Dissolution Dissolve Corporation For 10 Years

Description

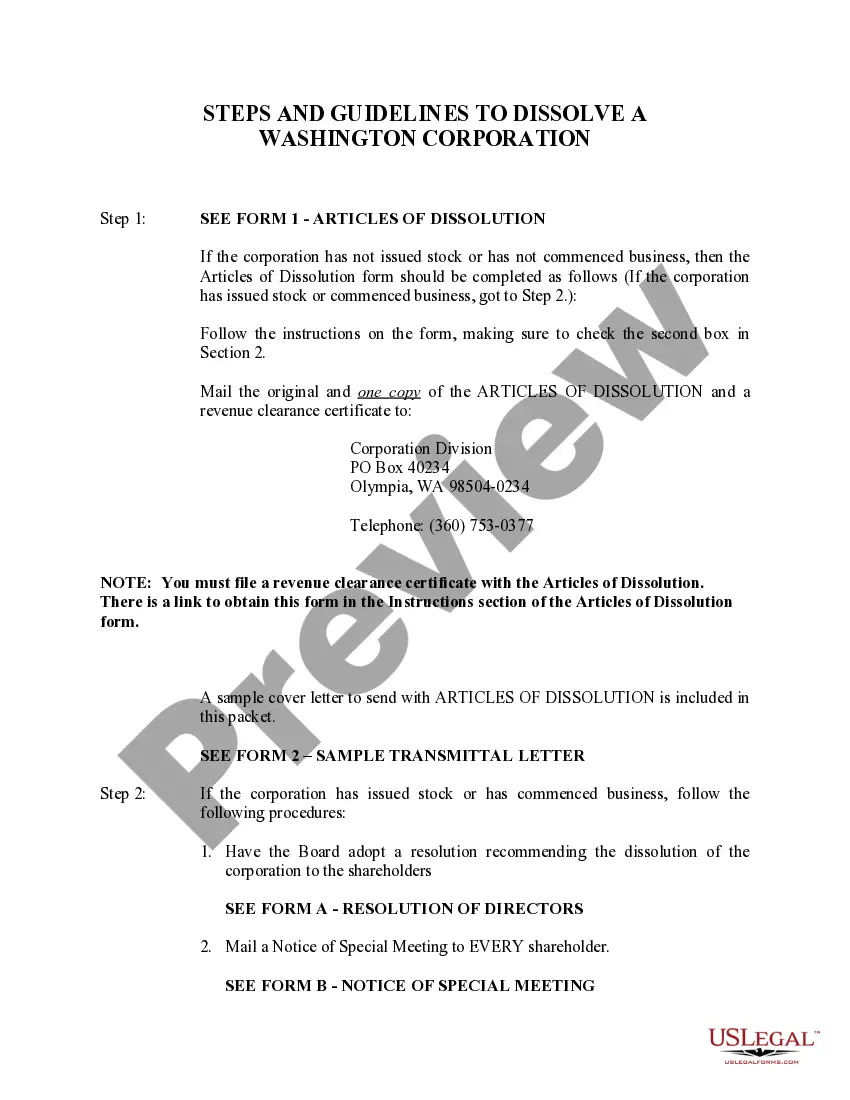

How to fill out Washington Dissolution Package To Dissolve Corporation?

