liability and pass-through taxation benefits. To establish an LLC, consider utilizing uslegalforms for a seamless experience.

Limited liability means that a business owner’s financial risk is confined to the investment made in the business. This concept protects personal assets from business liabilities, ensuring that, in the event of financial hardship, the owner's personal wealth is not at stake. It creates a safety net for entrepreneurs, encouraging them to invest confidently. To understand how this structure works, explore resources on uslegalforms.

An example of a limited company could be a small tech startup structured as an LLC, which protects its owners from personal liability. Through this structure, the company places a barrier between personal and business assets, which is a key feature of limited liability. This allows founders to focus on innovation without the fear of losing personal possessions. If you are considering forming a limited company, uslegalforms can streamline the process.

world example of limited liability is seen in a singlemember LLC, where the owner’s personal assets remain safeguarded from business creditors. If the LLC faces a lawsuit or bankruptcy, only the business assets are at risk, while personal wealth stays secure. This reallife application demonstrates how limited liability serves to protect individuals from financial devastation. Engaging with uslegalforms can help you set up such a structure.

Limited liability refers to the financial protection provided to owners, where they are only liable for the amount they invested in the business. In contrast, unlimited liability means that owners are personally responsible for all business debts, putting personal assets at risk. Understanding these concepts is vital when choosing a business structure, as limited liability fosters a safer investment environment. With platforms like uslegalforms, you can navigate these options easily.

A limited liability company, commonly referred to as an LLC, blends elements of partnership and corporation structures. It limits personal liability for business debts, meaning owners are not personally responsible for their company’s liabilities. Additionally, an LLC typically offers flexible tax treatment and management options. This makes it an attractive choice for many business owners seeking protection under limited liability.

Starting an LLC generally involves several costs, including formation fees, state registration fees, and possibly legal fees if you seek professional assistance. The exact amount varies by state, but you should be prepared to invest some capital for your limited liability structure. Using USLegalForms can simplify the process and provide necessary documents to ensure you understand all related expenses.

While LLCs provide limited liability protection, they come with certain drawbacks. For example, an LLC may involve more paperwork and compliance requirements than operating as a sole proprietor. Additionally, some states impose a franchise tax or annual fees, which can add to your expenses. It’s vital to weigh these factors alongside the benefits of limited liability.

Yes, you can establish an LLC even if you do not have an active business. Limited liability companies often serve as a protective structure for future ventures. Many entrepreneurs create an LLC to secure their personal assets before they fully develop a business plan. This strategic step allows you to pave the way for future opportunities while enjoying legal protections.