Joint Living Trust For Married Couples

Description

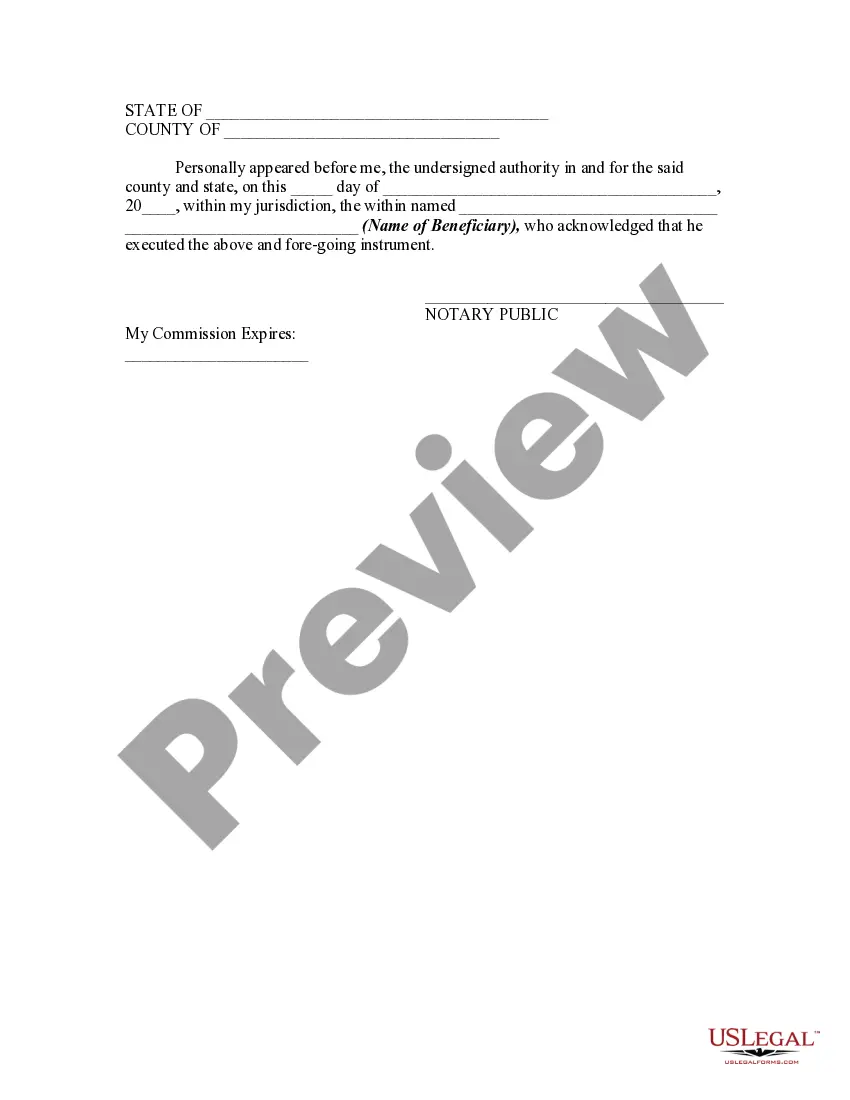

How to fill out Consent To Revocation Of Trust By Beneficiary?

It’s well-known that you cannot instantly become a legal authority, nor can you swiftly learn how to create a Joint Living Trust For Married Couples without possessing a specific skill set.

Drafting legal documents is a lengthy process that necessitates particular education and expertise. So why not entrust the creation of the Joint Living Trust For Married Couples to the experts.

With US Legal Forms, one of the most extensive libraries of legal templates, you can discover everything from court documents to templates for in-office communication. We recognize how vital compliance and adherence to federal and state laws and regulations are.

Create a free account and select a subscription option to purchase the form.

Select Buy now. After the payment is processed, you can obtain the Joint Living Trust For Married Couples, complete it, print it, and send or mail it to the required individuals or organizations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to start with our website and acquire the document you require in just minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the Joint Living Trust For Married Couples is what you’re looking for.

- Begin your search again if you require a different form.