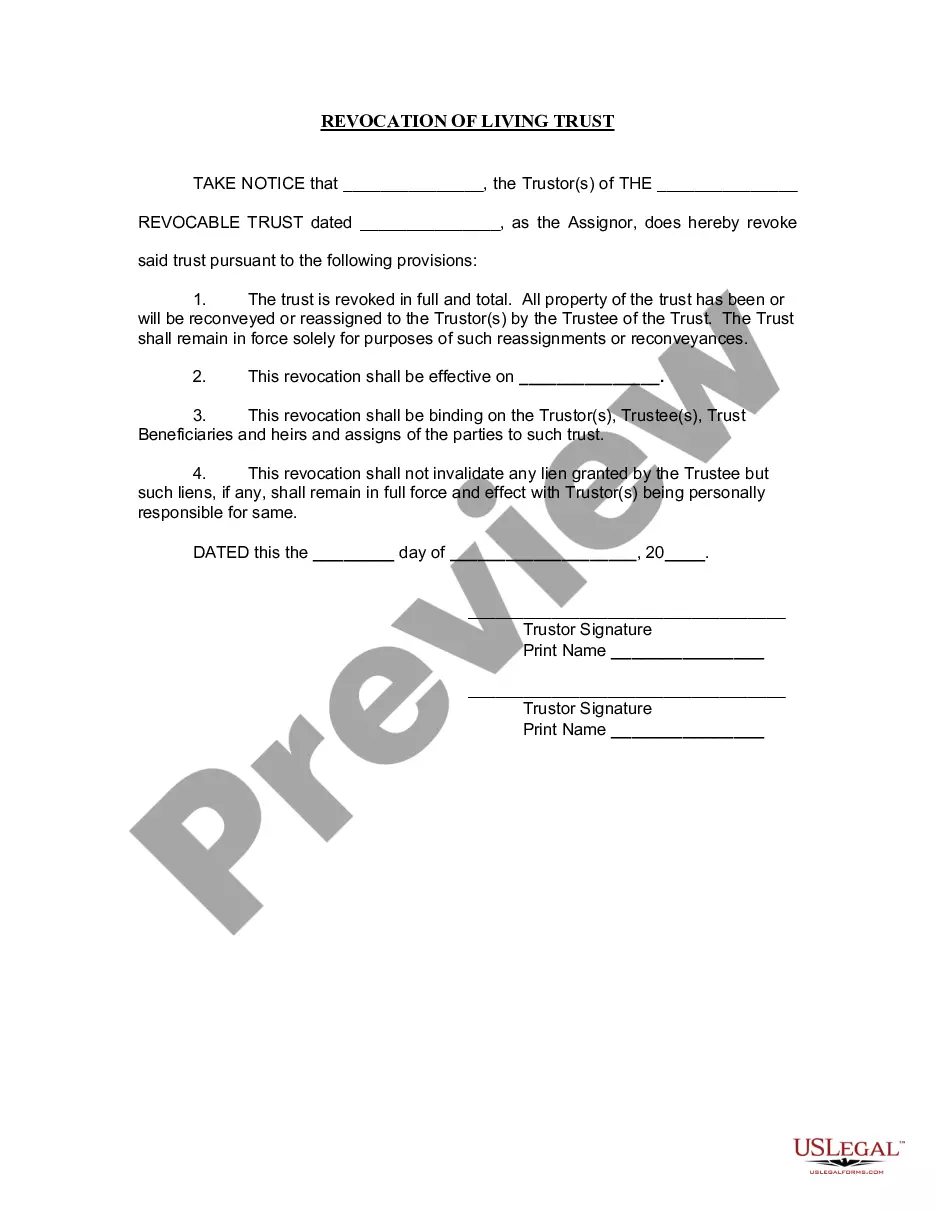

- Visit the US Legal Forms website and log in to your existing account or create a new one to access their document library.

- Browse through the extensive form collection, using the Preview mode to confirm that you have selected the correct dissolution form suited to your jurisdiction.

- If necessary, utilize the Search tab to find additional templates that may better fit your specific needs.

- Select your desired form and click the Buy Now button, choosing a subscription plan that fits your needs to proceed.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- Download your completed form and save it to your device for future use, easily accessible in the My Forms section of your account.

By following these steps using US Legal Forms, you'll ensure a smooth dissolution process. Their robust form library and premium expert assistance provide invaluable support for anyone needing legal documentation.

Empower yourself and get started today with US Legal Forms to simplify your legal documents!

Form popularity

FAQ

There are two primary types of dissolution for a corporation: voluntary and involuntary. Voluntary dissolution occurs when the corporation's owners decide to dissolve the business legally. In contrast, involuntary dissolution can happen due to legal issues, failure to meet state requirements, or other unforeseen circumstances. Understanding these types can help you navigate the process of dissolution to dissolve your corporation for 10 years effectively.

When a corporation dissolves, its legal existence comes to an end. This process involves settling debts, distributing remaining assets, and filing necessary documents with the state. It's essential to follow the correct procedures to ensure a smooth dissolution. If you're navigating this process, uslegalforms can provide the necessary forms and guidance to help you dissolve your corporation for 10 years.

