Washington Dissolve Llc With Irs

Description

Form popularity

FAQ

The primary difference between a Washington LLC and a professional LLC lies in the nature of the business activities. A Washington LLC can operate any type of business, while a professional LLC is specifically designed for licensed professionals, such as lawyers or medical practitioners. This distinction can affect liability and operational regulations. When planning to Washington dissolve LLC with IRS, be aware of how these classifications might influence your dissolution process.

Dissolving an LLC in the USA generally requires gathering member consent and submitting dissolution paperwork to the state where the LLC operates. Each state has its own guidelines, so it's important to follow the specific requirements outlined by that state. After filing, clearing any outstanding debts and taxes is essential. If you're looking to Washington dissolve LLC with IRS, make sure you address federal tax obligations as part of this process.

When an LLC is administratively dissolved in Washington state, it loses its legal status and the ability to conduct business. The LLC must settle outstanding debts and file any final tax forms with the IRS. Properly addressing these issues will help your business transition smoothly out of its legal obligations.

Dissolving a partnership business entails following the procedures set in your partnership agreement. This commonly includes a formal agreement among partners to dissolve, settling debts, and filing appropriate paperwork. Do remember to inform the IRS about the dissolution of your partnership business to ensure proper compliance.

Removing yourself from a business partnership usually requires following the terms outlined in your partnership agreement. You'll need to communicate with your partners and document the withdrawal. Make sure to notify the IRS of this change when you Washington dissolve LLC with IRS to avoid tax complications.

To remove yourself from an LLC in Washington state, you will need to follow the operating agreement procedures. This often includes obtaining consent from other members and filing any required documents. Properly notifying the IRS is crucial when you Washington dissolve LLC with IRS, ensuring your tax responsibilities are clear.

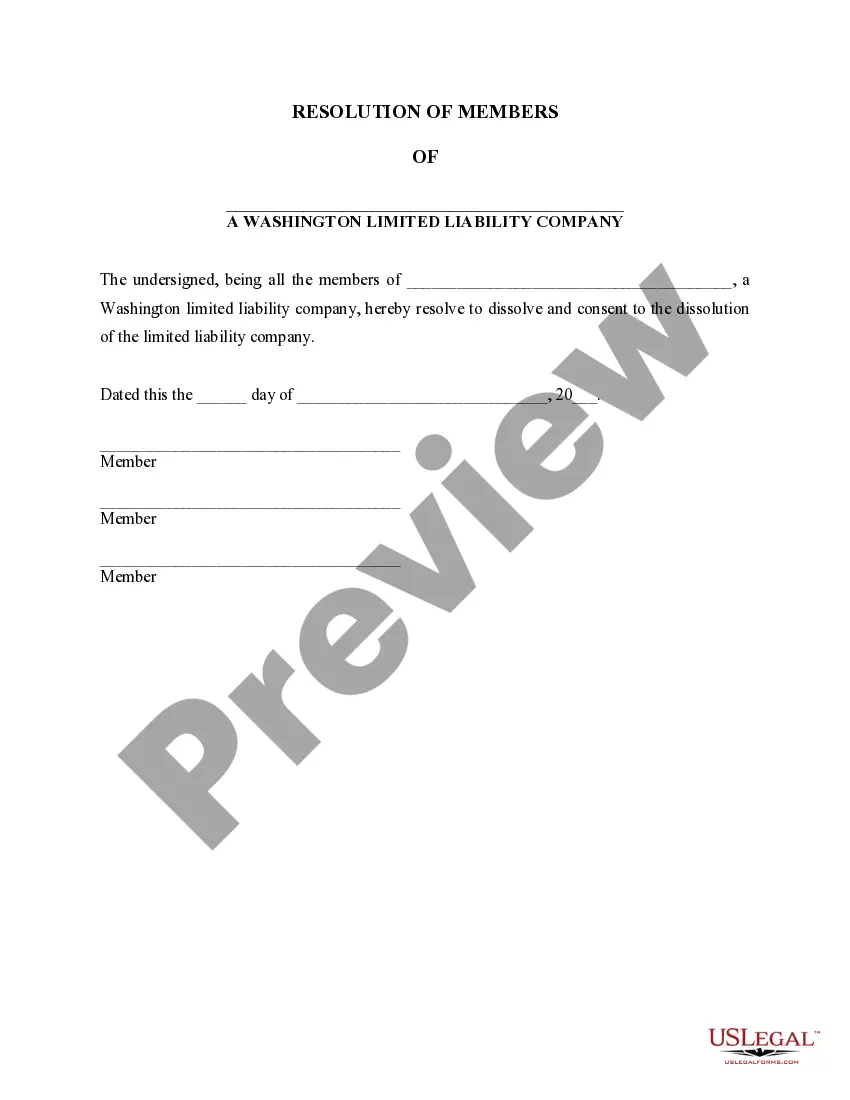

Closing an LLC involves several steps to ensure a complete and lawful dissolution. First, you should hold a meeting to pass a resolution for closing the business. Afterwards, file the necessary dissolution documents with the state, while also ensuring you notify the IRS that you have dissolved your Washington LLC.

To dissolve your Washington state LLC, you must first adopt a resolution to dissolve. Then, you'll file the Certificate of Dissolution with the Washington Secretary of State's office. Don't forget to settle any outstanding debts and inform the IRS to formally conclude your financial responsibilities.

To dissolve a limited partnership, you typically need to file a formal dissolution document with the appropriate state authority. Make sure to settle all debts and obligations first. Additionally, inform the IRS of your dissolution by filing the necessary tax forms, allowing for a smooth transition when you Washington dissolve LLC with IRS.

Shutting down your business may seem like a quick solution, but it's essential to formally dissolve your LLC. If you simply stop operating, you may still face tax liabilities. Properly dissolving your Washington LLC with the IRS ensures you meet all legal obligations and minimizes potential future issues.