Form popularity

FAQ

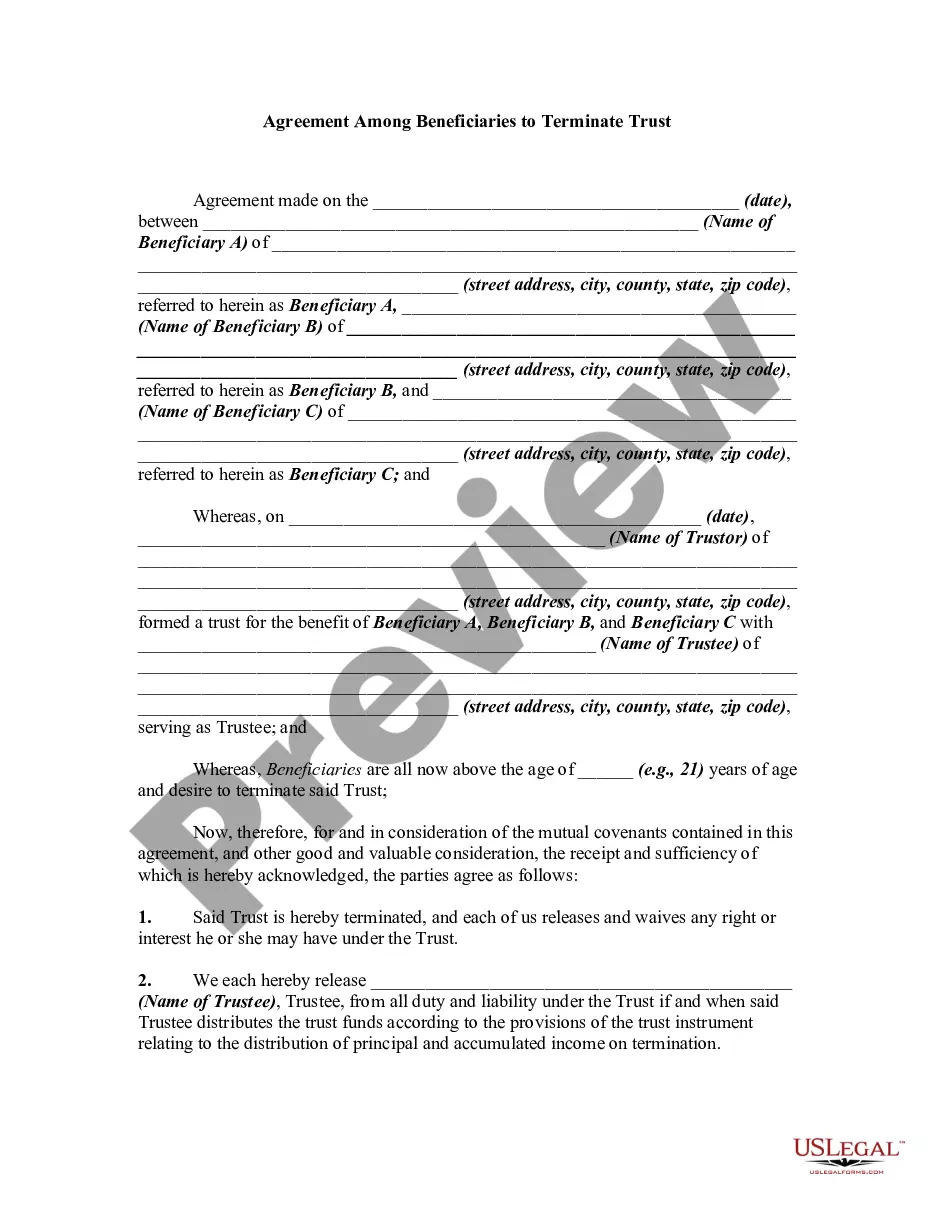

The couple, as grantors of a Joint Revocable Living Trust, retain significant control over the trust assets and decisions. They can amend or terminate the trust during their lifetime and can also designate the ultimate beneficiaries of the trust assets.

A joint trust gives the surviving spouse more flexibility to use all of the assets of the trust after the death of the first spouse. A joint revocable trust is also easier to fund and maintain during a couple's lifetime. All assets simply go into the same place; there's no need to decide which trust an asset goes into.

Simple Living Trusts for Married Couples Simple living trusts are often considered the easiest kinds of trusts to set up and keep. In a simple living trust, a couple can share the control and benefits of the trust while they are living.

Joint Trust: Because all assets are inside one trust, sometimes Joint Trusts can make things simpler. While both spouses are living, each has equal control regarding the management of joint assets held in the Joint Trust.

The surviving spouse is the sole Settlor/Trustee/Beneficiary if one dies. In short, nothing changes. The surviving spouse manages the Trust and its assets as they see fit. For example, if the surviving spouse desires to, they can amend the Trust, add or remove assets, change future beneficiaries, etc.