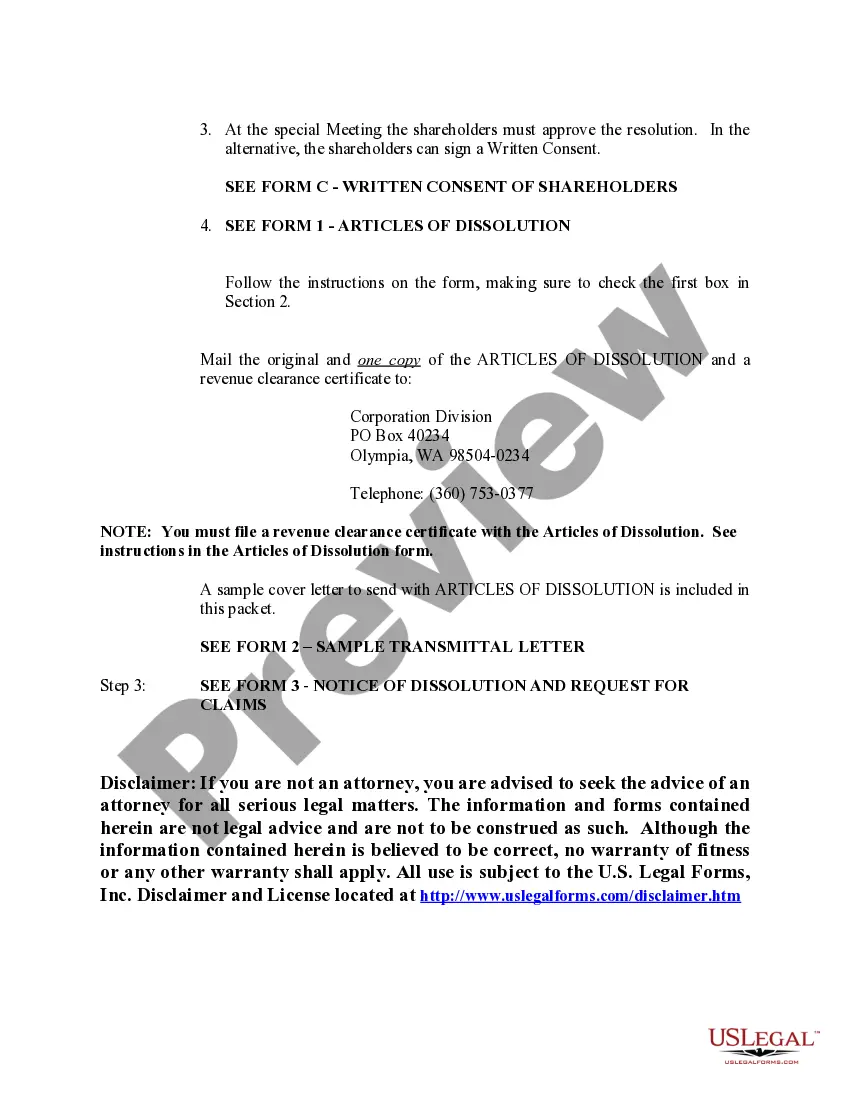

Writing a notice of dissolution involves outlining important details such as the corporation's name, state of registration, and the effective date of dissolution. You must also include a statement indicating the decision made by the board of directors. Once drafted, send the notice to both the state and its stakeholders to fulfill your formal obligations. If you need assistance drafting this notice, uslegalforms offers resources to help you dissolve your corporation for 10 years effectively.

The IRS code relevant to dissolving corporations is found under Internal Revenue Code Section 331. This section outlines the conditions under which a corporation may be liquidated and provides guidelines for tax treatments. Familiarizing yourself with this code can help you understand the tax implications as you dissolve your corporation for 10 years. Consulting with uslegalforms can also provide clarity on these regulations.

Yes, when dissolving an LLC, you typically need to complete IRS Form 966. This form serves to notify the IRS officially about the dissolution of a business entity. Submitting this form is critical to ensuring that the IRS has accurate records of your company's status. With support from platforms like uslegalforms, you can navigate this paperwork easily as you dissolve your corporation for 10 years.

The first step in terminating a corporation is to hold a formal meeting with the board of directors to discuss and approve the dissolution plan. After gaining approval, it is essential to obtain shareholder consent if required. Documenting these actions properly is vital to ensure a smooth process during the dissolution of the corporation for 10 years. Utilizing resources like uslegalforms can help guide you through this initial step.

Notifying the IRS about your business dissolution is a crucial step after completing your corporation's dissolution. You need to file your final tax return and mark the return as 'final.' Additionally, if applicable, you may need to include Form 966, which notifies the IRS of the dissolution. By following these steps, you ensure compliance and proper documentation as you dissolve your corporation for 10 years.

To complete the dissolution of a corporation, first, the board of directors must adopt a plan of dissolution. Following this, the corporation should file Articles of Dissolution with the state where it is incorporated. Once these steps are taken, it is important to notify all stakeholders and settle any outstanding debts and taxes. Engaging with a professional service, like uslegalforms, can simplify the process as you dissolve your corporation for 10 years.

To close your C corporation, you must follow several steps, including holding a board meeting to approve the decision, filing articles of dissolution with the state, and paying any outstanding taxes. Make sure to inform all stakeholders and settle any debts or obligations before finalizing the closure. It’s essential to follow these steps meticulously, particularly if the corporation has been in operation for ten years. US Legal Forms can assist you in fulfilling these requirements.

To prove that a business is dissolved, you can obtain a certificate of dissolution from your state’s business registry. Additionally, you may present the company's final tax filings and other official documents indicating dissolution. This proof is important when addressing tax matters or if inquiries arise in the future. Accessing US Legal Forms can help you gather the necessary documentation for this verification.