Dissolution Of The Trust

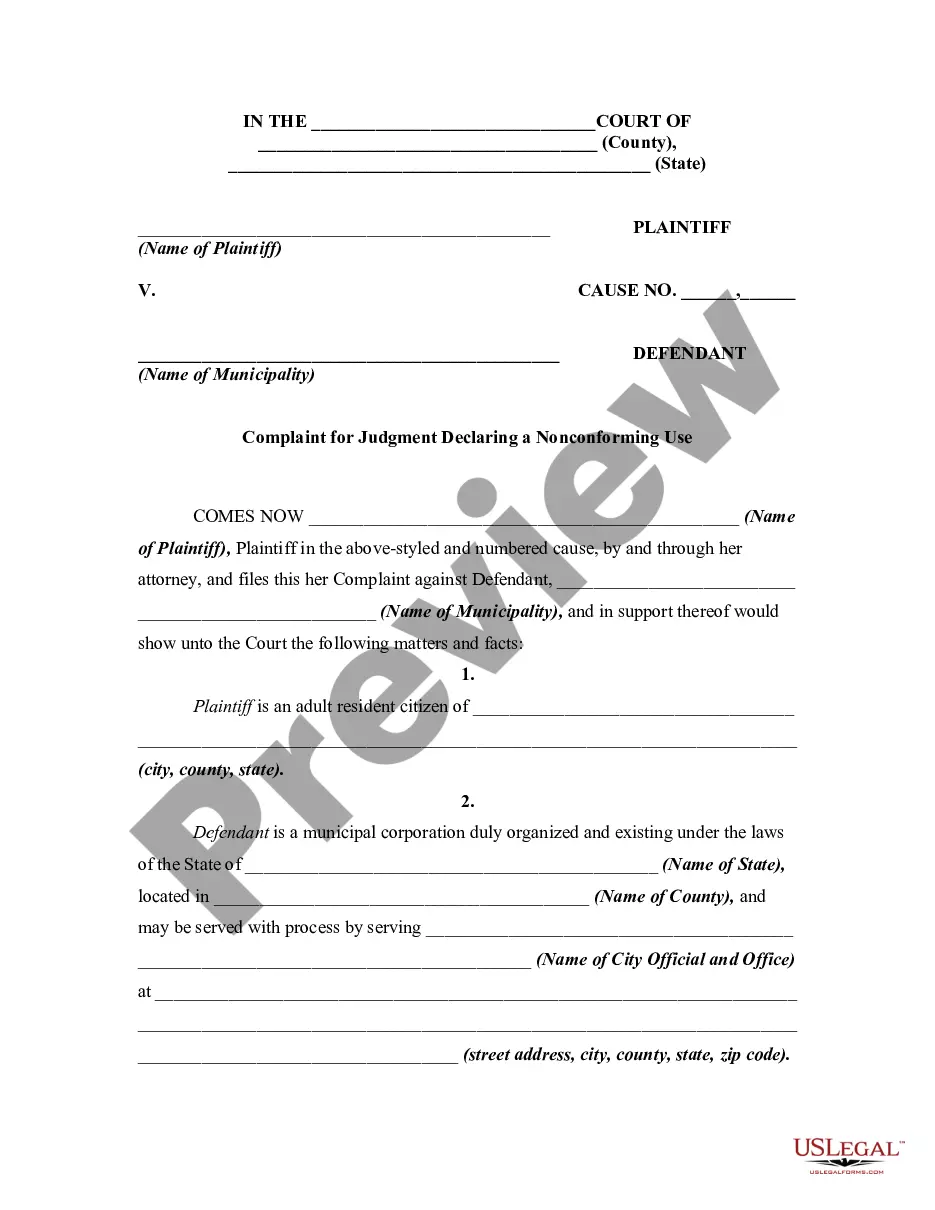

Description

How to fill out Termination Of Trust By Trustee?

- Log into your US Legal Forms account. If you're a returning user, ensure that your subscription is active. If it’s not, renew it according to your payment plan.

- Browse the library for the trust dissolution form. Familiarize yourself with the preview mode and form descriptions to confirm it's suitable for your jurisdiction.

- If needed, refine your search using the Search tab to find the accurate form. Ensure it aligns with your requirements.

- Select the appropriate plan by clicking the Buy Now button. If this is your first visit, you will need to register an account for full access.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Download your selected form. You can save the document on your device and access it anytime through the My Forms section.

In conclusion, the dissolution of the trust can be a straightforward process when leveraging the resources available at US Legal Forms. With an extensive library and premium support, you can ensure that your legal documents are both accurate and compliant.

Start your journey today by visiting US Legal Forms and access the forms you need!

Form popularity

FAQ

To dissolve a trust, you typically need to follow specific legal steps, which can include reviewing the trust documents, obtaining consent from the beneficiaries, and filing necessary paperwork with the court if required. Accurate handling of these steps ensures the lawful dissolution of the trust. For assistance navigating this process, consider using the uslegalforms platform, which provides useful resources and legal forms related to the dissolution of the trust.

The dissolution of a trust refers to the legal process of terminating a trust and distributing its assets according to the terms set forth in the trust document. This process can involve various legal and financial considerations, depending on the type of trust and the circumstances surrounding its creation. Understanding the dissolution of the trust is crucial for beneficiaries to ensure they receive their fair share of the assets.

A trust can be terminated in three primary ways: through the distribution of assets, by mutual agreement among beneficiaries, or through a court order. In the case of asset distribution, the trust assets are given to the beneficiaries, effectively ending the trust. Mutual agreement occurs when all beneficiaries consent to dissolve the trust, while court orders typically come at the request of a beneficiary for various reasons related to the dissolution of the trust.

To close out a trust with the IRS, complete and file a final Form 1041, indicating it is the trust’s last return. Ensure that all income has been reported, and final distributions have been accounted for. Following these steps will facilitate the smooth dissolution of the trust with the IRS while meeting all requirements.

The process of dissolving a trust starts with reviewing the trust document to ensure compliance with its terms. Next, you will need to settle any debts, file final tax returns, and distribute assets to beneficiaries. This systematic approach ensures a proper and legally sound dissolution of the trust.

Dissolving a trust with the IRS requires you to file Form 1041 for the final tax return, marking it as the last return for the trust. Additionally, you must ensure all income and distributions are accurately reported. Keeping organized records is essential for a smooth dissolution of the trust with the IRS.

To bring a trust to an end, you should follow the procedures specified in the trust agreement, which typically include settling debts and distributing assets to beneficiaries. It is vital to keep detailed records during this process. Using resources from platforms like US Legal Forms can help guide you through bringing the trust to a successful conclusion.

Closing a trust involves distributing its assets according to the terms outlined in the trust document. Each beneficiary must receive their share, and any outstanding debts or obligations must be settled. This process is crucial for the proper dissolution of the trust and ensures all legal requirements are fulfilled.

When you terminate a trust, there may be tax consequences based on the trust’s activities and assets. Any distributions made at the time of dissolution can trigger capital gains taxes if the assets have appreciated in value. It’s beneficial to consult a tax professional to navigate the potential implications during the dissolution of the trust.

Filing a final tax return for a trust involves completing IRS Form 1041, which is used to report the trust’s income. Make sure to indicate that this is the final return by checking the appropriate box. Proper documentation during the dissolution of the trust will ensure that all taxes are filed correctly and on time.